Narcolepsy Treatment Market Awakens: A Projected Boom Fueled by Emerging Therapies

Aug 08, 2025

Table of Contents

Narcolepsy is a chronic neurological disorder that disrupts the brain’s ability to regulate sleep-wake cycles. Often misunderstood and underdiagnosed, it typically begins in adolescence but may remain unrecognized for years. The hallmark symptoms include Excessive Daytime Sleepiness (EDS), sudden muscle weakness, vivid hallucinations during sleep onset or awakening, and temporary sleep paralysis. While not life-threatening, narcolepsy can severely impact daily life, academic performance, and mental health. Diagnosis is frequently delayed, with many patients waiting up to a decade for confirmation. Early recognition and a comprehensive, personalized treatment plan are key to improving quality of life.

According to the National Organization for Rare Disorders (NORD), narcolepsy affects approximately 1 in 2,000 people in the general population. However, due to frequent underdiagnoses or misdiagnoses, the actual prevalence may be higher. Narcolepsy is classified into two types: Type 1 (with cataplexy) and Type 2 (without cataplexy). Orphanet estimates that Type 1 narcolepsy affects between 1 in 2,000 and 1 in 5,000 individuals, making it the more commonly recognized form. Despite available treatments, a significant unmet need remains for therapies that fully address the condition’s root causes and restore normal sleep-wake regulation.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Narcolepsy: Treatment options and market outlook

- FDA approves Non-Controlled treatment for Excessive Daytime Sleepiness

- Sleep Aids Market: Examining Cutting-Edge Technologies and Major Breakthroughs

- Lion TCR Secures Triple FDA Milestones with IND Clearance for Chronic Hepatitis B; Corstasis Ther...

- Narcolepsy now a confirmed Autoimmune Disorder

Current Narcolepsy Treatment Landscape: Managing Symptoms, not the Root Cause

Narcolepsy has no cure, but a combination of FDA-approved narcolepsy medications and lifestyle adaptations can substantially improve symptoms and quality of life. The most commonly used narcolepsy medications include modafinil (PROVIGIL) and armodafinil (NUVIGIL) as first-line wake-promoting stimulants, along with traditional stimulants such as methylphenidate and amphetamines for EDS. For cataplexy, hypnagogic hallucinations, and sleep paralysis, central nervous system depressants like sodium oxybate (XYREM, extended‑release formulation LUMRYZ) are effective. Additionally, pitolisant (WAKIX) and solriamfetol (SUNOSI) represent newer drug classes: Pitolisant as an H₃ histamine receptor inverse agonist and solriamfetol as a dopamine-norepinephrine reuptake inhibitor, both targeting wakefulness and cataplexy symptoms.

Despite these options, significant unmet needs persist. Pediatric narcolepsy treatment remains especially constrained: while sodium oxybate (LUMRYZ) received approval in October 2024 for pediatric patients aged 7 years or older, many agents, such as modafinil, pitolisant, and solriamfetol, are still off-label or under evaluation in children, and safety/efficacy data are limited. Patients frequently report variable efficacy, side effects, tolerance development, and incomplete control of cognitive issues such as “brain fog,” automatic behaviors, anxiety, or mood disturbances—all areas not adequately addressed by current therapies.

Clinical Innovation Accelerates: New Compounds Aim to Address Unmet Needs

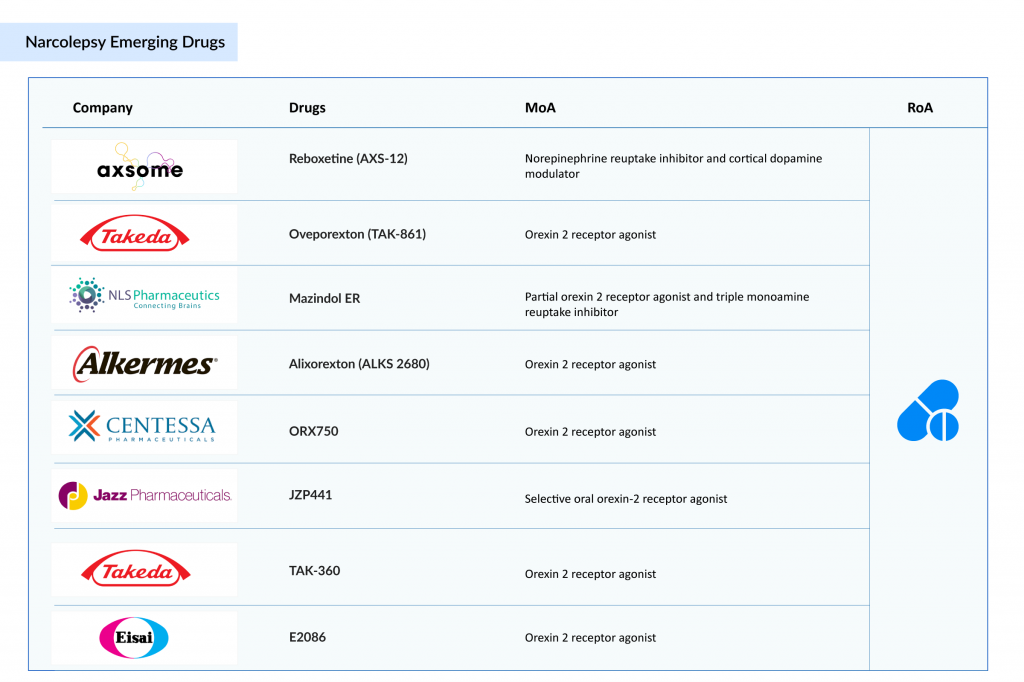

Novel narcolepsy treatments in the pipeline, including orexin receptor agonists (e.g., TAK‑861, Mazindol ER, and ALKS 2680), are under investigation and may better target the underlying hypocretin deficiency in narcolepsy Type 1. A few other candidates in the initial phase of development also have the potential to emerge as a novel treatment for narcolepsy. A few of the emerging narcolepsy drug candidates are listed below

Takeda Leads the Charge in Addressing Root Causes of Narcolepsy Type 1

Takeda is poised to become a game-changer in the narcolepsy treatment landscape with its investigational drug oveporexton (TAK-861), a potential blockbuster therapy that directly targets the root cause of narcolepsy Type 1. In July 2025, Takeda announced overwhelmingly positive results from two large Phase III trials, FirstLight and RadiantLight, where oveporexton met all primary and secondary endpoints across all doses with statistically significant improvements in wakefulness, cataplexy, and quality of life. Unlike current treatments that only manage symptoms, oveporexton works by selectively activating Orexin 2 Receptor (OX2R), addressing the core orexin deficiency that defines narcolepsy Type 1. This first-in-class approach could redefine the standard of care, representing a true therapeutic breakthrough. According to Takeda, Oveporexton is projected to achieve peak annual sales of USD 2–3 billion.

Takeda’s rapid clinical development, global trial reach across 19 countries, and commitment to regulatory acceleration reflect its ambition to lead a new era in sleep disorder treatment. The robust safety and efficacy data from the Phase III trials, combined with high patient retention in long-term studies, further underscore oveporexton’s transformative potential. With regulatory submissions for TAK‑861 planned for fiscal year 2025, Takeda is not only expanding its orexin-based pipeline but also establishing itself as a pioneer in orexin biology. In addition to oveporexton for narcolepsy type 1, Takeda is also advancing TAK‑360, an investigational oral OX2R agonist currently in Phase I development for narcolepsy Type 2, further strengthening its multi-asset orexin franchise. All these positions the company for long-term market leadership in an area with substantial unmet medical need and could significantly impact the lives of thousands suffering from narcolepsy worldwide.

Axsome’s AXS-12 Delivers Breakthrough Results in Narcolepsy

Axsome Therapeutics is emerging as a leading contender and potential disruptor in the narcolepsy market with its investigational therapy reboxetine (AXS-12). In the Phase III ENCORE trial, reboxetine delivered a dramatic 82% reduction in cataplexy attacks over 6 months, while also improving excessive daytime sleepiness and cognitive function. As a norepinephrine reuptake inhibitor and cortical dopamine modulator, AXS-12 brings a novel mechanism to a field long dominated by symptomatic treatments. With plans to submit an NDA to the FDA, Axsome is fast-tracking what could become a breakthrough, multi-symptom treatment that not only manages but meaningfully improves the daily lives of people living with narcolepsy. According to Axsome Therapeutics, reboxetine is projected to achieve US peak annual sales of USD 0.5–1 billion.

Other Promising Candidates in the Narcolepsy Pipeline

A few other emerging narcolepsy candidates from leading biopharmaceutical companies are poised to transform narcolepsy treatment by targeting its root causes rather than just symptoms. Mazindol ER, by NLS Pharmaceutics, a partial OX2R agonist and triple monoamine reuptake inhibitor, is in Phase III trials for narcolepsy with cataplexy and excessive daytime sleepiness. Alixorexton (ALKS 2680), developed by Alkermes, is in Phase II for both narcolepsy Type 1 and Type 2. ORX750, an oral OX2R agonist developed by Orexigen Therapeutics, is another potential candidate, currently in Phase II trials for treating narcolepsy Type 1 and Type 2 in adults. A few early-stage assets in Phase I development include JZP441 by Jazz Pharmaceuticals and E2086 by Eisai —both oral OX2R agonists currently being investigated for the treatment of narcolepsy Type 1 in adults. These novel therapies may offer more targeted, durable, and disease-modifying options, significantly improving long-term outcomes and quality of life for patients.

Conclusion

The narcolepsy treatment landscape is on the brink of a major transformation, presenting a blockbuster opportunity in the coming years. With the entry of novel, disease-modifying agents like Takeda’s TAK-861, Axsome’s AXS-12, and several other promising candidates from companies like Alkermes, Jazz Pharmaceuticals, Orexigen Therapeutics, Eisai, and NLS Pharmaceutics, the market is set for accelerated growth. Unlike traditional symptomatic treatments, most of these next-generation therapies target the underlying orexin deficiency, offering the potential for more effective, long-term relief. The presence of global biopharma leaders and high-value late-stage assets underscores the commercial and clinical potential of this evolving field. As awareness, diagnosis, and access to innovative treatments improve, the narcolepsy market is expected to expand rapidly—bringing hope to patients and unlocking significant opportunities for investment, innovation, and impact in sleep medicine. The coming decade could well mark the beginning of a new era in narcolepsy care.

Downloads

Article in PDF

Recent Articles

- Sleep Disorders: An Emerging Public Health Issue

- FDA approves Non-Controlled treatment for Excessive Daytime Sleepiness

- Lion TCR Secures Triple FDA Milestones with IND Clearance for Chronic Hepatitis B; Corstasis Ther...

- Narcolepsy now a confirmed Autoimmune Disorder

- Sleep Aids Market: Examining Cutting-Edge Technologies and Major Breakthroughs