Understanding How Cardiac Devices are Aiding in Treatment and Prevention of Heart Disease

Jul 31, 2025

Table of Contents

Cardiovascular diseases (CVDs) continue to dominate as the leading global cause of death, responsible for approximately 17.9 million deaths annually, as reported by the World Health Organization (2021). Representing the highest disease burden worldwide, CVD incidence is rising rapidly across most low- and middle-income nations, even in regions where prior trends suggested a decline. The global cardiovascular crisis is further intensified by the widening gap between disease recognition and the timely implementation of effective, scalable solutions. Despite the development of advanced cardiovascular medical devices and therapies, many regions still struggle with equitable access and delivery.

In the United States alone, heart disease claims around 6.6 million lives each year — accounting for nearly one in every four deaths — with a significant number occurring between the ages of 30 and 70. Additionally, nearly 8 million individuals suffer a heart attack annually, with roughly 20% classified as “silent,” causing unnoticed damage. These staggering figures point to an urgent need to optimize the deployment of existing cardiac medical devices, including heart failure medical devices, coronary artery disease device support, and cardiac devices for heart rhythm management. Efforts must now shift toward expanding access to cost-effective cardiology devices and promoting innovation in cardiac disease technology to meet the evolving needs of cardiovascular care.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- FDA Clears Medtronic’s New Inpen™ App; Zimmer Biomet Gets FDA Approval for Oxford® Cementless Par...

- Apyx Medical Received FDA 510(k) Clearance for the Use of Renuvion; Medtronic’s Next-generation M...

- Medtronic Secures FDA Green Light for Affera™ Mapping and Ablation System Alongside Sphere-9™ Cat...

- Major Drugs Decisions for Cardiovascular Diseases to Watch Through 2022

- Boston Scientific Corporation Agreement to Acquire Silk Road Medical; Philips Introduced Duo Veno...

Treatment Options in the Cardiac Diseases Market

There are several cardiovascular disease treatment options available today, tailored to the individual based on the specific type and severity of their condition. The primary goals of cardiovascular disease treatment are to alleviate symptoms, prevent recurrence, reduce the risk of severe complications such as heart failure, stroke, or cardiac arrest, and ultimately, to improve overall quality of life. These treatment options typically include medications to lower LDL cholesterol, improve circulation, and regulate heart rhythm, as well as lifestyle interventions through cardiac rehabilitation programs involving guided exercise and counseling.

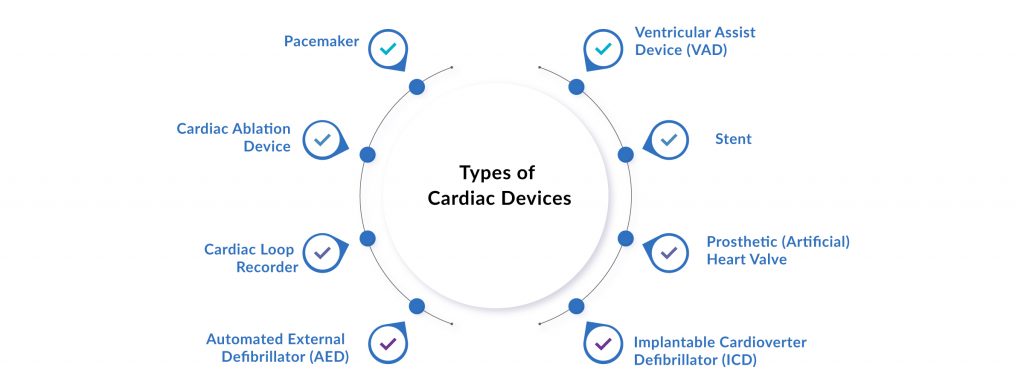

However, in recent years, the emergence of innovative cardiac devices has significantly enhanced the standard of care. A wide range of cardiac medical devices—from implantable pacemakers, stents, and prosthetic heart valves to automated external defibrillators and cardiac loop recorders—are now widely used to manage heart failure and rhythm disorders. These cardiovascular medical devices are particularly crucial for maintaining regular heart function in patients with arrhythmias or advanced heart failure. As the cardiovascular devices market evolves, these electronic devices that help the heart maintain normal rhythm are becoming indispensable tools in both acute care and long-term disease management, signaling a promising future for cardiology medical devices in improving survival and reducing hospitalization.

Some of the leading FDA-approved Cardiac Devices Available in the Market Include:

Automated External Defibrillators

Automated External Defibrillators (AEDs) are critical cardiac medical devices designed to restore a normal heart rhythm during sudden cardiac arrest. These electronic devices that help the heart maintain normal rhythm are portable, easy to use, and are often found in public spaces, ambulances, and heart machines in hospitals. AEDs work by detecting life-threatening arrhythmias and delivering a shock to reset the heart’s rhythm — especially when a dangerously rapid or erratic heartbeat compromises the heart’s ability to pump blood, potentially leading to cardiac arrest.

The global cardiovascular medical devices market is witnessing significant growth, and AEDs are a major contributor to this momentum. One of the primary drivers is the rising burden of cardiovascular diseases, including heart failure and arrhythmias, which continue to elevate the need for advanced heart medical devices. Additionally, the growing prevalence of lifestyle-induced conditions such as hypertension and obesity has accelerated the demand for cardiac devices for heart failure and emergency interventions like AEDs.

Innovations such as wearable AEDs are reshaping the landscape of innovative cardiac devices, allowing for continuous monitoring and rapid intervention outside clinical settings. These advances highlight the ongoing transformation in cardiology medical devices, where life-saving technologies are becoming more accessible and efficient.

According to DelveInsight’s latest analysis, the automated external defibrillators market is poised to grow at a CAGR of 8.62% by 2032, fueled by ongoing R&D, rising cardiac emergency cases, and increasing public awareness about AED usage.

Some of the top cardiovascular medical device companies operating in this segment include Koninklijke Philips N.V., Stryker, ZOLL Medical Corporation, NIHON KOHDEN CORPORATION, and SCHILLER, alongside rising innovators like Kestra Medical Technologies and HEARTHERO. These leaders continue to drive forward the next generation of cardiac care equipment through robust product pipelines and strategic partnerships in cardiovascular product development.

Stents

Stents are small, expandable wire mesh tubes used to open up blocked arteries, particularly in the treatment of coronary heart disease. These cardiac medical devices play a pivotal role in restoring proper blood flow by widening arteries narrowed due to plaque buildup — a condition commonly leading to angina (chest pain) or heart attacks.

During a stent placement procedure, a catheter-guided balloon is used to deliver the stent to the blocked artery, where it is expanded and locked into position. Once in place, the stent keeps the artery open, allowing blood to flow more freely. Compared to traditional coronary artery bypass surgery, patients undergoing angioplasty with stents often experience faster recovery and shorter hospital stays.

Stents are made from various materials such as metal alloys, polymers, and plastics, and can be tailored based on the clinical need, including drug-eluting stents and bioresorbable vascular scaffolds, which represent next-gen innovative cardiac devices.

The growing prevalence of cardiovascular diseases, rising geriatric population, and increasing burden of chronic conditions are major factors driving the demand for heart medical devices like stents. As cardiovascular disease continues to dominate global morbidity, the stents market has gained substantial momentum within the broader cardiovascular medical devices market.

According to DelveInsight’s analysis, the global stents market is projected to grow at a CAGR of 5.61% from 2025 to 2032, reflecting consistent innovation and growing clinical adoption.

Despite this growth, challenges such as stringent regulatory approvals and risks related to stent thrombosis or implantation complications could impact market dynamics. However, continuous R&D and product advancements are helping to address these concerns.

Leading cardiac device companies such as Boston Scientific Corporation, Medtronic, Abbott, BD, Terumo Europe NV, and BIOTRONIK SE & Co. KG are actively investing in next-generation cardiology medical devices. Meanwhile, emerging players like Elixir Medical Corporation and REVA Medical, LLC are pushing the frontier of vascular innovation, aiming to enhance long-term outcomes in heart disease treatment.

Cardiac Ablation Devices

Cardiac ablation devices are cardiac medical devices used in minimally invasive procedures to correct abnormal heart rhythms, or arrhythmias, by eliminating problematic cardiac tissue. These heart medical devices use energy sources such as radiofrequency, cryotherapy, or lasers to create small scars that disrupt faulty electrical signals in the heart. Cardiac arrhythmias—when the electrical impulses that regulate heartbeats malfunction—can lead to irregular rhythms, which may progress to serious conditions like stroke or heart failure if untreated. As a result, cardiac ablation has become a critical intervention in modern heart disease treatment.

The growing global burden of cardiovascular diseases, particularly among the aging population, is significantly boosting the cardiovascular medical devices market. The increasing prevalence of heart failure and atrial fibrillation has positioned cardiac ablation devices as one of the most effective treatment options. Leading cardiac device companies such as Abbott Laboratories, Boston Scientific Corporation, Medtronic, AtriCure, Biosense Webster (Johnson & Johnson), and Teleflex are accelerating innovation and expanding manufacturing capacity to meet rising demand.

According to DelveInsight, the global cardiac ablation devices market was valued at USD 2.25 billion in 2023 and is projected to grow at a robust CAGR of 12.77%, reaching USD 4.63 billion by 2032. This growth is further supported by ongoing advancements in innovative cardiac devices, including catheter-based ablation systems, robotic-assisted technologies, and real-time imaging solutions.

However, regulatory challenges and product recalls continue to pose hurdles for market players. Despite these constraints, the strong therapeutic value and increasing adoption of ablation therapies globally are expected to sustain the market’s upward trajectory, offering new hope for patients with complex arrhythmias.

Ventricular Assist Devices

Ventricular assist devices (VADs), also known as mechanical circulatory support devices, are sophisticated electromechanical systems designed to aid the heart in pumping blood from the ventricles to the rest of the body. They are primarily used in patients with severe heart failure, where the heart can no longer effectively circulate blood on its own. By mechanically supporting the weakened cardiac function, these devices serve as a bridge to transplantation or, in some cases, as a long-term therapy for those who are not transplant candidates.

The ventricular assist devices market is witnessing sustained growth due to a rising global burden of cardiovascular diseases and the increasing prevalence of chronic heart failure. This growth is further fueled by the aging population, who are more prone to develop comorbidities such as diabetes, hypertension, and neurological disorders, all of which can contribute to cardiovascular decline. The demand is also rising due to the growing need for organ transplants, particularly for those with end-stage heart failure, where ventricular assist devices can serve as life-sustaining support until a donor heart becomes available.

Technological advancements have also contributed significantly to the expansion of the ventricular assist devices market. Innovations include better biocompatibility, improved infection control properties, reduced device size, and enhanced battery life, making these devices more practical and less intrusive for patients. Companies are increasingly incorporating elements of artificial intelligence to optimize device performance and patient monitoring, which further boosts the device’s clinical value. As per DelveInsight’s estimates, the ventricular assist devices market size stood at USD 1.9 billion in 2023 and is projected to grow at a CAGR of 8.12%, reaching around USD 3.1 billion by 2032.

Despite their advantages, ventricular assist devices are not without limitations. High treatment costs, along with associated complications such as bleeding, ischemia, and hemorrhagic stroke, pose significant challenges to widespread adoption. However, leading medical device companies—including Abiomed, Abbott Laboratories, Berlin Heart, Medtronic, SynCardia Systems, and Jarvik Heart—are actively investing in the development of next-generation devices aimed at minimizing risks and improving overall outcomes. Their efforts are expected to play a pivotal role in shaping the future landscape of the ventricular assist devices market by delivering safer and more efficient cardiac support solutions.

Cardiac Loop Recorders

Implantable loop recorders are small, thumb-sized cardiac monitoring devices designed for continuous, long-term tracking of heart rhythms. These devices function similarly to Holter monitors, but offer a significant advantage in terms of duration and convenience. Implanted just beneath the skin on the left side of the chest, they continuously capture electrical signals from the heart and are capable of recording data for up to 15–18 months. Patients or healthcare providers can manually activate recordings during symptomatic episodes, while the device also automatically detects and logs irregular heart rhythms, ensuring no critical event is missed.

These cardiac loop recorders have emerged as a vital tool in the diagnosis and monitoring of atrial fibrillation, cardiac arrhythmias, and other complex cardiovascular conditions. Their ability to deliver more definitive results, especially in cases where standard diagnostic tools fall short, has revolutionized the approach to long-term ECG monitoring. One of the most compelling benefits of these devices is their support for wireless remote monitoring, allowing clinicians to access real-time or stored heart data without requiring in-person visits, a capability that is proving crucial in both urban and rural healthcare settings.

The growing burden of cardiovascular diseases, particularly atrial fibrillation, is a key driver propelling the implantable loop recorders market forward. As the demand for remote patient monitoring increases across healthcare systems worldwide, these minimally invasive devices are being increasingly adopted for early detection and timely intervention in high-risk cardiac patients. Their unobtrusive nature allows patients to carry on with their daily routines while the device passively monitors their heart health, significantly improving quality of life and clinical outcomes.

Several major MedTech companies, including Medtronic, Abbott, and BIOTRONIK, are spearheading innovations in this space to enhance accuracy, battery life, and connectivity features. These advancements are not only streamlining data sharing between patients and physicians but are also making implantable loop recorders more accessible and effective. As a result, the implantable loop recorders market is expected to witness consistent growth over the coming years, driven by technological innovation and the need for proactive cardiac care.

Pacemakers

Pacemakers are small, implantable cardiac devices designed to regulate abnormal heart rhythms by sending electrical pulses to maintain a normal heartbeat. They are commonly used in cardiovascular disease treatment, especially for conditions like bradycardia and cardiac rhythm management disorders. These devices help prevent sudden cardiac arrest and reduce the risk of heart failure, making them vital for long-term care.

The global pacemakers market has seen steady growth driven by rising heart disease prevalence, an aging population, and greater awareness. The introduction of MRI-safe and leadless pacemakers, along with remote monitoring features, is enhancing both patient safety and physician oversight. As demand grows, innovation is also accelerating.

Major MedTech companies such as Medtronic, Inc., St. Jude Medical, Inc., Boston Scientific Corporation, Biotronik SE & Co. KG, LivaNova PLC, Shree Pacetronix Ltd., OSCOR Inc., MEDICO S.p.A., Lepu Medical Technology Co. Ltd., MicroPort Scientific Corporation, and others are leading the way in developing next-gen pacemakers. According to DelveInsight, the cardiac devices market was valued at USD 4.88 billion in 2023 and is expected to grow at a CAGR of 5.85% (2025–2032), reinforcing its crucial role in the cardiac devices segment.

Implantable Cardioverter Defibrillator (ICD)

Implantable Cardioverter Defibrillators (ICDs) are small, battery-powered cardiac devices designed to detect and correct life-threatening arrhythmias. Unlike pacemakers that maintain a steady heart rate, ICDs monitor the heartbeat and deliver electric shocks only when abnormal rhythms like ventricular tachyarrhythmias or cardiac arrest are detected. These devices are typically implanted under the skin of the chest or abdomen.

ICDs are recommended for patients at high risk of sudden cardiac arrest, including those with a history of heart attack, Long QT syndrome, congenital heart defects, or dysrhythmias. While most patients receive traditional ICDs, those with structural heart issues may be advised to use a Subcutaneous subcutaneous Implantable Cardioverter Defibrillator (S-ICD) for enhanced safety and performance.

The global Implantable Cardioverter Defibrillator market is expanding due to the rising burden of heart disease and advancements in cardiac care. Leading MedTech companies like Medtronic, Abbott Laboratories, Boston Scientific, MicroPort Scientific, Biotronik, Cintas Corp., and others are actively developing next-generation ICDs with better remote monitoring, longer battery life, and smarter shock algorithms.

Prosthetic (Artificial) Heart Valves

Prosthetic (artificial) heart valves are surgically implanted devices used to replace damaged or malfunctioning valves in the heart. Designed to mimic natural valve function with minimal complications like low thrombogenicity, these devices significantly improve hemodynamics and patient outcomes. The heart has four valves, and failure in any may require valve replacement to restore normal cardiac function.

There are three main types of prosthetic heart valves: mechanical valves, tissue/bioprosthetic valves, and transcatheter heart valves (TAVR). Mechanical valves offer long-term durability (20–30 years) but may require lifelong anticoagulation. Valve selection depends on several factors—most notably patient age, lifestyle, and risk profile—making it a complex but critical decision in cardiology.

The prosthetic heart valve market is growing rapidly due to rising cardiovascular disorders, an aging global population, and technological advancements. Key players like Lepu Medical Technology, Sorin Group, Abbott Laboratories, Colibri Heart Valve, On-X Life Technologies, Micro Interventional Devices, Direct Flow Medical, Edwards Lifesciences Corporation, LivaNova, JenaValve Technology, Cryolife, Inc., Medtronic, MERIL LIFESCIENCES, Boston Scientific Corporation, and others are driving innovation and R&D, supported by favorable regulatory frameworks and increasing awareness among patients and providers.

Recent Developments and Breakthroughs in the Cardiac Devices Segment

- In May 2025, Johnson & Johnson MedTech launched the SOUNDSTAR CRYSTAL™ Ultrasound Catheter in the U.S. for intracardiac echocardiography imaging during cardiac arrhythmia ablation procedures.

- In March 2025, Caristo Diagnostics announced it received FDA 510(k) clearance for its CaRi-Plaque™ technology, an AI-assisted image analysis application designed to aid in the diagnosis of coronary artery disease (CAD).

- In March 2025, the FDA approved the first generics of Xarelto (rivaroxaban) 2.5 mg tablets, an anticoagulant to prevent deep vein thrombosis in adults with peripheral artery disease and to reduce the risk of major cardiovascular events in adults with coronary artery disease.

- In Feb 2025, Artrya Limited submitted its response to the FDA’s queries regarding its 510(k) application for the Salix® Coronary Anatomy product. The company expects regulatory clearance by the end of March 2025, marking a key milestone in offering its AI-based coronary disease detection technology in the US market.

- In February 2025, Riverain Technologies announced its expansion into eight countries in 2024, adding nearly 50 new customers with its ClearRead solutions to improve detection of cardiothoracic diseases. Building on 147% growth in 2024, the company is entering 2025 with new FDA-cleared technology that extends ClearRead CT functionality, offering coronary artery calcium (CAC) scores for ungated scans without contrast. This advancement enables opportunistic screening for coronary heart disease, the leading cause of death globally.

- In January 2025, EBR Systems, Inc. announced the successful completion of the FDA’s Pre-Approval Inspection for its wireless cardiac pacing device, with no observations. This progress moves the Premarket Approval submission into its final phase, with regulatory approval expected by April 2025 and a commercial launch slated for the second half of 2025, strengthening EBR’s position in the cardiac device market.

- In January 2024, Boston Scientific Corporation announced that it received FDA approval for the FARAPULSE™ Pulsed Field Ablation (PFA) System. The system is used to isolate pulmonary veins in treating drug-resistant, paroxysmal atrial fibrillation (AF) and offers a new alternative to traditional thermal ablation treatments.

- In September 2024, Boston Scientific Corporation received U.S. Food and Drug Administration (FDA) approval to expand the indication for the current-generation INGEVITY™+ Pacing Leads, which are thin wires placed inside the heart and connected to an implantable device. The approval now includes conduction system pacing (CSP) and sensing of the left bundle branch area (LBBA) when connected to a single- or dual-chamber pacemaker.

- In October 2023, Medtronic plc, received FDA approval for its Aurora EV-ICD™ MRI SureScan™ Extravascular Implantable Cardioverter-defibrillator and Epsila EV™ MRI SureScan™ defibrillation lead. These devices are designed to treat dangerously fast heart rhythms that can lead to sudden cardiac arrest.

Cardiac Devices Market – Future Prospects

Driven by rising demand, favorable regulatory support, and increased R&D funding, the cardiac devices market is poised for strong expansion. The sector is expected to attract new players and see a surge in mergers, acquisitions, and strategic collaborations among top MedTech firms, further strengthening its innovation pipeline.

The future of cardiac devices looks highly promising, underpinned by their clinical effectiveness and expanding applications in cardiovascular care. However, integrating next-generation technologies into clinical practice poses challenges. Tailored treatments, real-world data, and personalized strategies will be essential to fully unlock the benefits of emerging device innovations.

Ongoing advancements in device design, minimally invasive implantation, and post-procedure monitoring are likely to reshape treatment paradigms. As these technologies continue to evolve, cardiac devices are set to play a more central role in diagnosing, managing, and preventing cardiovascular disease worldwide.

Frequently Asked Questions

Pacemakers are small implantable devices that regulate abnormal heart rhythms by sending electrical pulses to the heart to maintain a steady beat, particularly for conditions like bradycardia or conduction delays. According to DelveInsight, innovations such as MRI-safe and leadless pacemakers, remote monitoring capabilities, and improvements in battery life are boosting both patient safety and convenience, while making these devices more adaptable to varied clinical needs.

An ICD is a cardiac device implanted under the skin (usually in the chest or abdomen) designed to monitor the heartbeat and deliver electrical shocks if life-threatening arrhythmias such as ventricular tachycardia or ventricular fibrillation are detected. Unlike a pacemaker, which primarily prevents the heart from beating too slowly, an ICD intervenes when there are dangerously fast or chaotic rhythms; there are also subtypes such as subcutaneous ICDs (S-ICDs) which avoid placing leads inside the heart chambers.

CRT devices, sometimes paired with pacemakers or ICDs, help coordinate the contractions of the heart’s ventricles (especially the left and right lower chambers) in patients whose heart failure includes dyssynchronous ventricular activity. By improving synchronization, these devices can enhance cardiac output, improve symptoms, reduce hospitalizations, and improve quality of life for selected heart failure patients. The market for CRT devices is expanding, in part driven by rising heart failure prevalence and technological enhancements in lead design and energy efficiency.

Heart rhythm monitors and implantable loop recorders are devices that continuously or intermittently record the electrical activity of the heart over long periods (weeks to years) to detect intermittent arrhythmias that might not be caught during clinic visits. These tools are vital for diagnosing conditions like unexplained fainting, palpitations, or risk of sudden arrhythmia, guiding decisions about whether patients need more invasive therapies like pacemakers or ICDs. Their small size and capability for remote data transmission are augmenting their clinical utility.

The global cardiac devices market is experiencing steady growth, driven by the rising prevalence of cardiovascular diseases, aging populations, and advancements in medical technology. As of recent estimates, the market is valued in the tens of billions of dollars and is projected to expand significantly over the next decade. Among device categories, implantable devices such as pacemakers, implantable cardioverter-defibrillators (ICDs), and cardiac resynchronization therapy (CRT) systems lead due to their critical role in managing arrhythmias and heart failure. Additionally, minimally invasive interventional devices, including stents and transcatheter heart valves, are witnessing rapid adoption owing to improved patient outcomes and reduced recovery times.

Downloads

Article in PDF

Recent Articles

- The Revolution of Healthcare: Smart Medical Devices Transforming the Future

- From Lab to Lifesaver: Advancing Artificial Blood Vessels for Healthier Tomorrows

- GSK’s RSV Vaccine Clears Phase III Test in Adults; Roche’s Tecentriq for Adjuvant NSCLC; Owkin Ba...

- What are the Top Five Leading Causes of Deaths in the World?

- Pacemakers: Analyzing the Market Dynamics and Major Developments