Ophthalmic Devices Market Summary

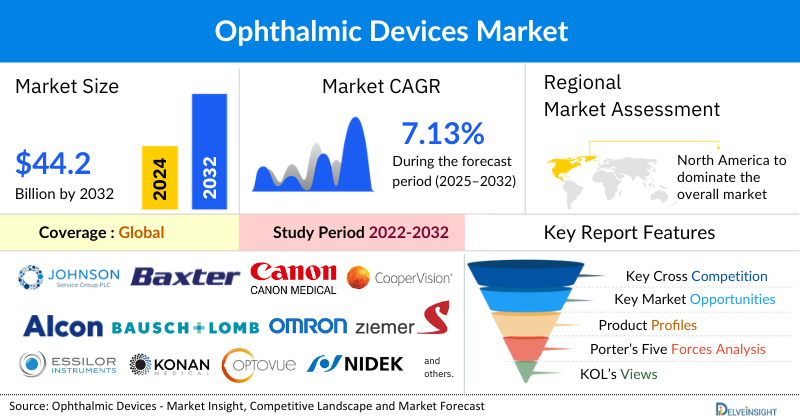

- The Global Ophthalmic Devices Market is expected to increase from USD 31,902.50 million in 2024 to USD 44,247.53 million by 2032, reflecting strong and sustained growth.

- The Global Ophthalmic Devices Market is growing at a CAGR of 7.13% during the forecast period from 2025 to 2032.

Ophthalmic Devices Market Trends & Insights

- The Ophthalmic Devices Market solutions is being primarily driven by the growing cases of eye-related disorders and increasing government initiatives to improve eye health worldwide.

- The leading Ophthalmic Devices Companies such as Johnson & Johnson Services, Inc., Baxter, CANON MEDICAL SYSTEMS EUROPE B.V., CooperVision Inc., Alcon Inc., Bausch & Lomb, Inc., OMRON Corporation, Ziemer Ophthalmic Systems AG, Essilor Instruments USA Ltd., Konan Medical USA, Inc., Optovue Incorporated, NIDEK CO. LTD., ZEISS Group, Luneau Technology Group, OPTOPOL Technology Sp. z o.o., Rudolf Riester GmbH, Rexxam Co. Ltd., Keeler, Sonomed Escalon, STAAR Surgical, and others.

- North America is expected to dominate the overall Ophthalmic Devices Market. The region's Ophthalmic Devices Market Growth is primarily driven by the presence of a significant number of eye care professionals and clinics, including optometrists and ophthalmologists, a large patient pool associated with vision loss, hypermetropia, and astigmatism, and the presence of a developed & sophisticated healthcare infrastructure.

- In the product type segment of the ophthalmic devices market, the glaucoma drainage devices category is estimated to account for the largest market share in 2024.

Request for unlocking the report of the @ Ophthalmic Devices Market

Ophthalmic Devices Market Size and Forecasts

- 2024 Market Size: USD 31,902.50 million

- 2032 Projected Market Size: USD 44,247.53 million

- Growth Rate (2025-2032): 4.21% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Concentrated

Factors Contributing to the Growth of the Ophthalmic Devices Market

Rising incidence of eye disorders leading to a surge in ophthalmic devices market

The global ophthalmic device market is witnessing robust growth, primarily driven by the rising incidence of eye disorders such as cataracts, glaucoma, age-related macular degeneration, diabetic retinopathy, and refractive errors. Factors such as aging populations, increasing prevalence of diabetes and hypertension, and greater exposure to digital screens are significantly contributing to the growing patient pool. This surge in eye-related conditions is fueling demand for advanced diagnostic, surgical, and vision correction devices, prompting continuous innovation and adoption of technologies like minimally invasive surgeries, laser systems, and AI-enabled diagnostics. Consequently, the escalating burden of eye diseases is a key catalyst shaping the expansion of the ophthalmic device market worldwide.

Increasing government initiatives to improve eye health

Increasing government initiatives to improve eye health are significantly boosting the ophthalmic device market worldwide. National programs aimed at reducing preventable blindness, expanding access to affordable eye care, and integrating vision screening into primary healthcare are creating strong demand for advanced diagnostic and surgical solutions. Public awareness campaigns, subsidies for cataract surgeries, and partnerships with private players to establish specialized eye care centers are further enhancing patient access to ophthalmic services. Additionally, investments in tele-ophthalmology and screening programs in rural and underserved regions are accelerating the adoption of innovative devices. These proactive efforts by governments are not only addressing the growing burden of eye disorders but also fostering the market growth of the ophthalmic devices market by expanding the reach and affordability of eye care.

Rising geriatric population

The global ophthalmic devices market is experiencing significant growth, primarily driven by the world's burgeoning geriatric population. As individuals age, they become more susceptible to a range of chronic and progressive eye conditions such as cataracts, glaucoma, diabetic retinopathy, and age-related macular degeneration. This demographic shift is creating a substantial and growing patient pool, increasing the demand for diagnostic tools, surgical equipment, and vision care products. Furthermore, advancements in technology, including AI-integrated diagnostics and minimally invasive surgical techniques, are making eye care more accessible and effective, further accelerating market expansion and enabling better outcomes for an aging population with increasing visual health needs.

What are the latest Ophthalmic Devices Market Dynamics and Trends?

The ophthalmic devices market is undergoing a profound transformation, propelled by the convergence of two major demographic and technological trends: the alarming rise of myopia, particularly among younger populations, and the sustained growth of the global geriatric demographic. While an aging population continues to drive demand for devices to treat conditions like cataracts and presbyopia, the escalating "myopia epidemic" presents a new and massive market driver. The recent data from DelveInsight’s analysis indicates that by 2050, more than 4.8 billion people, or half the world's population, are projected to be myopic, with a significant increase in high myopia. This surge is largely attributed to urbanization, digital screen exposure, and lifestyle changes, intensifying demand for regular eye exams and advanced ophthalmic devices.

The market is responding with innovative solutions beyond traditional corrective lenses, including specialized myopia-control spectacles and contact lenses, and AI-powered diagnostic tools for early detection and management. Furthermore, government initiatives and global campaigns by organizations like the WHO and IAPB are boosting public awareness and expanding access to eye care, ensuring that the demand for ophthalmic devices, from advanced diagnostic equipment to surgical instruments, will continue to accelerate for decades to come.

Our analysts estimate that high myopia alone is expected to affect almost 1 billion people, significantly raising the risk of permanent vision impairment. Simultaneously, demographic shifts are accelerating demand: DelveInsight projects that by 2050, the global population aged between 60-65 will be more than 2 billion, increasing the prevalence of presbyopia and other age-related ocular conditions. These factors, coupled with advancements in AI-powered diagnostics and minimally invasive ophthalmic technologies, are positioning the market for rapid and sustained expansion.

While rising geriatric and myopic populations are powerful drivers, the ophthalmic devices market faces significant headwinds that could temper its growth. The challenge of inconsistent readings with certain ophthalmic devices remains a concern, as it can lead to misdiagnosis or inaccurate prescriptions, potentially eroding physician and patient confidence. Furthermore, the rapid advancement of telemedicine and remote eye examination technologies presents a double-edged sword. While these innovations expand access to care, particularly in underserved regions, they may also reduce the need for certain traditional, in-person diagnostic and monitoring devices, potentially shifting market demand away from expensive clinic-based equipment toward more affordable, portable, or even smartphone-based solutions. This technological evolution necessitates a strategic pivot for manufacturers, focusing on devices that can either be integrated into a remote care ecosystem or offer advanced capabilities that remote solutions cannot replicate, such as high-resolution imaging and complex surgical functions. Therefore, the market's future will be defined not just by demographic demand but by its ability to navigate these technological and logistical challenges.

Ophthalmic Devices Market Report Segmentation

This ophthalmic devices market report offers a comprehensive overview of the global ophthalmic devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product Type (Surgical Devices [Phacoemulsification Devices, Ophthalmic Viscoelastic Devices, Glaucoma Drainage Devices, Vitrectomy Systems, Excimer Lasers, Photocoagulation Lasers, and Others], Diagnostic and Monitoring Devices [Optical Coherence Tomography Systems, Ophthalmic Ultrasound Systems, Fundus Cameras, Slit Lamps, Corneal Topography Systems, and Others], Lenses [Intraocular Lenses, Contact Lenses [Soft Contact Lenses and Rigid Gas Permeable Contact Lenses], Spectacle Lenses, and Others], and Others), Application (Glaucoma, Cataract, Retinopathies, Age-Related Macular Degeneration, Myopia, and Others), End-User (Hospitals, Specialty Clinics, and Others), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing ophthalmic devices market.

Ophthalmic devices are specialized medical instruments and equipment designed for the diagnosis, monitoring, and treatment of eye-related disorders. These devices enable visualization of ocular anatomy, facilitate accurate disease detection, and support therapeutic interventions to preserve or restore vision.

The ophthalmic devices market is growing rapidly, driven by the rising prevalence of eye disorders such as myopia, astigmatism, and glaucoma, along with proactive government initiatives to improve eye health. The expanding geriatric population, highly prone to age-related vision problems, further adds to the demand for advanced diagnostic, surgical, and corrective solutions. Coupled with technological advancements and greater awareness, these factors are expected to accelerate the global ophthalmic devices market during the forecast period from 2025 to 2032.

Ophthalmic Devices Market Segment Analysis

Ophthalmic Devices Market by Product Type (Surgical Devices [Phacoemulsification Devices, Ophthalmic Viscoelastic Devices, Glaucoma Drainage Devices, Vitrectomy Systems, Excimer Lasers, Photocoagulation Lasers, and Others], Diagnostic and Monitoring Devices [Optical Coherence Tomography Systems, Ophthalmic Ultrasound Systems, Fundus Cameras, Slit Lamps, Corneal Topography Systems, and Others], Lenses [Intraocular Lenses, Contact Lenses [Soft Contact Lenses and Rigid Gas Permeable Contact Lenses], Spectacle Lenses, and Others], and Others), Application (Glaucoma, Cataract, Retinopathies, Age-Related Macular Degeneration, Myopia, and Others), End-User (Hospitals, Specialty Clinics, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

Ophthalmic Devices Market Segment By Product Type

By Product Type: Glaucoma Drainage Devices Category Dominates the Market

In the product type segment of the surgical devices category of the ophthalmic devices market, the glaucoma drainage devices sub-category is estimated to account for the largest market share in 2024 and is growing at a CAGR of 12% during the forecast period from 2025-2032. This growth is primarily fueled by the increasing global prevalence of glaucoma, driven by the aging population and rising rates of lifestyle diseases like diabetes and hypertension. A major trend defining this market is the shift toward Minimally Invasive Glaucoma Surgery (MIGS) devices. The MIGS segment now accounts for a significant portion of the market, as these devices offer a safer alternative to traditional surgery with faster recovery times and fewer complications.

Key innovations and dynamics shaping the market include the development of next-generation devices like valved implants, biodegradable stents, and smart drainage devices designed to release anti-fibrotic drugs. There is also a growing focus on "deviceless" MIGS procedures that utilize advanced lasers or microcatheters to improve aqueous humor outflow without leaving an implant behind. While the market is expanding, challenges such as the high cost of devices, potential for inconsistent readings, and post-operative complications remain factors that influence market adoption. North America currently leads the market due to its advanced healthcare infrastructure and high glaucoma prevalence, while the Asia-Pacific region is poised for the fastest growth, driven by increasing healthcare spending and an expanding patient base.

Ophthalmic Devices Market Segment By Application

By Application: Cataracts Category Dominates the Market

The cataract segment continues its market dominance by accounting for approximately 37% market share of the overall ophthalmic devices market in 2024, driven by an aging global population and the fact that cataracts remain the leading cause of blindness worldwide. This segment's leading position is further solidified by significant technological advancements that are expanding its value. The rise of premium intraocular lenses (IOLs) is a key trend, with advanced IOLs correcting not just cataracts but also astigmatism and presbyopia, offering patients spectacle independence. Furthermore, the increasing adoption of minimally invasive and laser-assisted surgical techniques, such as Femtosecond Laser-Assisted Cataract Surgery (FLACS), is enhancing surgical precision, safety, and patient outcomes. These innovations are not only improving existing procedures but also driving demand by making cataract surgery more appealing to a broader patient base seeking better post-operative visual quality.

Ophthalmic Devices Market Segment By End-User

By End-User: Hospitals Dominates the Market

Within the ophthalmic device market's end-user segment, the Hospitals and Specialty Ophthalmic Clinics category consistently dominates. This is attributed to several key factors: these facilities are the primary hubs for a vast majority of complex eye care procedures, including cataract, glaucoma, and vitreoretinal surgeries, which require expensive, high-tech diagnostic and surgical equipment. The increasing prevalence of age-related eye diseases and the high volume of patients seeking surgical interventions, particularly for cataracts, solidify their leading market share. Moreover, these clinics and hospitals benefit from the adoption of advanced technologies like AI-powered diagnostics and laser-assisted surgical systems, which enhance efficiency and patient outcomes, further cementing their role as the central pillars of the ophthalmic device ecosystem.

Ophthalmic Devices Market Regional Analysis

North America Ophthalmic Devices Market Trends

North America is projected to hold the largest share of the global ophthalmic devices market in 2024 and is expected to do the same during the forecast period from 2024 to 2030. This is driven by the presence of a significant number of eye care professionals and clinics, including optometrists, ophthalmologists, and eye care centers, a large patient pool associated with vision loss, hypermetropia, and astigmatism, the presence of a developed & sophisticated healthcare infrastructure, and product developmental activities are factors that drive the expansion of the ophthalmic devices market in the North America region during the forecast period from 2024 to 2030.

According to the DelveInsight analysis, more than 30% of people in the United States have astigmatism. Astigmatism affects people of all ages and races. Babies may even have astigmatism, although most soon outgrow it. Additionally, our analysts estimate that more than 13.5 million Americans aged 40 and above are affected by hypermetropia. Ophthalmic devices are essential in diagnosing and managing astigmatism and hypermetropia by analyzing how light interacts with the eye. Refractometers and autorefractors measure light refraction to detect vision imperfections, while corneal topography maps the curvature of the cornea to identify irregularities. Phoropters are used during eye exams to determine the correct lens prescription, aiding in the treatment of these conditions.

Therefore, the interplay of all the aforementioned factors would provide a conducive growth environment for the North American ophthalmic devices market.

Europe Ophthalmic Devices Market Trends

The European ophthalmic devices market is being propelled by a combination of a rapidly aging population, which is increasing the prevalence of age-related eye diseases like cataracts and glaucoma, and high per-capita healthcare spending that supports the adoption of advanced technologies. A key trend is the strong demand for premium and technologically advanced products, including premium intraocular lenses (IOLs) that correct astigmatism and presbyopia, as well as minimally invasive glaucoma surgery (MIGS) devices. The market is also heavily influenced by stringent regulatory frameworks set by the European Medicines Agency (EMA) and a strong focus on patient safety, which drives innovation toward more precise and effective devices. The increasing adoption of teleophthalmology and AI-powered diagnostic tools is also a significant trend, as it seeks to improve access to eye care and streamline clinical workflows across the region.

Asia-Pacific Ophthalmic Devices Market Trends

The Asia-Pacific ophthalmic devices market is poised for explosive growth, driven by a confluence of powerful demographic and economic trends. The region is home to a massive and rapidly aging population, which is leading to a dramatic increase in age-related eye diseases like cataracts, glaucoma, and age-related macular degeneration. Simultaneously, the "myopia epidemic" is particularly severe in countries like China, Japan, and South Korea, creating a huge and underserved patient pool for vision correction and myopia control devices. This demographic shift is complemented by significant economic growth, rising disposable incomes, and improving healthcare infrastructure, which are making advanced eye care services more accessible and affordable. As a result, the region is not only a major consumer but also a growing hub for manufacturing and innovation in ophthalmic technology.

Who are the major players in the Ophthalmic Devices Market?

The following are the leading Ophthalmic Devices Companies in the market. These Ophthalmic Devices Companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Baxter

- CANON MEDICAL SYSTEMS EUROPE B.V.

- CooperVision Inc.

- Alcon Inc.

- Bausch & Lomb, Inc.

- OMRON Corporation

- Ziemer Ophthalmic Systems AG

- Essilor Instruments USA Ltd.

- Konan Medical USA, Inc.

- Optovue Incorporated

- NIDEK CO. LTD.

- ZEISS Group

- Luneau Technology Group

- OPTOPOL Technology Sp. z o.o.

- Rudolf Riester GmbH

- Rexxam Co. Ltd.

- Keeler

- Sonomed Escalon

- STAAR SurgicalCAE Inc.

How is the competitive landscape shaping the Ophthalmic Devices Market?

The competitive landscape of the ophthalmic devices market is moderately concentrated, with a few global leaders such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss Meditec dominating through extensive product portfolios, strong R&D capabilities, and broad geographic reach. These players are driving innovation in areas like AI-enabled diagnostics, minimally invasive surgical systems, and advanced intraocular lenses, setting high entry barriers for smaller firms. However, regional players and emerging startups are actively contributing with niche solutions in digital eye care, tele-ophthalmology, and affordable vision correction devices, particularly in developing markets. Overall, the market is witnessing both consolidation among major players and increasing competition from specialized innovators, creating a dynamic balance between concentration and fragmentation.

Recent Developmental Activities in the Ophthalmic Devices Market

- In June 2025, 2EyesVision launched SimVis Gekko2 internationally, a cutting-edge device that lets patients preview post-surgery vision based on their chosen intraocular lens. Developed in Spain, it enhances the preoperative experience and improves communication between patients and professionals.

- May 2025 (In-progress), EssilorLuxottica has agreed to acquire Optegra, which operates over 70 eye hospitals and diagnostic centers across Europe (UK, Czech Republic, Poland, Slovakia, Netherlands), expanding into comprehensive eyecare services including diagnostics, cataract and glaucoma treatments, refractive lens replacement, and laser surgery. The deal is expected to close later in 2025

- In April 2025, BVI Medical received FDA 510(k) clearance for its Leos™ Laser Endoscopy Ophthalmic System, a first-of-its-kind laser device offering digital endoscopic visualization for minimally invasive glaucoma surgery. The system achieved its first clinical use later that July.

- In March 2025, Alcon announced its acquisition of LENSAR, the company behind the ALLY Robotic Cataract Laser Treatment System, for approximately USD 356 million; the transaction is expected to close in the latter half of 2025.

- In March 2025, Haag-Streit officially launched the METIS 900, a new surgical control center. This ophthalmic microscope system is designed to provide surgeons with comprehensive control during procedures. It features superior optics, enhanced ergonomics, and an integrated 4K video option.

- In Feb 2025, Alcon launched its new product, Voyager™ DSLT, in the U.S. This is the first and only Direct Selective Laser Trabeculoplasty device, designed as a more accessible and automated first-line laser treatment for glaucoma and ocular hypertension.

Scope of the Ophthalmic Devices Market

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Ophthalmic Devices Market CAGR |

4.21% |

|

Key Companies in the Ophthalmic Devices Market |

Johnson & Johnson Services, Inc., Baxter, CANON MEDICAL SYSTEMS EUROPE B.V., CooperVision Inc., Alcon Inc., Bausch & Lomb, Inc., OMRON Corporation, Ziemer Ophthalmic Systems AG, Essilor Instruments USA Ltd., Konan Medical USA, Inc., Optovue Incorporated, NIDEK CO. LTD., ZEISS Group, Luneau Technology Group, OPTOPOL Technology Sp. z o.o., Rudolf Riester GmbH, Rexxam Co. Ltd., Keeler, Sonomed Escalon, STAAR Surgical, and others |

|

Ophthalmic Devices Market Segments |

by Product Type, by Application, by End-user, and by Geography |

|

Ophthalmic Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Ophthalmic Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Ophthalmic Devices Market Segmentation

Ophthalmic Devices Product Type Exposure

- Surgical Devices

-

-

- Phacoemulsification Devices

- Ophthalmic Viscoelastic Devices

- Glaucoma Drainage Devices

- Vitrectomy Systems

- Excimer Lasers

- Photocoagulation Lasers

- Others

- Diagnostic and Monitoring Devices

- Optical Coherence Tomography Systems

- Ophthalmic Ultrasound Systems

- Fundus Cameras

- Slit Lamps

- Corneal Topography Systems

- Others

- Lenses

- Soft Contact Lenses

- Soft Contact Lenses

- Rigid Gas Permeable Lenses

- Spectacle Lenses

- Others

- Soft Contact Lenses

-

Ophthalmic Devices Application Exposure

-

- Glaucoma

- Cataracts

- Retinopathies

- Age-related Macular Degeneration

- Myopia

- Others

Ophthalmic Devices End-User Exposure

-

- Hospitals

- Specialty Clinics

- Others

Ophthalmic Devices Geography Exposure

North American Ophthalmic Devices Market

- United States

- Canada

- Mexico

Europe Ophthalmic Devices Market

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific Ophthalmic Devices Market

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

Rest of the World Ophthalmic Devices Market

- South America

- Middle East

- Africa

- Rest of the World

Ophthalmic Devices Market Recent Industry Trends and Milestones (2022-2025)

|

Category |

Key Developments |

|

Ophthalmic Devices Product Launches |

Voyager™ DSLT by Alcon, METIS 900 Ophthalmic Microscope by Haag‑Streit, TECNIS Odyssey (J&J), |

|

Ophthalmic Devices Regulatory Approvals |

VIA360 Surgical System - New World Medical (FDA) |

|

Partnerships in the Ophthalmic Devices Market |

Topcon Healthcare & OphtAI, Visionix Aligns with Espansione Group & Insight Medical Technologies |

|

Acquisitions in the Ophthalmic Devices Market |

EssilorLuxottica Acquires Optegra, Alcon Acquires LENSAR |

|

Company Strategy |

EssilorLuxottica: Expanding into medical services, Alcon: Acquisitions & innovation growth, Bausch + Lomb: Financial strengthening & portfolio expansion, |

|

Setbacks in the Ophthalmic Devices Market |

Lensar: Ended strategic collaboration with Oertli, potentially impacting product integration |

|

Emerging Technology |

Artificial Intelligence (AI) & Machine Learning, Teleophthalmology & Remote Diagnostics, Robotics & Image-Guided Surgery, Gene & Cell Therapy Integration with Devices |

Impact Analysis on Ophthalmic Devices

What is the impact of AI on the Ophthalmic Devices Market?

AI-Powered Innovations and Applications:

Artificial Intelligence (AI) powered innovations are transforming the ophthalmic devices market by enabling earlier and more accurate disease detection, improving surgical precision, and expanding access to care. AI-driven diagnostic platforms integrated with OCT and fundus cameras can autonomously detect conditions such as diabetic retinopathy and glaucoma, while AI-assisted surgical systems enhance cataract and retinal procedures with real-time analytics and precision mapping. In parallel, AI-enabled teleophthalmology solutions and smart wearables, such as contact lenses for continuous intraocular pressure monitoring, are widening access to eye care and supporting proactive disease management. These applications are driving demand for advanced ophthalmic devices, positioning AI as a key growth catalyst for the market.

U.S. Tariff Impact Analysis on the Ophthalmic Devices Market:

The U.S. tariffs have a significant impact on the ophthalmic devices market by increasing costs and disrupting supply chains. A universal 10% import tariff on all goods, combined with higher rates for specific countries like China (54%) and the European Union (20%), directly raises the price for importers, which is often transferred to healthcare providers and patients. This has prompted medical device manufacturers to re-evaluate their global sourcing strategies and has led some to consider shifting their manufacturing to the U.S. to mitigate the financial burden. The tariffs also alter the competitive landscape, posing a particular challenge for smaller companies and startups to absorb the increased costs.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends in the Ophthalmic Devices Market

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

XPANCEO |

$250M in Series A (most recent round; company now a unicorn; earlier rounds reported as well) |

AI-powered smart contact lenses (XR/health monitoring/vision augmentation) |

Late R&D/scaling toward regulatory filings and market launch (Series A to accelerate product launch) |

Deep-tech optics + miniaturized electronics + XR/AI integration (multifunction smart lens) |

|

Science Corporation (Science Corp.) |

> $180M+ total reported fundraising (large VC rounds reported to advance BCI/vision implants) |

PRIMA/Science Eye - retinal implant/BCI systems to restore vision in AMD/retinal degeneration. |

Clinical stage (early human/clinical results reported; CE-mark submission reported) |

Wireless photovoltaic micro-LED/microelectronic retinal implants + brain-computer-interface approaches. |

|

ForSight Robotics |

Total funding reported ~$195M (recent $125M Series B included) |

ORYOM™ - robotic platform for cataract & other ophthalmic surgery (robotic-assisted microsurgery) |

Pre-clinical - preparing first-in-human clinical trials; ISO 13485 achieved, and large VC backing. |

Robotics + computer vision + micromechanics + AI for ultra-precise ocular microsurgery. |

|

Innovega |

Reported >$16M–$33M. Company reports ~$20M+ and prior non-dilutive contracts. |

Combination smart contact lenses + display eyewear (aimed at vision restoration and AR display) |

Clinical investigations reported; lenses investigational and not FDA-cleared (pre-market/regulatory work ongoing) |

Nano-optics/patented contact-lens optics paired with miniature eyewear displays (optical coupling) |

|

Ciliatech |

Reported ~€6M total (Series A ~€3.5M; reported total funding around €6M) |

CID - a novel cilio-scleral glaucoma implant (minimally disruptive implant to lower IOP) |

Pre-clinical/early clinical; Series A to fund CE-marking activities and clinical trials. |

New implant design (cilio-scleral placement) - surgical implant mechanics and micro-device design for durable IOP control. |

|

AcuSurgical |

Reported €5.75M Series A (to develop its robotic ocular microsurgery platform) |

Robotic assistant for retinal/ocular microsurgery (console with haptic feedback, OCT guidance) |

Prototype/pre-clinical validated; Series A funded further development toward clinical pilots. |

Robotics + haptics + intraoperative OCT/visualization for retinal microsurgery. |

Key takeaways from the ophthalmic devices market report study

- Market size analysis for the current ophthalmic devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the ophthalmic devices market.

- Various opportunities available for the other competitors in the ophthalmic devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current ophthalmic devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the ophthalmic devices market growth in the future?