Tumor‑Infiltrating Lymphocyte (TIL) Therapies: Redefining Cell Therapy for Solid Tumors

Feb 20, 2026

Table of Contents

Summary

- TIL therapy marks a major shift in solid-tumor immunotherapy, offering an effective approach where CAR-T strategies have struggled, broadening options beyond PD-1 and BRAF/MEK inhibitors for metastatic melanoma, and driving extensive clinical evaluation across NSCLC, HNSCC, CRC, pancreatic, prostate, cervical, and other cancers.

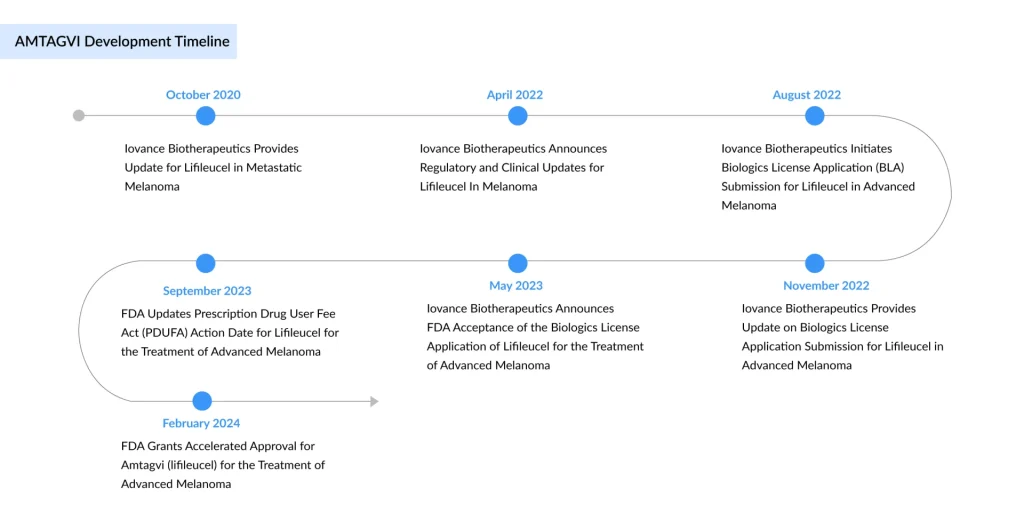

- Iovance’s AMTAGVI (lifileucel) has emerged as the first approved personalized TIL treatment, earning accelerated FDA authorization for advanced melanoma after PD-1 therapy.

- Its approval has catalyzed a surge in competitive development, with companies such as Obsidian Therapeutics (OBX-115), KSQ Therapeutics (KSQ-001EX and KSQ-004EX), Curacell Holding (CC-38), Intima Bioscience (CISH-inactivated TIL), and others advancing next-generation TIL programs.

- At the same time, Iovance is broadening its own TIL pipeline, including candidates like LN-145 and IOV-4001, while pursuing combination regimens and expanding into new therapeutic areas such as NSCLC and endometrial cancer.

- The TIL therapy market across the 7MM was valued at roughly USD 103 million in 2024. It is projected to grow at a CAGR of 37%, driven by rising disease awareness, improvements in diagnostic practices, and the introduction of new therapies.

Over the past decade, cell-based immunotherapies have revolutionized the treatment landscape for hematologic malignancies. In contrast, solid tumors have remained far more resistant to curative cellular approaches. Tumor-infiltrating lymphocyte (TIL) therapies are now emerging as one of the most promising solutions to this challenge, offering a highly personalized strategy that leverages a patient’s own immune system to target cancer.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Novo Nordisk’s Concizumab for Hemophilia; AbbVie Ends its Alliance with Alector; ADC Therapeutics...

- Top 5 Cancers Creating Major Challenge To The Global Healthcare System

- Smith+Nephew’s Hip Arthroplasty System; Mammotome Launched the HydroMARK Plus Breast Biopsy Site ...

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

- GSK’s RSV Vaccine Clears Phase III Test in Adults; Roche’s Tecentriq for Adjuvant NSCLC; Owkin Ba...

TIL therapy marks a major shift in solid-tumor immunotherapy, delivering effective tumor targeting where CAR-T therapies have struggled, extending treatment options beyond PD-1 and BRAF/MEK inhibitors in metastatic melanoma, and enabling broad clinical exploration across NSCLC, HNSCC, CRC, pancreatic, prostate, cervical, and other solid tumors.

In 2024, the selected indications for TIL therapies accounted for 4.5 million cases across the 7MM, a number expected to rise by 2034. Prostate cancer represents the largest opportunity for TIL therapy, followed by NSCLC, driven not only by high incidence but also by low tumor immunogenicity, poor response rates to checkpoint inhibitors, and limited effective therapies after standard of care, highlighting a substantial unmet medical need.

With the first FDA approval of a TIL product, rapid clinical development across multiple tumor types, and increasing commercial momentum, TIL therapies are transitioning from experimental concepts to a foundational pillar in the treatment of solid tumors.

Iovance Brings TILs to Market

The TIL therapy field reached a historic inflection point in 2024 when the US FDA approved AMTAGVI (lifileucel), developed by Iovance Biotherapeutics, as the first TIL‑based therapy and the first autologous cell therapy approved for a solid tumor. AMTAGVI is an autologous T-cell therapy derived from a patient’s own tumor and is approved for adults with unresectable or metastatic melanoma who have previously received a PD-1 inhibitor, and, for those with a BRAF V600 mutation, prior treatment with a BRAF inhibitor with or without a MEK inhibitor.

This approval of TIL-based therapy was granted under the FDA’s accelerated approval pathway based on overall response rate (ORR), with continued approval dependent on confirmation of clinical benefit in follow-up studies. By the end of 2024, more than 200 patients had received AMTAGVI during the first three quarters of its commercial availability. Iovance introduced the therapy in the U.S. at a wholesale acquisition cost of USD 515,000 per patient. After its U.S. launch on February 20, 2024, AMTAGVI generated USD 103.6 million in product revenue for the year.

Sadaf Javed, Manager of Forecasting and Analytics at DelveInsight, said that with more than a year into the US launch of AMTAGVI for advanced melanoma, the first FDA-approved TIL cell therapy, the adoption continues to grow. For the first time, AMTAGVI surpassed more than 100 patients treated in a single quarter. The real-world data set for AMTAGVI shows a nearly 49% response rate among 41 patients, and for 23 patients treated in third-line or earlier treatment settings, and approximately 61% response rate, all from patients treated in accordance with the label.

In November 2025, Iovance Biotherapeutics reported that it expects potential regulatory approvals for AMTAGVI in the U.K. and Australia in the first half of 2026, and in Switzerland in 2027. The company submitted a centralized Marketing Authorization Application (MAA) for lifileucel to the European Medicines Agency in June 2024, which the EMA validated and accepted for review in August 2024. However, Iovance later withdrew the application for melanoma treatment in adults on July 22, 2025.

According to the company’s Q1 2025 presentation, AMTAGVI is listed in the NCCN guidelines as a preferred second-line or later therapy option for cutaneous melanoma. The approval has catalyzed broader investment in TIL platforms and firmly positioned Iovance as the current market leader, while also raising the bar for emerging competitors.

The Emerging TIL Pipeline: Next‑Generation Innovation

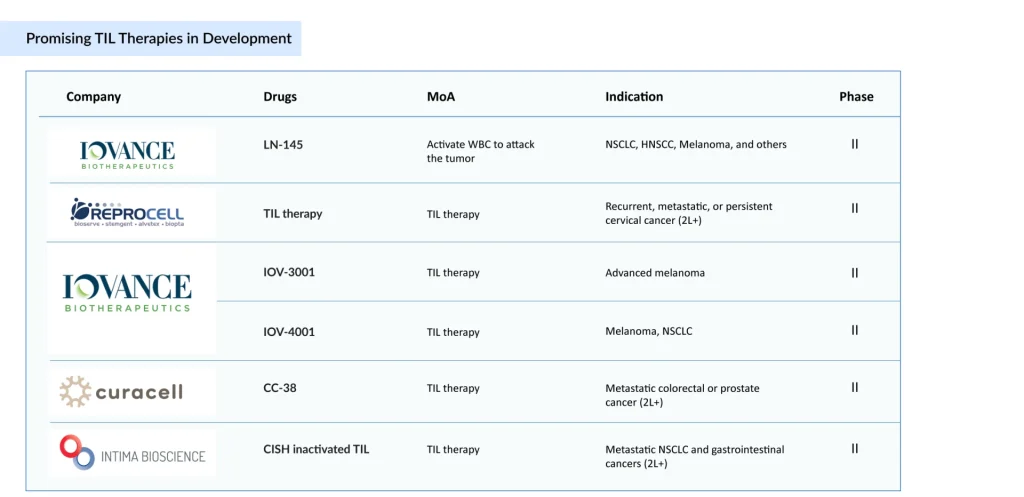

Following AMTAGVI’s approval, a wave of next‑generation TIL candidates is advancing through early‑ to mid‑stage development. TIL-based therapies under development encompass a range of adoptive cell therapy approaches, including conventional autologous TIL products (LN-145, CC-38), next-generation engineered or edited TILs (CISH-inactivated TILs, KSQ-001EX [SOCS1 single-edit eTIL], KSQ-004EX [SOCS1/Regnase-1 dual-edit eTIL], IOV-3001, and IOV-4001), cytokine-optimized platforms (OBX-115, an IL-2–sparing engineered TIL therapy), and highly selected tumor-reactive T-cell populations (AGX148, enriched for CD39⁺CD103⁺CD8⁺ cells). These programs aim to improve efficacy, safety, manufacturing efficiency, and patient access.

Key TIL therapy developers, including Iovance Biotherapeutics, REPROCELL, Curacell Holding, Intima Bioscience, KSQ Therapeutics, Obsidian Therapeutics, and others, are advancing diverse, next-generation platforms, largely targeting melanoma while exploring broader solid tumors; Iovance’s push to position TIL therapy in earlier-line settings could significantly reshape both the treatment landscape and competitive dynamics.

Sadaf said that TIL therapy developers are primarily targeting the US market, driven by Iovance’s first-in-class approval in the world’s largest commercial market, while development in Asia, particularly Japan, remains limited; ReproCELL’s Phase II program represents an early local effort that, if successful, could leverage lower manufacturing costs and expand treatment options for Japanese patients.

Recent Developments in the TIL Therapy Segment

- In November 2025, Iovance Biotherapeutics (NASDAQ: IOVA) announced that potential approvals of AMTAGVI are anticipated in the United Kingdom and Australia in the first half of 2026 and in Switzerland in 2027.

- In November 2025, Iovance (NASDAQ: IOVA) announced that it expects the IOV-LUN-202 trial to complete enrollment in 2026 and support a supplemental BLA for lifileucel in nonsquamous NSCLC, with a potential launch in 2027.

- In November 2025, Iovance (NASDAQ: IOVA) announced that initial results from the IOV-END-201 clinical trial of lifileucel in previously treated advanced endometrial cancer are on track for early 2026.

- In August 2025, Iovance Biotherapeutics (NASDAQ: IOVA) announced that more than 100 patients were treated with lifileucel in 2Q25. The company also announced that review in the United Kingdom is on track for potential approval and launch in the first half of 2026.

- In June 2025, Obsidian Therapeutics announced initial Phase I safety and efficacy data from the Phase I/II Agni-01 multicenter study of OBX-115, a novel engineered tumor-derived autologous TIL cell therapy armored with pharmacologically regulatable membrane-bound IL15 (mbIL15), in patients with immune checkpoint inhibitor (ICI)-resistant advanced or metastatic melanoma (NCT06060613).

- In May 2025, Biosyngen announced presentation of BST02 Phase I results at ASCO 2025.

- In April 2025, KSQ Therapeutics announced the first patient dosed in the Phase I/II clinical study of KSQ-004EX, a novel CRISPR-engineered TIL (eTIL) therapy.

Conclusion: A New Era for Solid Tumor Cell Therapy

TIL therapy is ushering in a new era for cell‑based treatment of solid tumors, shifting the field from experimental promise to tangible clinical impact. With the approval of AMTAGVI and a rapidly advancing pipeline, these therapies are beginning to redefine expectations for patients who historically had very limited options.

Unlike earlier generations of immunotherapies that often struggle with tumor heterogeneity, TIL products leverage a polyclonal T‑cell repertoire capable of recognizing multiple neoantigens and shared tumor antigens. This breadth of recognition positions TILs as a powerful option in complex tumors such as melanoma, NSCLC, cervical, endometrial, and liver cancers, where antigen escape and resistance to checkpoint inhibitors are common. As real‑world data accumulate, they are reinforcing the clinical trial signal that TILs can deliver deep and durable responses in heavily pretreated patients.

With a growing pipeline targeting high‑burden indications such as NSCLC, melanoma, liver, endometrial, and cervical cancers, the total addressable TIL therapy market in the leading markets is substantial and poised for sustained growth from USD 103 million in 2024 at a tremendous CAGR of 37% by 2034.

Sadaf further noted that several factors are expected to accelerate the growth of the TIL therapies market during the forecast period (2025–2034), including faster and more accurate patient diagnosis, increased clinical and patient awareness, the introduction of emerging TIL therapies, and label expansions to additional indications.

The next wave of innovation is already in motion, with engineered and “armored” TILs, CRISPR‑edited products, and cryopreserved formulations aiming to boost efficacy, simplify logistics, and broaden access. Combination strategies with checkpoint inhibitors, targeted agents, and novel immune modulators are being tested to enhance durability and push TILs into earlier lines of therapy. Success in these areas could expand use beyond ultra‑refractory populations and cement TILs as a core component of multimodal treatment paradigms.

Taken together, TIL therapies stand at a pivotal moment: no longer a niche academic curiosity, but not yet fully mature. Their trajectory over the next decade will be shaped by how effectively developers can translate scientific advances into reproducible, efficient, and accessible products. If these challenges are met, TILs have the potential to become a foundational modality in solid tumor oncology, delivering sustained benefit for patients who have long faced poor prognoses and limited hope for long‑term control.

Downloads

Article in PDF

Recent Articles

- Edwards’ Sapien 3 with Alterra Prestent; Koios Medical’s breast, thyroid cancer-spotting AI; Line...

- AstraZeneca’s Imfinzi for Biliary Tract Cancer; FDA Clears Boehringer’s Spesolimab; Novo Nordisk ...

- Role of TLR7/8 Agonists in Treating Various Cancers

- The Rise of TCR Therapy: A Beacon of Hope in Cancer Treatment

- Non-Small Cell Lung Cancer Market: Treatments and Market Forecast