Alcohol Use Disorder: A High-Burden Disease with Untapped Market Promise

Sep 19, 2025

Table of Contents

Insights around AUD patient burden

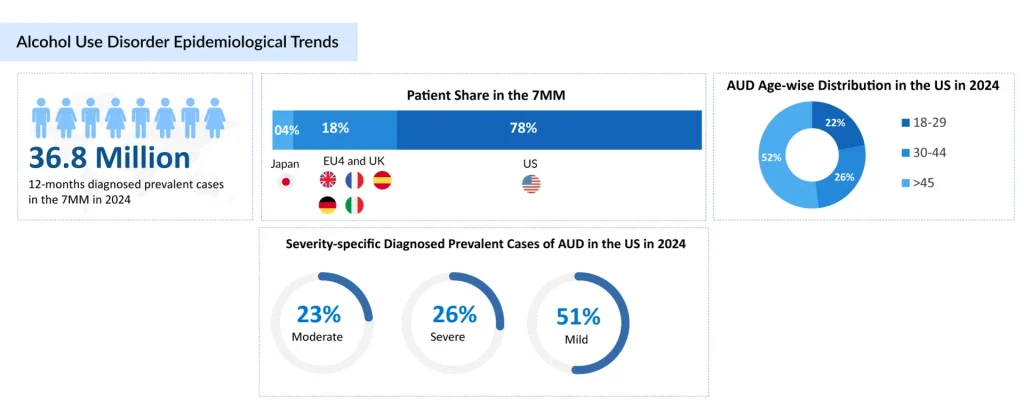

Over the years, AUD has emerged as a pressing global health challenge, with prevalence steadily rising, particularly in the United States and parts of Europe. This upward trend is fueled by modern lifestyle pressures, work-related stress, anxiety, and shifting social habits, as well as increased exposure to medications that may contribute to dependency.

Prevalence patterns vary widely across regions. In Asian countries, including Japan, relatively low rates of AUD are attributed to cultural norms and generally lower alcohol consumption per capita.

Downloads

Click Here To Get the Article in PDF

In contrast, the United States exhibits a markedly higher prevalence, with recent estimates suggesting ~28 million Americans are affected by AUD due to more permissive cultural attitudes toward drinking, where the majority of them fall above the age of 30 years.

According to Delveinsight’s estimates, the 12-month diagnosed prevalent cases of AUD in the 7MM were 36.8 million in 2024. Variations in severity were observed within the 7MM, with mild AUD patients contributing the most in the US and severe cases leading in Japan.

The AUD Treatment Journey

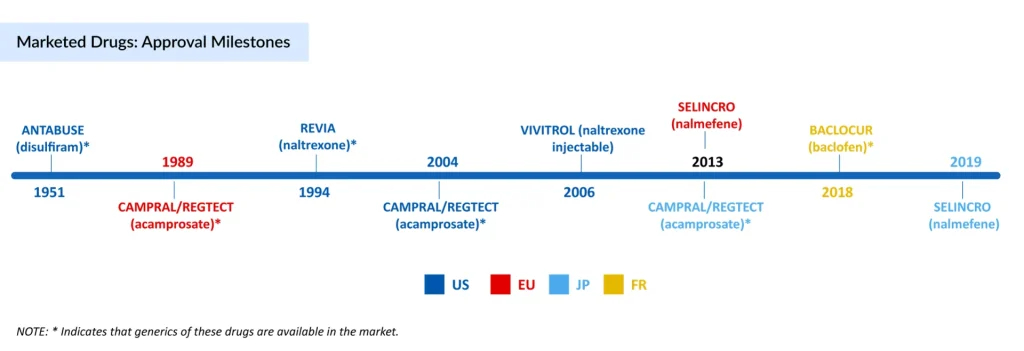

The treatment journey for AUD spans over seven decades, beginning in 1951 with the FDA approval of ANTABUSE (disulfiram).. In 1994, a new chapter unfolded with REVIA (oral naltrexone) in the US, which shifted the focus from deterrence to reducing cravings and relapse risk by targeting opioid receptors. To improve adherence further, VIVITROL, an extended-release injectable naltrexone, was launched in 2006 in the US, offering more extended coverage but limited by liver safety concerns, a common comorbidity in AUD. CAMPRAL (acamprosate) was introduced in 2004, providing neuroprotective support for maintaining abstinence in already sober patients. While its branded presence has faded, generic versions remain widely prescribed due to their tolerability.

Parallel to these developments, in Europe and Japan, the market evolved differently with SELINCRO (nalmefene), approved to reduce alcohol consumption without requiring prior detoxification. Meanwhile, France approved BACLOCUR (baclofen) after long off-label use, and sodium oxybate (GHB) gained traction in Italy and Austria for withdrawal and abstinence management.

Alongside branded AUD drugs, off-label generics such as topiramate, gabapentin, ondansetron, and benzodiazepines etc., have become widely used because of cost-effectiveness and clinician familiarity.

Factors responsible for a massive gap in existing AUD treatment rates

Despite the high prevalence, why are only 5-10% of the diagnosed patients getting treated?. Several factors contribute to this gap.

- Stigma and fear of being labeled often discourage individuals from seeking help. Lack of awareness about AUD as a medical condition is another reason.

- Limited access to specialized services, especially in low-resource settings, and financial barriers.

- In addition, many patients show reluctance or denial due to social pressure.

Currently, the AUD market is entering a new phase. With generics dominating current use, the focus is shifting toward emerging therapies designed to be more tailored, accessible, and patient-friendly.

Upcoming AUD competitive landscape: Will they accelerate the treatment rate?

Adherence to the FDA-approved medications remains a significant challenge, often limiting their real-world effectiveness. Factors such as side effects, dosing frequency, and the stigma around taking daily medications contribute to poor compliance.

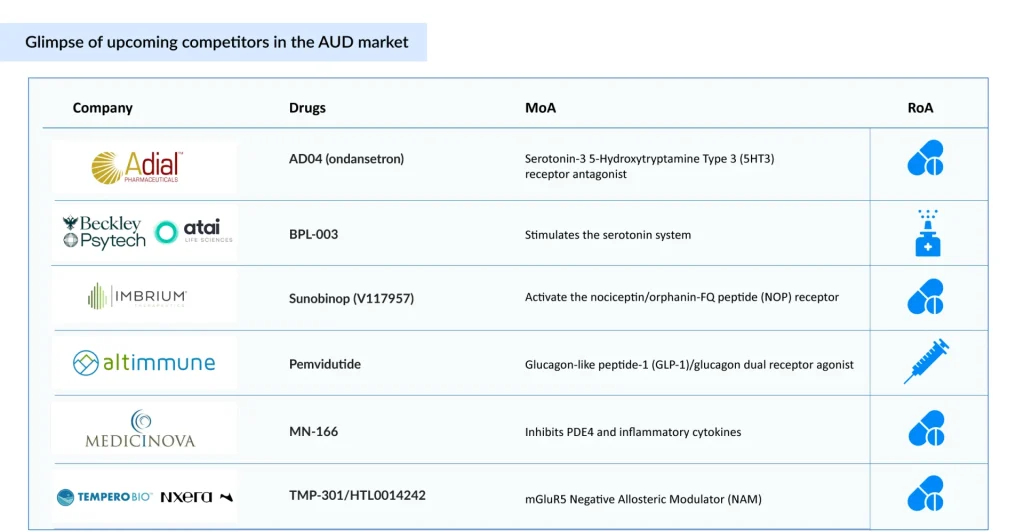

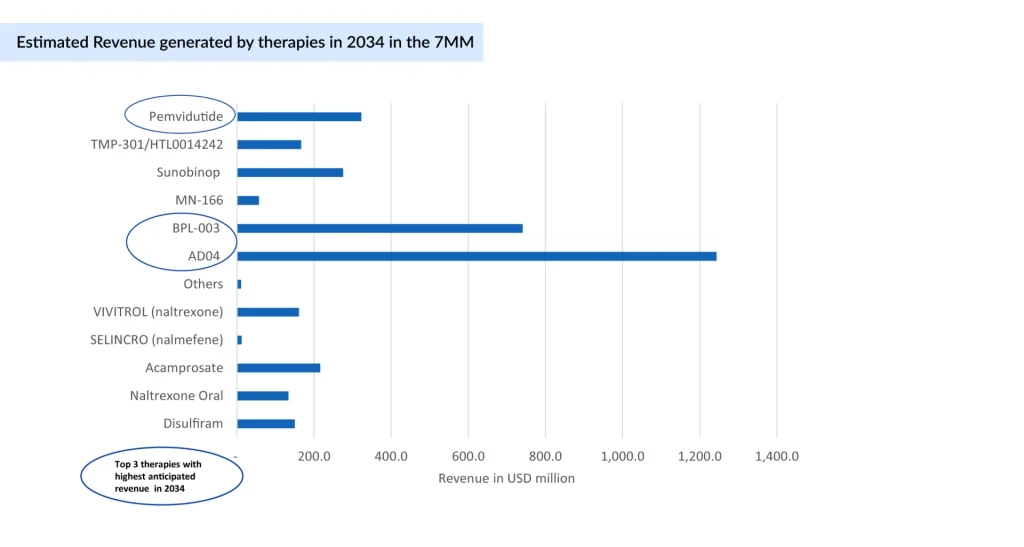

To address these issues, various alternative routes of administration are being actively developed. Emerging AUD therapies are exploring varying routes of administration, including intranasal (BPL-003 by Beckley Psytech and Atai Life Sciences), subcutaneous (Pemvidutide by Altimmune), and oral (AD04 by Adial Pharmaceuticals), aiming to improve adherence and treatment outcomes. Among these, AD04 is anticipated to launch by 2027 in the US with an estimated cost of therapy of roughly USD 5,000 at the time of launch, which stands out with promising safety and efficacy, with a strong commercial potential. These novel delivery methods aim to improve patient adherence by reducing the treatment burden, ensuring more consistent therapeutic levels, and offering discreet options that help overcome stigma and forgetfulness.

Beyond administration, another critical gap lies in the lack of severity-specific AUD treatments. Currently, no approved treatment is tailored to AUD severity; patients generally receive uniform therapy regardless of individual risk. However, emerging AUD drugs like BPL-003, Sunobinop, TMP-301/HTL0014242, Pemvidutide, and others are being evaluated for moderate-to-severe AUD, with BPL-003 expected to launch by 2028.

Despite the high prevalence of alcohol dependence, treatment rates remain disproportionately low, highlighting a persistent public health challenge. Psychosocial interventions, including cognitive behavioral therapy and relapse prevention strategies, are significantly underutilized, underscoring a critical gap in delivering comprehensive, holistic care for AUD. Compounding this issue, the limited efficacy, accessibility, and uptake of approved pharmacological treatments such as naltrexone, acamprosate, and disulfiram have led clinicians to explore alternative strategies. As a result, off-label agents like gabapentin, topiramate, and baclofen have gained increasing traction in clinical practice, despite lacking formal regulatory approval for AUD.

In 2020, the AUD treatment market across seven major markets was approximately USD 900 million, with the US alone accounting for about USD 800 million, with over 80% of the total share. The anticipated launch of novel therapies, including AD04, BPL-003, MN-166, Sunobinop, and TMP-301, is expected to expand AUD treatment options and stimulate market growth. As innovative therapies enter the market, the focus must remain on integrating pharmacological and psychosocial approaches to address the full complexity of alcohol use disorder.

Downloads

Article in PDF