CEACAM5 Market

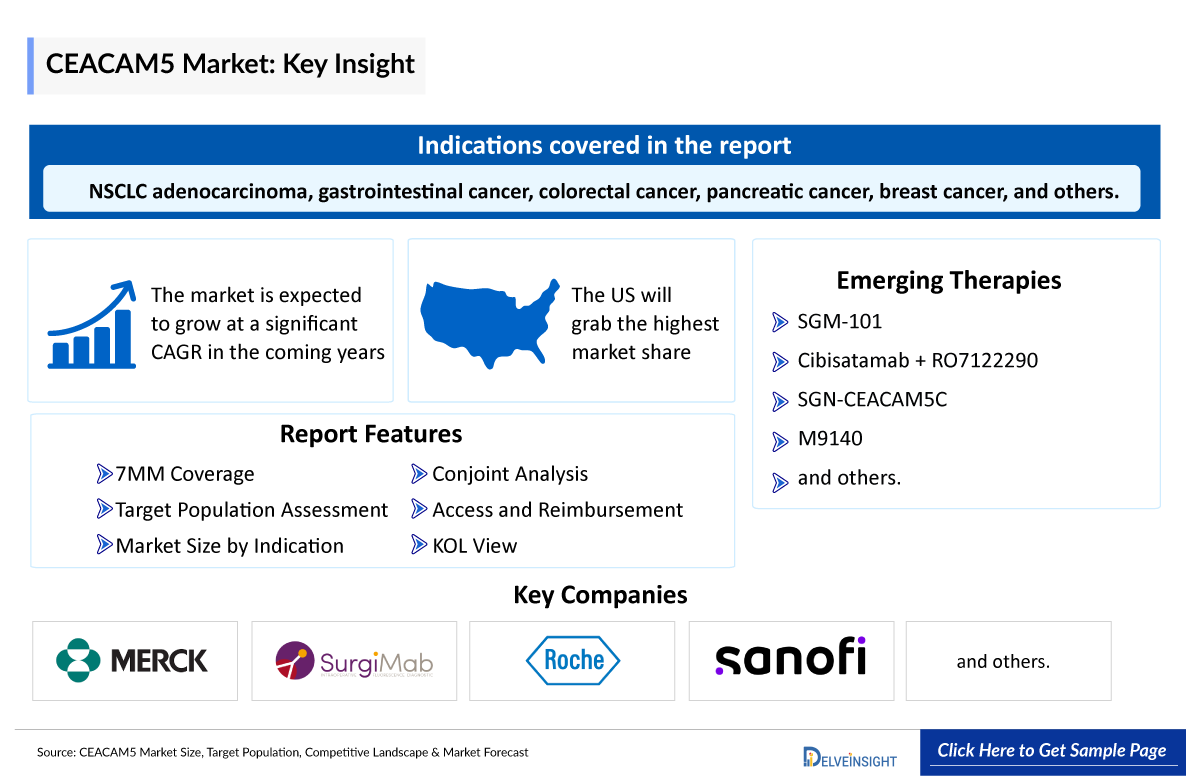

- The CEACAM5 market is expected to grow significantly in the coming years. This is due to the increasing number of patients being diagnosed with cancer and the increasing number of CEACAM5 that are under clinical trials. Currently, there are no CEACAM5 approved by any regulatory bodies.

- CEACAM5 Drugs Market, or Carcinoembryonic Antigen-Related Cell Adhesion Molecule 5, is a cell surface glycoprotein that is overexpressed in certain types of cancer cells. Due to its high expression in these tumor types and low expression in normal epithelial tissues, CEACAM5 presents a potential target for anticancer therapy.

- CEACAM5 is overexpressed on the surface of multiple solid tumors, including NSCLC adenocarcinoma, gastrointestinal cancer, colorectal cancer, pancreatic cancer, breast cancer, and others. Thus, CEACAM5 specific therapies present a potential for anticancer therapy.

- Several therapeutic approaches are being developed to target CEACAM5 in cancer. These include vaccines, bispecific T-cell engagers, chimeric antigen receptor T-cell therapies, and antibody-drug conjugates (ADCs).

- In December 2023, Sanofi ended its tusamitamab ravtansine program as it missed the study's primary endpoint and did not beat the chemotherapy docetaxel when it came to progression-free survival. tusamitamab ravitansine (CEACAM5) was originated from a long-running deal between Sanofi and ImmunoGen and evaluated as a monotherapy in previously treated patients with metastatic non-squamous non-small cell lung cancer (NSCLC).

- Several CEACAM5 ADCs are currently under evaluation in clinical trials. One such ADC is Surgimab’s SGM-101. This drug is being developed for the treatment of Colorectal Neoplasms and pancreas Adenocarcinoma and is anticipated to receive approval during the forecast period.

- Another drug candidate SGN-CEACAM5C which is jointly developed by Sanofi and Seagen is being studied in clinical trial Phase I for the treatment of advanced solid tumors. Its development is based on Sanofi's proprietary monoclonal antibody (mAb) technology and Seagen's proprietary ADC technology and is designed to stick to cancer cells and kill them.

- Merck KGaA, Sanofi, Surgimab, Roche, and several other CEACAM5 companies are currently engaged in the development and production of selective CEACAM5 ADCs, which have the potential to significantly impact and enhance the CEACAM5 market.

Experience the depth of our analysis with a free sample page. Request now and take the first step toward informed decision-making @ CEACAM5 for Non Small Cell Lung Cancer

DelveInsight’s “CEACAM5 Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CEACAM5, historical and forecasted epidemiology, competitive landscape as well as the CEACAM5 market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The CEACAM5 market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CEACAM5 market size from 2024 to 2034. The CEACAM5 market report also covers current CEACAM5 treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the CEACAM5 market’s potential.

CEACAM5 Market: Understanding and Treatment Algorithm

CEACAM5 (carcinoembryonic antigen-related cell adhesion molecule-5), also known as CD66e or CEA, is a part of the CEA family. CEACAM5 is characterized by several extracellular immunoglobulin (Ig)-like domains. However, the primary structure of CEACAM5 includes an Ig variable region (IgV)-like domain, termed N, followed by six Ig constant region (IgC)-type 2-like domains, termed A1, B1, A2, B2, A3, and B3. Among the CEA gene family, CEACAM1, CEACAM5, CEACAM6, and CEACAM7 have crucial roles in tumorigenesis.

CEACAM is a cell surface glycoprotein that is overexpressed on tumor cells and is associated with tumor differentiation, invasion, and metastasis. While expression of CEACAM5 is high in several tumor types, such as gastric, colorectal, and pancreatic cancers, expression in normal epithelial tissues is low. Thus, CEACAM5 presents a potential target for anticancer therapy.

CEACAM5 ADCs are a class of compounds that target CEACAM proteins and their mechanism of action, can be summarized in three key aspects: (i) Anti-adhesion - crucial for tumor invasion and metastasis, driving malignant tumor progression. (ii) Extracellular matrix (ECM) degradation - vital for tumor cell migration, with excessive CEACAM expression hindering apoptosis and disrupting cell structure. (iii) Activation of tumor signaling pathways-CEACAMs activate integrin signaling pathways, including elemental ILK and the PI3Kwork by inhibiting its activity.

CEACAM5 is used as a tumor marker for diagnosing various tumors and predicting their progression, deterioration, and subclinical metastasis.

CEACAM5 Drugs Market Expression

CEACAM5 is overexpressed on the surface of multiple solid tumors, including in about 20% of patients with NSCLC adenocarcinoma, but is not found in normal lung tissue, 90% of gastrointestinal, colorectal, and pancreatic cancers and 50% of breast cancers. This makes CEACAM5 a potentially attractive therapeutic target.

Any patient group with high levels of CEACAM5 expression has a high risk of poor overall survival

Further details related to country-based variations are provided in the report

CEACAM5 Drugs Market Therapy Treatment

Specific therapies targeting CEACAM5 directly, are not approved yet by regulatory bodies. However, researchers are actively exploring various strategies to inhibit CEACAM5 function as a potential therapeutic approach for cancers that overexpress this protein. Some approaches which are being investigated are:

- Small Molecule Inhibitors: CEACAM5 Companies are working to develop small molecules that can inhibit the activity of CEACAM5 for Non Small Cell Lung Cancer. These inhibitors could potentially interfere with CEACAM5-mediated signaling pathways involved in cancer progression.

- Antibodies Blocking CEACAM5: Monoclonal antibodies are being designed to specifically bind to CEACAM5, blocking its function. These antibodies could potentially inhibit tumor growth and metastasis by interfering with CEACAM5-mediated processes.

- Peptide-based Inhibitors: Peptides derived from the CEACAM5 protein sequence or designed to mimic its binding partners could potentially block CEACAM5 function. These peptides could interfere with CEACAM5-mediated cell adhesion, migration, and invasion.

- Gene Silencing: RNA interference (RNAi) or CRISPR-based gene editing techniques can be used to silence CEACAM5 expression in cancer cells. By reducing CEACAM5 levels, these approaches could potentially inhibit cancer cell growth and metastasis.

- Combination Therapies: Inhibition of CEACAM5 function could be combined with other targeted therapies, chemotherapy, or immunotherapy to enhance treatment efficacy. Combinatorial approaches may offer synergistic effects and overcome potential resistance mechanisms.

Request your free sample page and access the insights that matter @ CEACAM5 Market

CEACAM5 Drug Chapters

The drug chapter segment of the CEACAM5 market reports encloses a detailed analysis of CEACAM5 marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the CEACAM5 clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed CEACAM5 Drugs

Currently, there are no approved drugs for CEACAM5-specific therapy.

Emerging CEACAM5 Drugs

- SGM-101: Surgimab

SGM-101 is a tumor-specific antibody conjugated to a near-infrared fluorochrome. It selectively binds a specific marker overexpressed in gastrointestinal and other tumors. Currently in Phase III for the delineation of primary and recurrent tumors and metastases in patients undergoing surgery for colorectal cancer.

CEACAM5 receptor-targeted near-infrared fluorochrome, for molecular imaging-guided lung cancer resections, because glycoprotein is expressed in more than 80% of adenocarcinomas.

- M9140: Merck KGaA

M9140 is an investigational CEACAM5 antibody-drug conjugate that is designed to deliver a cytotoxic topoisomerase 1 (TOP1) inhibitor payload to CEACAM5-expressing tumor cells. The TOP1 inhibitor payload enters the nucleus and disrupts DNA replication and repair, thereby killing CEACAM5-expressing tumor cells. The payload can also enter and kill neighboring tumor cells via a bystander effect. It has been rationally designed for stability in circulation and superior cancer cell-killing activity with a broad therapeutic window. M9140 has synergistic potential with DDR inhibition as well.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | |||||

|

SGM-101 |

SurgiMab |

Colorectal Neoplasms

|

CEACAM5 |

III |

NCT03659448 |

|

SurgiMab |

Pancreas Adenocarcinoma |

CEACAM5 |

II |

NCT05984810 | |

|

M9140 |

Merck KGaA |

Colorectal Cancer |

CEACAM5 |

I |

NCT05464030 |

|

SGN-CEACAM5C |

Sanofi |

Colorectal Neoplasms Carcinoma, Non-Small-Cell Lung, Stomach Neoplasms, Pancreatic Ductal Adenocarcinoma, Gastroesophageal Junction, Adenocarcinoma, Small Cell Lung Carcinoma |

CEACAM5 |

I |

NCT05464030 |

|

Cibisatamab + RO7122290 |

Hoffmann-La Roche |

CEACAMS |

I |

NCT04826003 | |

Note: The emerging drug list is indicative, the full list will be given in the final report

CEACAM5 Market Outlook

The CEACAM5 market is expected to grow significantly in the coming years. This is due to the increasing number of patients being diagnosed with cancer and the increasing number of CEACAM5 that are under clinical trials. Currently, there are no CEACAM5 approved by any regulatory bodies.

- SAR408701 (tusamitamab ravtansine), an antibody-drug conjugate was the most advanced novel agent in clinical testing targeting CEACAM5 specifically in patients with NSCLC, but recently Sanofi discontinued the global clinical development program of this drug as it did not meet the primary endpoint in the clinical study.

- Roche was testing cibisatamab (RG7802/RO6958688), a bispecific antibody that targets CEACAM5 and CD3 for the treatment of solid tumors but recently, the study was stopped and cibisatamab has been removed from Phase I clinical development.

- Several key CEACAM5 companies, including Merck, Surgimab, Roche, Sanofi, and others, are involved in developing CEACAM5-specific therapy which is being studied in Phase I, and Phase II.

- Currently, Roche is testing cibisatamab in combination with RO7122290 for the treatment of Metastatic colorectal cancer in phase I/II and Surgimab

- Surgimab is testing its CEACAM5 agent SGM-101 for the treatment of Colorectal Neoplasms and pancreas Adenocarcinoma, and Merck KGaA is testing M9140 for the treatment of Colorectal Cancer.

- Sanofi is also testing its CEACAM5 agent SGN-CEACAM5C in Phase I for the treatment of multiple indications such as Colorectal Neoplasms Carcinoma, Non-Small-Cell Lung, Stomach Neoplasms, Pancreatic Ductal Adenocarcinoma and others.

Overall, this is a new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of CEACAM5-specific therapies and define their role in the therapy of cancer.

Unlock a world of insights with our report sample page. Request now to see the future of your industry @ CEACAM5 Drugs Market

CEACAM5 Drugs Market Uptake

This section focuses on the uptake rate of potential approved and emerging CEACAM5-specific therapies expected to be launched in the market during 2020–2034.

CEACAM5 Pipeline Development Activities

The CEACAM5 market report provides insights into different therapeutic candidates in the Phase II and Phase I stages. It also analyzes key CEACAM5 companies involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for CEACAM5 market growth over the forecasted period.

CEACAM5 Clinical Trial Activities

The CEACAM5 market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CEACAM5 emerging therapies.

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive CEACAM5 market expansion. For example, In March 2022, Sanofi and Seagen announce collaboration to develop and commercialize multiple novel antibody-drug conjugates including SGN-CEACAM5C. SGN-CEACAM5C is designed for targeted cancer therapy. This compound combines a monoclonal antibody (mAb) specific to CEACAM5C, also known as carcinoembryonic antigen-related cell adhesion molecule 5C, with a potent cytotoxic payload.

KOL Views on CEACAM5

To keep up with current and future CEACAM5 market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CEACAM5 ADCs' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Center for Thoracic Cancers and Targeted Immunotherapy, Massachusetts, and others were contacted.

Their opinion helps understand and validate current and emerging therapy treatment patterns or CEACAM5 market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the CEACAM5 market and the unmet needs.

|

KOL Views |

|

“CEACAM5 is overexpressed on the surface of multiple solid tumors, including in about 20% of patients with NSCLC adenocarcinoma, but is not found in normal lung tissue. This makes CEACAM5 a potentially attractive therapeutic target, although efforts to design lung cancer drugs aimed at the protein have been limited” |

- Many CEACAM5 companies will be presenting the data of their CEACAM5 ADCs during the ASCO 2024 conference including Merck and others. During the ASCO 2024 annual meeting, Merck KGaA is expected to present the results of clinical trial NCT05464030, with the title “M9140 First-in-human trial of M9140, an anti-CEACAM5 antibody-drug conjugate (ADC) with exatecan payload, in patients (pts) with metastatic colorectal cancer (mCRC)” (Abstract # 3000).

- In December 2023, Sanofi halted tusamitamab ravtansine program due to failure to meet primary endpoint, trailing behind docetaxel in progression-free survival in metastatic NSCLC. Originating from a Sanofi-ImmunoGen partnership, tusamitamab ravitansine (CEACAM5) was assessed as a monotherapy in previously treated patients with metastatic non-squamous NSCLC.

Scope of the CEACAM5 Market Report

- The CEACAM5 market report covers a segment of key events, an executive summary, and a descriptive overview of CEACAM5-specific therapies, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the CEACAM5-specific therapies market, historical and forecasted CEACAM5 market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The CEACAM5 market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM CEACAM5-specific therapies market.

CEACAM5 Market Report Insights

- CEACAM5 Targeted Patient Pool

- Therapeutic Approaches

- CEACAM5 Pipeline Analysis

- CEACAM5 Market Size

- CEACAM5 Market Trends

- Existing and future CEACAM5 Market Opportunity

CEACAM5 Market Report Key Strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- CEACAM5 Drugs Uptake

- Key CEACAM5 Market Forecast Assumptions

CEACAM5 Market Report Assessment

- Current Treatment Practices for CEACAM5 Drugs Market

- CEACAM5 Market Unmet Needs

- Pipeline Product Profiles

- CEACAM5 Market Attractiveness

- CEACAM5 Drugs Market Qualitative Analysis (SWOT)

- What was the CEACAM5 market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which CEACAM5 is going to be the largest contributor in 2034?

- Which is the most lucrative market for CEACAM5-specific therapies?

- Which drug type segment accounts for maximum CEACAM5-specific therapy sales?

- What are the pricing variations among different geographies for emerging therapies?

- What are the risks, burdens, and unmet needs of treatment with CEACAM5-specific therapies?

- What will be the growth opportunities across the 7MM for the patient population of CEACAM5-specific therapies?

- What are the key factors hampering the growth of the CEACAM5-specific therapies market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for CEACAM5-specific therapies?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- The CEACAM5 Market report will help develop business strategies by understanding the latest trends and changing dynamics driving the CEACAM5-specific therapies Market.

- Understand the existing CEACAM5 market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved CEACAM5 products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming CEACAM5 companies in the CEACAM5 market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CEACAM5 market so that the upcoming CEACAM5 companies can strengthen their development and launch strategy.

Click here to view the latest blogs:

Visit delveinsight latest blogs @ Latest Delveinsight Blogs