The Next Wave of Metastatic Colorectal Cancer Drug Treatment: 6 Therapies Poised to Change the Landscape

Dec 01, 2025

The metastatic colorectal cancer drug treatment landscape has advanced considerably, with a growing range of targeted therapies, immunotherapies, and innovative agents now complementing standard chemotherapy. The mCRC treatment paradigm is structured across multiple lines of therapy. First-line (1L) treatment typically involves combination chemotherapies such as FOLFOX, FOLFIRI, or CAPEOX, along with anti-angiogenic agents or targeted therapies like VECTIBIX and ERBITUX, with or without chemotherapy. More recently, KEYTRUDA and BRAFTOVI (used with ERBITUX and mFOLFOX6) have also gained approval for use in the 1L setting.

Second-line (2L) mCRC therapies build on these options, incorporating agents such as OPDIVO (with or without YERVOY), JEMPERLI, TUKYSA (± Trastuzumab), LONSURF (± Bevacizumab), and the KRAZATI plus ERBITUX combination. In the third-line (3L) setting, treatments like STIVARGA and FRUZAQLA are available. As the field continues to evolve toward biomarker-guided strategies and immunotherapy-focused regimens, the mCRC treatment landscape is poised to grow more competitive, ultimately supporting longer survival and enhanced quality of life for patients.

Yet, even with these advancements, the landscape remains intensely competitive, and there is still a substantial need for therapies that deliver durable, long-term responses. Continued exploration of investigational agents underscores the drive toward more effective treatments that address resistance mechanisms and reshape the tumor microenvironment, reflecting a rapidly evolving future for mCRC care.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Anbogen’s ABT-301 Cleared by FDA for Phase I/II Colorectal Cancer Trial; Dyne’s DYNE-251 Gets FDA...

- FDA Approves Lexicon’s INPEFA (Sotagliflozin); PTC Therapeutics’s Vatiquinone MOVE-FA Registratio...

- Novel and Emerging Metastatic Colorectal Cancer Treatment Drugs Anticipated to Change Market Dyna...

- Unlocking New Avenues in KRAS-Driven Cancer Research Beyond G12C

- FDA Approves LUMAKRAS with VECTIBIX for KRAS G12C-Mutated Colorectal Cancer; PYC Receives FDA Rar...

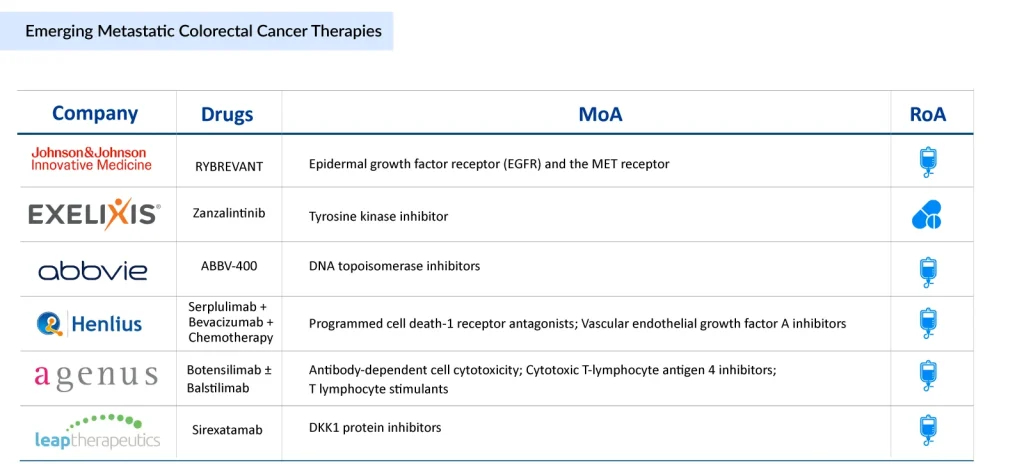

Companies such as Johnson & Johnson Innovative Medicine, Exelixis, AbbVie, Shanghai Henlius Biotech, Agenus, Leap Therapeutics, Inspirna, Treos Bio, Cardiff Oncology, Tizona Therapeutics, Enterome, Innovative Cellular Therapeutics, and others are currently evaluating their lead mCRC drug candidates in different stages of development. Let’s take a closer look at the six most promising mCRC drugs expected to change the landscape once approved.

Johnson & Johnson Innovative Medicine’s RYBREVANT

Amivantamab is a bispecific antibody designed to target tumors with specific genetic alterations, most notably EGFR exon 20 insertion mutations. It acts by simultaneously binding to the Epidermal Growth Factor Receptor (EGFR) and the MET receptor—two key drivers of tumor growth and survival. By blocking these signaling pathways, amivantamab can overcome resistance mechanisms that often limit the effectiveness of other treatments.

This dual action not only suppresses cancer cell proliferation but also helps activate the immune system’s response against the tumor, resulting in increased cancer cell death. Amivantamab is currently undergoing evaluation in Phase III clinical trials for the treatment of mCRC.

Exelixis’ Zanzalintinib

Zanzalintinib (XL-092) is an orally administered, next-generation tyrosine kinase inhibitor designed to block several receptor tyrosine kinases linked to cancer progression, such as VEGF receptors, MET, AXL, and MER. These pathways play essential roles in normal cell activity but also drive malignant processes, including tumor initiation, metastasis, angiogenesis, and the development of resistance to various treatments, notably immune checkpoint inhibitors.

Exelixis developed Zanzalintinib to advance the therapeutic profile established with its lead product, cabozantinib, while enhancing features such as pharmacokinetic half-life. The therapy is currently being evaluated in Phase III clinical trials for mCRC.

In October 2025, Exelixis announced comprehensive data from STELLAR-303, its global phase 3 trial assessing zanzalintinib plus atezolizumab (TECENTRIQ) versus regorafenib in patients with previously treated mCRC that is not MSI-high. The study, as noted earlier, achieved one of its two primary endpoints, showing that the combination therapy reduced the risk of death by 20% in the intention-to-treat (ITT) population at the final analysis (stratified HR 0.80; 95% CI 0.69–0.93; P=0.0045).

With a median follow-up of 18 months, median overall survival was 10.9 months with zanzalintinib and atezolizumab compared with 9.4 months with regorafenib. Additional results, including overall survival and progression-free survival outcomes in both the ITT group and the subgroup without liver metastases, are being shared today at the 2025 ESMO Congress during the Proffered Paper Session 2.

AbbVie’s ABBV-400

ABBV-400 is an investigational antibody-drug conjugate being developed for the treatment of mCRC. It targets c-Met, a protein frequently overexpressed in colorectal tumors, by combining the monoclonal antibody telisotuzumab with a potent topoisomerase I inhibitor payload. This design enables ABBV-400 to selectively deliver chemotherapy directly to c-Met–positive cancer cells, thereby enhancing anticancer activity while minimizing off-target effects. Currently, the mCRC drug is in phase III clinical trial.

Shanghai Henlius Biotech’s Serplulimab + Bevacizumab + Chemotherapy

HLX10 is a novel, humanized recombinant anti–PD-1 monoclonal antibody developed independently by Henlius and has promising potential for the treatment of multiple solid tumors. Preclinical and early clinical studies have shown that HLX10 demonstrates improved pharmacokinetic and pharmacodynamic profiles, along with favorable safety, tolerability, and antitumor activity.

In July 2024, HANSIZHUANG, used in combination with bevacizumab and chemotherapy, received approval to initiate an international, multicenter Phase III clinical trial in Japan. The therapy is currently progressing through Phase II/III clinical development.

Agenus’ Botensilimab ± Balstilimab

Botensilimab is an investigational, Fc-enhanced human CTLA-4–blocking antibody engineered to activate both innate and adaptive antitumor immunity. Its innovative design targets mechanisms that may help extend the benefits of immunotherapy to traditionally “cold” tumors, which often show limited response to standard treatments or remain resistant to conventional PD-1/CTLA-4 regimens and other experimental therapies.

In July 2025, Agenus reported that the combination of botensilimab and balstilimab (BOT/BAL) achieved a 2-year overall survival rate of 42% and a more mature median overall survival of 21 months. These findings are based on an expanded cohort of 123 patients with microsatellite-stable (MSS) metastatic colorectal cancer (mCRC) who did not have active liver metastases.

Additionally, in December 2024, Tanner Pharma announced a partnership with Agenus to broaden access to BOT and BAL. The program is currently in Phase II of clinical development.

Leap Therapeutics’ Sirexatamab

DKN-01 is a humanized monoclonal antibody targeting the Dickkopf-1 (DKK1) protein and is currently in development for esophagogastric, gynecologic, and colorectal cancers. In October 2025, Leap Therapeutics reported the final findings from Part B of the DeFianCe Phase 2 trial (NCT05480306), which evaluated sirexatamab combined with bevacizumab and chemotherapy versus bevacizumab plus chemotherapy alone in patients with microsatellite-stable (MSS) colorectal cancer who had previously undergone one line of systemic therapy for advanced disease.

Apart from these six, the other mCRC drugs in clinical trials include Ompenaclid (RGX-202) + Chemotherapy + Bevacizumab (Inspirna), PolyPEPI1018 + Atezolizumab (Treos Bio), Onvansertib (Cardiff Oncology), TTX-080 (Tizona Therapeutics), EO4010 (Enterome), GCC19CART (Innovative Cellular Therapeutics), and others.

The emergence of these next-generation therapies signals a transformative shift in the mCRC treatment landscape. Collectively, these agents, from bispecific antibodies and multi-targeted kinase inhibitors to enhanced immunotherapies and ADCs, are designed to tackle long-standing barriers such as resistance, limited durability of response, and poor outcomes in microsatellite-stable (MSS) disease. With several candidates demonstrating meaningful improvements in overall survival, progression-free survival, and response rates in early and late-stage trials, they offer the potential to redefine standards of care across multiple lines of therapy.

Once approved, the impact of these therapies on mCRC management is expected to be substantial. Agents such as amivantamab and zanzalintinib may push the field further toward biomarker-guided precision medicine, enabling treatment personalization at a level not previously possible. Immunotherapy-optimized candidates like botensilimab, serplulimab combinations, and DKN-01 hold the promise of expanding effective treatment options for the historically hard-to-treat MSS segment. Meanwhile, targeted payload delivery platforms like ABBV-400 could offer more potent yet safer alternatives to systemic chemotherapy.

Together, these advancements are poised to not only extend survival but also shift mCRC care toward more durable, immune-responsive, and resistance-overcoming treatment paradigms—ultimately improving both quality of life and long-term patient outcomes.

Downloads

Article in PDF

Recent Articles

- Anbogen’s ABT-301 Cleared by FDA for Phase I/II Colorectal Cancer Trial; Dyne’s DYNE-251 Gets FDA...

- Unlocking New Avenues in KRAS-Driven Cancer Research Beyond G12C

- Novel and Emerging Metastatic Colorectal Cancer Treatment Drugs Anticipated to Change Market Dyna...

- FDA Approves LUMAKRAS with VECTIBIX for KRAS G12C-Mutated Colorectal Cancer; PYC Receives FDA Rar...

- FDA Approves Lexicon’s INPEFA (Sotagliflozin); PTC Therapeutics’s Vatiquinone MOVE-FA Registratio...