ENHERTU’s Rapid Rise: How the HER2-Targeting ADC Is Redefining Cancer Treatment with Back-to-Back Label Expansions

Aug 20, 2025

Table of Contents

ENHERTU, a next-generation antibody-drug conjugate (ADC) jointly developed by Daiichi Sankyo/ AstraZeneca since March 2019, except in Japan, where Daiichi Sankyo maintains exclusive rights. It is worth noting that recently, in November 2024, Daiichi Sankyo and AstraZeneca were awarded the Galien Foundation 2024 Prix Galien USA Award for Best Biotechnology Product for ENHERTU.

Breast cancer remains a leading indication for ENHERTU. DelveInsight’s estimates approximately 300K breast cancer incident cases in the US in 2024, with around 15% classified as HER2+, which has remained a significant revenue driver for ENHERTU since its first launch in third-line HER2+ Breast Cancer. Following the first launch, ENHERTU received approvals in HER2+ Gastric cancer, second-line HER2+ Breast Cancer, HER2-Low or ultra-low breast cancer, HER2+ NSCLC, and a tumor-agnostic label in all solid tumors expressing HER2+.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Harnessing the Power of Immunomodulators: Applications and Implications

- Triple Negative Breast Cancer Responds to TINAGL Therapy

- New Asundexian Phase III Study Result; Zibotentan/Dapagliflozin Combination Demonstrated Signific...

- Astellas & AviadoBio’s Exclusive Deal for AVB-101; GSK’s Depemokimab Shows Positive Res...

- Harmony in Treatment: GOLCA (golcadomide) Reveals Favorable Safety Profile and Seamless Integrati...

Post HER2+, Delveinsight expects ENHERTU to drive momentum with this new patient segment of HER2-low or ultra-low type, which represents roughly 55-60% of all breast cancer cases. The high incidence of the new HER2-low subtype and the tumor-agnostic label highlight the strong market potential for ENHERTU, especially given its role as an innovative treatment option for patients with limited therapeutic options.

Expectations in 2025: With HER2+ breast cancer being the leading revenue generator initially, expectations are high post HER2-low/ultra-low Breast and Tumor Agnostic label.

ENHERTU’s Journey of Growth: Broadening the Horizon

ENHERTU received its first FDA approval in December 2019 for treating third-line and above HER2+ metastatic breast cancer patients. This was followed by approval in January 2021 for adults with metastatic HER2+ gastric or gastroesophageal junction (GEJ) adenocarcinoma who had received a trastuzumab-based treatment.

Further, in August 2022, it received approval for HER2-low breast cancer in patients with advanced disease who had prior chemotherapy, as well as for unresectable or metastatic non-small cell lung cancer (NSCLC) with HER2 mutations, after previous systemic therapy. Later in April 2024, the FDA approved it for HER2+ solid tumors in adults who had received prior systemic therapy and had no satisfactory alternative treatment options.

ENHERTU Dosing, Variable Cost of therapy, and Sales performance

ENHERTU is administered as an intravenous infusion once every 3 weeks. Due to its variation in dose, its lower per-dose strength may seem cost-effective initially, but often requires more vials per patient, increasing overall drug use and treatment costs. This impacts healthcare budgeting, reimbursement, and inventory planning.

The Average Cost of Therapy for ENHERTU varies significantly across indications, based on median progression-free survival (PFS). Within the United States, in HER2-mutant second-line NSCLC, treatment costs is approximately 165,000 based on a median PFS of 9.9 months, whereas for HER2-low breast cancer, an annual cost of therapy has been assumed considering a median PFS of 10.1 and 13.2 months based on data from DESTINY BREAST-04 and DESTINY BREAST-06 respectively. Contrary to dosing in other indications, for HER2+ gastric cancer, slightly higher dosing of 6.4mg/kg has been recommended based on the FDA label.

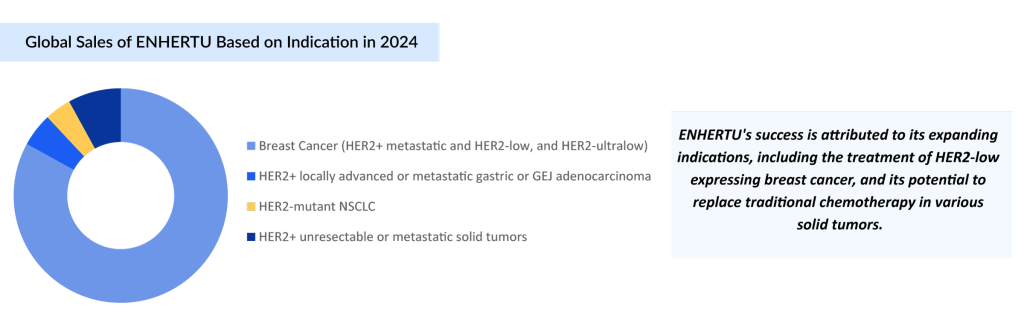

As per Daiichi, breast cancer contributes to about 85% of ENHERTU’s total net revenue, but its use in other types of cancer is steadily growing, creating new opportunities for both treatment and sales.

Notably, ENHERTU’s combined sales surpassed the USD 1 billion mark in 2022, reaching approximately USD 1.2 billion. This momentum continued, with sales more than doubling to USD 2.5 billion in 2023. In FY 2024, combined revenues reported by Daiichi Sankyo and AstraZeneca exceeded USD 3.5 billion, marking an impressive year-over-year growth of around 40% compared to FY 2023. Furthermore, the market for ENHERTU is expected to grow exponentially in the coming years.

Breast cancer continues to be the primary source of revenue for ENHERTU, largely due to the high prevalence of the disease and its expanded approval based on HER2 expression in multiple subtypes. The combination of broad clinical utility, growing physician familiarity, and established reimbursement frameworks in major markets such as the US, Europe, and Japan has made breast cancer the largest contributor to ENHERTU’s commercial success.

It is worth highlighting that ENHERTU’s patent is set to expire in the US in 2033 and between 2033 and 2035 in Europe, which could lead to increased competition from generic versions and potentially reduced market exclusivity and revenue for the developers.

Upcoming Trials and Expectations in 2025

Although ENHERTU is approved for HER2-mutant NSCLC, researchers are now testing it as a first-line treatment in this group through a Phase III trial (DESTINY-Lung04), with results expected in the second half of 2025, and another Phase Ib trial (DESTINY-Lung03) for first-line treatment of patients with advanced or metastatic non-squamous NSCLC and HER2 overexpression, with results expected in 2026. At this point, no other company is developing an ADC for late-stage HER2-mutated NSCLC. With fewer competitors, ENHERTU will have an edge in the coming years, as other companies focus on developing tyrosine kinase inhibitors.

Furthermore, ENHERTU is being evaluated as monotherapy or in combination with anti-cancer agents in a Phase II study (DESTINY-PanTumor03), with results expected in 2H 2025 for HER2-expressing tumors, excluding breast and gastric cancers.

It’s worth noting that ENHERTU’s Phase II trial (DESTINY-PanTumor02) has received multiple regulatory designations, including Accelerated Approval, Breakthrough Therapy, PRIME, Sakigake, and Priority Review, for a range of HER2-expressing tumors such as bladder, biliary tract, cervical, endometrial, ovarian, pancreatic cancers, rare tumors, and others, excluding breast, gastric, and colorectal cancers. The study is expected to be completed by July 2027.

Despite side effects such as interstitial lung disease (ILD), ENHERTU remains at the forefront of the HER2-targeted therapy landscape, benefiting from strong clinical efficacy, multiple regulatory approvals, and an expanding range of indications. Within the emerging HER2-low segment, multiple therapies such as Duality Biologics/BioNTech’s DB-1303/BNT323, Immutep’s Eftilagimod alpha, Daiichi Sankyo/Merck’s Ifinatamab deruxtecan, Bliss Biopharmaceutical’s BB-1701, Zymeworks/Jazz Pharmaceuticals’ Zanidatamab, Dragonfly Therapeutics’ DF1001, and RemeGen/Pfizer (Seagen) are being evaluated in late and mid-stage trials in various indications (breast cancer, gastric cancer, urothelial cancer, NSCLC, and others) expressing HER2-low.

Conclusion

Looking ahead, ENHERTU is poised to significantly broaden its clinical impact as it continues to demonstrate efficacy across a range of HER2-expressing cancers. With multiple early-, mid-, and late-stage trials underway in lung, colorectal, biliary, and other solid tumors, the drug’s role is expanding well beyond its current indications. ENHERTU’s first-mover advantage, expanding tumor-agnostic applications, and robust clinical pipeline position it strongly against future entrants.

As precision oncology continues to evolve, ENHERTU is well-placed to retain a leadership role in redefining treatment standards for HER2-expressing cancers. Looking forward, in the next three years, ENHERTU is positioned to become one of the most successful breast cancer drugs ever.

Downloads

Article in PDF

Recent Articles

- How CDK4/6 Inhibitors Are Changing the Cancer Treatment Paradigm?

- Eli Lilly’s Jaypirca Approval; Novartis’ Adakveo EMA Review; Janssen’s CARTITUDE-4 Study of CARVY...

- Immuno-Oncology (I-O) Therapeutics: The Key to Future Cancer Treatment

- A helping hand in treatment of CRC

- Bristol-Myers Squibb’s Opdivo Approval; Mirati’s KRAS-inhibitor Adagrasib; J&J and Legend Bi...