Limited Availability and Lack of Access are Unlikely to Hinder the Billion-Dollar Alpha-1 Antitrypsin Deficiency (AATD) Treatment Market

Oct 21, 2022

In the 21st century, public health has yielded major advances in understanding and managing diseases. Sometimes, early diagnosis remains crucial in managing and treating a serious condition. One such rare genetic disorder, alpha-1 antitrypsin deficiency (AATD), has witnessed improvements concerning awareness and considerations during treatment.

AATD is an inherited condition in which levels of protective enzyme inhibitor—alpha 1 antitrypsin get lowered, leading to lung damage and signifying loss of function. The other pathophysiology leads to misfolding of AAT protein (gain-of-function), contributing to increased proteolytic stress in the liver and less AAT. Being a genetic disorder, individuals who inherit two copies of this faulty gene are at a heightened risk of developing various comorbidities. According to published medical literature, about 80% of the affected individuals develop lung disease.

According to the DelveInsight assessment, the total prevalent patient population of alpha-1 antitrypsin deficiency in the 7MM countries was nearly 190K cases in 2021. As per the estimates, the US had the highest prevalent patient population of AATD in 2021.

Downloads

Click Here To Get the Article in PDF

Recent Articles

However, optimization in diagnosis and management and improvement in access to intravenous alpha-1 antitrypsin therapy (the only available treatment regime) remains unsettled.

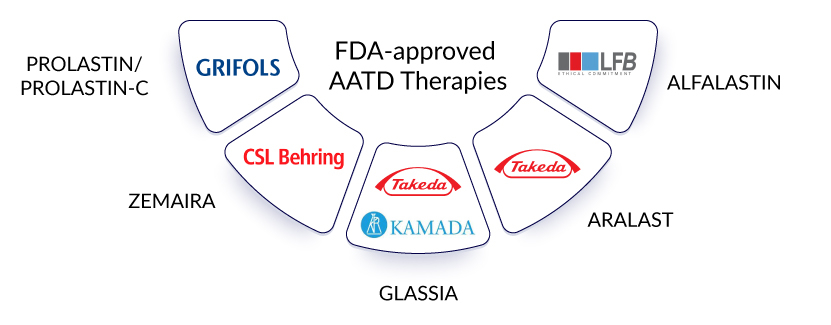

Currently, the alpha-1 antitrypsin deficiency treatment market revolves around using alpha-1 antitrypsin augmentation therapy. This refers to garnering normal AAT from blood plasma and its infusion. Some currently marketed alpha-1 antitrypsin augmentation therapy includes the use of PROLASTIN/PROLASTIN-C (Grifols), ZEMAIRA (CSL Behring), GLASSIA (Kamada/Takeda), ARALAST (Takeda), and ALFALASTIN (LFB Biotechnologies). These alpha-1 antitrypsin deficiency drugs are not approved globally, yet somehow, that does not seem to hinder a billion-dollar alpha-1 antitrypsin deficiency treatment market as they are highly-priced. Grifols is the dominant player in the US and some major European countries.

Further, Grifols received PMDA approval for its drug LYNSPAD for alpha-1 antitrypsin deficiency treatment in 2021. Similarly, RESPREEZA (marketed as ZEMAIRA ex-EU) is the only alpha-1 antitrypsin therapy approved throughout Europe. In the United Kingdom, RESPREEZA was licensed in 2015, but a patient can only receive the drug if NHS agrees to pay for it. Currently, in the United Kingdom, NICE does not recommend any specific alpha-1 antitrypsin deficiency treatment, with the idea of slowing down progression based on the guidelines for related comorbidities.

This limited availability of these therapies results from high prices and a lack of uniform reimbursement. Within Europe, 60% of patients in France and Germany receive alpha-1 antitrypsin therapy (the highest proportion), while only 20% receive treatment with AAT in Spain. Similarly, 60% of the practitioners in Japan would recommend an alpha-1 antitrypsin therapy to their patients if reimbursed. These challenges confine the prioritization of alpha-1 antitrypsin deficiency testing among countries with no approvals, thus, making AATD an underdiagnosed and undertreated genetic predisposition of comorbidities like COPD, emphysema, or liver disease.

The future of the AATD market looks promising

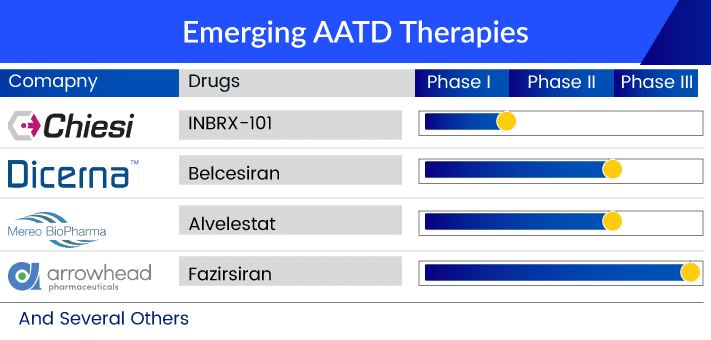

Despite the challenges mentioned above and slow progress, the emerging landscape of the alpha-1 antitrypsin deficiency treatment market looks promising, with the emerging therapies, although limited, having substantial potential. Among them, Arrowhead’s fazirsiran is in the pole position. RNAi approaches are the most advanced, with a prime focus on liver problems caused by AATD. The area is currently managed by off-label alpha-1 antitrypsin deficiency therapies. Fazirsiran knocks down the production of Z-AAT protein, thus, preventing severe AATD. This also explains the interest of the Japanese company Takeda in these products to mark its presence in this high-priced alpha-1 antitrypsin deficiency treatment market. Gearing up for this race, the next therapy on the list is Dicerna’s belcesiran. The company’s proprietary GalXC technology targets SERPINA1, reducing the production of abnormal AAT in the liver. The bigger Phase II alpha-1 antitrypsin deficiency clinical trials with the Estrella study have already begun, but clear safety and efficacy results are awaited.

Kamada’s inhaled AAT is another therapy being investigated for AATD-associated lung disease. Existing alpha-1 antitrypsin deficiency treatments require weekly intravenous (IV) infusions. Kamada believes that its inhalation formulation will increase patients’ convenience and reduce/replace IV infusions of AAT therapy, reducing medical costs. Likewise, Mereo Biopharma’s Alvelestat is an oral drug being developed for severe AATD lung disease. Further, the early stage of clinical development includes Inbrix-101 and some gene therapies. Inbrix-101 is a modified recombinant version of human alpha-1 antitrypsin (AAT), which offers enhanced efficacy and less frequent dosing for AATD-affected individuals. The drug is being developed by Inbrix, in agreement with Chiesi Farmaceutici, and offers solutions for lung and liver problems in AATD. However, the presence of bigger players like CSL and Grifols would be a challenge.

As per Delveinsight’s analysis, the alpha-1 antitrypsin deficiency market is expected to reach ~USD 3 billion by 2032.

Despite the promising alpha-1 antitrypsin deficiency pipeline, the aforementioned challenges cannot be ignored. However, new patient-centric initiatives have been established in Europe with the European Reference Network for Rare Lung Diseases (ERN-LUNG) and the European Alpha-1 Research Collaboration (EARCO) aiming to address these issues. ERN- LUNG’s objective is to set up quality control for AATD laboratories along with a disease management program. At the same time, EARCO aims to create a pan-European registry to understand the natural history and support, manage, and promote easy access to alpha-1 antitrypsin deficiency treatment modalities. Given these initiatives, it is likely that most of the concerns surrounding alpha-1 antitrypsin deficiency treatment and management might be addressed in the near future.

FAQs

AATD is an inherited condition in which levels of protective enzyme inhibitor—alpha 1 antitrypsin get lowered, leading to lung damage and signifying loss of function. The other pathophysiology leads to misfolding of AAT protein (gain-of-function), contributing to increased proteolytic stress in the liver and less AAT.

2. What are the symptoms of alpha-1 antitrypsin deficiency?

Shortness of breath, excessive cough with phlegm/sputum production, wheezing, decreased exercise capacity, and a persistent low-energy state are all AATD symptoms associated with lung disease. Tiredness, loss of appetite, weight loss, swelling of the feet or belly, yellowish discoloration of the skin (jaundice) or the white part of the eyes, vomiting of blood, or blood in stools are all alpha-1 antitrypsin deficiency symptoms.

Variants (also known as mutations) in the SERPINA1 gene are the prominent reason among the alpha-1 antitrypsin deficiency causes. This gene codes for a protein called alpha-1 antitrypsin, which protects the body from a powerful enzyme called neutrophil elastase.

Early detection of AATD is critical because some people will qualify for alpha-1 antitrypsin augmentation therapy and benefit from lifestyle changes. Imaging and biopsies are used to investigate liver and lung diseases. Low serum A1AT concentrations and molecular genetic testing are used to confirm the alpha-1 antitrypsin deficiency diagnosis.

Currently, the AATD treatment market revolves around using alpha-1 antitrypsin augmentation therapy. This refers to garnering normal AAT from blood plasma and its infusion. Some currently marketed alpha-1 antitrypsin augmentation therapy includes the use of PROLASTIN/PROLASTIN-C (Grifols), ZEMAIRA (CSL Behring), GLASSIA (Kamada/Takeda), ARALAST (Takeda), and ALFALASTIN (LFB Biotechnologies).

Leading companies proactively working in the alpha-1 antitrypsin deficiency treatment market include Arrow Head Pharmaceuticals, Mereo Biopharma, Kamada Ltd, Grifols, CSL Behring, Shire, LFB Biotechnologies, among others.

Downloads

Article in PDF

Recent Articles

- Antitrypsin Deficiency Pipeline

- Alpha-1 Antitrypsin Deficiency: Symptoms, Treatments and Key Companies in the Market

- Sanofi’s Qfitlia Becomes First FDA-Approved Therapy for Hemophilia A or B; FDA Approves AstraZene...

- Eli Lilly’s ZEPBOUND Surpasses WEGOVY in SURMOUNT-5 Trial; Verastem Oncology Secures FDA Approval...

- CHMP Reviews Takeda’s Qdenga; FDA Sets Date for Gilead’ Trodelvy Review; Odyssey’s Announce...