Liver Fibrosis Market Summary

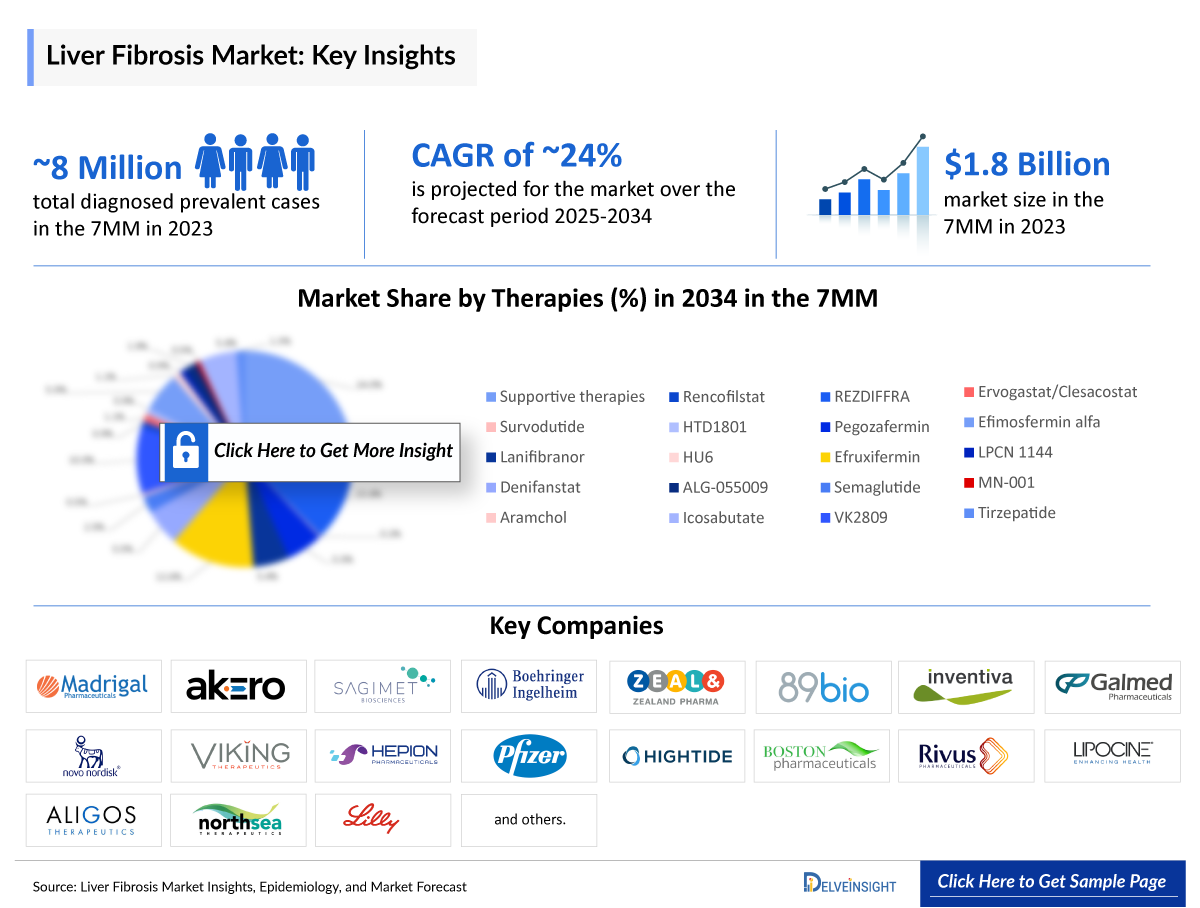

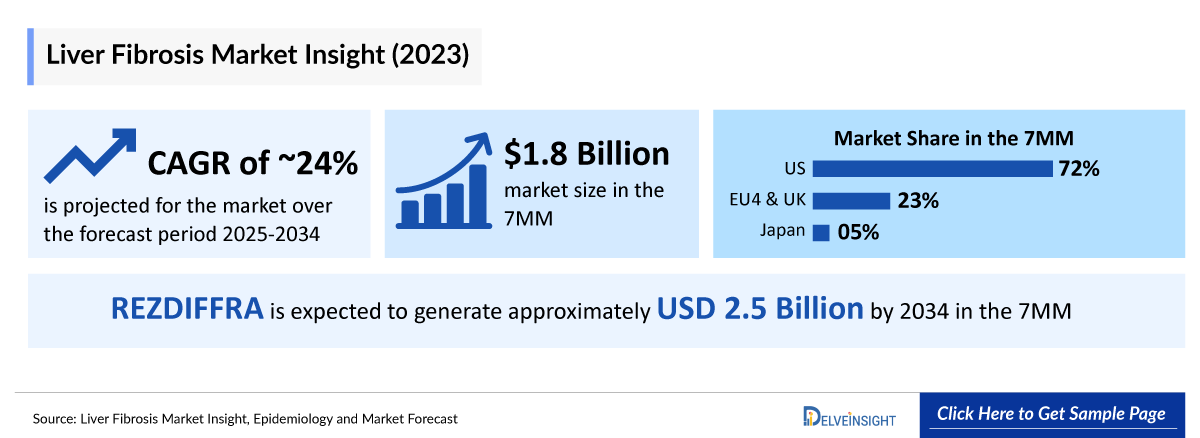

- The Liver Fibrosis market size in the 7MM is expected to grow from USD 2,660 million in 2025 to USD 18,312 million in 2034.

- The Liver Fibrosis market is projected to grow at a CAGR of 23.9% by 2034 in leading countries like US, EU4, UK and Japan.

Liver Fibrosis Market and Epidemiology Analysis

- The Liver Fibrosis Market is projected to see consistent growth, with a robust compound annual growth rate (CAGR) anticipated from 2025 to 2034. This expansion across the 7MM will be driven by the introduction of innovative therapies, including Efruxifermin (EFX), Pegozafermin (BIO89-100), VK2809, Lanifibranor (IVA337), Semaglutide, Denifanstat (TVB-2640), Efimosfermin alfa (BOS-580), Icosabutate, and Survodutide (BI 456906), among others.

- Currently, REZDIFFRA is the first and only US FDA-approved medication for the NASH Treatment (also known as MASH). Its accelerated approval was based on Phase III data demonstrating improvements in liver fibrosis and NASH resolution in patients with noncirrhotic NASH with moderate to advanced liver fibrosis.

- Akero Therapeutics, Sagimet Biosciences, Inventiva Pharma, Novo Nordisk, Viking Therapeutics, Boston Pharmaceuticals, Aligos Therapeutics, NorthSea Therapeutics, Boehringer Ingelheim, 89bio, and others are progressing their assets through various Liver Fibrosis Clinical Trials phases, driving innovation in the liver fibrosis market and creating significant growth opportunities.

- In January 2025, Akero Therapeutics announced preliminary topline Week 96 results from the Phase IIb SYMMETRY study evaluating Efruxifermin in patients with compensated cirrhosis (F4) due to MASH.

- Despite REZDIFFRA’s approval for noncirrhotic NASH with fibrosis, a significant gap remains as most treatments manage underlying causes rather than directly reversing fibrosis. Approved antifibrotic options are limited to specific patient subsets, leaving many without effective therapies. There is an urgent need for broadly effective agents to halt or reverse fibrosis across diverse liver disease etiologies.

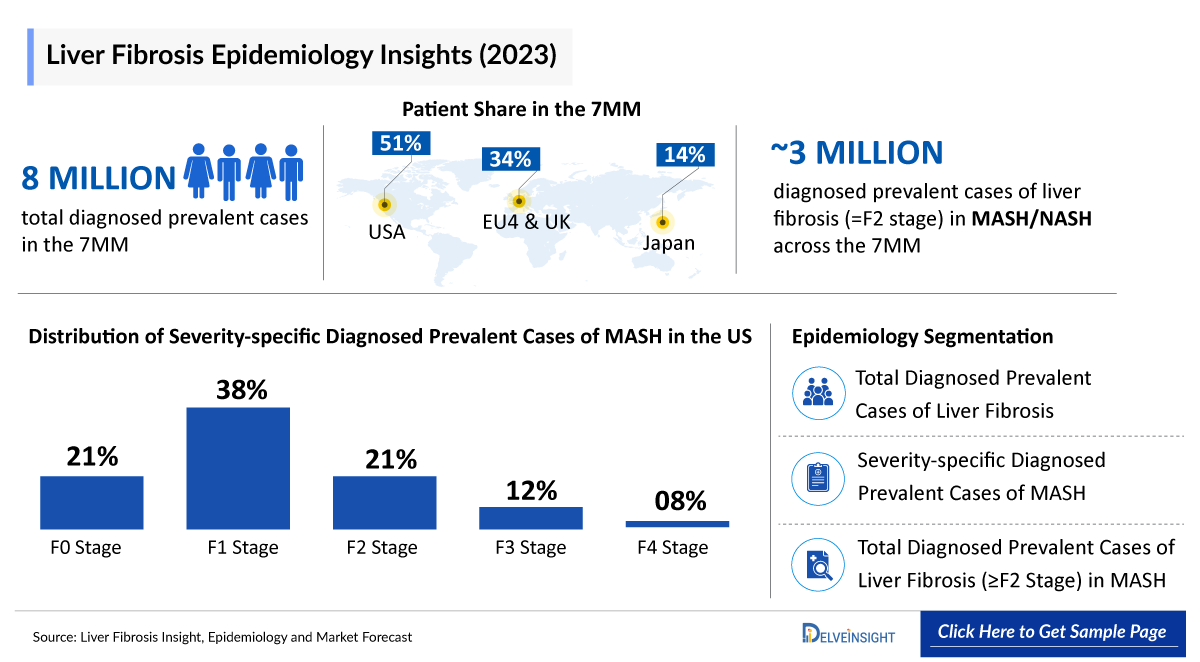

- According to DelveInsight’s estimates, in 2023, there were approximately 8 million Liver Fibrosis Diagnosed Prevalent Cases in the 7MM. Of these, the United States accounted for 51.4% of the cases, while EU4 and the UK accounted for nearly 34.1% and Japan represented 14.4% of the cases, respectively.

Liver Fibrosis Market size and forecast

- 2025 Market Size: USD 2,660 million in 2025

- 2034 Projected Market Size: USD 18,312 million in 2034

- Growth Rate (2025-2034): 23.9% CAGR

- Largest Market: United States

Key Factors Driving the Liver Fibrosis Market

Advancements in NASH and Liver Fibrosis Treatments

Currently, REZDIFFRA is the first and only US FDA-approved medication for the treatment of non-alcoholic steatohepatitis (NASH), also referred to as MASH. Its accelerated approval was granted based on Phase III clinical data demonstrating significant improvements in liver fibrosis and NASH resolution among patients with noncirrhotic NASH with moderate to advanced liver fibrosis. This milestone has paved the way for broader interest and investment in liver fibrosis therapies.

Robust Pipeline Driving Innovation

Several companies are advancing promising therapies through various phases of liver fibrosis clinical trials. Key players such as Akero Therapeutics, Sagimet Biosciences, Inventiva Pharma, Novo Nordisk, Viking Therapeutics, Boston Pharmaceuticals, Aligos Therapeutics, NorthSea Therapeutics, Boehringer Ingelheim, and 89bio are actively developing next-generation treatments. Investigational therapies include Efruxifermin (EFX), Pegozafermin (BIO89-100), VK2809, Lanifibranor (IVA337), Semaglutide, Denifanstat (TVB-2640), Efimosfermin alfa (BOS-580), Icosabutate, and Survodutide (BI 456906), offering novel mechanisms of action and the potential to improve patient outcomes significantly.

Growing Diagnosed Patient Pool

According to DelveInsight estimates, there were approximately 8 million diagnosed liver fibrosis cases in the 7MM in 2023. The United States accounted for 51.4% of these cases, EU4 and the UK contributed 34.1%, and Japan represented 14.4% of the diagnosed population. This sizeable patient pool highlights the unmet need and underscores the growth potential for innovative therapies in this space.

Market Outlook and Revenue Potential

The liver fibrosis market is projected to experience steady growth, supported by the ongoing development of novel therapies and increasing disease awareness. Estimates suggest that REZDIFFRA (resmetirom) alone could generate approximately USD 2.5 billion by 2034 in the 7MM. As more drugs progress through clinical trials and enter the market, the liver fibrosis landscape is expected to expand further, offering enhanced treatment options and improved outcomes for patients worldwide.

DelveInsight’s “Liver Fibrosis Treatment Market Insights, Epidemiology, and Market Forecast 2034” report delivers an in-depth understanding of liver fibrosis, historical and forecasted epidemiology, as well as the liver fibrosis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Liver Fibrosis Treatment Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM liver fibrosis market size from 2020 to 2034. The report also covers liver fibrosis treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Liver Fibrosis Disease Understanding

Liver fibrosis is a progressive condition characterized by excessive extracellular matrix deposition, primarily collagen, resulting from chronic liver injury. This maladaptive wound-healing response disrupts normal hepatic architecture, increasing the risk of cirrhosis, portal hypertension, and liver failure. Key etiologies include chronic hepatitis C, prolonged alcohol abuse, and NASH, a disorder strongly linked to metabolic syndrome. Other contributors, such as chronic cholestatic liver disease, autoimmune hepatitis, and genetic metabolic disorders, drive persistent inflammation that activates collagen-producing cells, with genetic and environmental factors influencing disease severity.

The classification of liver steatosis has evolved from nonalcoholic fatty liver disease (NAFLD) and NASH to metabolic dysfunction-associated steatotic liver disease (MASLD) and metabolic dysfunction-associated steatohepatitis (MASH), reflecting the metabolic basis of these conditions. The broader category of steatotic liver disease (SLD) now includes metabolic-associated steatotic liver (MASL), nonalcoholic steatotic liver (NASL), and metabolic dysfunction-associated liver disease (MetALD), improving diagnostic precision and aligning with the underlying metabolic dysfunction driving liver fibrosis.

Liver Fibrosis Diagnosis

Diagnosis of liver fibrosis now relies on a noninvasive, multimodal approach that stratifies patients by risk while reducing reliance on invasive procedures. Clinicians routinely use serum biomarkers such as APRI, FIB-4, and FibroTest alongside imaging techniques like transient elastography to evaluate hepatic stiffness and fibrosis severity. Although liver biopsy remains the gold standard for detailed histologic assessment, its invasive nature, risk of sampling error, and interobserver variability have limited its use to cases with discordant noninvasive findings or when confirmation of specific liver diseases is necessary. This integrated diagnostic strategy has improved early detection and precise staging, enabling timely intervention and better patient outcomes.

Further details related to country-based variations are provided in the report…

Liver Fibrosis Treatment

Treatment strategies for liver fibrosis are multifaceted, addressing its complex pathophysiology through biological interventions, pharmacological therapies, dietary modifications, and surgical options aimed at slowing progression and improving liver function. Therapeutic approaches target key fibrogenic pathways, including LOXL2 inhibition, antiviral treatments for underlying infections, FXR agonists such as obeticholic acid, and metabolic regulators to reduce inflammation and fibrosis. These strategies are tailored to the specific etiology of fibrosis, highlighting the need for a personalized treatment approach in effectively managing this condition.

Liver Fibrosis Epidemiology

As the market is derived using a patient-based model, the liver fibrosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total Liver Fibrosis Diagnosed Prevalent Cases, severity-specific diagnosed prevalent cases of MASH, and total diagnosed prevalent cases of liver fibrosis (=F2 stage) in MASH in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Liver Fibrosis Epidemiological Analysis and Forecast:

- DelveInsight’s epidemiology model estimates that in 2023, there were approximately 8 million diagnosed prevalent cases of liver fibrosis across the 7MM which are expected to increase by 2034.

- In 2023, the US reported the highest number of liver fibrosis cases among the 7MM, with approximately 4 million, a figure expected to rise by 2034.

- In 2023, Germany reported the highest number of liver fibrosis cases among EU4 and the UK, with approximately 770 thousand cases, followed by Italy and France, with around 620 thousand and 520 thousand cases respectively. Spain had the lowest number, with approximately 360 thousand cases.

- In 2023, Japan reported approximately 1.2 million liver fibrosis cases, a number projected to increase by 2034.

- In Japan, in 2023, cases of MASH/NASH were categorized by severity into F0, F1, F2, F3, and F4 stages. The highest prevalence was observed in the F1 stage, with approximately 240 thousand cases, while the F4 stage had the lowest, around 35 thousand cases.

- In 2023, Germany recorded the highest number of severity-specific NASH/MASH cases among the EU4 and the UK, with approximately 285 thousand cases in the F1 stage and nearly 55 thousand in the F4 stage.

- In 2023, there were approximately 3 million diagnosed prevalent cases of liver fibrosis (=F2 stage) in MASH/NASH across the 7MM, a figure expected to rise by 2034.

- In 2023, Japan reported approximately 240 thousand diagnosed prevalent cases of liver fibrosis (=F2 stage) in MASH/NASH cases, a number projected to increase by 2034.

Liver Fibrosis Epidemiology Segmentation:

- Total Liver Fibrosis Diagnosed Prevalent Cases

- Severity-specific diagnosed prevalent cases of MASH

- Total diagnosed prevalent cases of liver fibrosis (=F2 stage) in MASH

Liver Fibrosis Market Recent Developments and Breakthroughs

- In May 2025, Roche announced the launch of its Elecsys® PRO-C3 test, a new diagnostic solution designed to assess the severity of liver fibrosis in patients with metabolic dysfunction-associated steatotic liver disease (MASLD). Developed in collaboration with Nordic Bioscience, the test provides clinicians with a simple and efficient way to identify patients with liver fibrosis of varying severity, facilitating timely intervention and management of the disease.

Liver Fibrosis Drugs Chapter Analysis

The drug chapter segment of the liver fibrosis report encloses a detailed analysis of liver fibrosis-marketed drugs and mid to late-stage (Phase III and Phase II) Liver Fibrosis pipeline drugs analysis. It also helps understand the liver fibrosis clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Liver Fibrosis Marketed Drugs

-

REZDIFFRA (resmetirom): Madrigal Pharmaceuticals

REZDIFFRA (resmetirom), a Thyroid Hormone Receptor-beta (THR-ß) agonist, received US FDA approval in March 2024 for adults with noncirrhotic MASH and moderate to advanced liver fibrosis (F2-F3) as an adjunct to diet and exercise, following accelerated approval based on improvements in MASH and fibrosis. Madrigal Pharmaceuticals secured Priority Review, Breakthrough Therapy Designation (BTD), and Fast Track Designation (FTD) from the US FDA for MASH with liver fibrosis, underscoring its therapeutic significance.

The company plans a phased European launch starting in Germany in the second half of 2025, pending EMA approval, positioning REZDIFFRA as the first approved MASH liver fibrosis therapy in Europe. Additionally, new two-year data from the MAESTRO-NAFLD-1 trial, released in February 2025, suggest potential benefits in patients with compensated MASH cirrhosis, indicating broader clinical utility.

Liver Fibrosis Emerging Drugs

-

Efruxifermin (EFX): Akero Therapeutics

Efruxifermin (EFX), an Fc-FGF21 fusion protein designed to mimic native FGF21 activity, regulates metabolism and mitigates cellular stress. It is currently in three Phase III trials for MASH, with Phase II data showing its potential to reduce liver fat and inflammation, reverse fibrosis (including compensated cirrhosis), and improve metabolic parameters. Akero completed enrolment for the double-blind portion of the Phase III SYNCHRONY Real-World study in January 2025, with results expected in the first half of 2026. The US FDA granted EFX BTD and FTD for NASH, while the EMA awarded it PRIME designation, highlighting its potential as a transformative therapy.

-

Denifanstat (TVB-2640): Sagimet Biosciences

Denifanstat, a selective fatty acid synthase (FASN) inhibitor, is in Phase III development for MASH, targeting De Novo Lipogenesis (DNL) to reduce palmitate production. In October 2024, Sagimet Biosciences successfully concluded end-of-Phase II discussions with the US FDA, advancing denifanstat into Phase III trials. The FASCINATE-3 trial focuses on noncirrhotic MASH (F2/F3), while FASCINIT evaluates patients with suspected or confirmed MASLD/MASH.

In February 2025, Sagimet announced an oral presentation at the MASH Pathogenesis and Therapeutic Approaches Keystone Symposium, showcasing lipidomic data from the Phase IIb FASCINATE-2 trial on triglycerides and LDL cholesterol in advanced fibrosis. The US FDA granted denifanstat BTD and FTD for noncirrhotic MASH with moderate to advanced fibrosis, reinforcing its potential as a targeted metabolic therapy.

-

Survodutide (BI 456906): Boehringer Ingelheim/Zealand Pharma

Survodutide, a dual GLP-1/glucagon receptor agonist, is in Phase III development for MASH and fibrosis, targeting key metabolic pathways. In October 2024, Boehringer Ingelheim initiated the LIVERAGE trials, including LIVERAGE for MASH with fibrosis and LIVERAGE-Cirrhosis for MASH with cirrhosis. The US FDA granted BTD for noncirrhotic MASH with fibrosis, while the EMA included survodutide in its Priority Medicines (PRIME) scheme for NASH. Additionally, Boehringer Ingelheim and Zealand Pharma received US FDA, underscoring its potential to address the unmet needs in MASH treatment.

-

Pegozafermin: 89bio

Pegozafermin, an investigational FGF21 analog developed using glycoPEGylation technology, is designed to activate FGFR1c, 2c, or 3c with the co-receptor ß-Klotho in metabolic tissues, addressing metabolic dysfunctions associated with MASH. In May 2024, 89bio initiated the Phase III ENLIGHTEN-Cirrhosis trial to evaluate its efficacy in MASH patients with compensated cirrhosis. The EMA granted pegozafermin PRIME designation for MASH with fibrosis and compensated cirrhosis, while the US FDA awarded BTD based on positive Phase IIb ENLIVEN trial data, reinforcing its potential as a novel treatment in the evolving MASH landscape.

Liver Fibrosis Drugs Analysis

Liver Fibrosis is being targeted through multiple therapeutic classes, each addressing distinct pathological mechanisms. THR-ß agonists enhance hepatic metabolism and reduce fibrosis by promoting lipid clearance and resolving MASH. FGF21 analogs improve insulin sensitivity, lipid metabolism, and inflammation while attenuating fibrogenesis. GLP-1/glucagon dual agonists regulate metabolic pathways by enhancing glucose homeostasis and reducing hepatic steatosis and fibrosis. FASN inhibitors block de novo lipogenesis, limiting the accumulation of harmful lipids that contribute to fibrotic progression. These pharmacological classes represent a multimodal strategy, targeting metabolic dysfunction, inflammation, and fibrotic pathways to improve liver health and slow disease progression.

Liver Firbrosis Market Outlook

Liver fibrosis is a pathological consequence of chronic liver injury, characterized by excessive extracellular matrix deposition that disrupts normal hepatic architecture and function. Current therapeutic strategies primarily target underlying etiologies such as viral hepatitis, metabolic dysfunction, and alcohol-related liver disease, with limited direct anti-fibrotic interventions. Among approved treatments, REZDIFFRA (resmetirom), a THR-ß agonist, is the first US FDA-approved therapy for noncirrhotic NASH with moderate to advanced fibrosis, reducing hepatic fat and modulating fibrogenic pathways.

Despite advancements, unmet needs persist in liver fibrosis treatment. Current therapies halt progression but fail to reverse advanced scarring. Effective fibrosis-degrading agents, regenerative therapies, and non-invasive biomarkers are critically needed. Personalized, multi-targeted approaches are essential due to disease heterogeneity.

Investigational agents such as Survodutide (a GLP-1/glucagon receptor agonist), Pegozafermin and Efruxifermin (FGF21 analogs), and Lanifibranor (a pan-PPAR agonist) focus on metabolic reprogramming, liver fat reduction, and anti-inflammatory effects. RNA interference therapy Fazirsiran targets mutant Z-AAT accumulation in AATD-associated liver disease, while Denifanstat (a FASN inhibitor) and Aramchol (an SCD1 inhibitor) disrupt lipid synthesis pathways linked to fibrosis progression. Rencofilstat, a cyclophilin inhibitor, aims to mitigate fibrosis through anti-inflammatory mechanisms, and VK2809, a liver-selective TRß agonist, reduces hepatic fat and fibrosis markers. Pfizer’s dual approach with Ervogastat (DGAT2 inhibitor) targets lipid metabolism to counteract fibrosis.

Liver Fibrosis Companies like Inventiva Pharma’s Lanifibranor (IVA337), Galmed Pharmaceuticals’ Aramchol, Novo Nordisk’s WEGOVY (semaglutide), among others are involved in the development of drugs for the treatment of liver fibrosis.

Apart from this, several Liver Fibrosis drugs currently in different stages of development include HU6 by Rivus Pharmaceuticals, LPCN 1144 by Lipocine, MN-001 by MediciNova, Icosabutate by NorthSea Therapeutics, Lixudebart (ALE.F02) by Alentis Therapeutics, PHIN-214 by PharmaIN, and FXR314 by Organovo.

- The Liver Fibrosis Treatment Market Size in the 7MM was approximately USD 1,800 million in 2023 and is projected to increase during the forecast period (2025–2034).

- The Liver Fibrosis Treatment Market Size in the US was approximately USD 1,300 million in 2023 and is anticipated to increase due to the launch of emerging therapies.

- The Liver Fibrosis Treatment Market Size of EU4 and the UK was calculated to be approximately USD 400 million in 2023, which was nearly 23% of the total market revenue for the 7MM.

- In 2023, Germany dominated the market among EU4 and the UK, generating around USD 120 million. Italy followed closely with approximately USD 95 million, while the UK recorded around USD 75 million.

- In 2023, the Liver Fibrosis Treatment Market Size was approximately USD 80 million in Japan which is anticipated to increase during the forecast period (2025-2034).

- Estimates suggest that REZDIFFRA (resmetirom) is expected to generate approximately USD 2,500 million by 2034 in the 7MM.

Liver Fibrosis Drugs Uptake

This section focuses on the uptake rate of potential Liver Fibrosis drugs expected to be launched in the market during 2020–2034.

Liver Fibrosis Pipeline Development Activities

The Liver Fibrosis Pipeline Report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Liver Fibrosis Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Liver Fibrosis Pipeline Segment Report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for liver fibrosis.

Latest KOL Views

To keep up with current Liver Fibrosis Therapeutics Market Trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on liver fibrosis evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the University of California, US, Arizona Liver Health, US, Houston Research Institute, US, University of Bonn, Germany, Hospital Saint-Antoine - Ap-Hp Sorbonne University, France, Fondazione Policlinico Universitario Agostino Gemelli, Italy, Instituto de Investigaciones Biomédicas August Pi i Sunyer (IDIBAPS), Spain, Royal Infirmary of Edinburgh, UK, and Aichi Medical University, Japan, among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or liver fibrosis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per the KOLs from the US, NASH affects approximately 5% of the US adult population, driven by the growing burden of obesity, diabetes, and metabolic syndrome. Despite up to 75% of individuals with NAFLD having underlying NASH, many remain undiagnosed due to gaps in screening and inconsistent diagnostic pathways. The lack of standardized criteria and reliance on varied data sources contribute to discrepancies in prevalence estimates, underscoring the urgent need for real-world epidemiological studies. Improved risk stratification and broader adoption of noninvasive diagnostic tools are essential to identifying high-risk patients earlier and mitigating long-term disease burden.

As per the KOLs from France, NAFLD is a growing public health challenge in France, particularly among men and those with metabolic risk factors. The link between diabetes and advanced fibrosis highlights the urgency of national screening programs. Strengthening preventive strategies through metabolic health initiatives and physician education is key to reducing long-term disease burden.

As per the KOLs from Japan, the increasing prevalence of NAFLD and NASH in Japan reflects global trends, yet lean-NASH remains a distinct concern. The interplay between metabolic health and fibrosis progression remains incompletely understood, emphasizing the need for longitudinal studies and improved noninvasive diagnostics to refine risk stratification and treatment pathways.

Liver Fibrosis Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Liver Fibrosis Treatment Market Landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate.

Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Liver Fibrosis Market Access and Reimbursement

REZDIFFRA

- Madrigal offers a Co-pay Savings Card for eligible, commercially insured patients, reducing REZDIFFRA costs to as low as USD 10.

- In 2025, the Inflation Reduction Act (IRA) enhances Medicare Part D affordability, capping annual out-of-pocket drug costs at USD 2,000 (down from USD 3,250 in 2024) and eliminating the “donut hole.” Medicare will cover remaining costs once the cap is reached.

- For those struggling with the USD 2,000 cap, the Medicare Prescription Payment Plan (MPPP) allows costs to be spread over monthly payments. Enrollment is available anytime via the Part D plan provider.

- The Extra Help (LIS) program expands in 2024, offering full benefits to low-income individuals. Eligibility requires an income under USD 22,590 (single) or USD 30,660 (couple), with asset limits of USD 17,220 and USD 34,360, respectively.

The Liver Fibrosis Therapeutics Market Report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Liver Fibrosis Therapeutics Market Report Scope

- The Liver Fibrosis Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Liver Fibrosis Treatment Market Landscape.

- A detailed review of the Liver Biopsy Market, historical and forecasted Liver Fibrosis Treatment Market Size, Liver Fibrosis Drugs Market Share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Liver Fibrosis Therapeutics Market Report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Liver Biopsy Market.

Liver Fibrosis Therapeutics Market Report Insights

- Patient-based Liver Fibrosis Market Forecasting

- Liver Fibrosis Therapeutics Approaches

- Liver Fibrosis Pipeline Drugs Analysis

- Liver Fibrosis Treatment Market Size and Trends

- Existing and Future Liver Fibrosis Drugs Market Opportunity

Liver Fibrosis Therapeutics Market Report Key Strengths

- 10 years Liver Fibrosis Market Forecast

- The 7MM Coverage

- Liver Fibrosis Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Liver Fibrosis Drugs Uptake

- Key Liver Fibrosis Market Forecast Assumptions

Liver Fibrosis Therapeutics Market Report Assessment

- Current Liver Fibrosis Treatment Market Practices

- Liver Fibrosis Unmet Needs

- Liver Fibrosis Pipeline Drugs Profiles

- Liver Fibrosis Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions answered through our Liver Fibrosis Market Report:

Liver Fibrosis Market Insights

- What was the Liver Fibrosis Treatment Market Size, the Liver Fibrosis Market by therapies, and Liver Fibrosis Drugs Market Share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will Lanifibranor affect the treatment paradigm of liver fibrosis?

- How will REZDIFFRA compete with other upcoming products and marketed therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Liver Fibrosis Epidemiology Insights

- What are the disease risks, burdens, and Liver Fibrosis Unmet Needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to liver fibrosis?

- What is the historical and forecasted liver fibrosis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent liver fibrosis population during the forecast period (2025–2034)?

- What factors are contributing to the growth of liver fibrosis cases?

Current Liver Fibrosis Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the Liver Fibrosis Treatment? What are the current clinical and treatment guidelines for treating liver fibrosis?

- How many companies are developing therapies for the Liver Fibrosis Treatment?

- How many emerging therapies are in the mid-stage and late stage of development for treating liver fibrosis?

- What are the recent novel therapies, targets, Liver Fibrosis Mechanisms of Action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of liver fibrosis?

Reasons to Buy

- The Liver Biopsy Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Liver Fibrosis Drugs Market.

- Insights on patient burden/disease Liver Biopsy Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Liver Biopsy Market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the Liver Biopsy Market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for liver fibrosis, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Liver Biopsy Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles:-