The Future of Myopia Treatment: Devices That Are Changing How We See

Jun 25, 2025

Table of Contents

Picture a world where billions struggle to see the stars clearly, where distant landscapes fade into a blur. This is the reality for approximately 2.6 billion people globally living with myopia, a number expected to nearly double to 4.8 billion by 2050, according to the World Health Organization. Myopia, or nearsightedness, is not just a vision issue but a pressing global health challenge, particularly in regions like Asia Pacific, where prevalence in some countries surpasses 80%. The myopia treatment market is at the forefront of addressing this epidemic, with innovative solutions transforming eye care worldwide.

As myopia rates surge, the need for robust interventions grows ever more critical. Untreated myopia can lead to serious complications, such as retinal detachment and glaucoma, placing a significant burden on global healthcare systems. From myopia management lenses to refractive surgery devices, advancements in myopia treatment devices are offering new hope. Whether it’s North America’s leadership in eye care innovation or Europe’s progress in orthokeratology lens markets, the global effort to combat myopia is gaining momentum. This blog dives into the pioneering technologies reshaping vision care for a clearer tomorrow.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Baxter Introduced New Injectable Pharmaceuticals to US Market; Bayer and Hologic Collaborated to ...

- Innovative Solutions, Lifesaving Possibilities: Evaluating the Artificial Organs Market Dynamics

- 4WEB Medical’s Cervical Spine Plating Solution; Viseon Launched Visualization System for Minimall...

- First Patient Enrolled in Kaizen Clinical Study in Japan; Koneksa’s At-Home Mobile Spirometry Cli...

- Aerin Medical’s RhinAer Stylus; CE Mark for Haemonetics’s VASCADE Vascular Closure Device; J&...

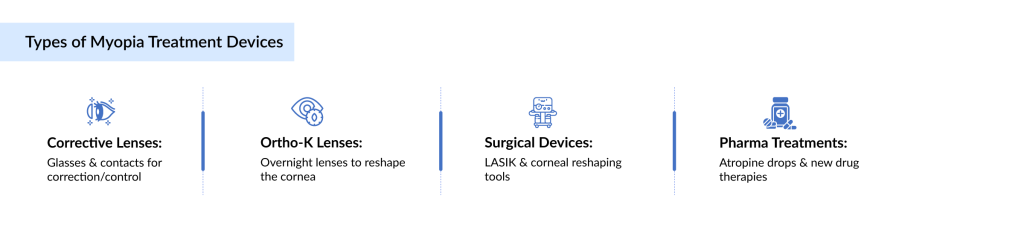

Overview of Myopia Treatment Devices

The myopia treatment devices market encompasses a diverse range of technologies designed to correct vision, slow myopia progression, and enhance eye health. From traditional corrective lenses to cutting-edge surgical solutions, these devices are pivotal in addressing the global myopia epidemic. Below, we explore the primary categories driving advancements in this field.

Corrective Lenses: Glasses and Contact Lenses

Corrective lenses remain the cornerstone of myopia management, offering accessible and non-invasive solutions. Myopia glasses and myopia control contact lenses are designed to correct refractive errors while, in some cases, slowing myopia progression in children and adolescents. Innovations like anti-blue ray myopia lenses protect against digital eye strain, addressing modern lifestyle challenges. The myopia management lenses market continues to grow, with products tailored for both vision correction and long-term eye health, making them a vital tool in regions with high myopia prevalence, such as Asia Pacific.

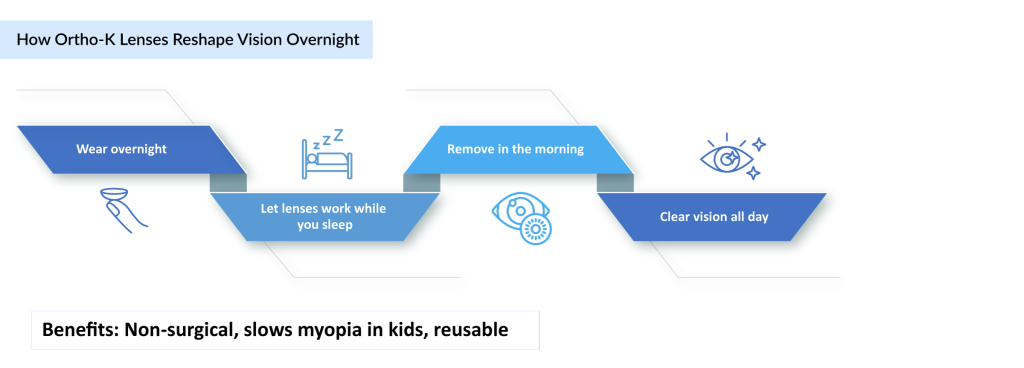

Orthokeratology: Reshaping the Future of Myopia Control

Orthokeratology, or ortho-k, represents a revolutionary approach in the global orthokeratology lens market. These specialized contact lenses, worn overnight, gently reshape the cornea to temporarily correct myopia, allowing clear vision during the day without glasses or contacts. Ortho-k lenses, such as those in the Asia Pacific orthokeratology lens market, are gaining traction for their ability to slow myopia progression, particularly in children. With growing adoption in North America and Europe, Ortho-K is redefining non-surgical myopia management.

Refractive Surgery Devices: LASIK and Beyond

For those seeking permanent solutions, refractive surgery devices like LASIK eye surgery offer transformative results. These advanced tools reshape the cornea with precision, correcting myopia and reducing dependency on corrective lenses. The refractive surgical devices market is expanding, with innovations in corneal surgery devices improving safety and outcomes. Beyond LASIK, emerging technologies in the eye laser surgery device market are pushing boundaries, offering hope for patients with high myopia or complex prescriptions. These solutions are particularly prominent in North America and Europe, where advanced surgical infrastructure supports market growth.

Innovations in Myopia Management Technologies

The myopia management system market is experiencing a wave of innovation, fueled by the urgent need to address escalating myopia rates. Recent advancements, as highlighted in DelveInsight’s reports, underscore the dynamic growth of the global myopia treatment devices market. Below, we explore key breakthroughs transforming myopia management.

Breakthroughs in Orthokeratology: Euclid Max Ortho-K Lenses

Euclid Max Ortho-K lenses, launched in 2023, have revolutionized the global orthokeratology lens market by end user. These lenses utilize advanced corneal mapping and high-oxygen-permeable materials to enhance comfort and efficacy in slowing myopia progression. The Euclid Max Ortho-K treatment is particularly effective for pediatric patients, with clinical studies demonstrating significant reductions in axial length elongation. Its toric design, as noted in recent X posts, also addresses astigmatism, broadening its applicability. The Euclid Max lenses are gaining traction in markets like North America and the Asia Pacific orthokeratology lens market, where non-surgical solutions are in high demand.

Specialized Contact Lenses for Myopia Control

The myopia control contact lenses market is flourishing, with lenses designed to both correct vision and slow myopia progression. Products like Acuvue Abiliti Overnight Therapeutic Lenses, introduced in 2022, leverage peripheral defocus technology to manage myopia in children effectively. These lenses are a key part of the myopia management lenses market, showing strong growth in regions like Europe and Asia Pacific. By altering retinal light distribution, they reduce stimuli for eye elongation, offering a proactive approach to managing the myopia progression market share.

Emerging Pharmaceutical Interventions: Atropine Eye Drops

Pharmaceutical interventions are carving a niche in the myopia treatment landscape. Low-dose atropine eye drops have shown significant promise in slowing myopia progression in children. Sydnexis’ SYD-101, a novel atropine-based therapy, received FDA acceptance for its New Drug Application in March 2025. This formulation balances efficacy with minimal side effects, addressing a critical need for non-invasive myopia treatments.

Other Breakthroughs in Myopia Treatment

Recent developments are expanding the horizons of myopia management. In January 2025, the ZEISS MEL 90 Excimer Laser received FDA approval, enhancing the corneal surgery devices market. This advanced laser system offers precise corneal reshaping for myopia correction, strengthening the refractive surgery devices market and supporting North America’s leadership in the eye laser surgery device market.

Additionally, in May 2025, iVeena submitted an Investigational New Drug (IND) application to the U.S. FDA for a Phase II clinical trial targeting pediatric myopia, according to BusinessWire. This trial explores a novel pharmacological approach, potentially complementing optical interventions and contributing to the myopia and presbyopia treatment market. These advancements highlight the rapid evolution of myopia treatment devices, offering diverse solutions for patients worldwide.

Asia Pacific: Addressing High Myopia Prevalence

The Asia Pacific orthokeratology lens market is set to experience the fastest growth in the global myopia treatment devices market, projected to grow at a CAGR of 7.57% from 2025 to 2032, according to DelveInsight’s Myopia Treatment Devices Market report. This rapid expansion is driven by the region’s alarmingly high myopia prevalence. For instance, a 2019 report by the Government of Singapore noted that 65% of children and 83% of young adults in Singapore are myopic, earning it the title of the “Myopia Capital of the World.” Projections estimate that 80-90% of Singaporean adults over 18 will be myopic by 2050, with 15-25% developing high myopia. This trend is mirrored across the region, particularly in countries like South Korea and China, where myopia rate data by country highlights a growing public health challenge.

The demand for myopia treatment devices is fueled by innovative solutions from key market players like Menicon Co., Ltd. and Kubota Pharmaceutical Holdings Co., Ltd. Menicon’s contributions to the Asia Pacific orthokeratology lens market by end user include advanced ortho-k lenses that slow myopia progression. Kubota Vision, a subsidiary of Kubota Pharmaceutical, is developing smart contact lenses using its Kubota Glass technology, which leverages nanotechnology to reduce myopia progression while maintaining clear central vision, as noted in DelveInsight’s analysis. These innovations are critical in addressing the region’s myopia progression market.

Government initiatives are also accelerating market growth. In 2021, the Optometry Council of India (OCI) launched a screening initiative for 100,000 individuals in 100 days, starting September 1, in support of the UN’s “Eye health for all by 2030” resolution. This campaign, highlighted by DelveInsight, included an awareness film on myopia treatments and interventions to prevent myopic progression, boosting demand for myopia management lenses and eye care devices. The Asia Pacific quality control systems for contact and intraocular lenses market by product type is also expanding, with companies like LUCID KOREA LTD. ensuring high standards in lens manufacturing.

Other key players, such as CooperVision, Johnson & Johnson, Essilor, and HOYA VISION CARE COMPANY, are active in the region, offering products like myopia control contact lenses and anti-blue ray myopia lenses. The combination of high prevalence, innovative devices, and proactive awareness campaigns positions Asia Pacific as a powerhouse in the myopia treatment market, with significant contributions to global market growth.

Challenges in Myopia Management

Despite the advancements in the global myopia treatment devices market, several challenges hinder widespread adoption and effective management of myopia, particularly in high-prevalence regions like Asia Pacific. Below, we explore key obstacles impacting the myopia treatment market.

Accessibility and Cost Barriers: Acuvue Abiliti Overnight Lenses

Advanced myopia control contact lenses like Acuvue Abiliti Overnight Therapeutic Lenses, introduced by Johnson & Johnson in 2022, are highly effective in slowing myopia progression. However, their high cost poses a significant barrier, especially in developing countries within the Asia Pacific region. The Acuvue Abiliti price can be prohibitive for many families, limiting access to these innovative solutions. Affordability remains a critical challenge, particularly in regions with high myopia prevalence but limited healthcare budgets. Subsidies and insurance coverage for myopia management lenses are often inadequate, restricting their reach to underserved populations.

Shortage of Specialized Eye Care Professionals

The effectiveness of myopia treatment devices like orthokeratology lenses and refractive surgery systems relies heavily on skilled professionals for fitting, monitoring, and follow-up care. In Asia Pacific, despite the high demand for eye care devices, there is a notable shortage of trained optometrists and ophthalmologists. For instance, rural areas in countries like India and China often lack access to specialists familiar with Euclid Max Ortho-K lenses or LASIK eye surgery devices. This shortage slows the adoption of advanced myopia treatments and limits the scalability of initiatives like India’s 2021 screening campaign by the Optometry Council.

Balancing Innovation with Safety and Regulation

The rapid pace of innovation in the myopia management system market brings challenges in ensuring safety and compliance with regulatory standards. Devices like anti-blue ray myopia lenses and refractive surgical devices require rigorous testing to meet quality and safety benchmarks, particularly in the Asia Pacific quality control systems for the contact and intraocular lenses market by country type. Regulatory bodies in countries like Singapore and South Korea impose strict guidelines, which, while essential, can delay product launches. For example, Kubota Vision’s smart contact lenses, still in development, face stringent approval processes, as highlighted by DelveInsight, potentially slowing market entry. Balancing innovation with safety remains a critical hurdle for companies like Menicon and HOYA VISION CARE COMPANY.

Future Trends in Myopia Treatment

The myopia treatment devices market is poised for transformative growth, driven by technological advancements and increasing global demand. As the industry evolves, several trends are shaping the future of myopia management, particularly in high-prevalence regions like Asia Pacific.

Integration of AI and Diagnostic Tools

Artificial intelligence (AI) is revolutionizing the eye care devices market by enhancing diagnostic precision and treatment personalization. AI-powered tools are being integrated into lenses for medical testing instruments to detect early signs of myopia progression and tailor interventions. For instance, AI-driven corneal topography systems are improving the fitting of myopia control contact lenses like those from CooperVision. In Asia Pacific, where myopia rates by country are among the highest, AI diagnostics are expected to streamline screening efforts, building on initiatives like India’s 2021 OCI campaign, and drive demand for myopia treatment devices.

Explore our blog, which is specifically curated on AI devices, including myopia, to learn everything there is to know about AI in diagnostics.

Growth in Anti-Blue Ray and Myopia Management Lenses

The anti-blue ray myopia lenses market is expanding rapidly, driven by the increasing use of digital devices, particularly among children. These lenses, offered by companies like Essilor and HOYA VISION CARE COMPANY, address both vision correction and digital eye strain, a growing concern in tech-heavy markets like South Korea and Singapore. The myopia management lenses market is also seeing innovation, with lenses incorporating peripheral defocus technology to slow myopia progression. DelveInsight projects significant growth in this segment, as awareness campaigns amplify demand for myopia glasses and myopia control contact lenses in the Asia Pacific.

Expanding Role of Quality Control Systems in Lens Manufacturing

The Asia Pacific quality control systems for contact and intraocular lenses market by product type are critical to ensuring the safety and efficacy of myopia treatment devices. Companies like LUCID KOREA LTD. are investing in advanced quality control systems to meet stringent regulatory standards in countries like South Korea and China. These systems ensure that Euclid Max lenses and other ortho-k products maintain high precision and safety, supporting the global orthokeratology lens market by end user. As the market grows, quality control will play a pivotal role in scaling production to meet rising demand.

The Path Forward for Myopia Treatment Devices

This blog has explored the dynamic landscape of the myopia treatment devices market, from the global surge in myopia prevalence to groundbreaking innovations like orthokeratology lenses, specialized contact lenses, and pharmaceutical interventions. We’ve delved into Asia Pacific’s pivotal role, where high myopia rates drive rapid market growth, and highlighted challenges like cost barriers and regulatory hurdles.

Looking ahead, the future of myopia management shines bright. With AI diagnostics pinpointing progression early, anti-blue ray myopia lenses shielding eyes from digital strain, and rigorous quality control ensuring safe, effective solutions, the path forward promises accessible, cutting-edge care. As the market grows at a steady CAGR, these advancements will empower millions to see the world with newfound clarity, transforming vision care for generations to come.

Downloads

Article in PDF

Recent Articles

- Xtant Medical’s SimipliGraft TM and SimpliMaxTM Launch; Perelel’s Fertility Support Products Expa...

- Ears to the Future: Evaluating Key Advancements and Trends Driving the Audiology Devices Market G...

- FDA Clearance to iRhythm’s ZEUS System; Respiri Introduces the Wheezo Device & App; CONMED to...

- Masimo W1® Medical Watch Secured FDA 510(K) Clearance; Stereotaxis Received the CE Mark in Europe...

- Fluidx Medical’s GPX Embolic Device; Cardiovascular Systems & OrbusNeich’s Scoreflex S...