Advancements in IgA Nephropathy (IgAN) Treatment: From Standard-of-care (SoC) to Emerging Therapies

Jun 20, 2025

Table of Contents

IgA Nephropathy (IgAN): Pathogenesis and the Need for Targeted Therapies

IgA nephropathy is a complex autoimmune disorder characterized by the accumulation of galactose-deficient IgA1 antibodies in the glomeruli, triggering a cascade of immune responses that ultimately lead to chronic kidney damage. Driven by a multi-hit pathogenesis involving genetic predisposition, aberrant immune complex formation, and complement activation, the disease progresses silently until proteinuria and hematuria become clinically evident. Environmental triggers such as infections and hypertension further amplify renal injury, highlighting the need for early intervention. Despite advances in understanding its pathophysiology, the etiology remains elusive, underscoring the critical need for targeted therapies and personalized disease management strategies.

Prevalence and Growth Projections for IgA Nephropathy

IgA nephropathy presents a steadily increasing burden across the major markets (the United States, Germany, France, Italy, Spain, the United Kingdom, and Japan), with an estimated 400K diagnosed prevalent cases of IgAN in 2024, according to DelveInsight. Driven by improved diagnostic awareness and access to renal biopsy, the diagnosed population is expected to grow at a significant CAGR through 2034. The highest prevalence is observed in Japan, followed by the US and European markets. This epidemiological trend underscores the growing demand for targeted therapies and supports continued investment in innovative treatment approaches.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Biogen’s SPINRAZA Phase II/III Trial Results; Travere’s FILSPARI FDA Approval; GSK’s ...

- Novo Nordisk Seeks FDA Approval for Higher-Dose 7.2 mg WEGOVY Injection; Ascendis Pharma Granted ...

- Roche’s Columvi Phase III STARGLO Trial; Novartis’ Fabhalta Latest Data; Vertex’s Alpine Im...

- BeiGene’s BRUKINSA Gets FDA Accelerated Approval; GSK’s Positive Results in DREAMM-8 ...

- 4 Late-Stage IgA Nephropathy Treatment Drugs to Look Out

Current Therapeutic Options: Navigating the IgA Nephropathy Treatment Paradigm

The IgA nephropathy treatment landscape is shifting towards more targeted and individualized care. While Angiotensin-Converting Enzyme (ACE) inhibitors and Angiotensin Receptor Blockers (ARB) remain the first-line for managing proteinuria and preserving renal function, newer agents like Sodium-Glucose Co-Transporter 2 (SGLT2) inhibitors and sparsentan offer added renal protection. Targeted-release budesonide marks a move toward precision therapies with reduced systemic side effects. In high-risk cases, corticosteroids and immunosuppressants like mycophenolate are used selectively due to safety concerns. Non-pharmacologic measures, including lifestyle modification and lipid management, remain essential. As IgA nephropathy becomes a chronically managed condition, balancing efficacy with safety is key to optimizing long-term outcomes.

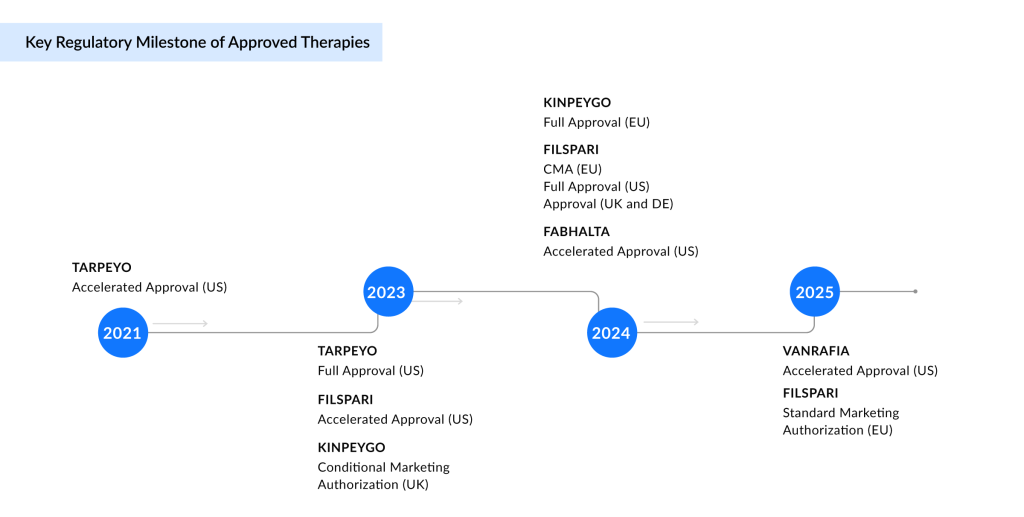

Current IgA Nephropathy Treatment Market Dynamics

The current IgA nephropathy market exhibits moderate competition, primarily dominated by small-molecule therapies, including Endothelin Type A Receptor (ETAR) antagonists, complement Factor B inhibitors, Angiotensin II Type 1 Receptor (AT1R) antagonists, and glucocorticoid receptor agonists. Notable products include VANRAFIA (atrasentan), FABHALTA (iptacopan), FILSPARI (sparsentan), and TARPEYO/KINPEYGO (budesonide). While these agents reflect growing therapeutic options, the landscape remains open for innovation, especially with limited biologic presence, creating clear opportunities for emerging monoclonal antibodies to differentiate and expand treatment choices.

FABHALTA and VANRAFIA, both developed by Novartis, represent targeted approaches to reshaping IgA nephropathy treatment. FABHALTA, an oral Factor B inhibitor, addresses complement-mediated kidney damage and is approved in the US to reduce proteinuria, with full approval pending Phase III outcomes. VANRAFIA, a highly selective ETAR antagonist acquired by Novartis through the acquisition of Chinook Therapeutics, also received accelerated US approval based on proteinuria reduction, with confirmatory data expected in early 2026. These therapies reflect Novartis’ precision nephrology strategy by targeting distinct drivers of IgA nephropathy progression.

FILSPARI and TARPEYO/KINPEYGO represent a major shift in the IgA nephropathy treatment paradigm by introducing targeted, nonimmunosuppressive oral therapies with global commercial reach. FILSPARI’s dual blockade of endothelin-1 and angiotensin II offers a novel mechanism to preserve kidney function, positioning it as a potential long-term cornerstone treatment. Travere has partnered with CSL Vifor for European distribution and Renalys Pharma in Japan, where pivotal data from a registration-enabling study is anticipated in the second-half of 2025, underscoring its expanding global footprint.

Similarly, TARPEYO/KINPEYGO’s gut-targeted delivery of budesonide addresses mucosal immune dysregulation at the source of IgA nephropathy, making it the first therapy to modify disease activity via the gut-kidney axis. In Japan, Viatris is developing it as NEFECON, with Phase III results expected in 2026. With established approvals and advancing pipelines across key regions, both therapies exemplify the shift toward precision medicine, reshaping clinical and commercial landscapes in IgA nephropathy.

Additionally, the distribution through REMS (Risk Evaluation and Mitigation Strategy) Programs for FABHALTA and FILSPARI underscores the safety challenges inherent to their mechanisms of action and reflects a critical regulatory safeguard in IgA nephropathy treatment. FABHALTA’s REMS focused on infection risk from encapsulated bacteria such as Streptococcus pneumoniae, Neisseria meningitidis, and Haemophilus influenzae type b due to complement inhibition, mandates pre-treatment vaccination and ongoing vigilance, particularly in immunologically vulnerable patients. FILSPARI’s REMS, targeting hepatotoxicity and teratogenicity, imposes strict liver function monitoring and reproductive risk management. These measures, while clinically justified, introduce logistical burdens that can hinder prescriber adoption, delay treatment initiation, and restrict access in community settings.

As a result, despite their therapeutic promise, REMS obligations temper the market penetration of both agents. From a strategic perspective, these programs highlight a broader trade-off: While enabling regulatory approval of high-risk, high-reward therapies, REMS can fragment access pathways and increase healthcare delivery complexity. Effective REMS navigation and provider education will, therefore, be essential to maximizing the real-world impact of these IgA nephropathy therapies.

Among the currently approved IgAN therapies, Novartis’ VANRAFIA (atrasentan) is projected to become a blockbuster drug, with DelveInsight estimating revenues to exceed USD 1 billion by the mid-2030s. This projection reflects both strong commercial momentum and increasing clinical adoption. Notably, VANRAFIA can be easily integrated into existing supportive care regimens for IgA nephropathy, offering foundational therapy without the constraints of a REMS requirement, further boosting its accessibility and uptake. Moreover, strong insights from Key Opinion Leaders (KOLs) further validate the clinical potential and strategic value of these IgAN therapies.

Despite recent advancements in IgA nephropathy treatment globally, Japan currently lacks approved therapies for the condition, creating a significant gap in the market. This absence presents an opportunity for companies to introduce innovative treatments, potentially addressing the unmet need in this region.

Critical Gaps in IgA Nephropathy Management

Despite therapeutic progress in IgA nephropathy, safety concerns remain a critical unmet need. Approved treatments, including corticosteroids, ETAR antagonist, and complement inhibitors, are often linked to serious adverse events, limiting their use in high-risk populations such as children and the elderly. These safety issues, compounded by the complexity of REMS programs and infection risks, hinder long-term adherence and the real-world utility of these programs. Additionally, the narrow clinical focus on renal endpoints overlooks the broader impact of comorbidities like hypertension, obesity, and dyslipidemia, which significantly influence disease progression. A shift toward integrated, patient-centered care, combining safer, targeted therapies with comprehensive metabolic and cardiovascular management, is essential for improving long-term outcomes in IgA nephropathy.

Innovative Therapies Reshaping the IgA Nephropathy Treatment Landscape

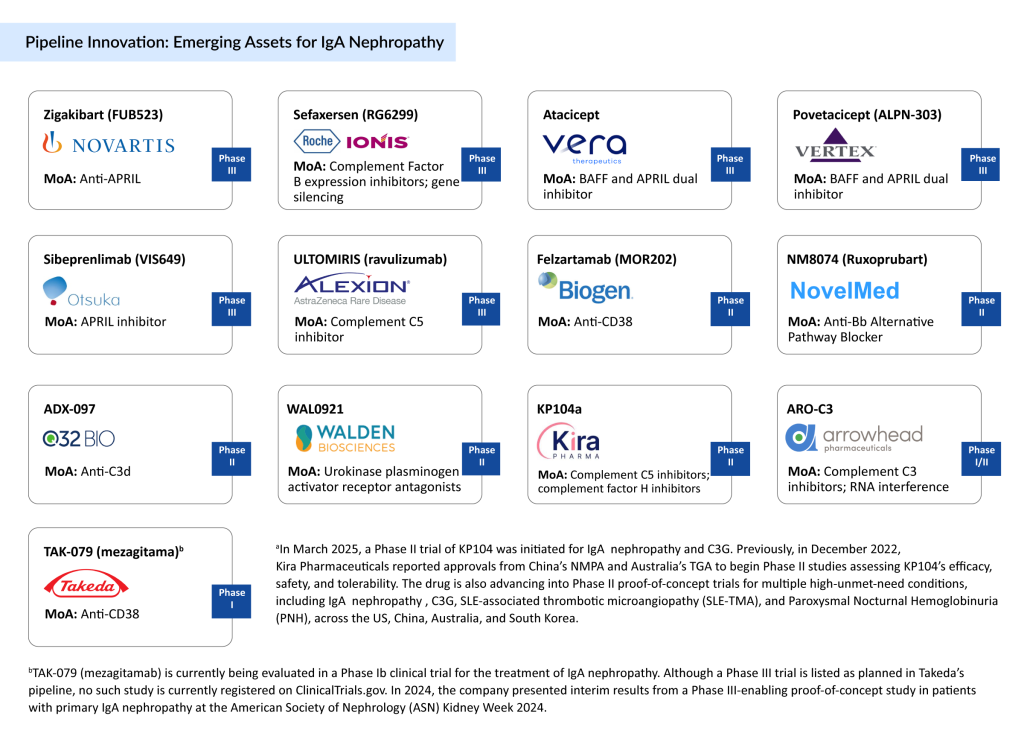

The late-stage pipeline for IgA nephropathy reflects a surge in innovation, with multiple assets in Phase III aiming to address key drivers of disease progression through targeted immunomodulation. IgAN drugs such as belimumab and siltuximab focus on B-lymphocyte stimulator (BLyS) inhibition, while atacicept and belimumab offer dual blockade of B-cell activating factor (BAFF) and B-lymphocyte stimulator (BLyS), aiming to suppress pathogenic B-cell activity. Meanwhile, sefaxersen employs antisense oligonucleotide technology to silence complement Factor B expression, and ULTOMIRIS targets terminal complement activation via C5 inhibition. These varied mechanisms mark a shift from symptomatic control toward disease-specific interventions.

Several of these candidates are expected to enter the US market by 2034, with sibeprenlimab anticipated to lead the wave in 2025, followed by atacicept and povetacicept in 2026. Zigakibart and ULTOMIRIS may follow in 2027, while sefaxersen is projected for 2028. Collectively, these launches could significantly reshape the IgA nephropathy treatment landscape, offering more personalized, mechanism-based therapies that may improve long-term outcomes for patients with high-risk diseases.

Additionally, a robust pipeline of early- and mid-stage assets is being explored for IgA nephropathy, including felzartamab, NM8074, ADX-097, WAL0921, KP104, ARO-C3, and TAK-079, among others. These candidates target various immune and complement pathways, further underscoring the expanding interest in disease-specific interventions aimed at modifying the underlying pathophysiology of IgA nephropathy.

Among the emerging IgAN therapies, atacicept and povetacicept are poised to become blockbuster treatments in the IgA nephropathy market; each projected to generate over USD 1 billion in revenue by the mid-2030s. These agents target key immunological drivers of the disease, BAFF and APRIL, offering a novel mechanism of action that directly addresses B-cell–mediated pathogenesis. Clinical data show promising efficacy, with povetacicept demonstrating a 64% reduction in UPCR and atacicept achieving a 52% ± 5% reduction, both with favorable safety profiles. Their advancement reflects a broader industry shift toward precision immunomodulation, highlighting their potential to redefine the future standard of care in IgA nephropathy.

Future Outlook of IgAN Treatment

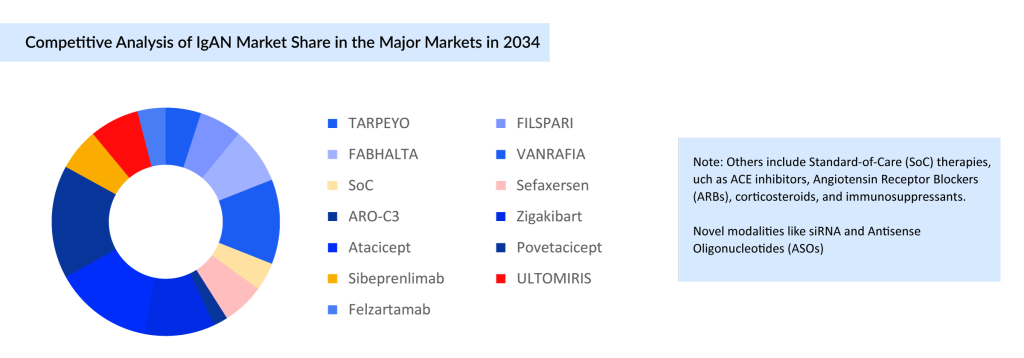

The projected IgA nephropathy market landscape in the major markets by 2034 reflects a transition from small molecule dominance to a more diversified therapeutic mix. Currently marketed agents, including VANRAFIA and FABHALTA, continue to hold a significant share; however, emerging biologics, such as atacicept and povetacicept, are expected to play a major role in shaping future treatment dynamics. Moreover, novel modalities and other therapies contribute smaller portions but represent ongoing innovation. This evolving distribution highlights the growing emphasis on targeted, disease-modifying therapies and suggests increasing competition, particularly as biologics gain momentum within a historically small molecule-driven market. For a visual depiction of this analysis, see the illustration below:

As IgA nephropathy continues to present therapeutic challenges, the treatment landscape is undergoing a meaningful shift with the rise of mechanism-driven therapies. While traditional IgAN treatments such as corticosteroids, RAAS blockers, and immunosuppressants remain foundational, emerging targeted agents are redefining the potential for disease modification. The growing IgAN pipeline, especially with several candidates in late-stage development, reflects a strong push toward personalized and durable treatment options. Japan, with its high disease prevalence, stands out as a key market likely to benefit from these advances. However, clinical adoption will depend not only on efficacy but also on safety, tolerability, and patient adherence, critical factors in managing a chronic autoimmune condition. Regulatory hurdles, real-world data, and payer alignment will further shape the success of these new entrants. Ultimately, the evolving therapeutic landscape holds the promise of transforming IgA nephropathy from a disease with limited options to one with more precise and impactful treatment strategies.

FAQs

IgA nephropathy presents a steadily increasing burden across the leading markets (the United States, Germany, France, Italy, Spain, the United Kingdom, and Japan), with an estimated 400K diagnosed prevalent cases of IgAN in 2024, according to DelveInsight. Driven by improved diagnostic awareness and access to renal biopsy, the diagnosed population is expected to grow at a significant CAGR through 2034.

The current IgA nephropathy market exhibits moderate competition, primarily dominated by small-molecule therapies, including Endothelin Type A Receptor (ETAR) antagonists, complement Factor B inhibitors, Angiotensin II Type 1 Receptor (AT1R) antagonists, and glucocorticoid receptor agonists. Notable approved IgAN drugs include VANRAFIA (atrasentan), FABHALTA (iptacopan), FILSPARI (sparsentan), and TARPEYO/KINPEYGO (budesonide).

Emerging IgAN drugs in clinical trials include Atrasentan, Sibeprenlimab (VIS-649), Zigakibart (BION-1301), IONIS-FB-LRx/RG6299, Povetacicept, ULTOMIRIS (ravulizumab), Atacicept (VT-001), Felzartamab, and others.

The IgAN market size in the 7MM was valued at ~USD 730 million in 2024 and is anticipated to grow with a significant CAGR of 30.5% during the study period (2020-2034).

Downloads

Article in PDF

Recent Articles

- FDA Approves Eisai & Biogen’s LEQEMBI IQLIK for Maintenance Treatment of Early Alzheimer’s; T...

- Sanofi to Acquire Provention Bio; USFDA Committee Votes in Favor Roche’s Polivy; FDA to Rev...

- Roche’s Columvi Phase III STARGLO Trial; Novartis’ Fabhalta Latest Data; Vertex’s Alpine Im...

- Recent Inclination of Pharma Companies, Emerging Pipeline Therapies Drive the IgA Nephropathy Mar...

- Novartis’ FABHALTA: Leading the Way as the First Complement Inhibitor for IgAN