Vitiligo Treatment Drug Pipeline Accelerates with Late-Stage Immune-Targeting Therapies

Jan 09, 2026

Table of Contents

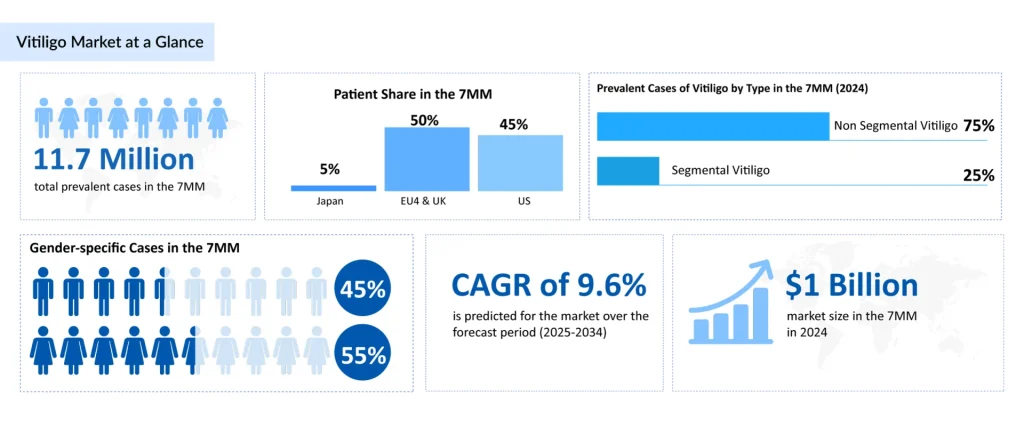

Vitiligo represents a significant yet underrecognized health burden globally. Vitiligo, a chronic autoimmune depigmenting disorder affecting 11.7 million individuals across the leading markets in 2024, is undergoing a seismic shift in therapeutic approaches. The condition typically emerges during the second and third decades of life, with approximately 63% of vitiligo patients receiving a diagnosis before age 30. The epidemiological profile reveals a slightly elevated female predominance and distinctive patterns by vitiligo phenotype, with non-segmental vitiligo comprising approximately 80% of cases in the United States, the psychosocially more impactful form due to its progressive nature and visible presentation on highly conspicuous areas, including the face, hands, and forearms.

The Traditional Vitiligo Treatment Paradigm: Inherent Limitations

Until 2022, vitiligo management remained predominantly symptomatic and largely unchanged for decades. Topical Corticosteroids dominate current practice, accounting for approximately 45% of patient utilization in 2024. While effective for localized disease, prolonged use carries well-established risks including skin atrophy, striae, and systemic absorption—concerns particularly acute when treating facial vitiligo or extensive body surface area involvement.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- VistaGen’s PH94B for Anxiety Disorder; Keytruda for Head and Neck Cancer Treatment; Bavarian Nord...

- Vitiligo – High Unmet Need Indeed!

- Novartis gets CAR-T drug; Shire aims to block; Xeljanz stands; Payer snubs; Lawmakers pass a bill

- FDA Extended the Review Period for Momelotinib; FDA Approves Roche’s Columvi; Avita Medical Obtai...

Topical Calcineurin Inhibitors represent a critical alternative, utilized in approximately 174 million patient-treatment instances across the 7MM in 2024. These agents circumvent steroid-related adverse effects through immunomodulatory mechanisms, though their mechanism differs fundamentally from newer JAK-based approaches.

Phototherapy remains integral to management, with narrowband UVB (NB-UVB) and PUVA constituting the light-based options. However, these modalities demand significant patient compliance, requiring 2-3 weekly treatments over extended periods (12+ weeks to 1 year), with modest repigmentation rates and frequent relapse upon discontinuation.

Critically, vitiligo treatment gap analysis reveals that despite therapeutic options, approximately 85% of prevalent vitiligo patients in major markets remain untreated in any given year—a reflection of disease stigma, access barriers, insurance coverage restrictions (which often classify vitiligo as “cosmetic”), and limited efficacy expectations among both patients and providers.

The JAK Inhibitor Revolution: OPZELURA and the Paradigm Shift

The July 2022 FDA approval of OPZELURA (ruxolitinib cream) for non-segmental vitiligo in patients aged 12 years and older marked a watershed moment in dermatology. OPZELURA represents the first and only FDA-approved therapy specifically targeting the immunopathogenic mechanisms of vitiligo, fundamentally diverging from symptomatic management approaches.

Ruxolitinib, a selective JAK1/JAK2 inhibitor, interrupts the pathological signaling cascade underlying vitiligo. Current understanding of vitiligo pathophysiology emphasizes aberrant T-cell mediated immune attack on melanocytes, driven by dysregulated interferon-gamma (IFN-γ) and interleukin-15 (IL-15) signaling—both JAK-dependent pathways. By selectively blocking JAK1 and JAK2, ruxolitinib suppresses this abnormal lymphocytic infiltration and cytokine-driven melanocyte destruction, directly addressing the disease mechanism rather than merely masking depigmentation.

Phase III trial data (TRuE-V1 and TRuE-V2) demonstrated that approximately 30% of patients achieved ≥75% improvement in facial vitiligo area and severity index (F-VASI 75), with nearly 50% achieving ≥50% improvement (T-VASI 50)—efficacy rates substantially exceeding those of traditional therapies in head-to-head analyses. Notably, repigmentation often becomes clinically apparent within 8-12 weeks of initiation, providing tangible evidence of efficacy to patients and practitioners accustomed to lengthy therapeutic delays.

Since launch, OPZELURA has captured 18% of the vitiligo treatment market share across the 7MM in 2024, despite premium pricing and initial barriers to insurance coverage. This rapid uptake reflects pent-up patient demand, growing clinician awareness of immunopathogenic mechanisms, and recognition of OPZELURA’s clinical superiority over traditional approaches—a dramatic reversal from the historical undertreatment of vitiligo.

The Emerging Vitiligo Treatment Pipeline: Convergence on Immune-Targeted Mechanisms

The success of OPZELURA has catalyzed unprecedented pipeline activity, with multiple pharmaceutical companies advancing JAK inhibitors and alternative immune-modulatory agents for vitiligo. The emerging vitiligo treatment landscape for 2025-2034 reflects a clear industry consensus: selective immune targeting is the direction of therapeutic innovation.

AbbVie’s RINVOQ

RINVOQ, a JAK1-selective inhibitor already approved for rheumatoid arthritis, entered vitiligo development with significant clinical momentum. In October 2025, AbbVie announced positive Phase III topline results from two pivotal studies (Phase III trials) evaluating RINVOQ in adults and adolescents with non-segmental vitiligo. The trial design focused on systemic therapy-eligible patients, a distinct population from OPZELURA’s topical application, suggesting complementary positioning. The projected approval timeline suggests market entry in 2026-2027. Oral formulation offers potential patient convenience advantages over topical administration, though systemic JAK inhibition carries distinct safety considerations compared to topical ruxolitinib.

Pfizer’s LITFULO

LITFULO, a selective JAK3 and TEC family kinase inhibitor, is currently in Phase III development for the treatment of vitiligo. JAK3 selective inhibition offers theoretical advantages by preferentially targeting lymphocyte signaling while sparing JAK2-dependent hematopoiesis—potentially enhancing safety. Pfizer’s 2028 projected approval timeline positions LITFULO for potential market entry in the latter portion of the forecast period.

Incyte’s Povorcitinib

Povorcitinib, a JAK1 inhibitor, entered Phase III development with enrollment initiated in late 2024. As an oral JAK1-selective agent, povorcitinib competes directly with RINVOQ in the systemic JAK inhibitor space for vitiligo, representing a potential differentiation through timing, dosing convenience, or safety profile optimization.

Clinuvel’s SCENESSE

SCENESSE represents a mechanistically distinct approach, functioning as a melanocortin-1 receptor (MC1R) agonist administered via subcutaneous implant. This novel route of administration and mechanism diversifies the pipeline beyond JAK inhibition, potentially offering alternatives for patients with contraindications to JAK inhibition or who prefer non-JAK-based approaches.

Vyne Therapeutics’ Repibresib Gel

VYN201 completed Phase IIb enrollment in January 2025, with projected Phase II/III advancement anticipated for 2029. As a topical formulation, repibresib offers positioning complementary to OPZELURA, potentially allowing for dual-agent or sequential therapy strategies.

Recent Developments in the Vitiligo Treatment Landscape

- In October 2025, AbbVie reported positive Phase III topline results for RINVOQ (upadacitinib) in treating vitiligo in adults and adolescents.

- In January 2025, VYNE Therapeutics completed enrollment of Repibresib in the Phase IIb trial.

- In January 2025, Clinuvel shared initial observations from the randomized study CUV105.

Future Outlook of Vitiligo Treatment

The vitiligo therapeutic market is experiencing exponential expansion driven by emerging approvals, improved diagnosis rates, and reduced treatment barriers. The 7MM market is projected to grow from approximately $1 billion in 2024 to significantly higher levels by 2034, with emerging therapies capturing 40-50% market share by decade’s end.In summary, the vitiligo therapeutic landscape is experiencing transformative change, shifting from decade-long stasis in symptomatic management toward targeted immunotherapy addressing disease pathogenesis. OPZELURA’s 2022 approval catalyzed an explosion of JAK inhibitor development, with RINVOQ, LITFULO, Povorcitinib, and emerging alternatives expected to reshape treatment patterns through 2034. This evolution promises substantial improvements in clinical outcomes, though challenges surrounding durability, patient access, long-term safety, and mechanistic diversity remain. For healthcare providers, pharmaceutical manufacturers, and patients, the next decade presents unprecedented opportunities to fundamentally advance vitiligo therapeutics from cosmetic amelioration to genuine disease-modifying treatment.

Downloads

Article in PDF

Recent Articles

- Novartis gets CAR-T drug; Shire aims to block; Xeljanz stands; Payer snubs; Lawmakers pass a bill

- FDA Extended the Review Period for Momelotinib; FDA Approves Roche’s Columvi; Avita Medical Obtai...

- VistaGen’s PH94B for Anxiety Disorder; Keytruda for Head and Neck Cancer Treatment; Bavarian Nord...

- Vitiligo – High Unmet Need Indeed!