HDAC Inhibitors Market Summary

- The HDAC inhibitors market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

HDAC Inhibitors Market and Epidemiology Analysis

- According to DelveInsight, HDAC inhibitors Market is expected to grow at a decent CAGR by 2034

- HDAC inhibitors are potent inducers of histone acetylation, which results in the expression of tumor suppressor genes that had been previously silenced by deacetylation. This gene expression leads to cell cycle arrest and apoptosis.

- HDAC inhibitors are mainly utilized in the treatment of different cancers, particularly hematologic malignancies such as T-cell lymphoma and multiple myeloma, as well as certain solid tumors. Additionally, they have applications beyond oncology, including the treatment of non-cancerous conditions like Duchenne Muscular Dystrophy (DMD).

- Currently, there are several HDAC inhibitors available in the market, recent additions include DUVYZAT (givinostat), and earlier approved treatments include BELEODAQ (belinostat), HIYASTA (tucidinostat), and others.

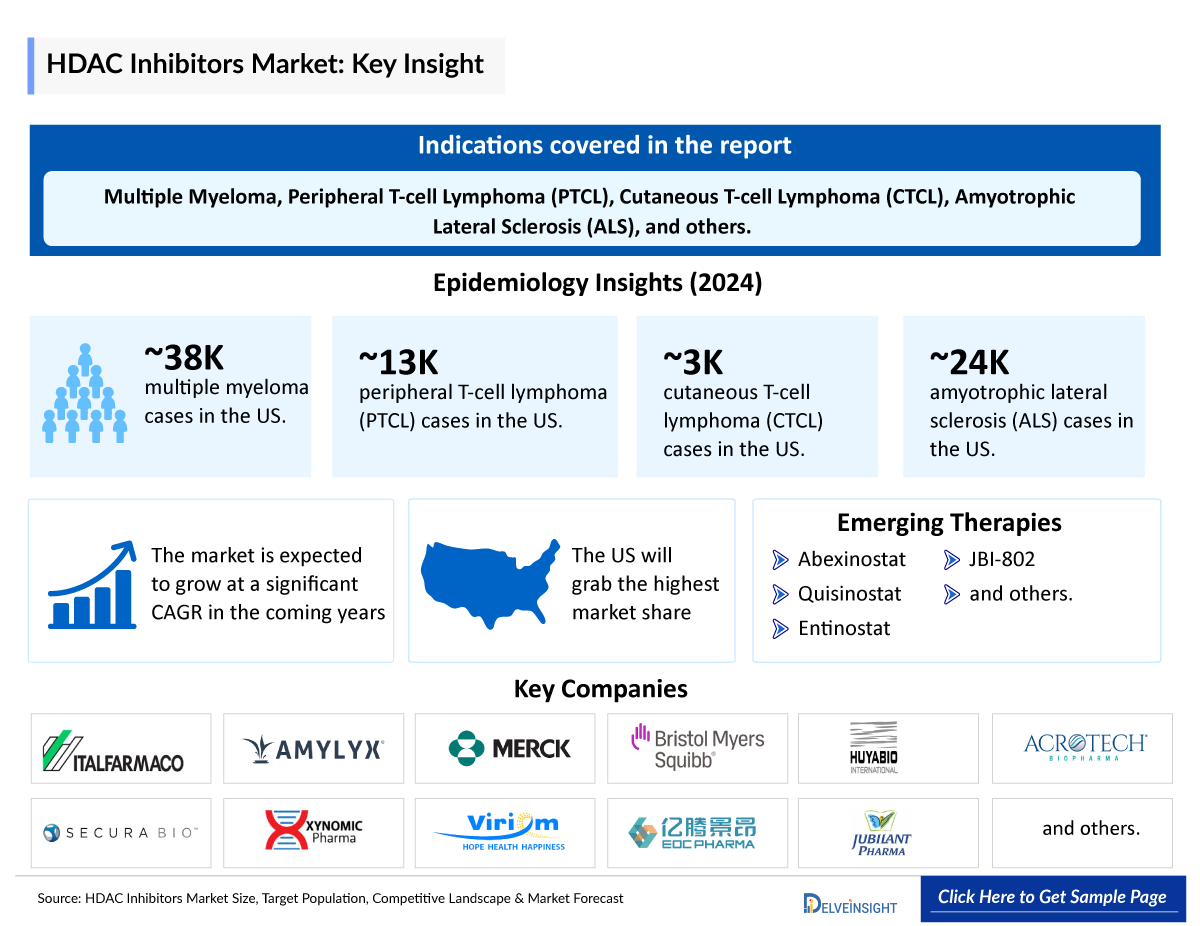

- HDAC inhibitors has a pipeline consisting of products such as abexinostat, quisinostat and others which are in late Phases (III and II).

- Several HDAC inhibitor companies, such as Xynomic Pharmaceuticals, Viriom, EOC Pharma/Syndax Pharmaceuticals, Jubilant Therapeutics, and several other are currently engaged in the development and production of HDAC inhibitors, which have the potential to significantly impact and enhance the market.

- In June 2025, the EC granted DUVYZAT conditional marketing authorization in the EU. The approval makes DUVYZAT available to ambulant DMD patients 6 years and older while Italfarmaco conducts additional clinical studies designed to further confirm and characterize its therapeutic benefit.

- In April 2024, Amylyx Pharmaceuticals announces formal intention to remove RELYVRIO/ALBRIOZA (AMX0035, approval US: 2022) from the market; provides updates on access to therapy, pipeline, corporate restructuring, and strategy. Amylyx continues to advance AMX0035 in Wolfram syndrome and progressive supranuclear palsy (Phase II).

Factor Affecting the HDAC Inhibitors Market Growth

Expanding Applications in Oncology and Beyond

Histone deacetylase (HDAC) inhibitors have shown strong therapeutic potential across multiple cancer types, including hematological malignancies (like multiple myeloma and lymphoma) and solid tumors (such as lung, breast cancer, and colorectal cancers). The expansion of their applications into neurological, inflammatory, and fibrotic disorders is broadening the market scope.

Rising Prevalence of Cancer Worldwide

With cancer cases increasing globally, there is a growing need for novel epigenetic therapies that target tumor progression and resistance mechanisms. HDAC inhibitors offer a promising therapeutic class that complements traditional chemotherapy and immunotherapy, driving market demand.

Advancements in Epigenetic Drug Development

Progress in understanding epigenetic modulation and gene expression control has accelerated research into more selective and potent HDAC inhibitors. The development of isoform-selective HDAC inhibitors aims to improve efficacy while minimizing toxicity, stimulating innovation and market growth.

Strong R&D Pipeline and Clinical Collaborations

A robust pipeline with numerous clinical-stage candidates from both large pharmaceutical companies and emerging biotech firms underscores the growing investment in HDAC inhibition. Collaborations and licensing agreements between academia and industry are further boosting translational research and clinical development.

Regulatory Approvals and Orphan Drug Designations

Several HDAC inhibitors, including Vorinostat, Romidepsin, Belinostat, and Panobinostat, have received FDA approvals for specific cancer indications. Regulatory incentives like orphan drug status and accelerated approval pathways for rare diseases support continued market expansion.

DelveInsight’s “HDAC Inhibitors - Market Size, Target Population, Competitive Landscape, and Market Forecast–2034” report delivers an in-depth understanding of the HDAC, historical and frecasted HDAC inhibitors patient pool, competitive landscape as well as the HDAC inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

The HDAC inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted HDAC inhibitors market size from 2020 to 2034 across 7MM. The report also covers current HDAC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the HDAC Inhibitors Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

HDAC Inhibitor Epidemiology |

Segmented by:

|

|

HDAC Inhibitor Key Companies |

|

|

HDAC Inhibitor Key Therapies |

|

|

HDAC Inhibitor Market |

Segmented by:

|

|

HDAC Inhibitor Market Analysis |

|

HDAC Inhibitor Understanding

HDAC Inhibitor Overview

HDACs catalyze the removal of acetyl groups from both histone and non-histone proteins. As histone acetylation is associated with an open chromatin configuration associated with active gene transcription, HDACs contribute to histone deacetylation and the epigenetic repression of gene transcription. As HDACs regulate a wide variety of processes involved in carcinogenesis, multiple mechanisms may explain the clinical activity of HDACi, including altered gene expression of cell-cycle and apoptotic regulatory proteins, acetylation of non-histone proteins regulating cell growth and survival, angiogenesis, aggresome formation, and DNA repair.

Currently, there are 18 types of HDACs, classified into two groups, which are also subdivided into four classes, according to their location, their homology, their enzymatic activity, their order of discovery, and their histone substrate specificity: the first group contains zinc-containing HDACs, which share a similar catalytic core for acetyl-lysine hydrolysis. This group comprises classes I (HDAC1, -2, -3, and -8), II (IIa: HDAC4, -5, -7, and -9; IIb: HDAC6 and -10), and IV (HDAC11). The second group consists of NAD-dependent HDACs (class III, also known as sirtuins, SIRTs 1–7), which need a nicotinamide adenine dinucleotide for the optimum use of their enzymatic activity.

Histone deacetylase (HDAC) inhibitors are potent inducers of histone acetylation, which results in the expression of tumor suppressor genes that had been previously silenced by deacetylation. This gene expression leads to cell cycle arrest and apoptosis. There are several HDAC inhibitors being used or studied in T-cell lymphoma, including ZOLINZA, ISTODAX, BELEODAQ, FARYDAK and others.

Further details related to country-based variations are provided in the report…

HDAC Inhibitor Patient Pool

The HDAC inhibitors patient pool chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for HDAC inhibitor, total eligible patient pool for HDAC inhibitor in selected indication, and total treated cases in selected indication for HDAC inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

Key findings from the HDAC Inhibitors Epidemiology Insights and Forecast

- The United States contributes the highest number of cutaneous T-Cell Lymphoma incident cases among the 7MM; in 2024, with 3036 incident cases.

- In 2024, US had 257 Adult T-cell leukemia/lymphoma cases.

- In 2024, highest Peripheral T-cell Lymphoma incident cases were recorded for stage IV in the US.

- Among the type-specific cases of ALS, nearly 21,850 cases comprised of sporadic ALS, and 2,430 cases were comprised of familial ALS in 2024 in the US.

- In EU4 and the UK, the incident cases of multiple myeloma were maximum in Germany in 2024. While the least number of cases were in Spain.

Epidemiology of Selected Indications | |

|

Indication |

Estimated Incidence Cases in US (2024) |

|

Multiple Myeloma |

~37,833 |

|

Peripheral T-cell Lymphoma (PTCL) |

~12,864 |

|

Cutaneous T-cell Lymphoma (CTCL) |

~3,036 |

|

Amyotrophic Lateral Sclerosis (ALS) |

~24,000 |

Note: Indications are selected based on pipeline activity

HDAC Drug Analysis

The drug chapter segment of the HDAC inhibitor market reports encloses a detailed analysis of late-stage (Phase III and Phase II) pipeline drugs. It also helps understand the HDAC inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed HDAC Inhibitors

DUVYZAT (givinostat): Italfarmaco

DUVYZAT is a histone deacetylase inhibitor indicated for the treatment of Duchenne muscular dystrophy (DMD) in patients 6 years of age and older. DUVYZAT is a histone deacetylase inhibitor. The precise mechanism by which DUVYZAT exerts its effect in patients with DMD is unknown.

In April 2025, Italfarmaco announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) had adopted a positive opinion on DUVYZAT.

Trials in other indications: Phase III – Becker Muscular Dystrophy clinical trial and Phase II – Polycythemia vera clinical trial.

HIYASTA (tucidinostat): HUYA Bioscience International

HIYASTA, also known as HBI-8000, is an epigenetic immunomodulator with several approved indications, including monotherapy for two subtypes of T-cell non-Hodgkin’s lymphoma, i.e., relapsed or refractory adult T-cell leukemia-lymphoma (ATLL) and relapsed or refractory PTCL in Japan. At the same time, HUYABIO International is conducting the overseas multinational Phase III clinical study of HIYASTA, in combination with nivolumab in patients with untreated metastatic or unresectable malignant melanoma. HIYASTA is an oral agent which targets Class I histone deacetylases (HDAC), causing cell cycle arrest and tumor cell death as the mechanism underlying its single-agent activity against lymphoma.

- In September 2020, HUYABIO announced that the MHLW granted ODD to HIYASTA in Japan as monotherapy for relapsed or refractory ATL.

- In December 2015, the MHLW granted ODD to HIYASTA in Japan for PTCL.

- In June 2021, HUYABIO announced the regulatory approval for HBI-8000 monotherapy of relapsed or refractory (R/R) ATL by the Japanese Pharmaceuticals and Medical Devices Agency.

|

Product |

Company |

RoA |

Target |

Indication |

Approval |

|

DUVYZAT (givinostat) |

Italfarmaco |

Oral suspension |

HDAC inhibitor |

DMD |

US: 2024 EU:2025 |

|

ZOLINZA (vorinostat) |

Merck |

Oral |

HDAC inhibitor |

CTCL |

US: 2006 JP: 2011 |

|

HIYASTA (tucidinostat) |

HUYA Bioscience International |

Oral |

HDAC inhibitor |

ATLL |

JP: 2021 |

|

PTCL | |||||

|

ISTODAX (romidepsin) |

Bristol-Myers Squibb |

IV infusion |

HDAC inhibitor |

CTCL |

US: 2009 |

|

PTCL |

JP: 2017 | ||||

|

FARYDAK (panobinostat) |

Secura Bio |

Oral |

HDAC inhibitor |

Mutiple Myeloma |

US: 2015 EU:2015 JP: 2015 |

|

BELEODAQ (belinostat) |

Acrotech Biopharma |

Intravenous injection |

HDAC inhibitor |

PTCL |

US: 2014 |

Emerging HDAC Inhibitors

Abexinostat: Xynomic Pharmaceuticals

Abexinostat, developed by Xynomic Pharmaceuticals, is an oral pan-HDAC inhibitor with promising activity across both hematologic malignancies and solid tumors. Initially developed by Pharmacyclics, Xynomic acquired global rights in 2017. Currently, it is being evaluated in multiple ongoing Phase I–III clinical trials globally.

In September 2019, Xynomic Pharmaceuticals announced that the FDA had granted Fast-Track Designation (FTD) to Xynomic’s lead drug candidate, abexinostat, for use as a single agent, as a fourth-line treatment of relapsed or refractory follicular lymphoma. FDA has already granted FTD to abexinostat, in combination with pazopanib, as a first- or second-line treatment of renal cell carcinoma.

Trials in other indications: Phase II - Diffuse Large B-cell Lymphoma clinical trials and Follicular Lymphoma clinical trials.

Quisinostat: Viriom

Quisinostat is a novel selective oral, highly-potent pan-histone deacetylase (HDAC1) inhibitor originated from Janssen Pharmaceuticals. HDAC inhibitors have been shown to induce cell cycle arrest, terminal differentiation, and/or apoptosis in a broad spectrum of human tumor cell lines in vitro, and exhibit potent in vivo antitumor activity in human xenograft models in nude mice. Inhibition of the HDAC enzyme promotes the acetylation of nucleosome histone tails, favoring a more transcriptionally competent chromatin structure, which in turn leads to altered expression of genes involved in cellular processes such as cell proliferation, apoptosis, and differentiation.

A number of non-clinical, Phase I and II clinical trials evaluated quisinostat's safety and efficacy and showed that qusinostat has a promising anti-tumor activity against several types of advanced refractory solid and hematological malignancies, including platinum-resistant ovarian cancer in combination with paclitaxel and carboplatin, uveal melanoma and synovial sarcoma.

|

Product |

Company |

RoA |

Phase |

Target |

Indication |

|

Abexinostat |

Xynomic Pharmaceuticals |

Oral |

III |

HDAC inhibitor |

Renal Cell Carcinoma |

|

Quisinostat |

Viriom |

Oral |

II |

HDAC inhibitor |

Uveal Melanoma |

|

Entinostat |

EOC Pharma/Syndax Pharmaceuticals |

Oral |

II |

HDAC inhibitor |

Hodgkin lymphoma |

|

JBI-802 |

Jubilant Therapeutics |

Oral |

I/II |

LSD1/HDAC6 |

Solid Tumors |

Note: Detailed emerging therapies assessment will be provided in the final report.

HDAC Inhibitor Market Outlook

HDAC inhibitors have established themselves as a clinically validated class of epigenetic-modifying agents with broad potential in oncology and rare diseases. Since the first approval of ZOLINZA by Merck in 2006 for CTCL, HDAC inhibitors have been incrementally introduced for various hematologic malignancies. Key marketed drugs in this class include ISTODAX for CTCL and PTCL, BELEODAQ for PTCL, FARYDAK for multiple myeloma, and HIYASTA for adult T-cell leukemia/lymphoma (ATLL) and PTCL in Japan. These agents, while demonstrating anti-tumor activity, are generally reserved for relapsed or refractory settings, reflecting their modest single-agent efficacy and toxicity profiles that require careful management.

A notable expansion of the HDAC inhibitor class occurred in 2024 with the US approval of DUVYZAT, an oral suspension developed by Italfarmaco, for DMD. This marked the first HDAC inhibitor approval in a non-oncology indication, and its upcoming 2025 EU approval is expected to further reinforce its role as a disease-modifying treatment. DUVYZAT’s success highlights the broader potential of HDAC inhibition beyond cancer, especially in genetic and neuromuscular diseases where epigenetic regulation plays a central role.

The HDAC inhibitor pipeline remains active, with several next-generation agents advancing in clinical trials. Abexinostat (Xynomic Pharmaceuticals) is in Phase III development for renal cell carcinoma, representing a potential expansion into solid tumors. Quisinostat (Viriom) is in Phase II for uveal melanoma, and Entinostat, partnered between EOC Pharma and Syndax, is being explored in Hodgkin lymphoma. Entinostat has previously shown promise in breast cancer, and its repositioning for hematologic malignancies underscores the flexibility of HDAC modulation. Additionally, JBI-802, from Jubilant Therapeutics, is a dual LSD1/HDAC6 inhibitor in Phase I/II for solid tumors, reflecting an evolving strategy to enhance efficacy through multi-target epigenetic inhibition.

Despite their promise, HDAC inhibitors face clinical limitations, including hematologic toxicity, gastrointestinal side effects, and limited durable responses when used as monotherapy. As such, future growth in this class is expected to come from combination strategies with immune checkpoint inhibitors, hypomethylating agents, and chemotherapy, as well as targeted patient selection based on epigenetic biomarkers.

Looking ahead, DUVYZAT is expected to lead a new wave of non-oncology HDAC applications, particularly in rare diseases. Meanwhile, oncology-focused agents like abexinostat and quisinostat may expand the therapeutic footprint of HDAC inhibitors into solid tumors an area historically resistant to epigenetic therapy. The pipeline is also gradually shifting toward oral formulations and isoform-selective compounds, such as HDAC6 inhibitors, to reduce off-target toxicity and improve patient tolerability.

HDAC Drugs Uptake

This section focuses on the uptake rate of potential emerging HDAC inhibitors expected to be launched in the market during 2025–2034.

HDAC Clinical Trial Analysis

The HDAC Inhibitors market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key HDAC Inhibitors companies involved in developing targeted therapeutics.

The presence of numerous HDAC inhibitor drugs under different stages is expected to generate immense opportunities for HDAC inhibitor market growth over the forecasted period.

HDAC Inhibitors Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HDAC inhibitor therapies.

Latest KOL Views on HDAC Inhibitors

To keep up with current and future HDAC Inhibitors market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on HDAC Inhibitor's evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center, UCSF Health; Memorial Sloan Kettering Cancer Center; Edinburgh Cancer Research UK Centre at the University of Edinburgh; Division of Hematology & Oncology, University of Illinois Health; Oncology Department at San Luigi Hospital Center for Thoracic Cancers at the Massachusetts General Hospital; Dana-Farber Brigham Cancer Center, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or HDAC market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on HDAC Inhibitors Patient Trends? |

|

“Vorinostat and romidepsin remain foundational in CTCL therapy, with robust response rates (~30%) and durable efficacy, though toxicity limits broader use. Their success paved the way for next-generation HDAC inhibitors in combination regimens.” MD, Memorial Sloan Kettering Cancer Center, US |

HDAC Inhibitors Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the HDAC inhibitor therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

HDAC Inhibitors Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

HDAC Inhibitors Market Recent Developments and Breakthroughs

- In May 2025, Amylyx Pharmaceuticals, announced positive Week 48 data from the Phase II open-label HELIOS clinical trial of AMX0035 in adults living with Wolfram syndrome.

- In May 2025, the University of Miami, in collaboration with Viriom, initiated a Phase II clinical trial in the US (NCT06932757) to evaluate an oral therapy for patients with uveal melanoma who have undergone at least one prior line of treatment.

- In April 2025, Xynomic Pharmaceuticals concluded a Phase I/II clinical trial in the United States (NCT03939182), evaluating a combination oral therapy for patients with Diffuse Large B-cell Lymphoma and Mantle Cell Lymphoma who had received at least one prior line of treatment.

- As of December 2024, Syndax Pharmaceuticals holds several provisional and non-provisional patent filings related to entinostat in the US.

- In January 2024, Jubilant Therapeutics pioneering the development of a first-in-class CoREST (Co-repressor of Repressor Element-1 Silencing Transcription) inhibitor JBI-802 with the dual activity on LSD1 and HDAC6, announced preliminary safety, pharmacokinetic and initial efficacy results of the Phase I trial in advanced cancer patients. Furthermore, the study results provide a human proof of principle for expanding the development of JBI-802 in Essential Thrombocythemia (ET) and related Myeloproliferative Neoplasms (MPN/MDS) with thrombocytosis.

- In November 2021, Secura Bio announced that, based on discussions with the US FDA, Secura Bio had submitted to the FDA for the withdrawal of the approval of NDA 205353 for FARYDAK oral capsules.

The abstract list is not exhaustive, will be provided in the final report

Scope of the HDAC Inhibitors Market Report

- The HDAC Inhibitors market report covers a segment of key events, an executive summary, and a descriptive overview of the HDAC inhibitors, explaining its mechanism, and emerging therapies.

- Comprehensive insight into the HDAC inhibitor competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the HDAC market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The HDAC Inhibitors market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM HDAC market.

HDAC Inhibitor Market Report Insights

- HDAC Targeted Patient Pool

- HDAC Inhibitor Therapeutic Approaches

- HDAC Pipeline Analysis

- HDAC Inhibitors Market Size

- HDAC Inhibitors Market Trends

- Existing and Future HDAC Inhibitors Market Opportunity

HDAC Inhibitor Market Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- HDAC Inhibitors Drugs Uptake

- Key HDAC Inhibitors Market Forecast Assumptions

HDAC Inhibitor Market Report Assessment

- Current Treatment Practices

- HDAC Inhibitors Unmet Needs

- HDAC Inhibitor Pipeline Product Profiles

- HDAC Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint)

Key Questions answered in the HDAC Inhibitors Market

- What was the HDAC inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which HDAC inhibitor drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for HDAC Inhibitor?

- What are the risks, burdens, and unmet needs of treatment with HDAC-based/targeting therapies? What will be the growth opportunities across the 7MM for the patient population of HDAC -based/targeting therapies?

- What are the key factors hampering the growth of the HDAC Inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for HDAC inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy the HDAC Inhibitors Market Report

- The HDAC Inhibitors market report will help develop business strategies by understanding the latest trends and changing dynamics driving the HDAC Inhibitor Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming HDAC inhibitor companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming HDAC Inhibitors companies can strengthen their development and launch strategy.