Biliary Tract Cancer: Emerging Players in the Market Transforming the Treatment Landscape

Nov 20, 2020

Table of Contents

Summary

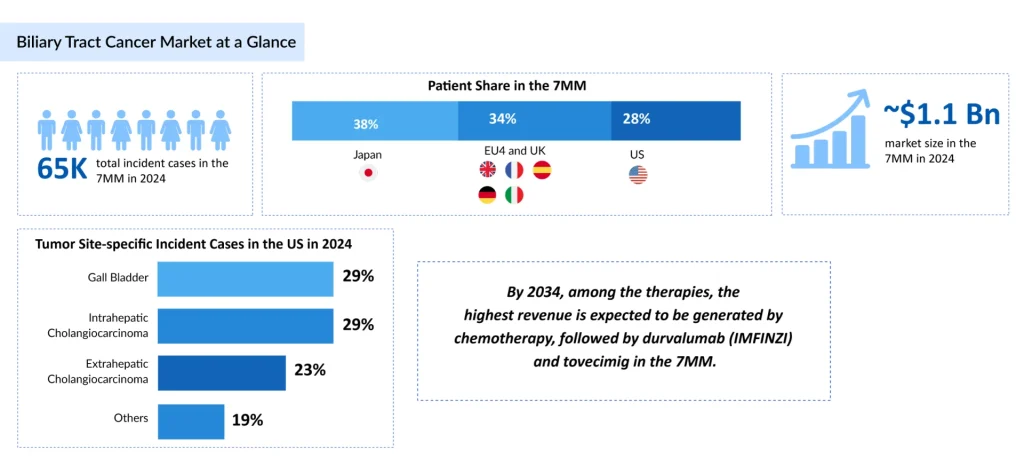

- BTC (including cholangiocarcinoma and gallbladder cancer) is a challenging malignancy with rising global incidence, especially in Asia and Latin America, driven by risk factors like chronic inflammation and liver flukes; ~65,000 incident cases in 7MM in 2024, projected to grow by 2034, with highest cases in ≥80 age group and TP53 mutations dominant.

- Limited curative surgery due to late diagnosis; platinum-based chemo as backbone for advanced disease, now enhanced by first-line immunotherapies like pembrolizumab (KEYTRUDA) + chemo and durvalumab (IMFINZI) + gem/cisplatin; targeted approvals include FGFR inhibitors (pemigatinib, futibatinib), IDH1 inhibitor (ivosidenib).

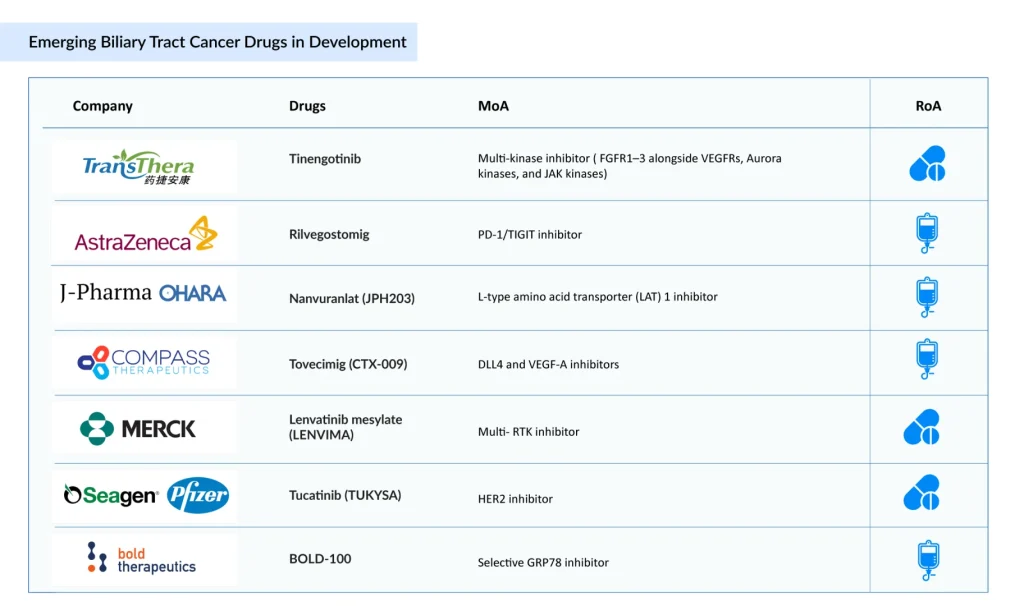

- Precision options target FGFR2, IDH1, BRAF, NTRK, HER2, MSI-H; key pipeline agents include tinengotinib (multi-kinase for FGFR-altered CCA, PhIII), rilvegostomig (PD-1/TIGIT bispecific, PhIII), CTX-009 (DLL4/VEGF-A bispecific), silmitasertib (CK2 inhibitor + chemo, PhIII planned), plus others like lenvatinib, tucatinib, and ADCs.

- 7MM market ~USD 1.1B in 2024, growing through 2034; chemo share drops from 70% to 35-40%, with emerging therapies (e.g., IMFINZI, tovecimig) capturing >50%; driven by biomarker-guided shifts, bispecifics, and unmet needs in non-actionable cases.

Biliary tract cancer (BTC) represents one of the most challenging oncological malignancies, yet recent therapeutic innovations are fundamentally reshaping clinical practice and patient outcomes. Encompassing cholangiocarcinoma (CCA) and gallbladder cancer (GBC), BTC has historically been characterized by late-stage diagnosis, limited treatment options, and poor prognosis. However, the emergence of precision medicine, immunotherapy combinations, and bispecific antibodies is creating unprecedented opportunities for patients previously facing limited therapeutic alternatives.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Gastrointestinal Cancers: Exploring the Range of Digestive Tract Malignancies

- AstraZeneca’s Imfinzi for Biliary Tract Cancer; FDA Clears Boehringer’s Spesolimab; Novo Nordisk ...

- New Asundexian Phase III Study Result; Zibotentan/Dapagliflozin Combination Demonstrated Signific...

- Gilead Sciences’ Sunlenca Approval; FDA Approves Roche’s CD20xCD3 Bispecific Antibody Lunsumio; E...

- Eisai Submits Marketing Authorization Application for Tasurgratinib; CHMP Issues Positive Opinion...

Biliary Tract Cancer: Disease Burden and Clinical Significance

BTC presents a significant public health challenge. Globally, the incidence of BTC is rising, particularly in parts of Asia and Latin America, driven by risk factors such as chronic biliary inflammation, liver fluke infections, primary sclerosing cholangitis, hepatolithiasis, and gallstone disease. Most patients present with advanced or metastatic disease, as early-stage BTC is often asymptomatic or associated with nonspecific clinical features, leading to poor overall prognosis.

In 2024, the total Incident cases of BTC across the 7MM were approximately 65,000, and this burden is projected to rise by 2034. Among the 7MM, as far as age-specific cases are concerned, ≥ 80 years age group accounted for the highest number of cases in 2024. As per mutation-specific cases of BTC, it was observed that TP53 mutations accounted for the highest number of cases in 2024 across the 7MM.

Despite advances in imaging and molecular characterization, curative surgery remains feasible for only a small subset of patients, and systemic therapies offer modest survival benefits. Consequently, BTC is associated with high mortality rates, substantial healthcare utilization, and significant unmet clinical needs, underscoring its growing clinical significance and the urgent need for more effective diagnostic and therapeutic strategies.

Current Biliary Tract Cancer Treatment Paradigm: The Foundation

Therapeutic management of biliary tract cancer is largely determined by disease stage and anatomical subtype. Although early-stage disease may be amenable to surgical resection, curative intent is feasible for only a small proportion of patients due to frequent late diagnosis. Moreover, high post-resection recurrence rates necessitate adjuvant systemic therapy, underscoring the limited durability of surgery alone. In unresectable or metastatic BTC, first-line chemotherapy remains the standard of care but delivers modest and short-lived benefit, with rapid disease progression contributing to high treatment attrition and restricted access to later lines of therapy.

From a treatment landscape and innovation perspective, BTC, particularly intrahepatic cholangiocarcinoma (iCCA), has experienced a paradigm shift with the adoption of routine molecular profiling. The identification of actionable genomic alterations has enabled the development of targeted therapies for defined patient subsets, resulting in improved outcomes compared with historical benchmarks.

Platinum-based combination chemotherapy has long served as the backbone of systemic treatment for advanced or unresectable BTC across the 7MM, forming the foundation upon which newer regimens have been introduced. More recently, immunotherapy has been integrated into first-line BTC treatment. Pembrolizumab (KEYTRUDA), an anti-PD-1 antibody, has been approved in combination with platinum-based chemotherapy for locally advanced unresectable or metastatic BTC. Similarly, durvalumab (IMFINZI), a PD-L1 inhibitor, in combination with gemcitabine and platinum chemotherapy, is established as a first-line immunochemotherapy option in major regulatory markets.

Regulatory approvals have also expanded targeted therapy options in BTC. FGFR inhibitors such as pemigatinib (PEMAZYRE) and futibatinib (LYTGOBI) are approved for FGFR2 fusion–positive cholangiocarcinoma, while the IDH1 inhibitor ivosidenib (TIBSOVO) is approved for previously treated IDH1-mutated disease.

Despite these advances, a substantial unmet need persists, particularly among patients who lack actionable molecular alterations. Looking ahead, the treatment landscape is expected to evolve over the next 3–5 years with the emergence of bispecific antibodies and antibody–drug conjugates (ADCs), although challenges related to biomarker testing, patient selection, and toxicity management remain.

Emerging Players Transforming the BTC Treatment Landscape

In recent years, precision oncology has substantially transformed the management of advanced BTC. The emergence of targeted therapies addressing FGFR2 fusions, IDH1 mutations, BRAF V600E mutations, NTRK fusions, HER2 amplifications, and microsatellite instability–high (MSI-H) disease has enabled more individualized treatment strategies. These developments have been especially influential in intrahepatic cholangiocarcinoma, where actionable genomic alterations are more prevalent, signaling a transition from empiric chemotherapy to biomarker-guided therapeutic approaches in select patient populations.

Some of the BTC drugs in the clinical trials include Tinengotinib (TransThera Sciences), Rilvegostomig (AstraZeneca), Nanvuranlat (JPH203) (J-Pharma/OHARA Pharmaceutical), Tovecimig (CTX-009) (Compass Therapeutics), Lenvatinib mesylate (LENVIMA) (Merck/Eisai), Tucatinib (TUKYSA) (Seagen/Pfizer), BOLD-100 (Bold Therapeutics), Silmitasertib (CX-4945) (Senhwa Biosciences), VG161 (Virogin Biotech), RP3-003 (Replimune), Sevabertinib (BAY 2927088) (Bayer), Opaganib (ABC294640) (RedHill Biopharma), Lirafugratinib (RLY-4008) (Relay Therapeutics/Elevar Therapeutics), Olomorasib (LY3537982) (Eli Lilly), CGT4859 (Cogent Biosciences), MT-4561 (Tanabe Pharma America), and others.

TransThera Sciences’ Tinengotinib is an investigational oral multi-kinase inhibitor being advanced for the treatment of cholangiocarcinoma, particularly in patients with FGFR-altered disease who have progressed following prior therapies. In contrast to first-generation selective FGFR inhibitors, tinengotinib inhibits FGFR1–3 as well as VEGFRs, Aurora kinases, and JAK kinases, offering broader suppression of tumor growth, angiogenesis, and resistance pathways. The agent is currently being evaluated in a global Phase III clinical trial in patients with cholangiocarcinoma.

AstraZeneca and Compugen’s Rilvegostomig is a first-in-class dual-checkpoint bispecific antibody designed to simultaneously block PD-1 and TIGIT on the same immune effector cell, thereby restoring antitumor immune responses and supporting the potential for durable clinical benefit. Its TIGIT-targeting domain is derived from Compugen’s wholly owned COM902, one of only two Fc-reduced anti-TIGIT monoclonal antibodies currently in clinical development. Rilvegostomig is currently being assessed across multiple Phase III trials in patients with biliary tract cancers (BTC).

Compass Therapeutics’ CTX-009 is a bispecific antibody that simultaneously inhibits Delta-like ligand 4/Notch (DLL4) and vascular endothelial growth factor A (VEGF-A) signaling, two key pathways involved in angiogenesis and tumor vascularization. Preclinical and early-stage clinical studies indicate that dual pathway inhibition with CTX-009 delivers strong antitumor activity across multiple solid tumors, including colorectal, gastric, cholangiocarcinoma, pancreatic, and non-small cell lung cancers. Partial responses have been reported with CTX-009 monotherapy in heavily pretreated patients who were refractory to approved anti-VEGF therapies.

Senhwa Biosciences’ Silmitasertib (CX-4945) is a synthetically derived, orally administered small-molecule CK2 (casein kinase 2) inhibitor formulated as a sodium salt in hard gelatin capsules. CK2 is frequently overactive in cancer and plays a critical role in DNA damage repair, enabling tumor cell survival following chemotherapy-induced injury. Inhibition of DNA repair pathways has been shown to enhance the effectiveness of DNA-damaging chemotherapeutic agents when used in combination.

In patients with locally advanced or metastatic cholangiocarcinoma (CCA), silmitasertib in combination with gemcitabine and cisplatin has demonstrated encouraging preliminary efficacy. Based on results from a Phase Ib/II study, a randomized Phase III trial is planned.

The anticipated launch of these emerging therapies are poised to transform the biliary tract cancer market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the biliary tract cancer market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

Future BTC Treatment Outlook

The biliary tract cancer treatment landscape is undergoing a fundamental transformation driven by emerging pharmaceutical players introducing precision medicine, bispecific antibodies, and optimized immunotherapy combinations. PEMAZYRE, IMFINZI, KEYTRUDA, tovecimig, zanidatamab, and next-generation FGFR2 inhibitors represent tangible evidence of therapeutic progress, yet substantial unmet medical needs persist.

The total market size of BTC in the 7MM was approximately USD 1.1 billion in 2024 and is projected to increase during the forecast period (2025–2034). As per DelveInsight’s analysis, by 2034, among the therapies, the highest revenue is expected to be generated by chemotherapy, followed by durvalumab (IMFINZI) and tovecimig in the 7MM.

By 2034, emerging players are projected to capture >50% of the BTC market, with chemotherapy declining from 70% to 35-40% BTC market share. This paradigm shift reflects both scientific progress in understanding BTC molecular heterogeneity and clinical evidence demonstrating superior outcomes with targeted and immunotherapy approaches.

In summary, the convergence of scientific understanding, therapeutic innovation, and regulatory support has established BTC as an emerging oncology market with sustained growth potential through 2034 and beyond.

Downloads

Article in PDF

Recent Articles

- Merck’s WINREVAIR Granted FDA Priority Review for Pulmonary Arterial Hypertension; KalVista’s EKT...

- New Asundexian Phase III Study Result; Zibotentan/Dapagliflozin Combination Demonstrated Signific...

- Eisai Submits Marketing Authorization Application for Tasurgratinib; CHMP Issues Positive Opinion...

- Another Feather in the Cap for Xtandi and Keytruda — The Two Main Cancer Drugs

- Gastrointestinal Cancers: Exploring the Range of Digestive Tract Malignancies