Rising of Orphan Drug Development

Oct 13, 2015

Introduction:

Any disease that affects less than 200,000 patients or 1 in 1500 is termed as a rare disease. There are around 5000 to 8000 rare disease reported, out which only 10% have cure. According to the European Organization for rare disease, 80% of rare diseases are genetic in nature. Some of the rare diseases include Alzheimer’s disease, Parkinson’s disease, Fabry disease, Gaucher disease, Pompe Disease and Hunter syndrome. Cancers are the most common category of rare diseases. Drugs are often “orphaned”, or never are produced and sold on the market, even when a compound is thought to be useful for the treatment of a rare disease.

Downloads

Click Here To Get the Article in PDF

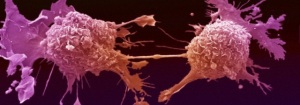

Figure 1: Rare Cancer Cell

Advantages of Orphan Drug Development:

Developmental drivers such as government incentives, shorter development timelines and high rates of regulatory approval are making Orphan drug development as economically successful as non-orphan drug development, even though the patient pool is smaller. In one analysis, the average time from Phase II to launch was 3.9 years for Orphan drugs, compared with 5.4 years for non-orphan drugs.

Orphan drugs also experience significant competitive advantage in being first to market. Recent research suggests that the higher pricing, increased market share, lower marketing costs, longer exclusivity period and faster uptake of Orphan drugs offset the smaller patient pool.

There are positive developments in the area of Orphan drugs as well, including the formation of Orphan drug and rare disease institutes, grant programs and the passage of Orphan drug legislation by various countries. At the same time, it must be pointed out that the 300 Orphan drugs and devices approved in the last 25 years are a drop in the bucket compared to thousands of Orphan diseases that manifested in that same period.

Challenges of Orphan Drug Development:

The drugs or treatments that brings in the largest amount of revenue is ranked highly and be of most importance, while developing treatments for rare diseases falls very low. Generally, bringing any drug into the market can be very costly and time consuming. The estimated cost of bringing a single drug through screening processes and FDA procedures to obtain approval is between $350 to $500 million.

Clinical trials involving therapies for rare diseases are challenging for various reasons, including poorly understood disease processes, a lack of validated endpoints, difficulty with finding patient and logistical problems in clinical trial organization. Although these obstacles are not unique to Orphan drug trials, the solutions to these challenges may be more difficult to find.

When designing a rare disease study, it is impossible to find fundamental disease information, such as disease prevalence, incidence or treatment patterns, on which to base the study protocol. In most rare diseases, there are no standardized clinical trial designs or efficacy outcome measures, leading to difficulty in selecting appropriate endpoints, outcome measures, tools and biomarkers.

Recruitment for Orphan drug trials is challenged by the small number of patients for each disease, low disease awareness in the general population and an ill-defined base of treating physicians or clinics. A majority of rare diseases affect children and pediatric studies require sponsors to carefully balance the ethical considerations of conducting studies in a vulnerable population with concerns about site selection, recruitment, compliance, and statistical powering.

Competitors of Orphan drug development:

According to global market estimation there are 600+ drugs in clinical phase and 280+ drugs in market. Only in US there are around 350+ Orphan drugs, which are under clinical phase. Novartis will maintain its position as the world’s No. 1 Orphan drug company in 2018. Kyprolis, a drug from Onyx Pharmaceuticals for multiple myeloma, was the most promising new Orphan drug in 2012.

Orphan market exclusivity, because it is limited to the approved indication, has a value that is in part determined by the Orphan drug’s competitive environment. For example, if the same drug, in the same dose and dosage form is available generically, the competing generic may be prescribed and substituted off-label for the drug that has obtained Orphan approval. This substitution is likely to significantly decrease the Orphan drug’s market share.

Recent development in regulating Orphan drug approval

The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have announced a more streamlined process to help regulators better identity and share information throughout the development process of Orphan drug and biologic products, which are developed specifically to treat rare medical conditions.

A country should try to produce important drugs for the benefit of the whole world, depending on the research and development investment, the return on such investment, the tax and patent incentives, and its regulatory policies. Australia, Japan, Singapore, Taiwan, and Korea have already implemented legislation for promoting research on Orphan drugs: India and New Zealand are in the process of establishing similar regulatory processes.

Conclusion:

Improved scientific understanding of rare diseases is transforming the biopharmaceutical industry approach to drug therapy. Increased industry focus on the development of targeted therapies, and the trend toward stratified or personalized medicine has been central to the development of many Orphan drugs, as approximately 80 percent of rare diseases are related to genetic aberrations. It has been suggested that targeting these genetic defects leads to a higher likelihood of R&D success.

As a result, Orphan drug development shows great potential for commercialization and is an important part of the future of the global biopharmaceutical industry. In order to capitalize on the opportunity in rare diseases, sponsors must learn to navigate the regulatory and operational challenges of Orphan drug development, with the ultimate goal of serving an unmet need for millions of patients around the world.

DelveInsight Orphan Indications reports:

We are a Business Consultant company and serve as a Knowledge partner across the value chain of Pharmaceutical Industry. We made strong presence in Orphan market, with 200+ Reports on Orphan based Indications, 100+ Reports on Oncology based Indications & Mechanism of Action (MOA), 70+ Reports on CVS Indications, 60+ Reports on CNS Indications and 15+ Reports on Specialized Gene Therapy.

Our custom Reports can provide assessment over Market size & forecast, epidemiology, advancement in technologies, market trend, partnering & licensing opportunities, pipeline scenario and competitive landscape. We also deal custom research services in coherence with interest area of the clients.

For more information on Orphan Indication Pipeline Insight Reports, email at info@delveInsight.com

About DelveInsight:

DelveInsight is a leading Business Consulting and Market Research Firm. We help our clients to find answers relevant to their business, facilitating decision-making; identify potential market opportunities, competitor assessments and business environmental assessment. In addition to this, DelveInsight also deals in providing custom research services in coherence with interest area of the clients.

Downloads

Article in PDF

Recent Articles

- BeiGene’s BRUKINSA Gets FDA Accelerated Approval; GSK’s Positive Results in DREAMM-8 ...

- Eli Lilly’s Jaypirca Approval; Novartis’ Adakveo EMA Review; Janssen’s CARTITUDE-4 Study of CARVY...

- The Paradox of Rare: Chalking out Challenges in the Rare Disease Market

- DelveInsight: One Year Anniversary!

- Chimeric Antigen Receptor T cell Immunotherapy Market Analysis and Forecast