CELMoDs – A Worthy Successor to REVLIMID?

Jul 25, 2024

Table of Contents

Over the years, REVLIMID has become an integral weapon in the cancer therapeutics armory. This odyssey of REVLIMID in the multiple myeloma segment began in 2005, when it was approved by the US FDA for the treatment of adult patients with multiple myeloma, in combination with dexamethasone.

As the wise say, no journey is smooth. Even REVLIMID’s journey has had its fair share of lows, including high prices, limited accessibility, and the recent patent expiry. Despite these challenges, REVLIMID has turned out to be a major blockbuster in multiple myeloma and is still unbeaten to this day. But will REVLIMID remain unchallenged forever, or will it eventually meet its match one day? That remains to be seen.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Understanding High Risk Smoldering Multiple Myeloma: A Bridge Between MGUS and Multiple Myeloma

- Transforming Multiple Myeloma Treatment: The Promise of Novel Drug Classes

- Rare Cancer Market: A Global Crusade on what is a ‘less common cancer’?

- BMS Vs. Janssen: Which Company Will Dominate The Multiple Myeloma Treatment Market This Decade?

- AZ offloads; Pfizer’s deal; Takeda’s work on plant; Germany’s doc payment

Generic competition to REVLIMID

Generic competition is an unavoidable reality for pharmaceutical firms. Come 2022, the year of REVLIMID’s patent expiry, the drug started facing generic competition from the low-cost rivals Teva and Natco.

REVLIMID, a small molecule drug, has a 12-year patent exclusivity period. However, it took 16 years for REVLIMID’s generics to reach the multiple myeloma therapeutics market. One of the major reasons for this was the REMS program for REVLIMID. Celgene used the REMS program to limit its distribution due to the safety concerns associated with REVLIMID. As a result, it became difficult for generic manufacturers to get REVLIMID samples to seek FDA approval for their generic versions.

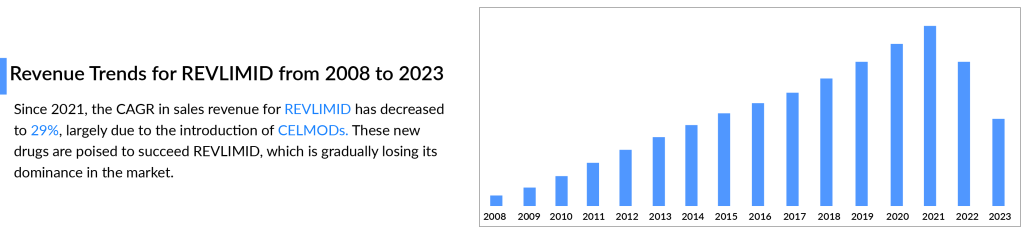

However, now that the patent has expired, BMS has experienced some hiccups. REVLIMID sales dropped from USD 12.8 billion in 2021 to USD 9.98 billion in 2022. The same pattern was observed in 2023, with US revenue declining by 37%, primarily due to generic erosion and a rise in the number of patients receiving free drug products from the Bristol Myers Squibb Patient Assistance Foundation, an independent 501(c)(3) entity supported by BMS donations. Additionally, lower average net selling prices contributed to this decrease.

Is REVLIMID’s game over? Will its legacy slowly diminish? Well, not yet. BMS is developing potential successors to REVLIMID to become the future cornerstone of multiple myeloma treatment.

The arrival of CELMODS and mechanistic differences between CELMODs and IMiDs

In 2021, BMS unveiled two future superstars, Iberdomide (CC-220) and Mezigdomide (CC-92480), colloquially known as the CELMODs (Cereblon E3 ligase modulator). They are not the same as other immunomodulatory medicines (IMiDs) like REVLIMID. While both IMiDs and CELMODs bind to cereblon, the known target for these classes of drugs differ in their mechanisms.Iberdomide binds to cereblon more tightly and has greater potency. The drug degrades Ikarose and Aiolos, which serve as anti-apoptotic transcription factors in multiple myeloma cells, with much greater potency than REVLIMID. The EC50 value is the testimony of the enhanced efficacy of Iberdomide as compared to REVLIMID. Moreover, Iberdomide has tumoricidal activity as opposed to the tumoristatic activity of IMiDs, even in relapsed/refractory multiple myeloma patients who have been administered IMiDs before.

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

When we talk about Mezigdomide, it can potentially degrade Aiolos compared to the blockbuster REVLIMID, courtesy of the cytotoxic capability of Mezigdomide.

It is important to note here that these efficacy comparisons have been made based on Phase I/II multiple myeloma clinical trials (NCT02773030 and NCT03374085) being carried out in heavily pretreated fourth-line or more multiple myeloma patients. Though it is still early for CELMODs, it can be concluded that we have a clear winner in CELMODs with regard to efficacy. As far as the safety profile of CELMODs is concerned, it was observed that 44.8% of the patients being administered Iberdomide in combination with dexamethasone experienced Neutropenia, compared to 75.3% of the patients who were administered Mezigdomide in combination with dexamethasone. Long-term data are still needed to comment on the safety profile of CELMODs; however, experts believe that CELMODs are safer than REVLIMID. Thus, safety issues would also be addressed by CELMODs.

In terms of adverse events, Iberdomide differs from IMiDs. The grade 3-4 non-heme toxicity is virtually non-existent, which really speaks about the differences in chemistry and biochemistry of Iberdomide, allowing it to have great utility, both in newly diagnosed patients and even in the maintenance setting, where it seems to be much better tolerated than REVLIMID.

– Emory School of Medicine, US

Future of CELMODs

CELMODs are very much in the line of succession to the throne that the great REVLIMID is slowly abdicating. The most novel late-stage Phase-III EXCALIBER trial results are not expected to be out before 2026. Iberdomide is expected to launch in 2027 and achieve multibillion-dollar sales.

In October 2023, Bristol Myers Squibb entered a clinical trial collaboration and supply agreement with Karyopharm Therapeutics Inc. to evaluate its investigational cereblon E3 ligase modulator (CELMoD) agent mezigdomide in combination with Karyopharm’s selinexor, an approved first-in-class Exportin 1 (XPO1) inhibitor, and dexamethasone in patients with relapsed/refractory multiple myeloma.

Furthermore, BMS has established a comprehensive multiple myeloma treatment strategy and is quite optimistic about CELMODs replacing REVLIMID in earlier lines of multiple myeloma treatment. As the newest treatment for multiple myeloma, CELMODs represent a significant innovation with the potential to redefine therapeutic approaches. However, it remains to be seen whether CELMODs can live up to such high expectations or if they will fall short. Further trials and clinical data will be crucial in determining whether CELMODs will become the next blockbuster in the evolving landscape of multiple myeloma therapies.

FAQs

Multiple myeloma is a type of plasma cell cancer. Multiple myeloma is a cancerous condition in which plasma cells grow uncontrollably. Plasma cells produce an abnormal protein (antibody) known as monoclonal immunoglobulin, monoclonal protein (M-protein), Mspike, or paraprotein. Normal plasma cells are found in the bone marrow and play an important role in the immune system.

The majority of researchers do not know what causes multiple myeloma. However, they have made progress in understanding how certain changes in DNA can cause plasma cells to become cancerous.

Multiple myeloma symptoms and signs can vary, and early in the disease, there may be none. the common multiple myeloma symptoms include Bone pain, especially in the spine or chest, nausea, constipation, loss of appetite, mental fogginess or confusion, fatigue, frequent infections, weight loss, and others.

Multiple myeloma treatment typically includes anti-myeloma medications to destroy myeloma cells or control cancer when it recurs (relapses), as well as medications and procedures to prevent and treat complications caused by myeloma, such as bone pain, fractures, and anemia. The main multiple myeloma treatment options are stem cell transplant, chemotherapy, targeted therapy, corticosteroids, proteasome inhibitors, immunomodulators, monoclonal antibodies, surgery, and radiation therapy.

Key players, such as AbbVie/Roche (Venetoclax), Janssen Research & Development (Teclistamab), Regeneron Pharmaceuticals (REGN5458), Bristol-Myers Squibb/Celgene (Iberdomide), Cartesian Therapeutics (Descartes-11), and others, are involved in developing drugs for multiple myeloma treatment.

Downloads

Article in PDF

Recent Articles

- Actinium Announces SIERRA Trial Results; Santhera Seeks FDA Review for Vamorolone; Seres Announce...

- Syndax Pharmaceuticals Receives FDA Approval for REVUFORJ; FDA Approves BLENREP for Adults with R...

- Kiadis inks license deal with Sanofi; Gilead Ends Hep B Collaboration; Merck & Foghorn inks ...

- 5 Most Promising CAR T-cell Therapies for Multiple Myeloma in Development

- Merck Wins FDA Approval for KEYTRUDA QLEX for Subcutaneous Use in Adults With Solid Tumors; Incyt...