Non-opioid Analgesics Chronic Pain Treatment: Savior of Underserved Patients

Oct 24, 2022

Chronic pain is the leading cause of adult disability in the United States. Approximately 50 million Americans are currently suffering from chronic pain. The most common sources of chronic pain are lower back problems, arthritis, cancer, RSDS, repetitive stress injuries, shingles, headaches, and fibromyalgia. Others include diabetic neuropathy, phantom limb sensation, and other neurological conditions. Sports injuries are among the most common causes of chronic pain in people in their twenties. Chronic pain costs society more than USD 100 billion each year.

As per the latest Chronic Pain Epidemiology Forecast report published by DelveInsight, chronic pain affected around 53 million people in the US, 80 million people in the EU5, and another 41 million in Japan in 2021.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Eosolutions Corp’s Dr. Banner Balloon Guide Catheter; US FDA Approves the Cyltezo® Pen; Orlucent’...

- Merck sells biosimilars; AbbVie’s PARP; Pharma heads; Biogen looks to M&A

- How are Neurostimulation Devices Playing a Vital Role in the Treatment of Chronic Pain?

- Knee Osteoarthritis Pipeline: Stepping Up to Get Bigger and Broader

- Pfizer’s RSV Vaccine; Forte Biosciences’ Atopic Dermatitis Asset; Bone Therapeutics’ Osteoarthrit...

There are numerous pharmacological, adjunctive, non-pharmacological, and interventional treatments available for chronic, severe, and persistent pain. Non-opioid analgesics on this list include nonsteroidal anti-inflammatories (NSAIDs), acetaminophen, and aspirin. Tramadol, opioids, and antiepileptic drugs (gabapentin or pregabalin) can all be helpful. Furthermore, antidepressants such as tricyclic antidepressants and SNRIs, topical analgesics, muscle relaxants, N-methyl-d-aspartate (NMDA) receptor antagonists, and alpha 2 adrenergic agonists are possible pharmacological chronic pain therapies.

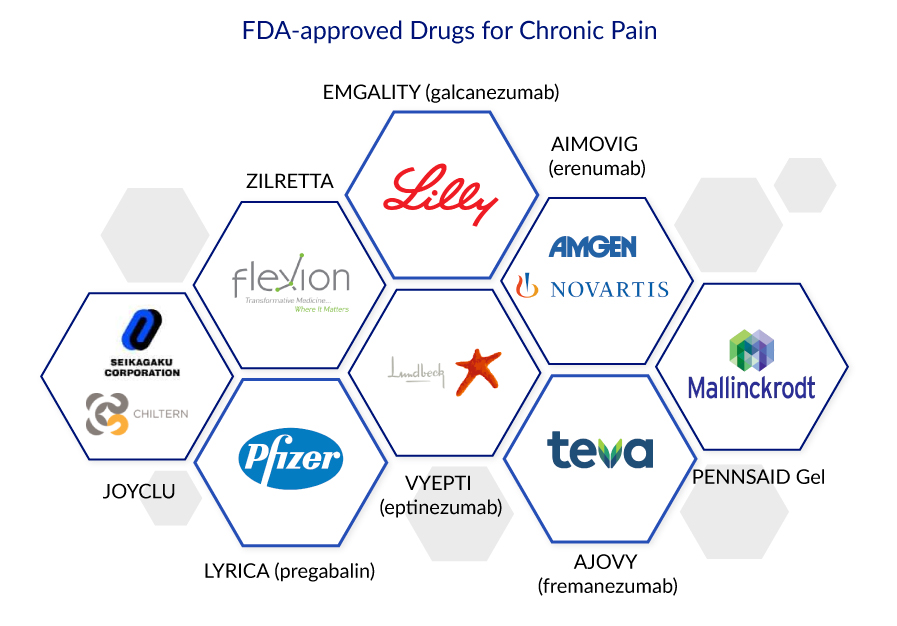

Non-pharmacologic chronic pain treatments can include exercise, physical therapy, counseling, electrical stimulation, biofeedback, acupuncture, hypnosis, chiropractic medicine, and other treatments. There are several approved drugs for chronic pain treatment due to different indications, including Emgality (galcanezumab-gnlm), Aimovig (Eptinezumab), Tarlige (Mirogabalin besylate), Aimovig (Erenumab-aooe), and Ajovy (Fremanezumab), Vyepti (Eptinezumab), and Pennsaid gel.

Opioids are regarded as the most effective drugs for chronic pain management despite controversies. The goal of chronic pain management is to provide symptom relief and improve an individual’s level of functioning in daily activities.

The use of opioids is considered the standard of care in the management of acute severe pain and chronic pain related to advanced medical illness. However, opioids are widely feared compounds and are associated with abuse, addiction, and the dire consequences of diversion. There are some unmet needs in the chronic pain treatment market. There are various challenges in identifying biomarkers for chronic pain treatment. Also, the mechanism-based chronic pain diagnosis has not been feasible, as its pathophysiological components are not elucidated yet. Therefore, the current chronic pain diagnosis is based solely on clinical signs and symptoms. Nevertheless, some developmental initiatives have recently been taken toward managing chronic pain. Several key pharmaceutical players have taken to the initiative to meet the unmet needs of the present situation of the chronic pain treatment market. Some key players are in the late and mid-clinical development stages with their leading drug candidates for chronic pain treatment.

Musings on the chronic pain treatment

It is not new that the prevalence of chronic pain is high in cancer patients; however, chronic pain is also reported in non-cancer patients suffering from various conditions. It has been discovered that a large percentage of chronic pain patients are suffering from pain caused by osteoarthritis. It is a crippling disease that causes excruciatingly painful joints due to cartilage damage between the joints.

To bridge the treatment gaps in the osteoarthritis treatment market, Paradigm Biopharmaceuticals is developing ZILOSUL. Pentosan polysulfate sodium (PPS) is a semi-synthetic drug derived from European beech tree wood chips. PPS activity is notable for its anti-inflammatory and tissue regenerative properties, as well as mild anti-thrombotic activity.

In May 2022, Paradigm announced that the first subjects in the PARA OA 002 pivotal Phase III clinical trial evaluating injectable PPS/ZILOSUL for the treatment of pain associated with knee osteoarthritis had been randomized and dosed in the United States (kOA) Moreover, the FDA granted Fast Track Designation for Paradigm Biopharmaceuticals Ltd.’s Phase III program investigating PPS for osteoarthritis treatment in April 2022.

Similarly, Noven Pharmaceuticals is also developing a drug to improve the osteoarthritis treatment space. HP-5000 is a transdermal investigational formulation created with Hisamitsu’s TDDS (Transdermal Drug Delivery System) technology. As one of the transdermal formulation attributes, the investigational product is expected to be a new treatment option for knee osteoarthritis, demonstrating efficacy and safety by achieving higher drug delivery to the affected area. The drug is currently in Phase III testing.

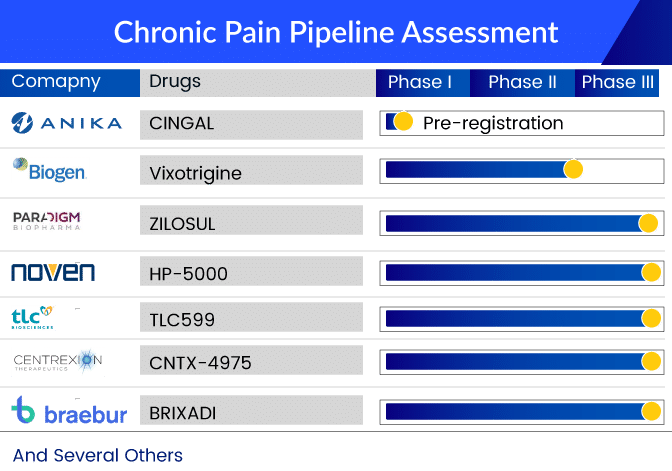

Apart from these companies, several other giants such as AbbVie, Tonix Pharmaceuticals, Pfizer, Centrexion Therapeutics, Anika Therapeutics, Vertanical GmbH, Braeburn Pharmaceuticals, Grünenthal GmbH, Regeneron, Teva Pharmaceuticals, Biogen, and others are also investigating their respective candidates in various chronic pain clinical trials for treatment and management in the 7MM.

The chronic pain pipeline looks promising with the emerging therapies including QULIPTA, TNX-102, reboxetine, CNTX-4975, CINGAL, dronabinol, buprenorphine, RTX-GRT7039, fasinumab, BIIB074, and others.

There are several other late-stage assets with distinct MoA being developed for treating chronic pain patients and are expected to enter the US, the EU5 (Germany, Italy, France, Spain, and the United Kingdom), and the Japanese chronic pain treatment market in the next few years.

The chronic pain treatment market is all set to grow significantly

The development of disease-specific chronic pain therapies will auger well for the chronic pain treatment market landscape, which, in turn, will facilitate significant changes during the forecast period (2019–2032). The chronic pain treatment market is expected to grow significantly with improved diagnosis and safe and efficacious chronic pain treatment options.

As per DelveInsight analysis, the chronic pain market size was valued at around USD 21 billion in 2021 and is expected to reach USD 32 billion by 2032 at a CAGR of ~4%.

Nevertheless, pricing and reimbursement challenges, along with associated long-term side effects of approved therapies, are two major factors that influence the chronic pain treatment market success of the upcoming therapies.

FAQs

Chronic pain is a pain that lasts for more than three months. It can gradually grow and recur intermittently, outlasting the normal recovery process and adversely affecting the person’s well-being. Pain is supposed to cease after damaged tissue recovers until the root cause is treated.

The most common sources of chronic pain are lower back problems, arthritis, cancer, RSDS, repetitive stress injuries, shingles, headaches, and fibromyalgia. Others include diabetic neuropathy, phantom limb sensation, and other neurological conditions. Sports injuries are among the most common causes of chronic pain in people in their twenties.

Chronic pain is usually not diagnosed until the patient has been in pain regularly for three to six months. A series of tests and procedures, as well as a review of chronic pain symptoms and medical history, are frequently used for chronic pain diagnosis. The doctor will perform tests based on where the pain is located and what is causing it, as well as other chronic pain symptoms.

There are several approved drugs for chronic pain treatment due to different indications, including Emgality (galcanezumab-gnlm), Aimovig (Eptinezumab), Tarlige (Mirogabalin besylate), Aimovig (Erenumab-aooe), and Ajovy (Fremanezumab), Vyepti (Eptinezumab), and Pennsaid gel.

Leading companies such as AbbVie, Paradigm Biopharmaceuticals, Tonix Pharmaceuticals, Pfizer, Centrexion Therapeutics, Anika Therapeutics, Vertanical GmbH, Braeburn Pharmaceuticals, Grünenthal GmbH, Noven Pharmaceuticals, Regeneron, Teva Pharmaceuticals, Biogen, and others are investigating their respective candidates in various chronic pain clinical trials for treatment and management in the 7MM.

The chronic pain pipeline looks promising with the emerging therapies including QULIPTA, ZILOSUL, TNX-102, reboxetine, CNTX-4975, CINGAL, dronabinol, buprenorphine, RTX-GRT7039, HP-5000, fasinumab, BIIB074, and others.

Downloads

Article in PDF

Recent Articles

- 6 Groundbreaking Applications of Organoids That Are Changing Healthcare

- Aidoc’s Pneumothorax; Cook Medical’s Zenith Thoraco+ Endovascular System; GRAFIX Membrane S...

- Merck sells biosimilars; AbbVie’s PARP; Pharma heads; Biogen looks to M&A

- Bright Peak, Ajinomoto to Create Novel Immunocytokines; FDA’s Rejection to Lilly/Pfizer’s T...

- Suneva Medical-Viveon Health merger update; Smith+Nephew acquires Engage Surgical; Abiomed’...