Empowering Change: REZDIFFRA’s Trailblazing Journey in NASH Treatment

Sep 04, 2024

Liver disease emerges as a burgeoning global health concern, presenting a myriad of formidable challenges. From viral hepatitis to alcoholic liver disease, nonalcoholic fatty liver disease (NAFLD), liver cirrhosis, and hepatocellular carcinoma (HCC), these conditions collectively afflict millions, exacting a toll of morbidity, mortality, and economic burden. Within this landscape, NAFLD/nonalcoholic steatohepatitis (NASH), recently renamed MASH (metabolic dysfunction-associated steatohepatitis), assumes prominence as a pivotal contributor. NAFLD, a comprehensive term encapsulating a spectrum of liver afflictions, encompasses everything from benign steatosis to progressive hepatocellular injury accompanied by fibrosis, cirrhosis, and, in severe instances, HCC. Central to NAFLD is NASH, the progressive manifestation characterized by escalating liver damage, posing risks of advancing fibrosis, cirrhosis, and terminal liver ailments.

According to DelveInsight estimates, in the 7MM, the total prevalent cases of NASH in 2023 were around 43 million; out of these, the diagnosed cases were 37%. The majority of individuals with metabolic syndrome, diabetes, or obesity are at risk of acquiring NAFLD and, in the end, NASH, which will cause a sharp increase in cases going forward. The surging prevalence of NASH poses a formidable healthcare challenge worldwide, demanding advanced diagnostic tools, innovative treatments, and holistic care approaches. Linked with obesity and metabolic disorders, it imposes significant economic strains, necessitating proactive prevention and management strategies.

Until mid-March, the therapeutic landscape of NASH lacked the FDA, EMA, or PMDA-approved medications, relying primarily on lifestyle adjustments like diet and exercise. Supplemental interventions encompassed off-label usage of vitamin E and antidiabetic agents (e.g., pioglitazone, liraglutide) and liver transplantation in the case of most severe cases. Given NASH’s multifaceted pathogenesis, effective treatment demands comprehensive targeting of various cellular and molecular pathways.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Notizia

- Advances in NASH Therapeutics Space: Latest Breakthroughs in Drug Development

- AstraZeneca’s Danicopan Trial; CHMP Recommends Sanofi/AstraZeneca’s nirsevimab; Akero’s NASH Drug...

- A Beacon of Hope: A Look at the Latest Advances in Emerging Therapies for Liver Cirrhosis Treatment

- From NASH to MASH: Unraveling the Evolution and Future of Liver Disease Treatment

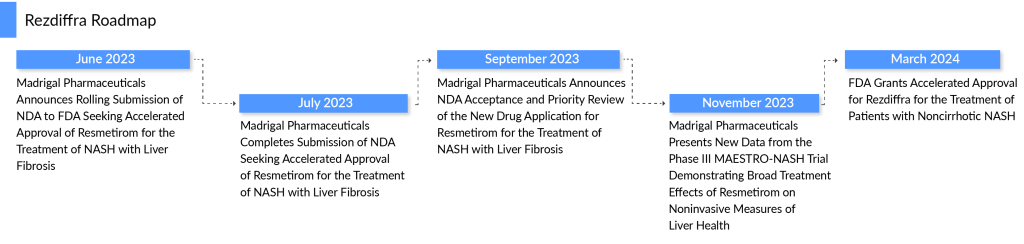

Recently, in March 2024, Madrigal Pharmaceuticals’ groundbreaking product, REZDIFFRA (resmetirom), a once-daily, oral THR-β agonist, received accelerated endorsement from the US FDA based on results from the Phase III MAESTRO-NASH trial. This approval marks a significant stride in the medical landscape, as REZDIFFRA becomes the inaugural and sole FDA-sanctioned therapy for adults afflicted with non-cirrhotic NASH, accompanied by moderate to advanced liver scarring (fibrosis) corresponding to stages F2–F3 fibrosis. Set to debut in April 2024, this milestone heralds a new era of hope and progress for individuals grappling with NASH, promising to revolutionize treatment paradigms with its integration alongside diet and exercise regimens. The accelerated green light for REZDIFFRA stands as a pivotal moment in the annals of NASH therapeutics, igniting fresh vigor and impetus within the NASH community.

Additionally in Europe, the marketing authorization application for REZDIFFRA is currently under review by the European Medicines Agency Committee for Medicinal Products for Human Use.

Based on the robust efficacy and safety data generated in two large Phase III MAESTRO studies, it is believed that REZDIFFRA will become the foundational therapy for patients with NASH with moderate to advanced liver fibrosis. Also now that the FDA has approved REZDIFFRA for NASH, pharmaceutical companies will have a better understanding of the thresholds they must meet to get future approvals.

Physicians hope the REZDIFFRA’s approval “energizes” the field and leads to more treatment advances. Madrigal Pharmaceuticals has already garnered widespread support among physicians. A significant portion of gastroenterologists plan to incorporate the brand into their practice within six months of its launch. They estimate that over a third of their patients with MASH/NASH could benefit from the drug, suggesting rapid adoption and utilization. Physicians are hopeful that insurance providers will cover the cost of REZDIFFRA and are poised to offer it to eligible NASH patients once it becomes available.

REZDIFFRA is available to patients with moderate to advanced fibrosis (F2/F3) in the US from the second week of April, the drug is distributed through a limited specialty pharmacy network with an annual WAC of USD 47,400. The price reflects value as the first-and-only therapy for NASH. Madrigal extends its unwavering commitment through the innovative Madrigal Patient Support program, facilitating insurance navigation, affordability solutions, and copay assistance for eligible recipients. Furthermore, a dedicated Patient Assistance Program (PAP) ensures access for uninsured patients seeking REZDIFFRA’s transformative benefits.

In April 2024, Madrigal Pharmaceuticals, Inc. announced that REZDIFFRA (resmetirom) had become available in the U.S. REZDIFFRA was indicated for use alongside diet and exercise in treating adults with noncirrhotic NASH and moderate to advanced liver fibrosis (stages F2 to F3 fibrosis). Continued approval for this indication was to be contingent upon the verification and description of clinical benefit in ongoing confirmatory trials.

Bill Sibold, Chief Executive Officer of Madrigal, stated, “The introduction of REZDIFFRA as the first and only FDA-approved therapy in NASH marks a turning point for Madrigal and the NASH community. Since approval, we have been partnering with healthcare providers, payers, and patient advocates to build new care pathways that will help patients access REZDIFFRA and achieve their treatment goals. Our field teams are fully deployed, our specialty pharmacy network is processing prescriptions, our supply chain is fully operational, and most importantly, the first patients are now receiving Rezdiffra.”

Various pharmaceutical companies have spent millions of dollars trying to develop a possible medicine, but none other than Madrigal Pharmaceuticals has been able to provide authorized treatments in the NASH treatment market. In the latest research and development space of NASH, FXR agonists, FGF21 stimulants, FGF19 analog, glucagon-like peptide-1 (GLP-1) agonists, peroxisome proliferator-activated receptor (PPAR) regulators, THR-β agonists, and some others are the most highlighted class of emerging therapies of this indication.

According to our projections, REZDIFFRA stands unchallenged as the primary treatment for NASH patients in stages F2-F3, with no foreseeable competitors shortly. Despite being the inaugural therapy approved in the US for NASH, Madrigal’s window of first-mover advantage is expected to narrow swiftly due to an increasingly crowded therapeutic environment driven by substantial unmet medical demand. It may face competition from both GLP-1 and non-GLP-1 drug candidates in development for NASH. Given the massive market size of NASH, it is not surprising that there are many (non-GLP-1) NASH drug candidates in development. Some of these include lanifibranor (Inventiva Pharma), MSDC-0602K (Cirius Therapeutics, Inc.), Aramchol (Galmed Research and Development, Ltd.), Belapectin (Galectin Therapeutics Inc.), VK2809 (Viking Therapeutics), and others.

Among GLP-1 drugs, REZDIFFRA is not feared of competition, mainly soon. Major GLP-1 drugs in the pipeline include Semaglutide (Novo Nordisk A/S), Survodutide (Zealand Pharma /Boehringer Ingelheim), and others. It is believed that GLP-1 drugs do not have statistically significant results in liver fibrosis improvement without worsening NASH resolution, despite statistically significant results in another efficacy endpoint (NASH resolution improvement without liver fibrosis worsening). However, recently, Zealand Pharma and their partner Boehringer Ingelheim announced the results from their GLP-1 candidate for the NASH Phase II trial at 48 weeks. Survodutide exhibited 83% positive results in adults having liver disease due to MASH, with significant improvements in fibrosis. While no specific date was given for the same.

In conclusion, millions of people afflicted by this difficult liver disease now have hope and promise thanks to the introduction of REZDIFFRA, a major advancement in the treatment of NASH.

Downloads

Article in PDF

Recent Articles

- Nonalcoholic Steatohepatitis Treatment Market: Which Pipeline Therapy Will Steal the Spotlight?

- Albireo Pharma’s PFIC Therapy; Lupin’s Trichomoniasis Oral Drug; Moderna’s Weapon Aga...

- 6 Promising Late-stage NASH Drugs to Challenge REZDIFFRA’s Supremacy

- From NASH to MASH: Unraveling the Evolution and Future of Liver Disease Treatment

- Off-label therapies dominate NASH Market Share