GvHD Drugs Treatment Market Heats Up: 4 Late-Stage Therapies Poised to Redefine the Landscape

Jul 04, 2025

The GvHD drugs treatment landscape is undergoing a dynamic transformation, driven by a wave of innovation aimed at improving patient outcomes and quality of life. Once dominated by steroids and broad immunosuppressants, the field is now witnessing a surge in targeted therapies, cellular approaches, and novel biologics designed to precisely modulate the immune response.

The GvHD treatment landscape has seen a wave of FDA approvals over the years. IMBRUVICA (AbbVie/Janssen) made history in 2017 as the first FDA-approved therapy for chronic GvHD. This was followed by JAKAFI (Incyte Corporation/Novartis) in 2019 for steroid-refractory acute GvHD and ORENCIA (Bristol Myers Squibb) in 2021 for GvHD prevention. That same year, REZUROCK (Sanofi/Meiji Seika Pharmaceuticals) was greenlit for chronic GvHD after failure of two or more therapies. Fast forward to 2024, NIKTIMVO (Incyte Corporation/Syndax) and RYONCIL (Mesoblast/JCR Pharmaceuticals) received approvals for chronic GvHD and pediatric steroid-refractory acute GvHD, respectively, marking another leap in the evolving GvHD therapy space.

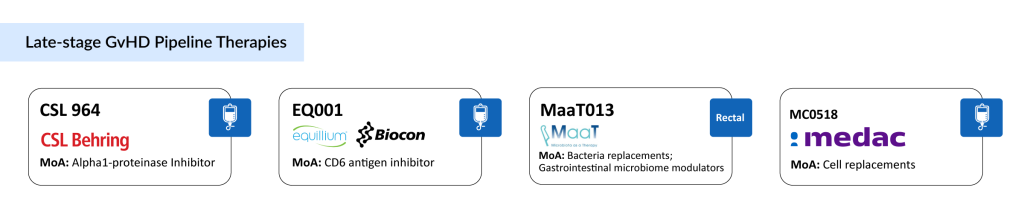

Fueled by a growing pipeline of innovative GvHD drugs and an expected market surge from USD 1.4 billion in 2024 to impressive heights by 2034 at a CAGR of 8.2%, the momentum is undeniable. Behind this surge lies a rich pipeline of GvHD therapies with novel mechanisms of action, and frontrunners like CSL964 (CSL Behring), EQ001 (Equillium/Biocon), MaaT013 (MaaT Pharma), and MC0518 (medac) are grabbing attention in late-stage development. As clinical trials progress and new breakthroughs emerge, the GvHD market is on the cusp of a new era.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- AstraZeneca’s Farxiga; Incyte’s Jakavi; FDA Fast Track Status to HM43239 for R/R AML; Idorsia’s I...

- Graft-Versus-Host Disease (GvHD) Treatment Market: A Moving Target For Therapies

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

- Japan is transforming its Healthcare sector through Regenerative Medicine

- Incyte Corporation submits positive results of trials for its drug Ruxolitinib in GvHD

Let’s dive into these late-stage GvHD therapies that could reshape the future of GvHD care.

CSL Behring’s ZEMAIRA

CSL964 Alpha-1 Antitrypsin, an Alpha1-Proteinase Inhibitor (A1-PI) developed by CSL Behring, is under investigation for its potential in treating steroid-refractory acute graft-versus-host disease (aGvHD) and in preventing aGvHD in high-risk patients undergoing allogeneic hematopoietic stem cell transplantation (HSCT). The therapy is currently in Phase III trials for steroid-refractory aGvHD treatment and is also being assessed in Phase II/III studies for its role in aGvHD prevention.

Equillium/Biocon’s EQ001

EQ001 (Itolizumab; Bmab600) is a pioneering immune-modulating antibody that targets the CD6 receptor to inhibit the activation and migration of pro-inflammatory T cells, which are key drivers of autoimmune and inflammatory diseases like GvHD, moderate-to-severe uncontrolled asthma, and lupus nephritis. By modulating the CD6-ALCAM pathway, Itolizumab selectively suppresses pathogenic effector T cells (Teffs) while sparing regulatory T cells (Tregs), which play a vital role in maintaining immune homeostasis.

EQ001 is currently being evaluated in a Phase III clinical trial as a first-line treatment for GvHD in combination with corticosteroids. In March 2025, Equillium announced topline results from the Phase III EQUATOR trial. Although the study did not meet its primary endpoints—complete response (CR) or overall response rate (ORR) at Day 29 compared to placebo, Itolizumab did show statistically significant and clinically meaningful benefits in secondary endpoints, such as CR at Day 99, response duration, and failure-free survival. However, in April 2025, the FDA declined to grant Breakthrough Therapy designation or support Accelerated Approval, citing shortcomings in the EQUATOR trial data.

MaaT Pharma’s MaaT013

MaaT013 is a donor-derived, standardized microbiome ecosystem therapy distinguished by its high microbial richness and diversity. It features the BUTYCORE bacterial consortium, known for generating anti-inflammatory short-chain fatty acids. This therapy aims to restore gut microbiome and immune system balance, enhancing immune tolerance and response to treat steroid-resistant, gastrointestinal-predominant acute GvHD. MaaT013 has received Orphan Drug Designation from both the US FDA and EMA.

In December 2024, MaaT Pharma presented promising new data from its Early Access Program at the ASH 2024 Annual Meeting. Following this, in January 2025, the company reported positive topline results from the Phase III ARES trial, where MaaT013 demonstrated a 62% overall GI response rate by Day 28, reinforcing its potential as a third-line treatment option for GI-aGvHD.

medac’s MC0518

MC0518 is an experimental mesenchymal stromal cell (MSC) therapy being developed by Medac GmbH, currently in clinical trials for treating steroid-refractory acute graft-versus-host disease (SR-aGvHD) following allogeneic stem cell transplantation. The therapy harnesses the immune-modulating capabilities of MSCs to reduce the intense inflammatory response typical of SR-aGvHD, a condition in which donor immune cells attack the host’s tissues despite corticosteroid treatment.

The ongoing IDUNN trial, a key Phase III study, is assessing the safety and effectiveness of MC0518 versus the best available therapy (BAT) in children and adolescents. The primary goal is to measure the overall response rate (ORR) at Day 28, while secondary endpoints include overall survival (OS) up to 24 months and freedom from treatment failure (FFTF) within six months. Preclinical studies have shown that MC0518 is well-tolerated in animal models, with no signs of tumor formation or major adverse effects.

In addition, a number of GvHD drugs are currently in early-stage development. These include RLS-0071 from ReAlta Life Sciences, Vimseltinib by Deciphera Pharmaceuticals, ASC-930 from ASC Therapeutics, RGI-2001 by REGiMMUNE, CYP-001 by Cynata Therapeutics, arsenic trioxide (As2O3) from BioSenic (Medsenic), TRX103 (Tregs) by Tr1X, TCD601 (Siplizumab) from ITB-MED, F-652 by Evive Biotech, RHPRG4 from Lubris BioPharma, XBI302 by Xbiome, RG6287 from Genentech, ALTB-168 by AltruBio, and SER-155 by Seres Therapeutics.

A new wave of prophylaxis and chronic GVHD treatments is poised to hit the U.S. market, with CSL964 (Alpha 1 Antitrypsin) and RGI-2001 leading the charge in 2027 and 2028. While uptake may start slow, CSL964 is projected to climb to a 7.5% peak market share, and RGI-2001 is expected to reach 4.2%, both within six years of launch.

Meanwhile, on the chronic GVHD front, arsenic trioxide, NIKTIMVO (Axatilimab), and REZUROCK (belumosudil) are eyeing launches between 2028 and 2030. Among them, REZUROCK is forecast to take the lead with a 10% market share, while arsenic trioxide and NIKTIMVO are each projected to hit 8%. Market peaks for these therapies are expected between five to six years post-launch, signaling steady yet impactful adoption curves.

In summary, the GvHD drug treatment landscape is on the brink of a transformation. A wave of next-generation therapies is emerging, promising to do more than just manage symptoms; they aim to reimagine the standard of care. With multiple novel drug candidates progressing steadily through clinical pipelines and regulatory milestones, the field is set for a paradigm shift.

These innovative GvHD therapies not only hold the potential to improve patient outcomes but also to reduce treatment burdens, target disease mechanisms more precisely, and offer hope where limited options previously existed. As they edge closer to approval, they are expected to raise the bar for efficacy and safety, unlocking both therapeutic and economic value.

Beyond clinical impact, this evolution in GvHD treatment could fuel partnerships, attract investment, and catalyze broader research into immune-mediated diseases. For patients, providers, and the biotech ecosystem alike, the next chapter in GvHD care is not just approaching — it’s accelerating.

Downloads

Article in PDF

Recent Articles

- Takeda’s ADZYNMA Approved by FDA; AskBio Presents Preliminary Data from Phase I Trial of Gene The...

- Fujifilm acquires global rights to Cynata’s novel therapy for GvHD; Themis raises EURO 40 m...

- AstraZeneca’s Farxiga; Incyte’s Jakavi; FDA Fast Track Status to HM43239 for R/R AML; Idorsia’s I...

- Graft-Versus-Host Disease (GvHD) Treatment Market: A Moving Target For Therapies

- Japan is transforming its Healthcare sector through Regenerative Medicine