Changing Dynamics of HIV-1 Treatment Market

Oct 29, 2021

Table of Contents

The HIV-1 treatment market for naïve and experienced patients is evolving consistently. Some of the major changes include the preference of single-tablet regimens (STRs) over multiple tablet regimens (MTRs), tenofovir alafenamide (TAF)-based therapies over tenofovir disoproxil fumarate (TDF)-based therapies, integrase strand transfer inhibitors (INSTIs) overs other classes of drugs, and approval of Cabenuva (Vocabria + Rekambys), marking a beginning of the new era of long-acting therapies.

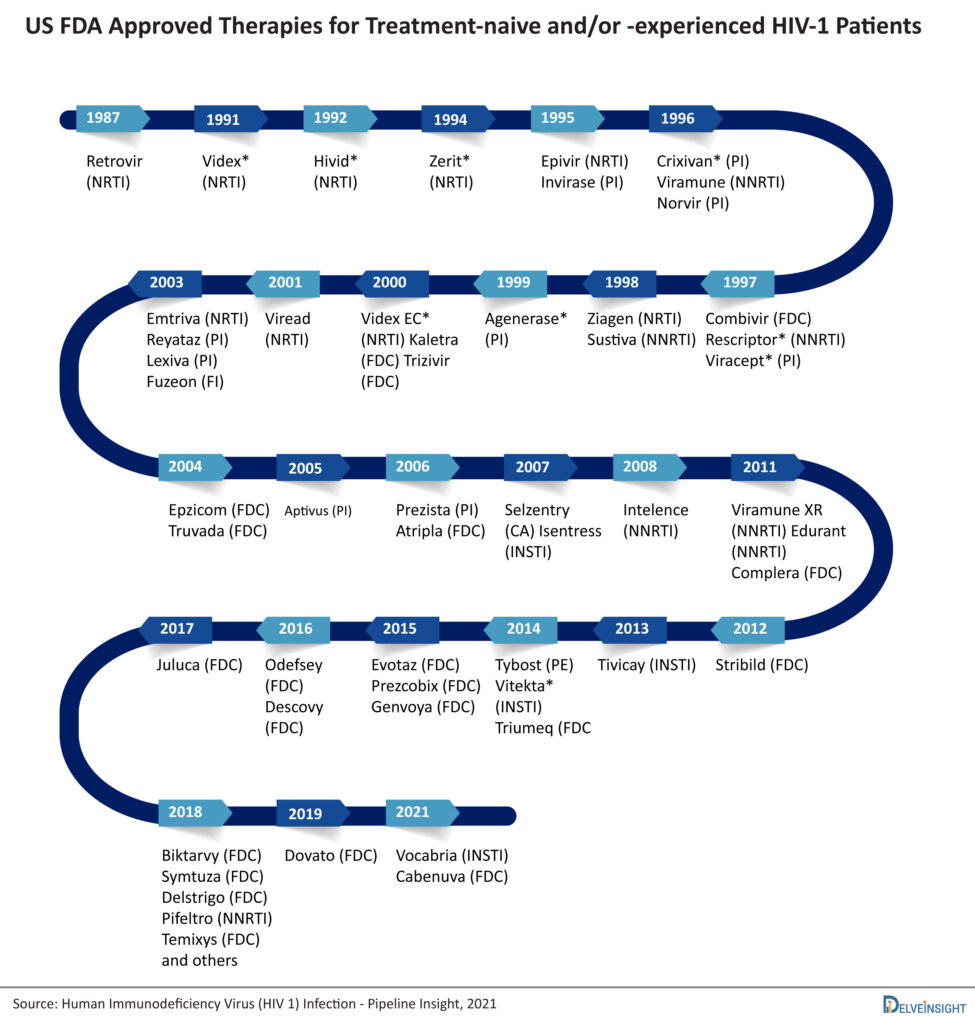

HIV was first reported in 1981. Six years later, in March 1987, the US FDA approved zidovudine (azidothymidine), the first drug for the treatment of AIDS. Since then, the treatment of HIV has evolved drastically, and now one can choose from several treatment options spanning different drug classes. However, there remains a dearth of options to treat multiple drug-resistant (MDR) HIV-1 and pre-exposure prophylaxis (PrEP) of HIV-1. For heavily treatment-experienced (HTE) MDR HIV-1 patients, Rukobia (fostemsavir) and Trogarzo (ibalizumab-uiyk) are approved by the US FDA and by the European Commission, and for PrEP of HIV-1, only Truvada and Descovy (not approved in the EU) are approved. Nevertheless, more treatment options will be available in the coming years for these patient populations, as various emerging therapies are in the later stages of their clinical development and might get approval. This article will focus on the market dynamics of HIV-1 therapies for treatment-naïve and -experienced patients.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Gilead Sciences’ Sunlenca Approval; FDA Approves Roche’s CD20xCD3 Bispecific Antibody Lunsumio; E...

- Pfizer’s RSV Vaccine; Forte Biosciences’ Atopic Dermatitis Asset; Bone Therapeutics’ Osteoarthrit...

- Notizia

- CereVasc’s eShunt System Study; FDA Approves NGS-Based CDx for Trastuzumab Deruxtecan; Nanopath S...

- Top Drugs To Watch in HIV (2025)

The approved antiretroviral (ARV) HIV-1 drugs are divided into different drug classes based on how each drug interferes with the virus life cycle: nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (PIs), fusion inhibitors, CCR5 antagonists, postattachment inhibitors, attachment inhibitors, and integrase strand transfer inhibitors (INSTIs). Fusion inhibitors, CCR5 antagonists, attachment inhibitors, and postattachment inhibitors are called entry inhibitors, as they prevent the entry of HIV into the CD4 cells. Attachment inhibitors (e.g., Rukobia) and postattachment inhibitors (e.g., Trogarzo) are not yet approved for treatment-naïve and/or -experienced HIV-1 patients.

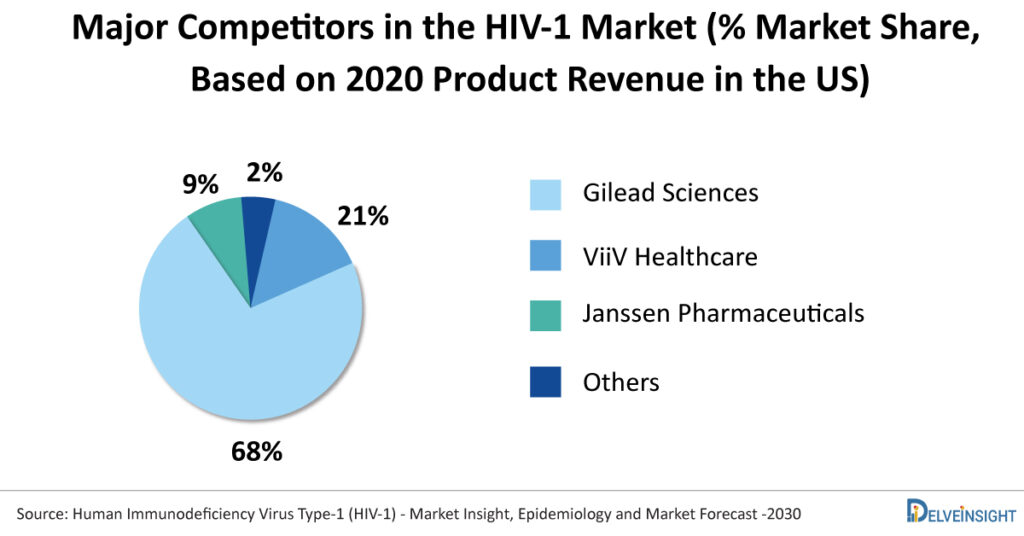

Which company is the leader in the HIV-1 therapy market based on the revenue of therapies for naïve and experienced patients?

Gilead Sciences dominates the HIV-1 market. The company had approximately 68% of the total HIV-1 market share of therapies for treatment-naive and experienced patients in the US in 2020. Out of the seven blockbuster drugs in the US, five (Descovy, Truvada, Biktarvy, Odefsey, and Genvoya) are owned by Gilead Science. ViiV Healthcare holds the second position with a 21% market share in 2020 and owns two blockbuster drugs, Tivicay/Tivicay PD and Triumeq. With the launch of Biktarvy, Gilead has gained the lost market from ViiV Healthcare and some small players.

What are the benefits of STRs over MTRs, and how has it changed the HIV-1 market?

Combinations of drugs are prescribed to treat HIV-1, reduce the chances of resistance, and maintain viral suppression. Initially, patients have to take multiple drug products of different active pharmaceutical ingredients (API) daily. This concept is called multiple treatment regimens (MTRs). The most common problem with MTR is low patient compliance and treatment adherence. Some of the approved MTRs include Pifeltro, Isentress/Isentress HD, Evotaz, Prezcobix/Rezolsta, Truvada, Descovy, etc.

To solve the problems with MTRs, single treatment regimens (STRs) have emerged. STR combines two or more antiretroviral drugs from more than one drug class in a single drug product. The first STR, a fixed-dose combination of three drugs in one tablet called Atripla, was introduced in 2006. Most of the STRs contain two NRTIs with an API from a different class of antiretrovirals. Later, two API combinations were approved, i.e., Juluca (dolutegravir and rilpivirine) and Dovato (dolutegravir and lamivudine). Less exposure to drugs is a good move to prevent patients from long-term side effects of drugs. Around 10+ STRs have been approved till now. The STRs include Triumeq, Biktarvy, Symtuza, Dovato, Juluca, Delstrigo, Atripla, Symfi, Symfi Lo, Genvoya, Stribild, Odefsey, and Complera/Eviplera.

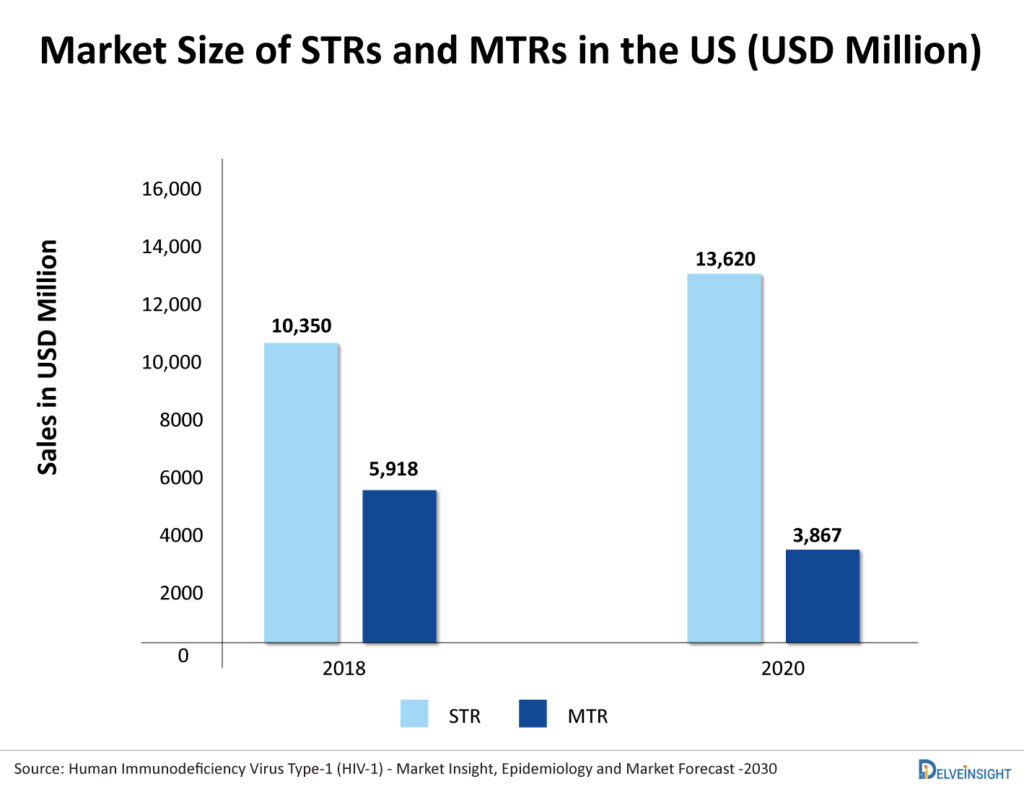

The market of MTR is constantly shrinking as patients and physicians have started preferring STR. As per DelveInsight, the US market of MTRs for treatment-naïve HIV-1 was USD 5,918 million in 2018, which reduced to USD 3,867 million in 2020. In contrast, the US market of STRs was 10,305 in 2018, which increased to 13,620 in 2020. With this trend, the market of MTRs is expected to further decline in the future with the expected launch of new STRs.

What were the concerns with TDF-based therapies that led to the emergence of TAF-based therapies and how it affected the HIV-1 market?

Tenofovir disoproxil fumarate (TDF) was first approved as Viread in 2001 and later in combination pills Truvada, Atripla, Complera, Delstrigo, Stribild, and Symfi/Symfi Lo. Tenofovir alafenamide (TAF) was first approved as Vemlidy in 2015 and is a component of the combination pills Descovy, Biktarvy, Genvoya, Odefsey, and Symtuza. Patents of TDF are expired, and less expensive generic versions are available. At the same time, the patents of TAF are expected to expire in 2022. The main concern with TDF is that it can cause renal toxicity, decreased bone mineral density (BMD), and increased bone turnover markers. Due to this, physicians now prefer TAF-based regimens, and this preference has affected the market of TDF-based regimens. The key players in the HIV market started introducing TAF versions of their TDF HIV drug products in the market. For example, Stribild (elvitegravir, cobicistat, emtricitabine, TDF) and Genvoya (elvitegravir, cobicistat, emtricitabine, and TAF) are the same product except that the tenofovir component has been switched from TDF to TAF; both are the products of Gilead Sciences. Similar is the case of Complera (TDF version) and Odefsey (TAF version).

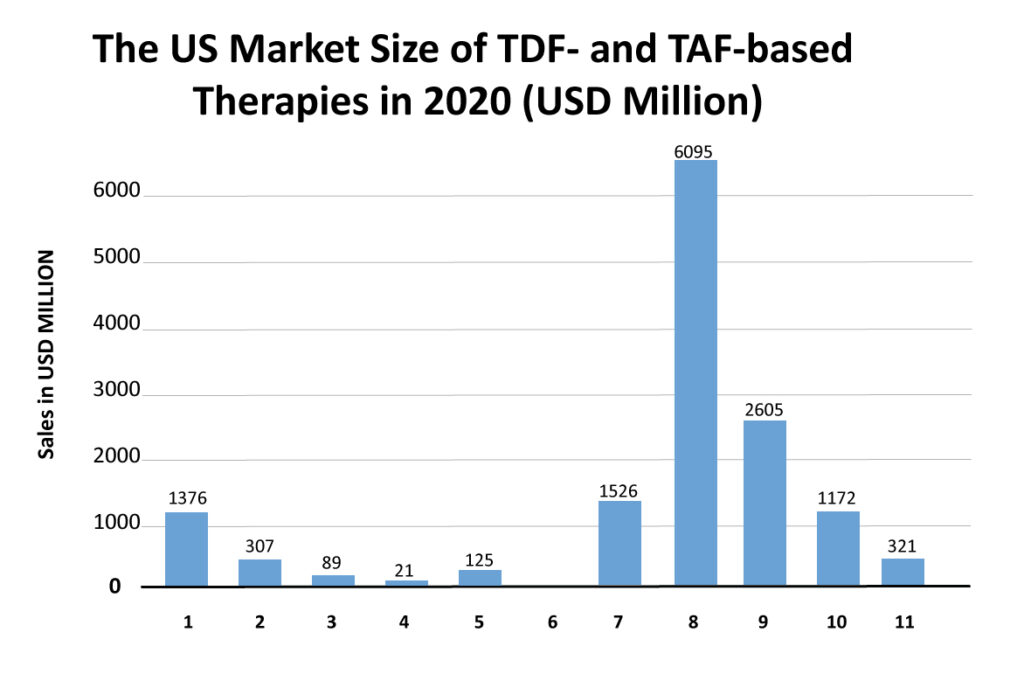

The market is shifting from TDF-based regimens to TAF-based regimens. For example, the 2018 market size of Stribild and Complera was USD 505 million and USD 276 million in the US, which then reduced to USD 125 million and USD 89 million in 2020, respectively. Opposite to this, Genvoya and Odefsey captured the US market with 2018 sales of USD 3,631 million and USD 1,242 million, respectively. However, after the launch of Biktarvy (integrase-based regimen) in 2018, the sales of these drugs started to decline as Gilead is heavily promoting Biktarvy, which has shown excellent safety and efficacy and does not require pharmacokinetic boosting.

What benefits are integrase inhibitors-based therapies offer, and how has it impacted other classes of drugs?

Since the launch of highly active ARV therapies, the standard of care for HIV-1 has been a combination of two NRTIs with a third agent from other classes. In 2007, the US FDA approved the first INSTI, Isentress (raltegravir), which became a preferred agent for treatment-naive HIV-1-infected adults. After that, Vocabria (cabotegravir) and Tivicay (dolutegravir) were approved. Now various INSTI containing STRs are approved, such as Triumeq, Biktarvy (contains bictegravir), Cabenuva, Dovato, Juluca, Genvoya, and Stribild.

In the key guidelines, most therapies recommended for ART naïve patients are integrase-based. Second-generation INSTI (dolutegravir and bictegravir) offers various benefits over other classes of drugs, such as excellent efficacy and tolerability, minimal drug interactions, and high barrier to resistance. However, recent observations found that patients on dolutegravir have shown weight gain, neuropsychiatric adverse effects, and initial signal of neural tube defects in pregnant women exposed to dolutegravir at the time of conception.

Biktarvy (INSTI + NRTI + NRTI) was approved in 2018, and it is capturing the market of older TDF-based regimens and TAF-based regimens. Its market size in the launch year was USD 1,144 million in the US, which increased to USD 6,095 million in 2020. DelveInsight expects it to capture a market size of USD 10,673 million in 2024 and become the market leader. The faster uptake of this therapy is believed to be for many reasons. One such reason is that Biktarvy does not require pharmacokinetic boosting. Physicians prefer a nonboosted regimen due to lower drug exposure, fewer side effects, and a lower risk of drug/drug interactions. In clinical trials, it has also shown noninferiority than GSK’s Triumeq and Tivicay (dolutegravir) containing regimens. As Gilead is heavily promoting Biktarvy, the sales of Genvoya (which is a TAF-based regimen) are also declining. The rise of Biktarvy has been seen in the decline of various HIV-1 therapies such as Stribild, Triumeq, etc.

Why do two-drug combinations have slow uptake?

Juluca (dolutegravir/rilpivirine) and Dovato (dolutegravir/lamivudine) are the two API combinations approved in 2017 and 2019, respectively. The uptake of these STR has been slow. The risk of resistance in two-drug regimens and safety concerns with dolutegravir might be the reason for the slow uptake. Juluca is an NNRTI-containing regimen, and patients/physicians usually do not prefer them. Physicians are apprehensive about the efficacy of this combination over established long-term efficacy of three-drug regimens.

Rise of long-acting regimens

Recently a significant development happened in the HIV-1 market with the approval of Cabenuva (cabotegravir extended-release injectable suspension; rilpivirine extended-release injectable suspension). It is a complete prescription regimen containing two injectables co-packed for intramuscular use. It is also approved as separate products in the EU as Vocabria (cabotegravir extended-release injectable suspension) and Rekambys (rilpivirine extended-release injectable suspension). Initially, patients have to take rilpivirine (Edurant) and cabotegravir (Vocabria) tablets for 1 month, after which Rekambys and Vocabria injections are given monthly or every 2 months. This long-acting injectable solves some key concerns with the old HIV-1 regimens, such as high pill burden, low patient compliance, and low adherence. Apart from this, some long-acting regimens are also in clinical trials, such as lenacapavir (GS-6207). It is being developed by Gilead Sciences, with its potential once in 6-month dosing, and might be the game-changer in the HIV-1 treatment market. The first 28 weeks of efficacy and safety results from CALIBRATE trial are disclosed, and lenacapavir with Descovy has shown viral suppression in 94% of the patients compared to 100% viral suppression in patients who received Biktarvy. In addition, no serious drug-related adverse events were observed.

Emerging therapies for HIV-1 and future prospective

Companies have started evaluating their emerging therapies in several patient populations of HIV-1 as a strategy to expand their portfolio in the future. Lenacapavir and islatravir are the two potential therapies expected to launch in three different patient populations, i.e., MDR HIV-1, treatment naïve patients, and PrEP.

The new drug application (NDA) of lenacapavir is filled for MDR HIV-1, and it is also being evaluated in Phase III to prevent HIV-1 and Phase II for treatment-naïve patients. At the same time, islatravir is being assessed as a monotherapy to prevent HIV-1 in high-risk groups. In combination, it is being evaluated for MDR HIV-1 (Islatravir/doravirine) and treatment naïve patients (Islatravir/doravirine; islatravir + MK-8507).

Other potential therapies include GSK3640254, UB-421, and Albuvirtide. GSK3640254, a maturation inhibitor, is currently being evaluated in a Phase II trial for treatment-naïve patients. Because maturation inhibitors use a unique mechanism of action that targets HIV differently than other ARV currently available, they can offer new treatment options. UB-421 (CD4 attachment inhibitor) and Albuvirtide (fusion inhibitor) are currently being evaluated in Phase III clinical trials for treatment-experienced HIV-1 patients.

The HIV-1 treatment market is expected to show steady growth in the coming years. However, it might get affected due to the wave of patent expiry of some of the products such as Selzentry (US: 2021), Atripla (US: 2021), Truvada (US: 2021), Isentress (US: 2024), Descovy (US: 2025), Complera/Eviplera (US: 2025), Cabenuva (US: 2026), etc. The peak of efficacy in HIV-1 has been achieved with Biktarvy that made it a market leader. In order to capture market share from Biktarvy, emerging therapies will have to demonstrate better safety and patient compliance.