Triple Threat to Clostridioides difficile Infections: New Antibiotics, Biotherapeutics & Vaccines

Aug 15, 2025

Table of Contents

Clostridioides difficile infection (CDI) remains a significant public health challenge worldwide, especially in healthcare settings. Despite advancements in diagnosis and treatment, the Clostridioides difficile infection treatment market is characterized by persistent therapeutic limitations, particularly the high recurrence of Clostridioides difficile infection (rCDI), which affects 25–45% of patients, depending on the severity and history of prior episodes.

From Legacy Antibiotics to Fidaxomicin: A Decade of CDI Evolution

The treatment landscape for CDI has undergone significant changes over the past decade. Once dominated by metronidazole and vancomycin, the current standard of care has transitioned to favor fidaxomicin due to its narrow-spectrum activity, minimal disruption to gut flora, and a substantially lower recurrence rate (15–20%) compared to vancomycin or metronidazole. Vancomycin was developed in the 1950’s and DIFICID (fidaxomicin) was approved in 2011. DIFICID became the first antibacterial drug indicated for Clostridium difficile-associated Diarrhea (CDAD) to be approved in over 25 years in the US. Metronidazole is now reserved for nonsevere cases when other drugs are unavailable, reflecting growing concern over its suboptimal pharmacokinetics for intestinal infections. However, while fidaxomicin has made a measurable impact in reducing recurrent CDI, its high cost and limited accessibility (especially in lower-resource healthcare systems) continue to hinder broader adoption.

Downloads

Click Here To Get the Article in PDF

The Rise and Fall of ZINPLAVA—First Human Monoclonal Antibody and Prevention Option for CDI

ZINPLAVA, approved by the FDA in October 2016, is a monoclonal antibody targeting Toxin B, designed to prevent rCDI in high-risk adults. Despite its clinical benefit, particularly in combination with antibiotic regimens, ZINPLAVA was withdrawn from the global market in early 2025, with Merck not citing a specific reason. ZINPLAVA was an expensive therapy, and because of the high cost, it was reserved for the most recurrent of patients and had to be administered intravenously in a hospital.

Experts speculate the discontinuation of ZINPLAVA may be linked to limited uptake due to cost, lack of strong payer coverage, and cautious use in patients with underlying heart conditions (particularly Chronic heart failure), where ZINPLAVA carries a boxed warning.

How Fecal Microbiota Transplant (FMT) Transitioned from Experimental to Regulated Therapies?

FMT has evolved from an investigational approach into a regulated therapeutic option for preventing rCDI. Once hindered by concerns over donor variability and inconsistent spore content, FMT is now endorsed by major US and European guidelines after a second recurrence (third CDI episode). This shift was solidified with the FDA approval of two FMT-based therapies, REBYOTA, developed by Ferring Pharmaceuticals, and VOWST, developed by Seres Therapeutics and Nestlé, marking a significant step forward in standardizing and scaling microbiome-based interventions.

REBYOTA, the first FDA-approved FMT product (2022), is administered rectally and offers a low-cost, single-dose option, making it ideal for institutional settings. In contrast, VOWST has gained commercial traction due to its ease of use and strong clinical efficacy, appealing to outpatient and patient-centric care. While both aim to restore microbial balance and reduce recurrence, their differences in delivery, accessibility, and care setting provide complementary options in the growing rCDI prevention landscape.

As of 2024, FMTs have not received approval in Europe or Japan. However, in Europe, the Substances of Human Origin (SoHO) framework recently endorsed the use of conventional FMT for patients with CDI, with the recommendation taking effect in June 2024.

From New Microbiome-based Therapies to Vaccines, How CDI Pipeline Expanding Beyond Traditional Antibiotics?

The future of CDI management is decisively shifting toward prevention, especially targeting recurrent CDI, which places a heavy burden on patients and the healthcare system. Emerging CDI drugs represent a strategic shift from merely treating acute infection to preventing recurrence and maintaining microbial equilibrium, addressing critical unmet needs and evolving clinical priorities.

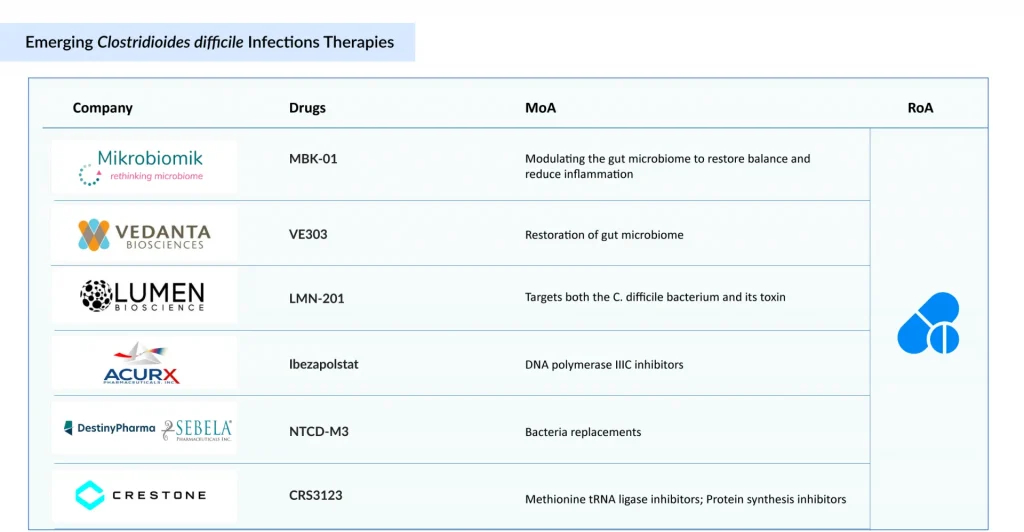

Among small-molecule antibiotics, Acurx’s ibezapolstat and Crestone’s CRS3123 are notable contenders. Ibezapolstat, a DNA polymerase IIIC inhibitor, has shown high initial cure rates and low recurrence in Phase II trials, supporting its potential as a first-line treatment. In contrast, CRS3123 targets the MetRS enzyme essential for bacterial replication, offering high C. difficile selectivity with limited disruption to gut flora similar to fidaxomicin, but via a novel mechanism.

Currently, FMTs are only approved in the US for the preventive treatment of CDI. MBK-01, developed by Mikrobiomik, is the first FMT-based therapy in development targeting both primary and recurrent CDI. With its oral formulation, MBK-01 holds first-to-market potential in Europe, providing a more scalable and regulated alternative to conventional FMT procedures. Owing to the lack of competition and regulatory consistency, FMTs have an opportunity to grow in Europe, especially if developers can offer standardized and safe options.

On the microbiome restoration front, Vedanta’s VE303, a Live Biotherapeutic Product (LBP) with eight defined human commensal strains, demonstrated positive Phase II data in recurrence prevention, making it a strong candidate for post-antibiotic use. Similarly, Destiny’s NTCD-M3, a non-toxigenic C. difficile strain, shows promise as a biologic prophylactic by competitively excluding toxigenic strains post-treatment.

Distinct from microbial or small-molecule approaches, Lumen’s LMN-201 introduces a nonmicrobial antibody-lysins cocktail, targeting C. difficile toxins directly, potentially ideal for immunocompromised populations.

Companies are increasingly focusing on primary prevention options for CDI, rather than limiting efforts to preventing recurrences. At present, Pfizer is active in this primary prevention space. However, Sanofi was among the first companies to pursue a primary prevention vaccine for CDI.

Sanofi’s C. difficile vaccine was anticipated to be the first prophylactic vaccine for CDI prevention, leveraging inactivated toxoids (Toxins A and B) to stimulate an immune response. While Phase II trials showed over 90% seroconversion rates, the Phase III Cdiffense trial failed to demonstrate protection against CDI, leading to a halt in its development.

Meanwhile, Pfizer’s vaccine candidate, PF-07831694, has emerged as the only vaccine currently in development for the primary prevention of CDI. It is now in Phase I/II trials, following a reformulation after a prior Phase III failure. Pfizer anticipates initiating a Phase III trial for this prophylactic vaccine in the second half of 2025. Pfizer is targeting adults over 65 years of age, a population at higher risk of CDI, although the vaccine could also be recommended for individuals over 50, given their increased susceptibility to the infection.

Idorsia is developing vaccine candidate IDOR-1134-2831 for the prevention of CDI in both hospital and community settings, aiming to target bacteria and spores with the potential to eradicate the pathogen. Initial Phase I results indicate the vaccine is well-tolerated and immunogenic, supporting its potential to prevent primary infection, symptoms, recurrence, and transmission—addressing a major unmet need in CDI prevention.

Key Market Trends Shaping the CDI Treatment Landscape

While each candidate targets a different point in the CDI lifecycle, acute treatment, prevention of recurrence, or primary prevention—those combining efficacy, precision targeting, and patient-specific application (e.g., non-steroidal, non-antibiotic, or microbiome-sparing) are likely to define the next wave of CDI management.

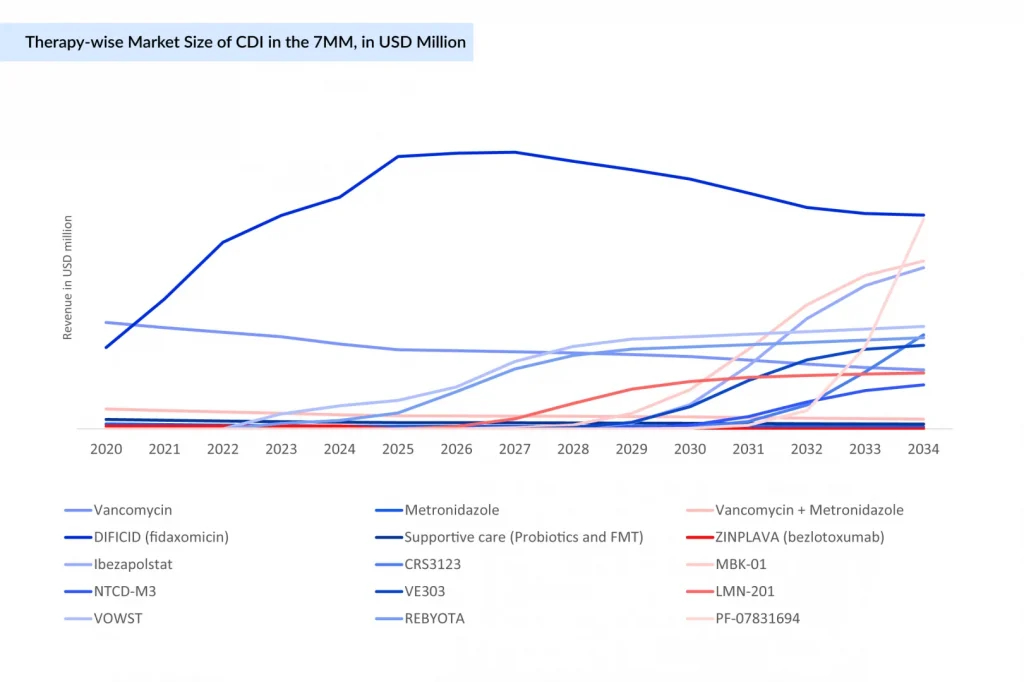

DIFICID is expected to maintain market leadership for the next few years; however, its revenue is projected to decline after 2026 due to intensifying competition gradually. New entrants such as Ibezapolstat, MBK-01, VE303, LMN-201, NTCD-M3, and others are poised to reshape the CDI landscape post-launch, driving a shift toward microbiome-based therapies, nonantibiotic solutions, and recurrence prevention strategies.

Meanwhile, traditional antibiotics like vancomycin and metronidazole are anticipated to remain stable or experience a modest decline. Preventive vaccine candidates, such as PF-07831694, are also expected to enter the Clostridioides difficile infections treatment market and could generate millions in revenue across the major markets by 2034.