B‐rapidly accelerated fibrosarcoma (BRAF) Metastatic Non-small Cell Lung Cancer Market

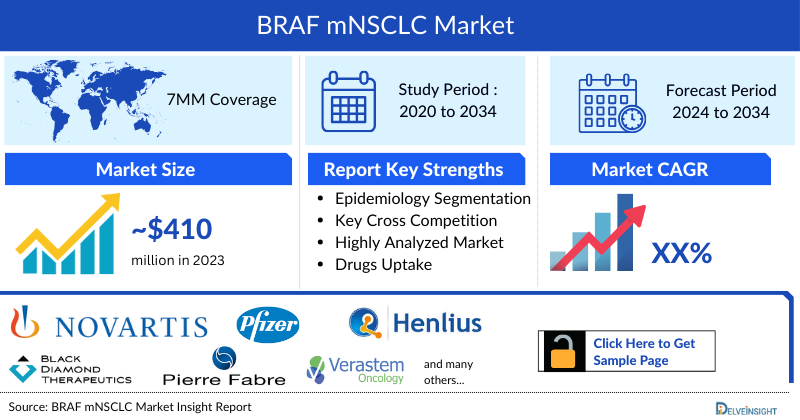

- The total BRAF-mutated Non-small cell lung cancer market size in the 7MM was estimated to be nearly USD 410 million in 2023, which is expected to increase by 2034.

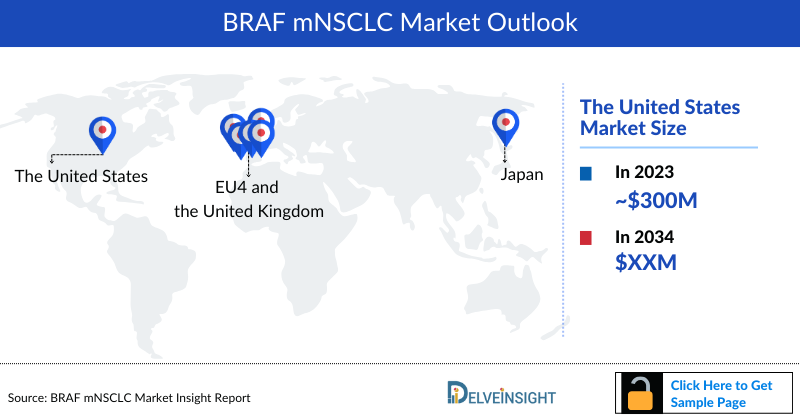

- In 2023, the United States accounted for the maximum share of the total market of BRAF mutated NSCLC in the 7MM, i.e., approximately 69%.

- NICE has recommended Novartis' TAFINLAR + MEKINIST in the final draft guidance for treating advanced NSCLC with a BRAF V600 mutation in adult patients. This decision comes six years after the combination was first approved in England via the European Medicines Agency (EMA).

- In 2023, TAFINLAR (dabrafenib) + MEKINIST (trametinib) captured the highest market size of BRAF-mutated NSCLC by therapies, i.e., around USD 100 million in EU4 and the UK combined.

- In biomarker-specific cases, the most number of the cases are from PD-L1, followed by KRAS, and EGFR. On the other hand, NTRK accounted for the least number of cases, whereas BRAF and MET accounted for approximately 5% and 4% of cases, respectively.

- In October 2023, the US Food and Drug Administration (FDA) approved BRAFTOVI (encorafenib) + MEKTOVI (binimetinib) for adult patients with metastatic NSCLC with a BRAF V600E mutation, as detected by an FDA-approved test.

- In July 2024, Pierre Fabre received the Committee for Medicinal Products for Human Use (CHMP) positive opinion for BRAFTOVI + MEKTOVI for the treatment of adult patients with advanced NSCLC with a BRAF V600E mutation.

DelveInsight’s “BRAF Metastatic Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of BRAF NSCLC, historical and forecasted epidemiology as well as BRAF NSCLC therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The BRAF NSCLC Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM BRAF NSCLC market size from 2020 to 2034. The report also covers current BRAF NSCLC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

BRAF Metastatic Non-small Cell Lung Cancer Market |

|

|

BRAF Metastatic Non-small Cell Lung Cancer Market Size | |

|

BRAF Metastatic Non-small Cell Lung Cancer Companies |

Novartis, Pfizer, Pierre Fabre, Black Diamond Therapeutics, Shanghai Henlius Biotech, Verastem, and others. |

|

BRAF Metastatic Non-small Cell Lung Cancer Epidemiology Segmentation |

|

BRAF Metastatic Non-small Cell Lung Cancer Treatment Market

BRAF Metastatic Non-small Cell Lung Cancer Overview

Non-small cell lung cancer (NSCLC) is the most common type of lung cancer, accounting for approximately 85% of all lung cancers. It is mainly subcategorized into adenocarcinomas, squamous cell carcinomas, large cell carcinomas, and several other types that occur less frequently, including adenosquamous carcinomas and sarcomatoid carcinomas. Over the past ten years, there has been a significant advancement in the treatment of lung cancer owing to the identification of several distinct druggable targets. The most prominent ones include epidermal growth factor receptor, anaplastic lymphoma kinase (ALK) translocation, BRAF mutation and ROS-1 rearrangement. BRAF mutated NSCLC is a rare form of NSCLC.

BRAF Metastatic Non-small Cell Lung Cancer Diagnosis

The diagnosis and staging of BRAF NSCLC are often done simultaneously. The tests and procedures used in the diagnosis of NSCLC are Physical Exam and History, Laboratory Tests, Chest X-ray, CT scan (CAT scan), Sputum Cytology, Thoracentesis, Fine-needle aspiration (FNA) biopsy of the Lung, Bronchoscopy and other techniques.

Further details related to diagnosis are provided in the report…

BRAF Metastatic Non-small Cell Lung Cancer Treatment

The results of the standard treatment of NSCLC are poor except for the most localized cancers. The newly diagnosed patients with NSCLC are potential candidates for studies evaluating new forms of treatment. There are different types of treatment available for NSCLC; however, mainly 10 types of standard treatment are used, which include Surgery, Radiation therapy, Chemotherapy, Targeted therapy, Immunotherapy, Laser therapy, Photodynamic therapy (PDT), Cryosurgery, Electrocautery, and Watchful waiting.

First-line treatment for BRAF V600E mutations in lung cancer is either:

- Immunotherapy with or without chemotherapy

- TAFINLAR (dabrafenib) + MEKINIST (trametinib)

- BRAFTOVI (encorafenib) + MEKTOVI (binimetinib)

Further details related to treatment are provided in the report…

BRAF Metastatic Non-small Cell Lung Cancer Epidemiology

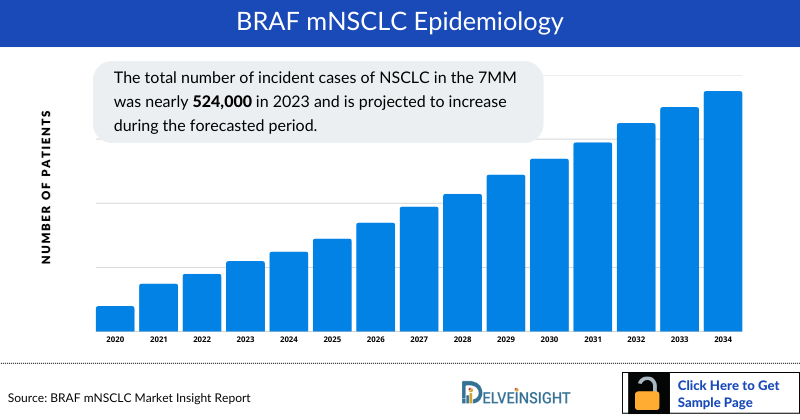

The BRAF NSCLC epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total NSCLC Incident Cases, Gender-specific Cases of NSCLC, Age-specific Cases of NSCLC, Total Incident Cases of NSCLC by Histology, Total Incident Cases of NSCLC by Stage, and Total Cases of NSCLC by Genetic Mutations/Biomarkers in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- The total number of incident cases of NSCLC in the 7MM was nearly 524,000 in 2023 and is projected to increase during the forecasted period.

- The total number of incident cases of NSCLC in the United States was nearly 202,590 in 2023.

- The total number of cases in the United States for BRAF-positive NSCLC was estimated to be nearly 10,430 in 2023, which is expected to show positive growth by 2034.

- In 2023, the incidence of NSCLC cases in the United States was ~114,300 in males and ~ 88,350 in females.

- In 2023, Germany had the highest number of cases of BRAF-positive NSCLC among EU4 and the UK.

BRAF Metastatic Non-small Cell Lung Cancer Drugs Market Chapters

- The drug chapter segment of the BRAF NSCLC report encloses a detailed analysis of the marketed and the late-stage (Phase III) pipeline drug. The marketed drugs segment encloses TAFINLAR + MEKINIST and BRAFTOVI + MEKTOVI. The drug chapter also helps understand the BRAF NSCLC clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

BRAF Metastatic Non-small Cell Lung Cancer Marketed Drugs

TAFINLAR + MEKINIST: Novartis

TAFINLAR (dabrafenib) combined with MEKINIST (trametinib) is indicated for treating BRAF V600E mutation in various types of cancers. TAFINLAR and MEKINIST are prescription medicines used in combination to treat patients with metastatic NSCLC with BRAF V600E mutation as detected by an FDA-approved test. Alterations in the MAPK pathway play a key role in many cancer cells' growth, invasion, and survival, including effects on normal, nontumor cells.

BRAF V600E can result in constitutive activation of kinases that may stimulate tumor cell growth in the BRAF pathway. Dabrafenib and trametinib target two kinases in the RAS/RAF/MEK/ERK pathway. Dabrafenib inhibits cell growth of various forms of BRAF kinase, including BRAF V600E in vitro and in vivo.

In June 2017, the US FDA approved TAFINLAR + MEKINIST to treat patients with metastatic NSCLC whose tumors express the BRAF V600E mutation.

BRAFTOVI (encorafenib) + MEKTOVI (binimetinib): Pfizer/Pierre Fabre

BRAFTOVI is an oral small-molecule BRAF kinase inhibitor, and MEKTOVI is an oral small-molecule MEK inhibitor that targets key proteins in the MAPK signaling pathway (RAS-RAF-MEK-ERK). Inappropriate activation of this pathway has been shown to occur in NSCLC. Some lung cancers are linked to acquired genetic abnormalities. Targeting components of this pathway could potentially inhibit unchecked tumor growth and proliferation caused by BRAF mutations. The BRAFTOVI and MEKTOVI combination has shown the potential to help more patients, such as those with BRAF V600E-mutant non-small cell lung cancer.

In October 2023, the US FDA approved BRAFTOVI + MEKTOVI for the treatment of adult patients with metastatic NSCLC with a BRAF V600E mutation. The FDA’s approval was based on data from the ongoing Phase II PHAROS clinical trial (NCT03915951), an open-label, multicenter, single‑arm study examining BRAFTOVI + MEKTOVI combination therapy in both treatment-naïve and previously treated patients with BRAF V600E-mutant metastatic NSCLC.

In July 2024, Pierre Fabre received a CHMP positive opinion for BRAFTOVI + MEKTOVI for the treatment of adult patients with advanced NSCLC with a BRAF V600E mutation.

Note: Detailed marketed and emerging therapies assessment will be provided in the final report...

Emerging BRAF Metastatic Non-small Cell Lung Cancer Drugs

Avutometinib + Defactinib: Verastem

Avutometinib is an RAF/MEK Clamp that induces inactive complexes of MEK with ARAF, BRAF and CRAF, potentially creating a more complete and durable antitumor response through maximal RAS pathway inhibition. Defactinib is a selective FAK inhibitor. The company has completed the Phase II (RAMP 202) trial of avutometinib + defactinib.

BDTX-4933: Black Diamond Therapeutics

BDTX-4933 is a Master Key inhibitor of Class I, II, and III oncogenic RAF mutations. Based on preclinical data, BDTX-4933 can also act as an “RAF-RAS clamp” that blocks mutant KRAS and NRAS signaling. Its development is aimed at treating recurrent advanced/metastatic non-small cell lung cancer with KRAS non-G12C mutations or BRAF mutations, advanced/metastatic melanoma with BRAF or NRAS mutations, histiocytic neoplasms with BRAF or NRAS mutations, and other solid tumors carrying BRAF mutations. Currently, it is undergoing Phase I clinical trial.

Note: Detailed insights will be provided in the final report.

BRAF Metastatic Non-small Cell Lung Cancer Market Outlook

BRAF is a member of the RAF kinases that regulate the MAP kinase pathway; V600E is the most common mutation. Treatments for advanced NSCLC have evolved. Most patients have received 1L systemic chemotherapy followed by Immuno-oncology (IO) monotherapies, targeted therapies, and IO combination regimens.

Only two products are available for the BRAF-mutated NSCLC patient pool: TAFINLAR + MEKINIST and BRAFTOVI + MEKTOVI. In June 2017, the US FDA approved TAFINLAR and MEKINIST, and in October 2023, BRAFTOVI + MEKTOVI was approved to treat patients with metastatic NSCLC whose tumors express the BRAF V600E mutation.

According to the NCCN guidelines, the preferred treatment regimen for BRAF V600E mutation NSCLC in both first-line and second-line treatment is dabrafenib + trametinib and Encorafenib + binimetinib. Moreover, in certain circumstances, ZELBORAF (vemurafenib) is also recommended by the NCCN guidelines in the first lines of settings.

- In 2023, the total market size of BRAF NSCLC in the US was approximately USD 300 million, which is expected to increase by 2034.

- The current market is dominated by the TAFINLAR + MEKINIST combination owing to the first mover advantage in the market then BRAFTOVI + MEKTOVI.

- BRAFTOVI + MEKTOVI is expected to generate ~USD 400 million in the total 7MM market size of BRAF NSCLC owing to familiarity among physicians and an established safety profile.

BRAF Metastatic Non-small Cell Lung Cancer drug uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2020–2034.

The landscape of BRAF NSCLC treatment has experienced a profound transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. Furthermore, the increased uptake of these transformative drugs is a testament to the unwavering dedication of physicians, oncology professionals, and the entire healthcare community in their tireless pursuit of advancing cancer care. This momentous shift in treatment paradigms is a testament to the power of research, collaboration, and human resilience. BRAFTOVI + MEKTOVI advantage in treating NSCLC and its higher efficacy in Phase II study, it is expected that this drug could eventually surpass alternative therapy approaches presently being researched as the market's emerging BRAF and MEK inhibitor for NSCLC.

Further detailed analysis of emerging therapies drug uptake in the report…

BRAF Metastatic Non-small Cell Lung Cancer Pipeline Development Activities

The report provides insights into BRAF Metastatic Non-small Cell Lung Cancer clincial trails within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for BRAF NSCLC emerging therapy.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on BRAF NSCLC's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including oncologists, radiation oncologists, surgical oncologists, and others.

Delveinsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as MD, The University of Texas MD Anderson Cancer Center, MD, Duke Cancer Institute at Duke University, PhD, MD, MPH, Dana-Farber Brigham Cancer Center, Michigan State University, Director, Massachusetts General Hospital, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or BRAF NSCLC market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most crucial primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and this clearly explains the drug's side effects in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The current scenario of therapeutics for NSCLC is mainly based on targeted therapies and immunotherapy. The current paradigm is mainly associated with treatment specific to mutations that occur in NSCLC.

Further detailed analysis of emerging therapies drug uptake in the report…

Scope of the BRAF Metastatic Non-small Cell Lung Cancer Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of BRAF NSCLC, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the BRAF NSCLC market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM BRAF-mutated NSCLC market.

BRAF Metastatic Non-small Cell Lung Cancer Report Insights

- BRAF NSCLC Patient Population

- BRAF NSCLC Therapeutic Approaches

- BRAF NSCLC Pipeline Analysis

- BRAF NSCLC Market Size and Trends

- Existing and Future Market Opportunities

BRAF Metastatic Non-small Cell Lung Cancer Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- BRAF NSCLC Epidemiology Segmentation

- Key Cross Competition

- BRAF NSCLC Drugs Uptake

- Key BRAF NSCLC Market Forecast Assumptions

BRAF Metastatic Non-small Cell Lung Cancer Report Assessment

- Current BRAF NSCLC Treatment Practices

- BRAF NSCLC Unmet Needs

- BRAF NSCLC Pipeline Product Profiles

- BRAF NSCLC Market Attractiveness

- Qualitative Analysis (SWOT Analysis and Conjoint Analysis)

- BRAF NSCLC Market Drivers

- BRAF NSCLC Market Barriers

FAQs

- What was the BRAF NSCLC market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What are the pricing variations among different geographies for approved therapies?

- What can be the future treatment paradigm of BRAF NSCLC?

- What are the disease risks, burdens, and unmet needs of BRAF NSCLC? What will be the growth opportunities across the 7MM concerning the patient population with BRAF NSCLC?

- Who is the major competitor of TAFINLAR + MEKINIST in the market?

- What are the current options for treating BRAF NSCLC? What are the current guidelines for treating BRAF NSCLC in the US, Europe, and Japan?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

Reasons to Buy BRAF Metastatic Non-small Cell Lung Cancer Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the BRAF NSCLC market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the Analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- The Next Chapter in NSCLC Treatment Space: Recent Discoveries and Innovations

- Novel mutation-targeting therapies in the horizon to relieve the global healthcare burden NSCLC poses

- Non-Small Cell Lung Cancer Market: Treatments and Market Forecast

- Evaluating Key Advancements and Emerging Therapies in EGFR-Non Small Cell Lung Cancer Treatment Market

- Novel Insights Into The Non-Small Cell Lung Cancer Market

- Evolving Landscape for Rare Biomarkers in Non-Small Cell Lung Cancer

- Latest DelveInsight Blogs

Related Infographics of the Report

- BRAF Non-Small Cell Lung Cancer (BRAF+ NSCLC) Market

- ALK Non-Small Cell Lung Cancer (ALK+ NSCLC) Market

- c-MET Non-Small Cell Lung Cancer (c-MET+ NSCLC) Market

- EGFR Non-Small Cell Lung Cancer (EGFR+ NSCLC) Market

- PD-L1Non-Small Cell Lung Cancer (PD-L1+ NSCLC) Market

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs

-metastatic-non-small-cell-lung-cancer-market.png&w=256&q=75)