Polycythemia Vera: Growing Competition and the Changing Treatment Landscape in 2025

Jul 10, 2025

Table of Contents

JAKAFI’s demand continues to grow in Polycythemia Vera

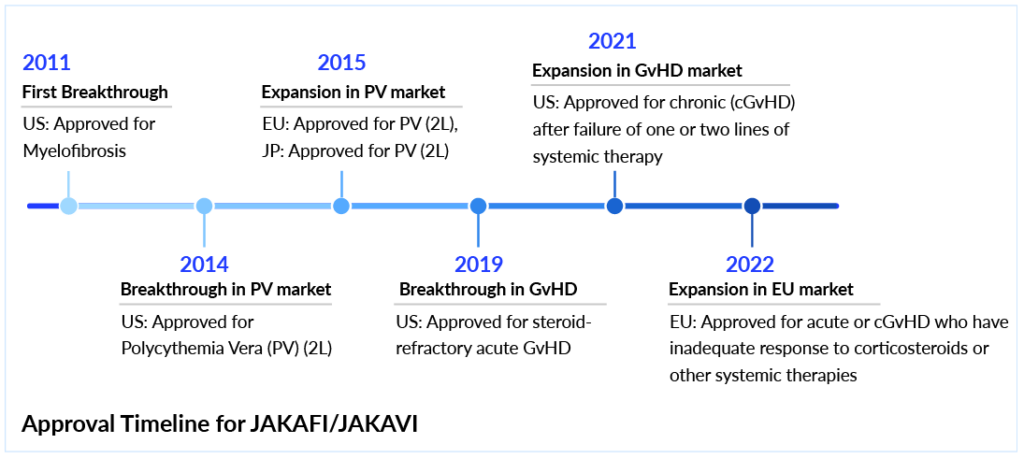

The therapeutic paradigm for polycythemia vera treatment has evolved notably in recent years. Historically managed with generics like aspirin, hydroxyurea, phlebotomy, and interferons, the landscape shifted dramatically with the FDA approval of JAKAFI (ruxolitinib) in 2014 as a second-line option. Developed by Incyte, JAKAFI remains a cornerstone in polycythemia vera treatment, particularly when hydroxyurea is ineffective or poorly tolerated. Another major advancement occurred in 2021 with the U.S. approval of BESREMi (ropeginterferon alfa-2b) as a first-line monotherapy for polycythemia vera. The ongoing BESREMi vs JAKAFI discussion is drawing attention in the polycythemia vera interferon therapeutics market, especially as more clinicians consider long-term efficacy, tolerability, and the cost of BESREMi compared to JAKAFI.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- The Dynamic Landscape of Myelofibrosis Treatment: A 2024 Perspective

- FDA Approves Eisai & Biogen’s LEQEMBI IQLIK for Maintenance Treatment of Early Alzheimer’s; T...

- Incyte’s Clinical Trial for Myelofibrosis; Eisai and Bioge’s Leqembi; FDA Approves Reata Pharmace...

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

- MorphoSys, Incyte receive FDA Ok for Monjuvi; Siemens Healthineers set to buy Varian; ImmunicR...

Incyte has strongly positioned JAKAFI not only in PV but across a broader spectrum of indications, including myelofibrosis and both acute and chronic GvHD. Globally, JAKAFI is marketed as JAKAVI by Novartis in the EU and Japan. A supplemental NDA for a ruxolitinib cream formulation in pediatric atopic dermatitis is under FDA review, with a potential approval expected by H2 2025. In Q3 2024, Incyte reported USD 741 million in revenue (+16% Y/Y), raising full-year guidance to USD 2.74–2.77 billion. Of that, roughly 35% of JAKAFI prescriptions were in polycythemia vera, highlighting its stronghold as a second-line therapy.

However, ruxolitinib patent expiration in 2028 is expected to open the door for generics and alternatives, including rusfertide, a novel hepcidin mimetic. Despite rusfertide’s FDA approval being awaited, its entry into the market is anticipated to impact JAKAFI’s PV revenues, which are expected to peak near USD 1.3 billion by 2026 before dropping by over 50% post-patent expiry.

JAKAFI’s Generics: Possible Delay in Entry?

The upcoming ruxolitinib patent expiration date in mid-2028 poses a major threat to JAKAFI’s long-standing dominance in the polycythemia vera treatment market. In response, Incyte has launched the LIMBER (Leadership in MPNs and GVHD BEyond Ruxolitinib) initiative—an ambitious life-cycle management strategy aimed at extending the therapeutic utility of JAKAFI and delaying the introduction of ruxolitinib generics. The LIMBER program is currently focused on advancing a once-daily ruxolitinib formulation, and exploring novel ruxolitinib-based combinations with innovative targets such as PI3K, BET, and ALK2, along with emerging treatments like mutant CALR inhibitors. If successful, this could effectively extend JAKAFI’s market exclusivity, delaying the competitive pressure from ruxolitinib generic versions.

Looking ahead, it will be critical to monitor how JAKAFI maintains its position, especially with BESREMi gaining ground in the polycythemia vera interferon therapeutics market and rusfertide emerging as a future contender pending FDA approval. As stakeholders weigh the therapeutic profiles, tolerability, and costs of BESREMi vs JAKAFI, or the potential of rusfertide, the PV market is poised for significant shifts in treatment patterns and market share dynamics.

PharmaEssentia’s new Entrant, Entry Into NCCN Guidelines, Insights on Pricing, and Launches

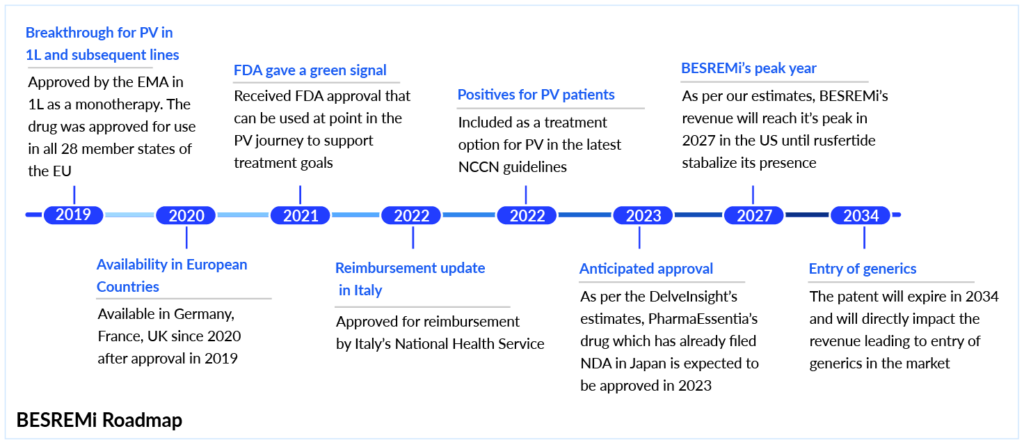

PharmaEssentia’s BESREMi (ropeginterferon alfa-2b) is a novel interferon-based therapy and the first approved first-line treatment for polycythemia vera patients without symptomatic splenomegaly. This monopegylated proline interferon has changed the polycythemia vera treatment landscape with its unique dosing regimen and favorable safety profile. Gaining FDA approval in Q4 2021, BESREMi polycythemia vera sales in the US began in 2022. Prior to that, it had already received approval in the EU (2019) and became available in countries like Germany, France, and the UK by 2020. In 2022, Italy’s National Health Service approved its reimbursement, followed by approvals in Japan (2023), and in Canada and Malaysia in 2024. To date, the drug has received approval in nearly 40 countries, and its footprint in the polycythemia vera market continues to grow.

Administered subcutaneously via a self-injectable pen once every two weeks or monthly, BESREMi’s annual cost in the US exceeds USD 180,000, while the besremi cost in some European countries ranges between USD 60,000–110,000. Compared to other treatments, the besremi vs jakafi debate continues to evolve. While BESREMi is not a direct substitute for JAKAFI, its upstream placement in NCCN guidelines could delay patient progression to JAKAFI, potentially impacting JAKAFI revenue.

What sets BESREMi apart is its robust 7.5-year efficacy data, broad label (first and subsequent lines), and infrequent dosing, all of which position it strongly against older interferon therapies and newer entrants. Its besremi polycythemia vera label and growing adoption could offer at least a 5-year market lead over emerging therapies like rusfertide, which is still awaiting FDA approval. With its patent expiration set for 2034, BESREMi is poised to play a major role in shaping the PV space before generics enter. Further expansion in global markets, potential indication extensions, and the launch of improved delivery systems, like the pen injector, are expected to fuel BESREMi’s growth through 2027 and beyond.

Protagonist Therapeutics’ Rusfertide is a Potential Therapy for Polycythemia Vera Patients

Rusfertide offers a novel approach in the evolving polycythemia vera treatment landscape. As a self-administered injectable therapy, rusfertide mimics the activity of the natural hepcidin hormone, effectively regulating red blood cell production and significantly reducing the need for routine phlebotomy, which remains a major burden in current clinical practice. This convenience could translate into improved patient compliance and quality of life. The drug is being co-developed by Protagonist Therapeutics and Takeda, with a 50:50 profit share in the U.S., while Takeda holds exclusive ex-U.S. commercialization rights. The global push is evident, as Takeda leads the commercialization strategy outside the U.S., positioning rusfertide for wide market impact.

Promising data from the Phase II REVIVE study demonstrated that rusfertide, when added to therapeutic phlebotomy (with or without cytoreductive agents), maintained hematocrit levels below 45% for over three years, highlighting its potential for durable disease control. The ongoing Phase III VERIFY trial is expected to deliver topline results in Q1 2025, followed by an NDA submission in Q4 2025. If all goes as planned, rusfertide FDA approval could arrive by late 2026, with commercial launch in 2027. Given its distinct mechanism of action compared to JAKAFI and BESREMi, and a potentially more favorable rusfertide side effect profile, the drug could emerge as an earlier-line option and a potential new standard of care. Its impact could be especially strong among patients poorly tolerant to JAK inhibitors. As a result, rusfertide is poised to redefine the polycythemia vera market, potentially challenging existing therapies with its differentiated efficacy, safety, and convenience profile.

Earlier Withdrawal of Breakthrough Therapy Designation (BTD)

Despite its promising clinical trajectory, rusfertide faced regulatory headwinds. In the second half of 2021, the US FDA placed a full clinical hold on the program after an animal study revealed rusfertide side effects, including benign and malignant skin tumors in mice. However, the hold was lifted shortly after Protagonist Therapeutics submitted detailed individual patient safety data. The challenges continued into early 2022, when the FDA issued a letter signaling its intent to revoke Breakthrough Therapy Designation for rusfertide in polycythemia vera. In response, the company voluntarily withdrew the BTD, citing strategic considerations and internal assessments regarding its value in Phase III development and beyond. Despite these setbacks, rusfertide remains a strong contender in the polycythemia vera pipeline, with Phase III data expected in 2025 and potential FDA approval anticipated by late 2026.

Looking ahead, the polycythemia vera market is poised for notable evolution and expansion over the next few years. Currently led by JAKAFI and BESREMi, two approved therapies addressing second-line and first-line PV patients respectively, the space is expected to welcome rusfertide as a third major entrant. With approximately 60–70% of PV patients experiencing symptomatic disease and receiving a formal diagnosis, the entry of safer and more targeted therapies could significantly drive market growth. In addition to Protagonist Therapeutics, other players aiming to reshape the PV landscape include Italfarmaco, Ionis Pharmaceuticals, Merck, Silence Therapeutics, and others, signaling an increasingly competitive and innovation-driven pipeline in the years ahead.

FAQs

Incyte has strongly positioned JAKAFI not only in polycythemia vera but across a broader spectrum of indications, including myelofibrosis and both acute and chronic GvHD. Globally, JAKAFI is marketed as JAKAVI by Novartis in the EU and Japan. A supplemental NDA for a ruxolitinib cream formulation in pediatric atopic dermatitis is under FDA review, with a potential approval expected by H2 2025.

The upcoming ruxolitinib patent expiration date in mid-2028 poses a significant threat to JAKAFI’s long-standing dominance in the polycythemia vera treatment market. In response, Incyte has launched the LIMBER (Leadership in MPNs and GVHD BEyond Ruxolitinib) initiative—an ambitious life-cycle management strategy aimed at extending the therapeutic utility of JAKAFI and delaying the introduction of ruxolitinib generics.

JAKAFI remains a cornerstone in polycythemia vera treatment, particularly when hydroxyurea is ineffective or poorly tolerated. Another significant advancement occurred in 2021 with the U.S. approval of BESREMi as a first-line monotherapy for polycythemia vera. The ongoing BESREMi vs JAKAFI discussion is drawing attention in the polycythemia vera interferon therapeutics market, especially as more clinicians consider long-term efficacy, tolerability, and the cost of BESREMi compared to JAKAFI.

Key companies aiming to reshape the PV landscape include Protagonist Therapeutics, Italfarmaco, Ionis Pharmaceuticals, Merck, Silence Therapeutics, and others, signaling an increasingly competitive and innovation-driven pipeline in the years ahead.

Downloads

Article in PDF

Recent Articles

- The Dynamic Landscape of Myelofibrosis Treatment: A 2024 Perspective

- MorphoSys, Incyte receive FDA Ok for Monjuvi; Siemens Healthineers set to buy Varian; ImmunicR...

- FDA Approves Eisai & Biogen’s LEQEMBI IQLIK for Maintenance Treatment of Early Alzheimer’s; T...

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prim...