A leading global international investment firm, Omega Funds has announced the closure of its sixth fundraising USD 438 Million.

More than decade old Life Sciences-based investment firm specialized in direct secondary transactions, Omega funds focuses in investing in Life Sciences vertical, aiming to fulfil the unmet needs in the domain. Till date, the firm has successfully raised USD 1 Billion and has advanced the R&D in opting for an innovative treatment approach spanning across multiple therapeutic areas such as oncology, immunology, rare diseases, precision medicine and others.

Known as ‘FUND VI’, the fund is a

stage-agnostic and will have both earlier venture-funding rounds along with

late-stage public funding. The proceeds thus collocated will be arrayed to be

used in different areas of the vertical across the USA and Europe.

Moreover, the firm has recently has funded a Series-A financing round for Nuvation Bio, worth USD 275 Million. In its portfolio, Omega has a total of 37 new products to market, while taking part in in 24 successful funding series.

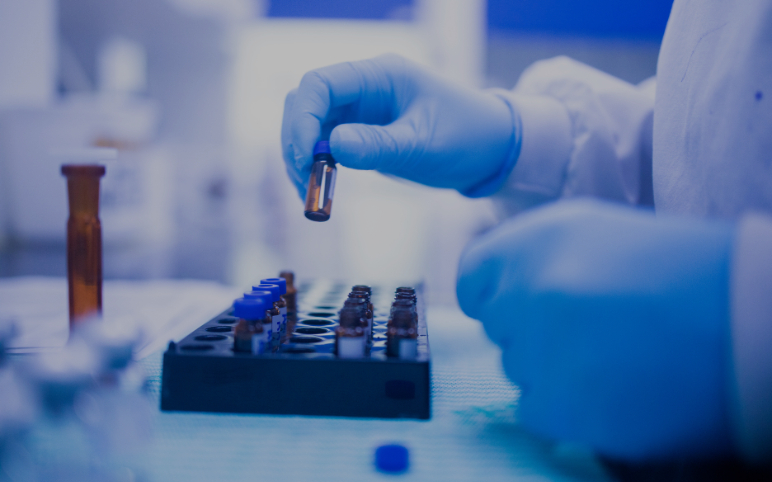

Correvio Pharma has been bludgeoned by the disapproval from the FDA’s CRDAC committee for its heart drug Brinavess.

The drug already approved outside the US is an anti-arrhythmic drug. The pharma company submitted for the approval of the drug-seeking New Drug Application (NDA) for Brinavess for the rapid conversion of recent-onset atrial fibrillation (AF) in adult patients.

Atrial fibrillation (AFib or AF) is a disruptive and irregular pattern of heartbeat (arrhythmia), which results in blood clots, stroke, heart failure, and other heart-related complications.

The hit took its toll on the company’s

shares which plunged 57% to 60 cents in trading before the bell. The drug

failed to gain the vote of the FDA committee over its not so efficient safety

issues and side effects such as low blood pressure and irregular rhythm

in the chambers of the heart during the trials.

The approval meant a great deal to the company since its approval would have fetched as much as USD 150 Million if had been launched in the USA market. The setback has caused the company to look for the other operations like sale and cutting the operation costs in the meantime.

Pharos Capital, an Equity Group has announced the acquisition of Birmingham Internal Medicine Associates (BIMA).

Complete Health, Pharos’s primary care group platform, and an 11th platform portfolio investment from Pharos III and III-A which is the ultimate acquirer of the BIMA will primarily keep a check on the care provided and expenses incurred. The terms and conditions, at the moment, remain undisclosed.

BIMA is a primary healthcare services provider, comprising diagnostic imaging, chronic care management, weight loss management, wellness, virtual office visits and risk assessments for seniors.

Other investments by the Pharos Pharma comprise Charter Health Care Group, a provider of post-acute care services; Behavior Care Specialists, a provider of autism spectrum disorder services and an addition to Pharos’s Family Treatment Network platform; and Verdi Oncology, an oncology practice, and clinical research management company.