Sanofi’s WAYRILZ Approval Ushers in New Era for Immune Thrombocytopenia Treatment

Sep 22, 2025

Table of Contents

Immune thrombocytopenia is a rare autoimmune disorder, affecting both children and adults. The global incidence of ITP is estimated at around 2–5 cases per 100,000 people annually, with prevalence higher in adults and a slight female predominance.

In 2024, the total cases of immune thrombocytopenia were approximately 186K cases in the leading markets (the US, EU4, the UK, and Japan), as per DelveInsight. Females comprised 63% of the total patient cohort, while males made up 37%. ITP is more common among children than adults. These numbers are further expected to grow due to improved disease awareness, better diagnostic techniques, and expanded access to healthcare. Rising adoption of advanced platelet count monitoring and differential diagnosis is leading to earlier and more accurate identification of cases.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- R&D and Upcoming therapies Paving the Way for a Potential and Better Cure for Immune Thrombo...

- BeiGene’s Brukinsa Approval; FDA Approval to Seagen’s TUKYSA; NICE Recommends Alnylam’s Amvuttra;...

- X4 Pharmaceuticals’ XOLREMDI FDA Approval; ONO to Acquire Deciphera Pharmaceuticals; Johnson &...

- Eli’s Jaypirca: A Beacon of Success in the BTK Inhibitor Market

- DelveInsight’s Oncology based Reports, 2015

Current Immune Thrombocytopenia Treatment Space

Current guidelines recommend ITP treatment initiation for platelet counts below 20–30 × 10⁹/L, regardless of bleeding. For counts between 20–30 × 10⁹/L and 50 × 10⁹/L, treatment is typically not advised unless specific situations arise, such as bleeding, surgery, or the need for antiplatelet or anticoagulant therapy.

Current treatment options for immune thrombocytopenia include thrombopoietin receptor agonists (PROMACTA, NPLATE, and DOPTELET), anti-CD20 antibodies (RITUXAN), Syk inhibitors (TAVALISSE/TAVLESSE), neonatal Fc receptor inhibitors (VYVGART), and various immunomodulatory agents.

Thrombopoietin receptor agonists are considered a safe and effective option for second-line management of chronic immune thrombocytopenia. In 2018, the US FDA approved two agents in this class: NPLATE (romiplostim), a peptide-based thrombopoietin mimetic, and PROMACTA (eltrombopag). These therapies have been extensively used in patients with relapsed or refractory chronic ITP, typically defined as persisting for at least one year. By stimulating the thrombopoietin receptor, they enhance megakaryocyte precursor proliferation, resulting in elevated platelet counts in many patients. Subsequently, in June 2019, the FDA also approved DOPTELET (avatrombopag maleate) for adults with chronic ITP who showed insufficient response to earlier treatments.

Some off-label and approved therapies mainly drive the EU immune thrombocytopenia treatment market. The approved immune thrombocytopenia therapies in the EU include DOPTELET (avatrombopag), TAVALISSE/TAVLESSE (fostamatinib), PROMACTA/REVOLADE (eltrombopag), and NPLATE/Romiplate (romiplostim). RITUXAN is only approved in Japan for the treatment of ITP.

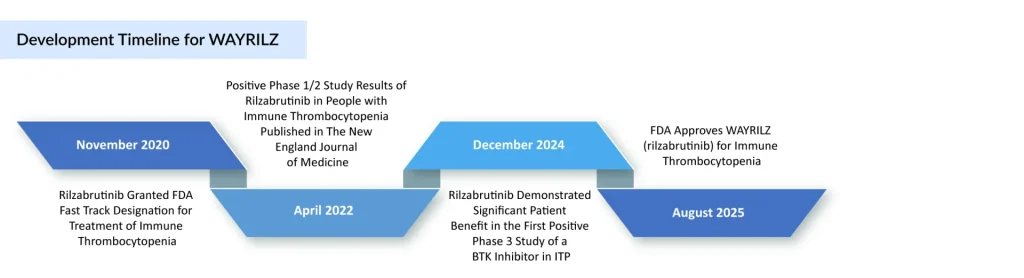

WAYRILZ Sets Milestone in BTK Drug Development for ITP

Sanofi’s WAYRILZ (rilzabrutinib) has achieved a significant regulatory milestone, becoming the first FDA-approved BTK inhibitor for immune thrombocytopenia. WAYRILZ, an innovative oral and reversible BTK inhibitor, is designed to tackle the underlying mechanisms of immune thrombocytopenia by modulating multiple immune pathways.

The approval is supported by results from the Phase III LUNA trial (NCT04562766), which showed a rapid and sustained platelet response along with improvements in other ITP symptoms. Its efficacy and safety were assessed in the phase III LUNA 3 trial, presented at the 66th American Society of Hematology Annual Meeting, which enrolled 202 adults with persistent or chronic ITP. Patients who achieved a platelet response at 12 weeks could remain in the 24-week double-blind period, with responses seen in 64% of those on WAYRILZ compared to 32% on placebo. In June 2025, WAYRILZ gained approval in the United Arab Emirates for adults with persistent or chronic ITP who failed or could not tolerate prior therapies, and it is currently under regulatory review in the EU and China.

The ITP therapy has received FDA Fast Track and Orphan Drug Designations (ODD) for ITP, with additional orphan status granted in Japan and the EU. More recently, the FDA extended ODD to WAYRILZ for warm autoimmune hemolytic anemia (wAIHA), IgG4-related disease (IgG4-RD), and sickle cell disease (SCD), alongside FDA Fast Track and EMA orphan designation in IgG4-RD. While Sanofi has not shared pricing information, it confirmed that patients will be able to access financial support, insurance guidance, and educational resources through its HemAssist patient assistance program.

Promising Immune Thrombocytopenia Therapies in Development

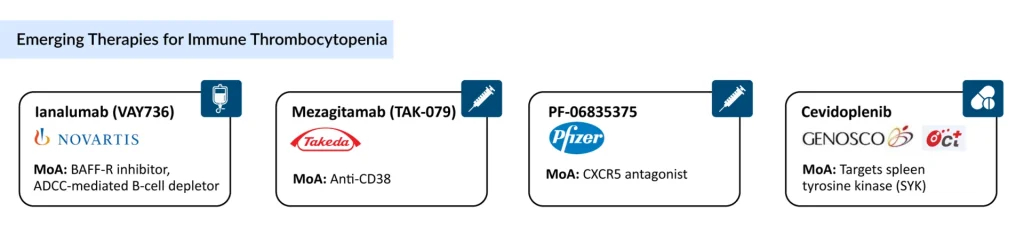

With WAYRILZ’s approval, competition to secure a strong foothold in the ITP market has intensified. The potential ITP therapies in clinical trials that can mark a significant change during the forecast period include Ianalumab (Novartis), Mezagitamab (Takeda), PF-06835375 (Pfizer), and Cevidoplenib (Genosco/Oscotec), which are being evaluated in the advanced stage of clinical development.

Novartis’ Ianalumab is a novel, fully human IgG1 monoclonal antibody that binds to the BAFF receptor and works through a dual mechanism: inducing B-cell depletion via antibody-dependent cellular cytotoxicity and suppressing B-cell differentiation, proliferation, and survival by blocking BAFF-R signaling. It is currently being evaluated in Phase III clinical trials as both a first- and second-line therapy for ITP.

In Novartis’ Q2 2025 update, the company highlighted two key trials: NCT05653349 (VAYHIT1) for first-line treatment, with results expected in 2026, and NCT05653219 (VAYHIT2) for second-line therapy, anticipated in 2025. Regulatory submission for ianalumab in first- and second-line ITP is projected for 2027.

Takeda’s Mezagitamab is another fully human IgG1 monoclonal antibody that selectively targets CD38-expressing cells, including plasmablasts, plasma cells, and natural killer cells, leading to their depletion. Its mechanism is intended to provide rapid, durable improvements in platelet response and restore platelet counts to functional ranges.

The U.S. FDA has granted mezagitamab Orphan Drug Designation for ITP and Fast Track Designation for chronic or persistent ITP. It remains an investigational therapy and has not yet been approved by any regulatory authority.

Genosco/Oscotec’s Cevidoplenib is an orally administered, small-molecule synthetic drug candidate designed to treat rheumatoid arthritis and other autoimmune conditions by selectively targeting SYK (Spleen Tyrosine Kinase). Its potent inhibition of SYK-mediated signaling and SYK-dependent cellular processes offers improved efficacy and safety compared to traditional non-selective kinase inhibitors. The drug has completed a Phase II clinical trial in ITP, and with further progress, it holds promise for expansion into a broader range of autoimmune disease indications.

The anticipated launch of these emerging immune thrombocytopenia therapies are poised to transform the immune thrombocytopenia market landscape in the coming years.

Future Outlook of Immune Thrombocytopenia Treatment Market

The immune thrombocytopenia treatment market is poised for continued biologic and targeted-therapy growth, with an emphasis on therapies that offer deeper, more durable platelet responses and improved safety profiles. Expect further expansion of FcRn inhibitors, next-generation TPO-RAs, and small-molecule oral agents that aim to reduce steroid dependence and chronic immunosuppression. Alongside new drug classes, combination regimens, and treatment sequencing strategies will gain attention as clinicians try to convert short-term platelet rises into long-term remissions; this will push more clinical trials and real-world studies aimed at optimizing when to use which modality for which patient subgroup.

As per DelveInsight, the immune thrombocytopenia market is positioned for substantial growth, driven by the introduction of novel therapies, including biologics, small molecules, and targeted treatments. Factors such as increased awareness, enhanced diagnostic capabilities, and a broader range of treatment options are propelling market expansion. The total market size of immune thrombocytopenia in the 7MM in 2024 was USD 3.8 billion; this is anticipated to grow by 2034.

Overall, the space is moving from broad immunosuppression toward targeted, individualized care — but costs, access, and the need for long-term safety data will determine how quickly that vision becomes standard practice.

Downloads

Article in PDF

Recent Articles

- R&D and Upcoming therapies Paving the Way for a Potential and Better Cure for Immune Thrombo...

- FcRn Inhibitors Being The Fastest Growing Class, Plans To Get Explored In 20+ Indications

- Pfizer succeeds COVID-19 vaccine safety milestone; Sanofi snags speedy review for BTK drug; Autoi...

- Thrombocytopenia Drugs Market: What Newer Agents Are Expected To Enter The Market?

- FDA Approves Eisai & Biogen’s LEQEMBI IQLIK for Maintenance Treatment of Early Alzheimer’s; T...