Game-Changers in Non-Alcoholic Steatohepatitis (NASH) Treatment: Insights into Novel Drug Classes

Sep 04, 2024

Table of Contents

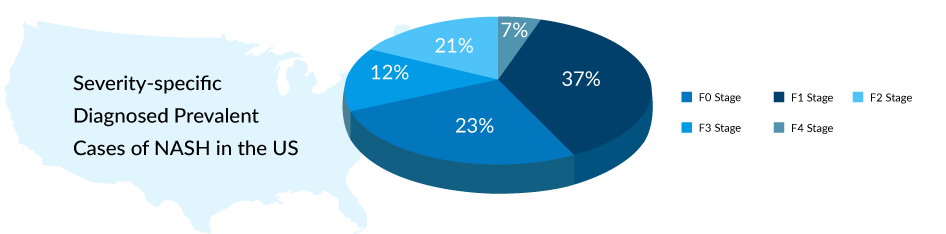

Non-alcoholic steatohepatitis (NASH) has emerged as a global health concern, affecting millions of individuals worldwide. NASH is a progressive liver disease characterized by inflammation and liver cell damage, often resulting from the accumulation of fat in the liver. In 2023, there were an estimated 42 million prevalent cases of NASH in the 7MM. Out of these, a total of ~15 million cases were diagnosed, and this number is projected to increase by the end of 2034 in the 7MM. As the prevalence of NASH continues to rise, researchers and pharmaceutical companies are actively exploring innovative therapeutic approaches.

In 2023, prominent liver disease organizations, including the American Association for the Study of Liver Diseases (AASLD) and the European Association for the Study of the Liver (EASL), officially redefined Nonalcoholic Steatohepatitis (NASH) to Metabolic Dysfunction-Associated Steatohepatitis (MASH), aligning the name more closely with its metabolic roots. For the most up-to-date insights, explore our comprehensive MASH Market Report.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Gene-edited T cells for diabetes treatment; Pliant raised $144 million; Accent, AstraZeneca aim R...

- TLX66 in AL Amyloidosis; Takeda’s Dengue Shot; Innovent’s Cholangiocarcinoma Clinical Trial; Anot...

- Redefining Liver Disease in the Metabolic Era: From NASH to MASH and the Rise of Obesity‐targeted...

- Algernon’s NP-120; FDA nod to 4DMedical tool; SaNOtize’s NORSTM trial; Pole’s c...

- Notizia

Available NASH Therapeutic Strategies

Currently, there are no approved treatments for NASH by regulatory agencies such as the FDA, EMA, or PMDA (Pharmaceuticals and Medical Devices Agency). However, ongoing research is exploring medications that could potentially address these conditions. The primary approach to managing NASH at present involves lifestyle modifications, including changes to diet and exercise. In addition to lifestyle adjustments, alternative treatment options for NASH have involved the off-label use of vitamin E and anti-diabetes agents like pioglitazone and liraglutide. According to the American Association for the Study of Liver Diseases (AASLD) NAFLD practice guidance statement, the off-label use of vitamin E is recommended for non-cirrhotic, non-diabetic patients with biopsy-proven NASH, while pioglitazone is suggested for managing diabetic patients with biopsy-proven NASH.

Vitamin E, renowned for its antioxidant properties, is regarded as a primary pharmacological intervention in addressing NASH, particularly when dietary and lifestyle adjustments prove inadequate. Agents with antifibrotic properties can impede the advancement of liver fibrosis and the progression from NAFLD to fibrotic NASH. While the impact of pioglitazone (an anti-diabetes medication) on NASH histology in individuals with T2D has been extensively studied, concerns persist, including issues such as weight gain, fluid retention, elevated cancer risk, and susceptibility to bone fractures. Furthermore, there are alternative targets for the treatment of NAFLD and NASH, such as G protein-coupled receptors (GPCRs), estrogen-related receptor alpha (ERRα), bone morphogenetic proteins (BMPs), and KLFs. Bariatric surgery (BS) or weight loss surgery is acknowledged as the most effective approach to combat obesity and diabetes, achieved by curbing food absorption and influencing the secretion of gut hormones, and mitigating metabolic dysfunction.

The NASH treatment market is currently vacant as there are no approved treatments, highlighting a significant demand for suitable NASH therapies. The anticipation is that the potential for effective NASH treatments will grow in the future, as a range of drugs is being added to the pipeline of new therapeutics. Several candidate drugs for NASH treatment are presently undergoing testing in phase II or III clinical trials, with some showing promising results.

Emerging Therapies: The Future of NASH Treatment

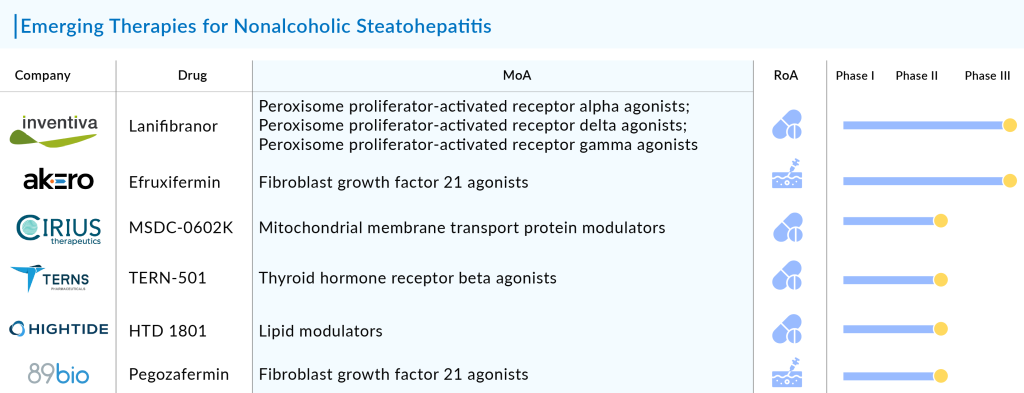

Companies across the globe are diligently working toward the development of novel treatment therapies with a considerable amount of success over the years. To date, there are several emerging NASH treatment market players, Inventiva Pharma, Eli Lilly and Company, Intercept Pharmaceuticals, Madrigal Pharmaceuticals, Inc., Intercept Pharmaceuticals, and others that are developing drugs for the treatment of NASH.

In the current scenario, several drug classes such as FXR agonist, THR-β Agonist, PPAR agonist, GLP-1 Agonist, FGF21 Stimulants, and some others are being studied to target the NASH population. Any drug approved with higher safety and efficacy to supposed to bring many changes in the overall NASH treatment market. The detailed assessment of NASH drugs from these classes is given below:

PPAR Agonist

Lanifibranor: Inventiva Pharma

Lanifibranor represents a cutting-edge panPPAR agonist designed for the secure and efficient management of fibrotic diseases, offering improved adherence. It stands out as the sole pan-PPAR agonist progressing through clinical development. Remarkably, it has gained recognition as a potential blockbuster for NASH, a type of fatty liver disease, having accomplished dual regulatory milestones in a pivotal study. Lanifibranor, also known as IVA337, has demonstrated favorable outcomes across all liver lesions associated with NASH. The drug, having received Fast Track and Breakthrough Therapy designations from the FDA in September 2019 and October 2020, respectively, is Inventiva’s primary product candidate. Currently undergoing a pivotal Phase III clinical trial called NATiV3, focusing on adult NASH patients, lanifibranor is poised to enter the US NASH treatment market in 2026.

In 2017, Inventiva secured $51 million through an IPO held in Paris, France. This capital infusion empowers the French biotech firm, which counts AbbVie and Boehringer Ingelheim among its collaborators, to advance its leading candidate through Phase IIb trials targeting NASH and systemic sclerosis. In 2021, Inventiva formed a partnership with a distinguished scientist from the faculty of medicine at Angers University, specializing in noninvasive diagnosis of liver lesions in chronic liver diseases. This collaboration aimed to develop noninvasive biomarkers that could identify patients responding to lanifibranor in terms of NASH resolution and fibrosis improvement. Subsequently, in May 2022, Inventiva entered into a financial agreement with the European Investment Bank, securing up to EUR 50 million under a Finance Contract. This funding is designated to bolster the preclinical and clinical pipeline, with a portion allocated to supporting the Phase III clinical trial of lanifibranor in individuals with non-alcoholic steatohepatitis.

In February 2024, Inventiva paused recruitment for its pivotal Phase III NATiV3 trial of lanifibranor after a participant reported a serious adverse event. This was the first such event for the drug across all trials. Inventiva’s CEO, Frédéric Cren, stated that the patient, who had elevated liver enzymes, is now asymptomatic and improving. The trial is expected to resume in four to six weeks, with patient enrollment and randomization anticipated to complete by mid-2024. Following the news, Inventiva’s stock fell over 16% in pre-market trading. The company’s market cap is $208.49 million. The trial, which has enrolled 913 patients so far, is assessing lanifibranor in non-alcoholic steatohepatitis (NASH).

Saroglitazar Magnesium: Zydus Therapeutics

Saroglitazar Magnesium developed by Zydus Therapeutics, is an investigational molecule in the US, undergoing clinical evaluation for the treatment of liver diseases like NAFLD with polycystic ovary syndrome (PCOS), NASH, and primary biliary cholangitis (PBC). Zydus Therapeutics’ drug is in Phase II for NASH treatment.

GLP-1 Agonist

Semaglutide: Novo Nordisk A/S

Semaglutide, a primary product developed by Novo Nordisk A/S and classified as a GLP-1 analog for the treatment of T2D, is currently undergoing assessment for weight management and the treatment of NASH. In its phase III trials, the drug has demonstrated a significant, dose-dependent reduction in alanine aminotransferase (ALT) and high sensitivity C-reactive protein (hsCRP) among patients with obesity or T2D. Notably, the FDA granted Breakthrough Therapy designation to this drug for NASH in August 2020. Additionally, in June 2023, Merck’s GLP-1/glucagon receptor co-agonist received Fast Track designation from the FDA for the treatment of NASH.

In 2015, Gilead Sciences, Inc. disclosed its acquisition of Phenex Pharmaceuticals’ FXR program, which includes small molecule FXR agonists like cilofexor, designed for the treatment of liver diseases, including NASH. Following that, in 2016, Gilead Sciences, Inc. and Nimbus Therapeutics entered into a definitive agreement. According to the agreement, Gilead would acquire Nimbus Apollo, Inc., a wholly owned subsidiary of Nimbus Therapeutics, along with its ACC inhibitor program (firsocostat) intended for addressing NASH and other liver diseases.

In November 2021, Gilead Sciences and Novo Nordisk broadened their collaboration in the clinical study of NASH. Both companies are set to carry out a Phase IIb double-blind, placebo-controlled research to assess the safety and effectiveness of Novo Nordisk’s semaglutide, a GLP-1 receptor agonist, as well as a fixed-dose combination of Gilead’s experimental FXR agonist cilofexor and the investigational ACC inhibitor firsocostat. The study will explore these compounds individually and in combination for individuals with compensated cirrhosis (F4) caused by NASH.

The progress of semaglutide in treating NASH is proceeding as planned and is currently in Phase III. According to earlier trial findings, the combination of firsocostat and cilofexor has also shown significant enhancements in various aspects of NASH, such as noninvasive assessments of liver enzyme levels and scarring. These results provide new insights into the diverse mechanisms underlying NASH and highlight the potential of combined approaches for patients in urgent need of a treatment option. These approaches aim to bring about improvements in liver fat content, liver biochemistry, and specific noninvasive tests for fibrosis. These improvements are associated with meaningful histologic advancements in NASH. The drug is expected to be introduced to the US market for NASH treatment in 2029.

Tirzepatide: Eli Lilly and Company

Tirzepatide sponsored by Eli Lilly and Company a once-weekly dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist that integrates the actions of both incretins into a single novel molecule. The company has started Phase II clinical trial for the drug. Mounjaro (tirzepatide) for adults with type 2 diabetes was approved by the FDA and received a positive opinion from the European Medicines Agency’s Committee for Medicinal Products for human use.

THR-β Agonist

MGL-3196 (Resmetirom): Madrigal Pharmaceuticals, Inc.

Resmetirom, also known as MGL-3196, is an orally active, liver-targeted drug developed by Madrigal Pharmaceuticals, Inc. It serves as a selective agonist for thyroid hormone receptor-β with the purpose of addressing NASH by enhancing hepatic fat metabolism and mitigating lipotoxicity. The primary mode of action of this medication implies potential benefits in improving a patient’s lipid profile and reducing hepatic fat. In July 2016, Madrigal Pharmaceuticals, Inc. merged with Synta Pharmaceuticals Corp., a move aimed at advancing their collective research and development initiatives, particularly focusing on the clinical progression of MGL-3196 as Madrigal’s leading product candidate. Notably, in April 2023, the FDA granted Breakthrough Therapy designation to resmetirom for the treatment of NASH and liver fibrosis in adults. Madrigal Pharmaceuticals has finalized the filing of a new drug application, aiming for expedited approval of resmetirom to treat NASH with liver fibrosis. The drug is anticipated to be available in the US by 2024.

TERN-501: Terns, Inc.

TERN-501 produced by Terns, Inc. is a thyroid hormone receptor beta (THR-β) agonist with high metabolic stability, enhanced liver distribution, and greater selectivity for THR-β compared to other THR-β agonists in development for use in fixed-dose combinations for NASH treatment. It has also, received Fast Track designation from the FDA for TERN-501 for the treatment of NASH in June 2021.

FXR Agonist

Vonafexor (EYP001): Enyo Pharma

Vonafexor (EYP001), developed by Enyo Pharma, is a synthetic non-steroidal, non-bile acid FXR agonist available in oral form, designed for NASH treatment. Distinguished from other FXR agonists, it demonstrates favorable effects on kidney function (eGFR), inflammation, and liver and visceral fat fibrosis, as evidenced in the Phase IIa LIVIFY study involving NASH patients. Preclinical studies further indicate its potential in addressing kidney diseases like CKD and Alport syndrome. The results highlight Vonafexor’s promise in the NASH treatment landscape, showcasing its ability to rapidly enhance liver function and reduce liver fat. Moreover, its notable impact on improving renal function positions it as particularly advantageous for NASH patients dealing with comorbidities like diabetes that significantly affect kidney function.

In June 2018, ENYO Pharma concluded a Series B funding round, securing EUR 40 million from investors in the United States and Europe. This additional financial support empowers the company to fund the initial two Phase II clinical trials for its EYP001 compound targeting chronic HBV and NASH. In November 2021, ENYO Pharma revealed that two abstracts regarding Vonafexor were accepted, with one scheduled for an oral presentation and the other as a poster, at the Liver Meeting 2021. This event was organized by the American Association for the Study of Liver Diseases (AASLD) from November 12 to 15, 2021. With the backing of nine completed clinical studies—comprising six Phase I and three Phase IIa trials—the drug is presently in Phase II for CKD in NASH patients and is anticipated to be launched in the United States in 2027.

FGF21 Stimulants

Pegozafermin: 89bio, Inc.

Pegozafermin represents an extended-release version of glycopegylated FGF21, designed to address the short half-life of the native FGF21, lasting only half an hour. Leveraging proprietary glycopegylation technology, this NASH treatment drug aims to prolong the activity and duration of the native protein, offering therapeutic advantages and clinical benefits for treating NASH. The efficacy and safety results of the drug underscore its potential, as evidenced by positive topline data from a Phase IIb trial. This suggests that Pegozafermin could emerge as a compelling treatment option for NASH. In March of 2023, 89bio, Inc. disclosed encouraging top-line results from the Phase IIb ENLIVEN study, which assessed the efficacy of pegozafermin in treating patients with NASH. Anticipated, the drug is set to be introduced to the US NASH treatment market by 2027.

Efruxifermin: Akero Therapeutics, Inc.

Efruxifermin (EFX), the primary product developed by Akero Therapeutics, Inc., is an innovative Fc-FGF21 fusion protein designed to replicate the well-balanced biological activity of natural FGF21. Currently, EFX is undergoing assessment in two Phase IIb clinical trials focused on patients with confirmed NASH through biopsy: the HARMONY study, which involves pre-cirrhotic patients with F2–F3 fibrosis, and the SYMMETRY study, which targets cirrhotic patients with compensated F4 fibrosis. In October 2020, efruxifermin was granted Priority Medicine (PRIME) status by the European Medicines Agency (EMA). A year later, the FDA bestowed Fast Track designation upon the drug. In December 2022, the FDA recognized efruxifermin with Breakthrough Therapy Designation for addressing NASH.

Efruxifermin is presently the only medication under assessment for individuals with NASH in both pre-cirrhotic and cirrhotic stages. EFX has the ability to imitate the functions of the natural FGF21. If granted approval, this drug could become an exceptionally distinct and superior FGF21 analog, serving as a promising standalone treatment for NASH. NASH is a complex ailment, necessitating intervention at various stages of its development. EFX holds the potential to address all phases of NASH pathogenesis in a single therapy, encompassing the reversal of fibrosis, resolution of steatohepatitis, and support in restoring a healthy metabolism across the entire body. Additionally, there is a belief that EFX could be employed in conjunction with other treatments to achieve a more substantial impact in specific subgroups. The anticipated launch of the drug in the US NASH treatment market is set for 2027.

The other promising assests in the NASH pipeline include Denifanstat (formerly TVB-2640) (Sagimet Biosciences Inc.), Leronlimab (PRO 140) (CytoDyn, Inc.|Amarex Clinical Research), Icosabutate (NorthSea Therapeutics B.V.), Aldafermin (NGM282) (NGM Biopharmaceuticals, Inc), PXL065 (Poxel SA), LPCN 1144 (Lipocine Inc.), HTD1801 (HighTide Biopharma Pty Ltd), Rencofilstat (Hepion Pharmaceuticals, Inc.), and Belapectin (Cirrhosis) (Galectin Therapeutics Inc.).

The Road Ahead in the NASH Treatment Landscape

The NASH treatment landscape holds both promise and challenges as researchers and pharmaceutical companies strive to address the complexities of this liver disease. In recent years, there has been a surge in research efforts to develop effective therapeutic interventions for NASH. The focus has been on understanding the underlying mechanisms of the disease, with an emphasis on inflammation, oxidative stress, and fibrosis. Several promising drug candidates have entered clinical trials, aiming to target key pathways involved in NASH progression.

As per DelveInsight analysis, the NASH market size is supposed to grow during the forecast period owing to the expected launch of novel emerging therapies, which shall fuel the growth of the NASH market during the forecast period, i.e., 2023–2032.

One of the challenges in the NASH treatment landscape is the heterogeneity of the patient population. NASH manifests differently in individuals, varying in terms of severity and progression. Tailoring treatment strategies to accommodate this diversity is crucial for achieving optimal outcomes. Additionally, identifying reliable biomarkers for patient stratification and monitoring treatment response remains an ongoing area of research.

The exploration of combination therapies is gaining traction as researchers recognize the multifactorial nature of NASH. Combining drugs that address different aspects of the disease, such as inflammation, lipid metabolism, and fibrosis, may offer a more comprehensive approach to treatment. Clinical trials assessing the safety and efficacy of combination therapies are underway, holding the potential to revolutionize NASH management.

As the road ahead unfolds, collaboration between academia, industry, and regulatory agencies will be crucial for advancing our understanding of NASH and accelerating the development of effective therapies. Patient advocacy groups and healthcare providers also play a vital role in raising awareness, fostering early diagnosis, and supporting individuals living with NASH.

Downloads

Article in PDF

Recent Articles

- Notizia

- EU approval for Libtayo and Dovato; Boehringer expands NASH pipeline

- A Beacon of Hope: A Look at the Latest Advances in Emerging Therapies for Liver Cirrhosis Treatment

- FTA for Gannex’s ASC4; Disappointment for Incyte’s Ruxolitinib; Historic win for Pfizer, BioNTech...

- Gene-edited T cells for diabetes treatment; Pliant raised $144 million; Accent, AstraZeneca aim R...