PCSK9 Inhibition in Cardiovascular Care: Unmet Needs, Market Evolution, and Emerging Players

Sep 08, 2025

Table of Contents

The Unmet Need in Cholesterol Management

Cardiovascular Diseases (CVDs) continue to be one of the leading causes of morbidity and mortality worldwide, primarily driven by underlying lipid disorders, including Hypercholesterolemia (familial and non-familial hypercholesterolemia), Dyslipidemia, Atherosclerotic Cardiovascular Disease (ASCVD), (Acute Coronary Syndrome [ACS], stroke, and coronary revascularization [CABG and PCI], etc.). Statins remain the foundation of lipid-lowering therapy, yet real-world use often falls short of guidelines. The 2021 American Heart Association (AHA) report found that only 31.9% of patients with severe hypercholesterolemia received appropriate statin therapy, and up to 50% discontinue due to side effects, polypharmacy, or contraindications. These gaps highlight the need for effective alternatives, especially in statin-intolerant populations.

In the United States, in 2024, approximately 1.3 million individuals experience ACS each year, encompassing both myocardial infarction and unstable angina. Additionally, around 0.825 million people suffer a stroke annually in 2024.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Booming Healthcare sector in MENA: Lucrative opportunity for Global pharma players

- Amylyx’s AMX0114 Fast Tracked by FDA for ALS; Cellectar’s Iopofosine I 131 Granted FDA Breakthrou...

- Medtronic Launches Infusion Set for Insulin Pumps; Penumbra’s Virtual Reality-Based Rehabil...

- Pacemakers: Analyzing the Market Dynamics and Major Developments

- Rising Global Prevalence of Cardiovascular Diseases And Top Players In Cardiology

Currently approved PCSK9 inhibitors achieve LDL-C reductions of up to 60% and favorably impact lipoprotein (a), triglycerides, and HDL-C. Despite proven efficacy and safety, adoption remains limited by cost and delivery challenges. Next-generation therapies must pair comparable efficacy with better affordability, simplified dosing, and patient-centered approaches to expand access and further reduce residual cardiovascular risk.

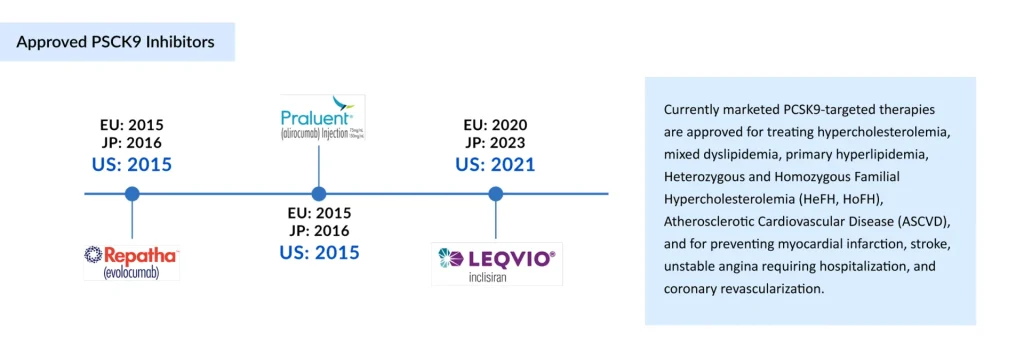

Current Therapeutic Landscape of Marketed PCSK9 Inhibitors

The marketed landscape of PCSK9 inhibitors currently consists of three agents – Amgen’s REPATHA (evolocumab) and Sanofi/Regeneron’s PRALUENT (alirocumab), both monoclonal antibodies that directly block circulating PCSK9 protein, and Novartis/Alnylam’s LEQVIO (inclisiran). This small interfering RNA (siRNA) therapy silences hepatic PCSK9 production.

In 2015, Amgen became the first company to secure FDA and EMA approval for REPATHA, indicated for patients with familial hypercholesterolemia and clinical ASCVD requiring additional LDL-C reduction. That same year, Sanofi/Regeneron received approval for PRALUENT, expanding treatment options for primary hypercholesterolemia and mixed dyslipidemia. More recently, in 2020, Novartis introduced LEQVIO, offering a twice-yearly dosing regimen that addresses adherence challenges associated with monoclonal antibody therapies.

Despite launching in the same year, REPATHA quickly outpaced PRALUENT in the PCSK9 inhibitors market adoption. Amgen secured broader payer access through aggressive pricing and rebate strategies, while PRALUENT faced reimbursement hurdles and uncertainty due to prolonged patent litigation (2016–2019). Another factor impacting PRALUENT’s sales is its withdrawal from the Japanese PCSK9 inhibitors market (lost a patent conflict), which eliminated a key source of regional sales.

REPATHA and PRALUENT were initially targeted for patients with familial hypercholesterolemia, but their market expanded significantly once they received approval for use in the broader ASCVD and ACS population. Pivotal outcomes trials supported this shift. The FOURIER trial (2017) evaluated evolocumab in patients with stable ASCVD and demonstrated a reduction in cardiovascular events compared to placebo, providing REPATHA with an early clinical advantage. In contrast, the ODYSSEY OUTCOMES trial (2018) assessed PRALUENT in patients with a recent Acute Coronary Syndrome (ACS), expanding PRALUENT’s label into this high-risk subgroup. The key distinction between these studies lies in the patient populations they addressed: FOURIER focused on stable ASCVD, whereas ODYSSEY OUTCOMES focused on post-ACS patients. Stronger global marketing and consistent commercial focus further cemented REPATHA’s lead, while Sanofi’s reduced involvement in 2020 left Regeneron solely responsible for PRALUENT’s US commercialization.

| FOURIER vs. ODYSSEY Trial Outcomes | |

| FOURIER (Evolocumab) | ODYSSEY (Alirocumab) |

| Published: 2017Population: ~27,500 patients with ASCVD on statins LDL-C Reduction: ~59%. Key Outcomes: 15% relative risk reduction in major adverse cardiovascular events (MACE: CV death, MI, stroke, hospitalization for unstable angina, revascularization). No significant reduction in all-cause or CV mortality. Takeaway: First definitive evidence that PCSK9 inhibition lowers hard CV outcomes. | Published: 2018 Population: ~18,900 patients post-ACS on intensive statins LDL-C Reduction: ~55% Key Outcomes: 15% reduction in MACE (death from CHD, nonfatal MI, fatal/nonfatal ischemic stroke, unstable angina requiring hospitalization) Signal toward reduced all-cause mortality (not statistically robust after adjustment) Takeaway: Confirmed cardiovascular risk reduction in very high-risk ACS patients. |

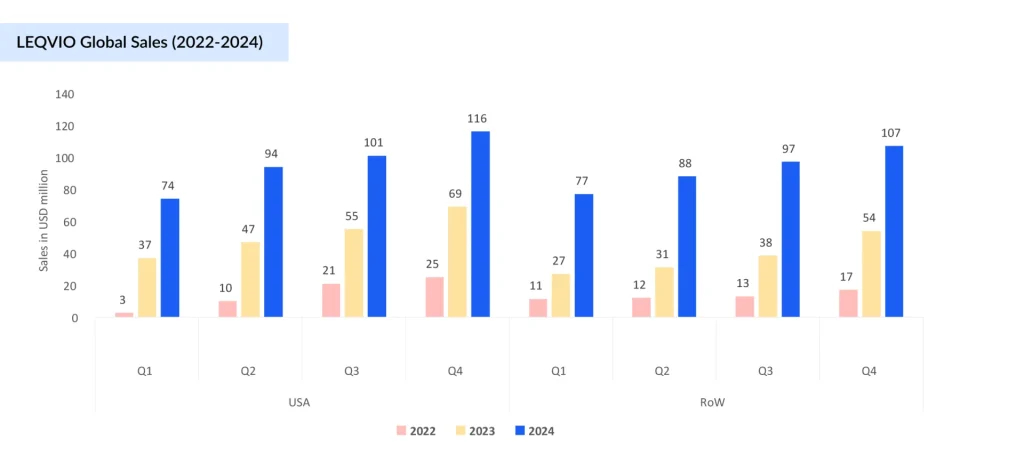

In contrast to the PCSK9 monoclonal antibodies (mAbs), Novartis’ inclisiran (LEQVIO) has charted a different trajectory. LEQVIO was first approved in the EU in late 2020. LEQVIO’s initial uptake was hampered by its approval coinciding with the COVID-19 pandemic in late 2020, which disrupted healthcare systems and patient access, further delayed by FDA rejection over manufacturing site issues that pushed its US launch to late 2021. Although its initial launch was relatively slow, LEQVIO is poised to become a blockbuster therapy in 2025, driven by several key differentiators

- First in Class siRNA: First and only siRNA drug approved for lowering LDL-C levels that are proven to be effective and provide sustained reduction of LDL

- Significant LDL-C Reduction and Enhanced Adherence: A significant benefit of inclisiran (LEQVIO) over evolocumab (REPATHA) and alirocumab (PRALUENT) is its 6-monthly dosing schedule

- First-line Monotherapy Approval: The US FDA approved LEQVIO in August 2025 as a first-line monotherapy for hypercholesterolemia

- Expansion of Target Patient Pool: LEQVIO’s market potential is expected to expand further as Novartis actively positions the drug in the primary prevention setting

Regardless of their proven efficacy, the adoption of PCSK9 therapies, REPATHA (evolocumab), PRALUENT (alirocumab), and LEQVIO (inclisiran), has been constrained by high costs, complex reimbursement pathways, and the burden of injectable administration for an asymptomatic condition. Initial launch prices of REPATHA and PRALUENT (~USD 14,500 per year) led to significant out-of-pocket expenses and ~33% abandonment rates due to stringent prior authorizations. Price reductions in 2018 (~60%) improved affordability, driving modest gains in initiation (0.5–3.3%) and persistence (18–60%). LEQVIO’s biannual dosing offers a more adherence-friendly alternative, though market penetration remains limited. Emerging data suggest a gradual shift, with revenue trends indicating improved payer alignment and broader access.

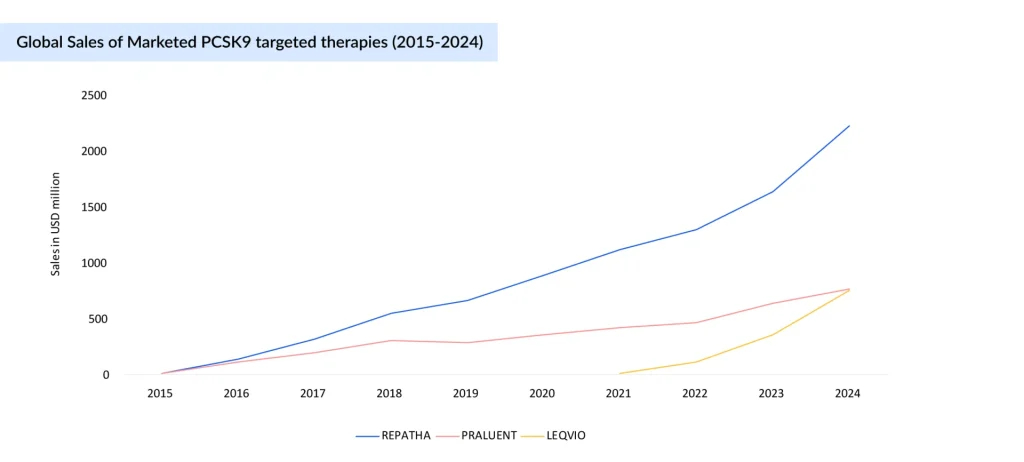

REPATHA continues to lead the PCSK9 inhibitors market with strong, consistent growth, rising from USD 10 million in 2015 to USD 2.22 billion in 2024, driven by volume growth and a higher number of patients using the drug worldwide. PRALUENT has seen slower uptake, growing to USD 765 million by 2024, underpinned by revenue increases in Europe and the rest of the world. LEQVIO, despite launching later (2021), is scaling rapidly, with a 570% growth from 2022 to 2024, reaching USD 754 million, and is expected to surpass PRALUENT this year. This indicates growing preference for LEQVIO’s infrequent dosing and increasing market share at the expense of PRALUENT. LEQVIO is expected to become a blockbuster this year.

PCSK9 Innovation Accelerates: Oral, Long-acting, and Gene-editing Therapies Redefine the Landscape

While marketed therapies have cemented PCSK9 inhibition as a powerful intervention, uptake challenges have left room for innovation. This gap is now fueling a new wave of competition with oral, long-acting, and gene-editing approaches.

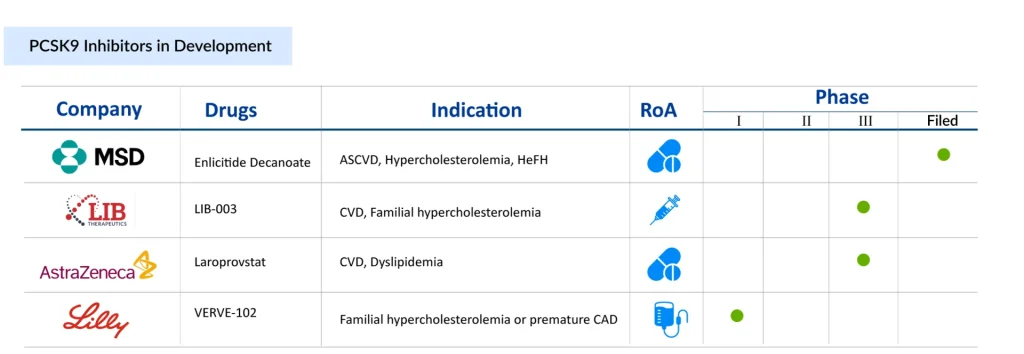

Despite varied modalities, the PCSK9 pipeline remains limited. For diseases with such a vast patient burden, the small number of drugs in development underscores a clear unmet need and opportunity.

At the forefront of this shift is the race to develop the first oral PCSK9 inhibitor, a closely watched contest with potentially game-changing implications for cardiovascular care. Merck has emerged as the clear frontrunner with MK-0616 (Enlicitide decanoate), a peptide-based candidate that has already delivered positive Phase III results. Demonstrating robust LDL-C reductions and a safety profile comparable to placebo, MK-0616 stands poised to become the first oral alternative in a field long dominated by injectables. Its late-stage success not only validates the approach but offers the potential to improve patient adherence and expand access significantly.

AstraZeneca, while trailing in the clinical timeline, is taking a different path with AZD0780 (laroprovstat), a small-molecule inhibitor currently in Phase III. Among all the late-stage PCSK9 therapies, laroprovstat is one of the newest therapies to enter the pivotal stage (AZURE studies). Its Phase II data has shown LDL-C reductions exceeding 50% and boasts the added convenience of not requiring fasting, an attribute that could enhance real-world usability. However, its pivotal trial only began in 2024, with primary completion expected by 2027, which will keep AstraZeneca behind Merck in the race. This delay positions Merck to secure first-mover advantage and reshape the competitive dynamics of a multibillion-dollar market. The difference between the two oral therapies is that Merck’s requires patients to fast before taking it to ensure adequate absorption. Since AstraZeneca’s tablet is a small-molecule drug, there are no dietary or fasting limitations.

“It is estimated that oral PCSK9 therapies are likely to expand the total PCSK9 market by two to three times.”

Beyond oral formulations, long-acting and gene-editing candidates are broadening the innovation landscape. LIB Therapeutics’ Lerodalcibep, a monthly recombinant fusion protein in Phase III, offers a potentially more convenient alternative to existing antibody-based treatments, and a BLA for this therapy has been filed with the US FDA, which has set a PDUFA (Prescription Drug User Fee Act) target action date of December 12, 2025. Meanwhile, Verve Therapeutics’ VERVE-102, a base-editing gene therapy in early development, represents the most disruptive vision of the future: A one-time, permanent treatment for hypercholesterolemia. Eli Lilly has acquired Verve Therapeutics. On July 25, Lilly announced the successful completion of its acquisition of Verve Therapeutics.

Together, these approaches mark a pivotal moment in lipid management, signaling not just iterative improvement but a possible transformation in how cardiovascular risk is treated—simpler, more durable, and increasingly tailored to patient needs.

PCSK9 Inhibitors Market: The Road Ahead

The future of the PCSK9 inhibitor market is set to be reshaped by next-generation therapies, with oral agents leading the charge. Beyond orals, the horizon extends to even more transformative modalities. Verve’s gene-editing programs represent a bold step toward a potentially one-time, curative approach in the earlier pipeline. If successful, these innovations could redefine not just PCSK9 inhibition but the broader paradigm of lipid management. Yet, the path forward is not without hurdles. High costs, market access restrictions, and reimbursement challenges remain critical barriers to broad adoption. Future success will depend not only on clinical efficacy and patient convenience but also on aligning payer strategies and ensuring affordability. If these challenges are addressed, the next wave of PCSK9 inhibitors, particularly orals and gene-based therapies, has the potential to transform a multibillion-dollar cardiovascular market and deliver lasting impact on global disease burden.

Downloads

Article in PDF

Recent Articles

- MEDIT’s i700 Intraoral Scanner; Phantom Neuro and Blackrock’s Next-Generation Assistive Devices; ...

- From Lab to Lifesaver: Advancing Artificial Blood Vessels for Healthier Tomorrows

- Pacemakers: Analyzing the Market Dynamics and Major Developments

- PCSK9 Inhibitors: A New Era for Cholesterol Management

- GSK’s RSV Vaccine Clears Phase III Test in Adults; Roche’s Tecentriq for Adjuvant NSCLC; Owkin Ba...