FAP Inhibitor Market Summary

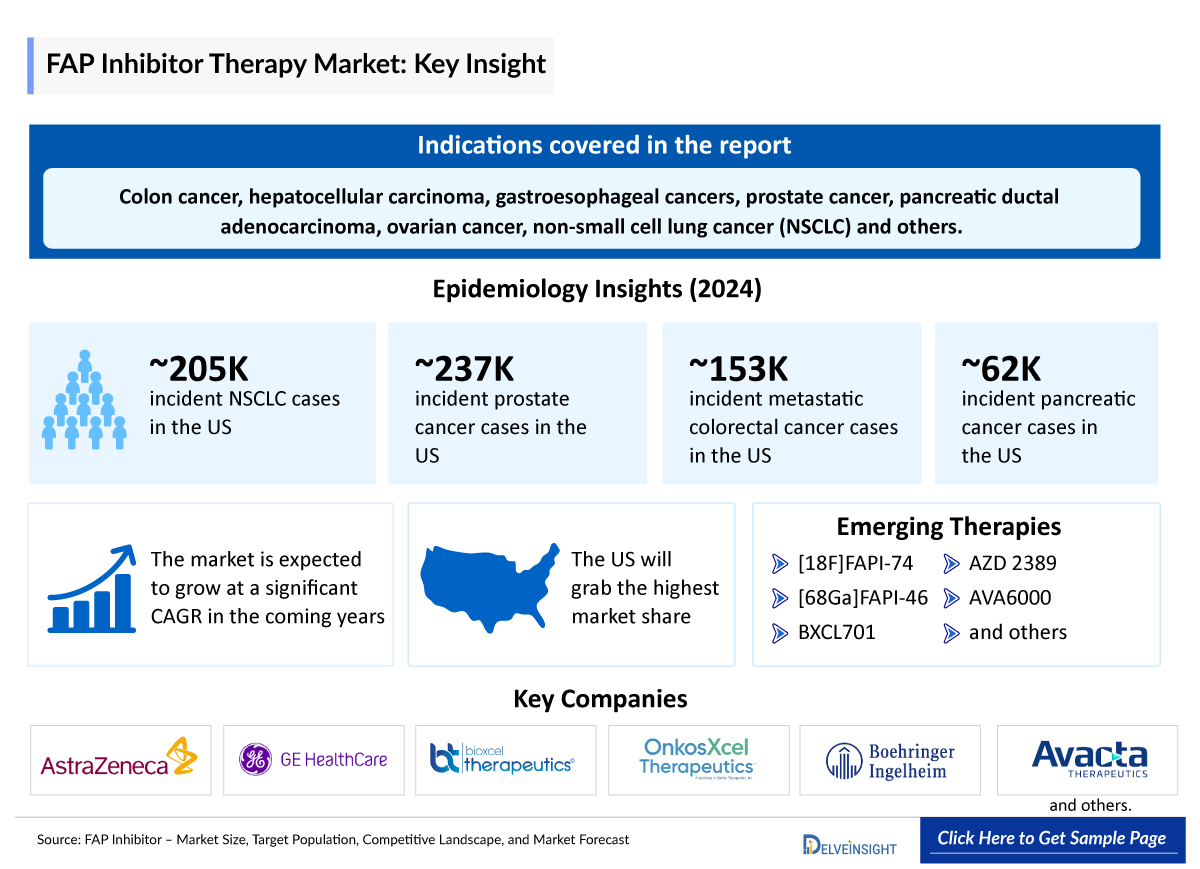

- The FAP Inhibitor market in the 7MM is projected to grow at a significant CAGR by 2040 in leading countries (US, EU4, UK and Japan).

FAP Inhibitor Market and Epidemiology Analysis

- Fibroblast activation protein-α (FAP) is a 97-kDa type II transmembrane serine protease. FAP is a member of the prolyl peptidase family, which also contains dipeptidyl peptidase IV (DPPIV, CD26), DPP7 (DPP II, quiescent cell proline dipeptidase), DPP8, DPP9, and prolyl carboxypeptidase.

- FAP has been shown to promote tumor progression and to be a predictor of poor overall survival for multiple cancer types, including colon cancer, hepatocellular carcinoma, gastroesophageal cancers, prostate cancer, pancreatic ductal adenocarcinoma, ovarian cancer, non-small cell lung cancer (NSCLC), triple negative breast cancer (TNBC), soft tissue sarcoma, salivary gland cancer and also metabolic dysfunction-associated steatohepatitis (MASH).

- In the 2024 ASCO Annual Meeting, BXCL701 plus KEYTRUDA delivered well-tolerated and showed early signs of potential clinical activity in patients with mPDAC refractory to chemotherapy (NCT05558982).

- In March 2025, Avacta announces promising early efficacy and safety data for AVA6000 in the Phase Ia Dose Escalation and ongoing enrollment in the Phase Ib Expansion Cohorts.

- In May 2023, SOFIE dosed and imaged the first patient with [18F] FAPI-74 in its US clinical trial of fluorine-18-labeled fibroblast activation protein inhibitor (FAP). This study was a Phase II, multicenter, non-randomized study of [18F]FAPI-74 PET for imaging patients with gastrointestinal cancers, including hepatocellular carcinoma, cholangiocarcinoma, gastric cancer, pancreatic cancer, and colorectal cancer.

- In November 2022, SOFIE received Investigational New Drug (IND) clearance to initiate a clinical study of [18F] FAPI-74, its lead fluorine-18-labeled fibroblast activation protein inhibitor (FAPI). As part of the FDA IND review, a Phase II, multicenter, single-arm, open-label, non-randomized study was approved to evaluate [18F] FAPI-74 PET imaging in patients with gastrointestinal cancers, including gastric cancer, cholangiocarcinoma, hepatocellular carcinoma, pancreatic cancer, and colorectal cancer.

- According to DelveInsight's analysis, the growth of the FAP inhibitor market is expected to be primarily driven by the anticipated launch of several emerging FAP inhibitor therapies such as [18F] FAPI-74, [68Ga] FAPI-46, AZD2389, BXCL701, AVA6000, and others targeting a range of indications.

- Key FAP inhibitor companies include AstraZeneca, Sofie/GE Healthcare, BioXcel/OnkosXcel, Avacta Life Science, and several others.

DelveInsight’s “FAP Inhibitor – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2040” report delivers an in-depth understanding of the FAP inhibitor, historical and and forecasted potential patient pools, competitive landscape as well as the FAP Inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

Factors Contributing to FAP Inhibitor Market Growth

-

Increasing Cancer Prevalence with FAP Overexpression

Rising incidence of FAP-overexpressing cancers including pancreatic, colorectal, ovarian cancer, NSCLC, and hepatocellular carcinoma is expanding the target patient population and therapeutic demand.

-

Emerging Clinical Pipeline of FAP Inhibitors

Anticipated launches of key candidates such as [18F] FAPI-74, [68Ga] FAPI-46, AZD2389, BXCL701, and AVA6000 across oncology and fibrosis indications are driving market expansion.

-

FAP's Role in Tumor Microenvironment Modulation

Deeper understanding of FAP expression on cancer-associated fibroblasts (CAFs) promoting tumor progression, metastasis, angiogenesis, and immune suppression validates it as a prime therapeutic target.

-

Shift Toward Precision and Targeted Oncology Therapies

Growing emphasis on biomarker-driven treatments and personalized medicine is accelerating development and adoption of FAP-selective inhibitors for improved efficacy.

-

Promising Early Clinical Efficacy Signals

Positive data from trials showing tumor shrinkage, disease control, and tolerability in refractory cancers like mPDAC and salivary gland cancers supports further investment and progression.

-

Expansion into Diagnostic Imaging Applications

High-contrast PET imaging with radiolabeled FAP inhibitors for tumor detection and theranostics is broadening applications beyond therapeutics into companion diagnostics.

-

Strategic Industry Partnerships and Investments

Collaborations such as SOFIE/GE Healthcare licensing deals and investments by AstraZeneca, Avacta, and BioXcel are accelerating innovation, manufacturing, and commercialization.

-

Unmet Needs in Fibrotic and Inflammatory Diseases

FAP upregulation in fibrosis, wound healing, and conditions like MASH creates opportunities for non-oncology applications, diversifying market potential.

The FAP inhibitor market report provides current treatment practices, emerging drugs, market share of individual FAP inhibitor therapies, and current and forecasted market size from 2020 to 2040 across 7MM. The report also covers current FAP inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the FAP inhibitor market potential.

Scope of the FAP Inhibitor Market Report | |

|

Study Period |

2020–2040 |

|

Forecast Period |

2025–2040 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

FAP Inhibitor Patient Pool |

Segmented by:

|

|

FAP Inhibitor Key Companies |

|

|

FAP Inhibitor Key Therapies |

|

|

FAP Inhibitor Market |

Segmented by:

|

|

FAP Inhibitor Market Analysis |

|

FAP Inhibitor Understanding

FAP Inhibitor Overview

Fibroblast activation protein-α (FAP) is a type II transmembrane serine protease selectively expressed on activated fibroblasts, particularly within the tumor microenvironment and sites of tissue remodeling. While largely absent in normal adult tissues, FAP is significantly upregulated in over 90% of epithelial cancers, where it contributes to tumor progression through extracellular matrix remodeling, angiogenesis, immune suppression, and facilitating tumor cell invasion. It is also elevated in fibrotic and inflammatory conditions such as liver cirrhosis, pulmonary fibrosis, rheumatoid arthritis, and wound healing, highlighting its broader role in pathological tissue remodeling. Due to its restricted expression in disease states and functional relevance, FAP has emerged as a valuable target for both diagnostic imaging and therapeutic intervention. Radiolabeled FAP inhibitors have shown remarkable success in positron emission tomography (PET) imaging, providing high-contrast visualization of tumors and fibrotic lesions with minimal background activity.

These advances have prompted the exploration of FAP-targeted radioligand therapies, antibody-drug conjugates, and CAR T-cell strategies to modulate the tumor stroma and enhance anti-tumor responses. However, challenges remain, including the need for selective inhibition over related proteases and managing off-target effects in fibrotic diseases. Ongoing research aims to improve FAP inhibitor pharmacokinetics, enhance therapeutic efficacy, and explore synergistic combinations with immunotherapies. Importantly, the application of FAP-targeted imaging and treatment is expanding beyond oncology into cardiology, pulmonology, and autoimmune disorders. As a result, FAP is increasingly recognized as a promising biomarker and therapeutic target with the potential to revolutionize precision medicine in both cancer and fibrotic disease management.

Further details related to country-based variations are provided in the report…

FAP Inhibitor Patient Pool

The FAP Inhibitor patient epidemiology chapter in the report provides historical as well as forecasted patient pool segmented by total cases of selected indication for FAP inhibitor, total eligible patient pool for FAP inhibitor in selected indication, total treated cases in selected indication for FAP inhibitor in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2040.

Key Takeaways from the FAP Inhibitor Patient Pool Analysis

- In 2024, the US accounted for the highest number of prostate cancer incident cases.

- Among the EU4 and the UK, Germany reported the highest number of prostate cancer incidence cases in 2024, followed by France, while Spain had the lowest.

- The NSCLC cases are higher among those aged ≥ 65 years than those aged < 65 years.

|

Epidemiology of Selected Indications | |

|

Indication |

Estimated Incidence Cases in the US (2024) |

|

~205,000 | |

|

~19,700 | |

|

~62,500 | |

|

~152,800 | |

|

~236,500 | |

|

~46,000 | |

|

~13,600 | |

FAP Inhibitor Market Recent Developments and Breakthroughs

- In December 2025, SOFIE Biosciences dosed first patient in the Phase 3 FAPI-GO trial of [18F]FAPI-74 PET for gastroesophageal cancers; FAPI-PRO (pancreatic) initiated.

- In May 2025, the FDA granted Orphan Drug Designation to a radiolabeled [18F]-FAP inhibitor for diagnostic management of esophageal cancer.

- Boehringer Ingelheim showcased its bold vision for the future of cancer care at ASCO 2025, highlighting an innovative pipeline aimed at transforming treatment approaches. Notably, BI 765179 is being developed as a first-line treatment for metastatic or incurable, recurrent PD-L1-positive head and neck squamous cell carcinoma (HNSCC).

- In February 2024, BioXcel Therapeutics received US FDA Fast Track Designation for BXCL701 in combination with a checkpoint inhibitor (CPI) for the treatment of patients with metastatic small cell neuroendocrine prostate cancer (SCNC) with progression on chemotherapy and no evidence of microsatellite instability.

- According to Avacta’s 2023 full-year report, the seventh dose cohort in the three-weekly dose escalation study of AVA6000 has been completed. Based on the highly positive safety data, a two-weekly dose escalation study is now underway to determine the recommended Phase II dose (RP2D), enabling dose expansion cohorts to begin in the second half of 2024, followed by a Phase II efficacy study in a selected orphan indication.

- In September 2022, the US FDA granted Orphan Drug Designation (ODD) to AVA6000 for the treatment of patients with soft tissue sarcoma.

The abstract list is not exhaustive, will be provided in the final report

FAP Inhibitors Drug Analysis

The FAP inhibitors report drug chapter segment encloses a detailed analysis of mid and early-stage (Phase II and Phase I) pipeline drugs. It also helps understand the FAP inhibitors drug clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

FAP Inhibitors Emerging Drugs

[18F]FAPI-74: SOFIE

A radioconjugate composed of FAPI-74, a quinoline-based fibroblast activation protein (FAP)-targeted tracer belonging to the group of FAP inhibitors conjugated to the bifunctional, macrocyclic chelating agent 1,4,7-triazacyclononane-N, N', N''-triacetic acid (NOTA) and labeled with the positron-emitting radioisotope fluorine F 18, with potential use as a tracer for FAP-expressing tumors and cancer-associated fibroblasts (CAFs) during PET. Upon administration of fluorine 18F FAPI-74, the FAPI-74 moiety targets and binds to FAP-expressing tumor cells and FAP-expressing CAFs. Upon binding and internalization, FAP-expressing tumor cells and CAFs can be detected during PET imaging. FAP, a cell surface protein, is overexpressed in a variety of human cancer cell types and on CAFs in the tumor microenvironment (TME). NCT05641896 is a clinical trial, specifically a Phase II, multicenter, single-arm, open-label, non-randomized study, evaluating the use of [18F] FAPI-74 PET in patients with gastrointestinal cancers.

In October 2023, SOFIE and GE Healthcare (GEHC) entered a licensing agreement to develop, manufacture, and commercialize [68Ga] FAPI-46 and [18F] FAPI-74 for diagnostic and companion diagnostic use. In this agreement, GE HealthCare took on global rights for [68Ga] FAPI-46 and outside US rights for [18F] FAPI-74. Although SOFIE maintained clinical development and commercialization rights for [18F] FAPI-74 in the US.

AVA6000: Avacta

AVA6000 is very similar to a standard chemotherapy drug called doxorubicin. Like doxorubicin, AVA6000 works to slow or stop the growth of cancer cells by blocking an enzyme. Unlike doxorubicin, however, AVA6000 is a “prodrug”, meaning it remains inactive until it reaches the site of the cancer. Because of the way AVA6000 works, it may be useful for treating cancer with fewer side effects than doxorubicin. AVA6000 is given intravenously (by vein).

On 16 January 2025, Avacta announced positive new data from the AVA6000 Phase I trial, demonstrating clinically meaningful tumor shrinkage in patients with salivary gland cancers. Meaningful tumor shrinkage was observed in five out of ten patients, with partial and minor responses, and a 90% disease control rate in this patient group.

|

Product |

Company |

RoA |

Molecule Type |

Phase |

|

[18F]FAPI-74 |

SOFIE |

IV |

Small molecule |

II |

|

[68Ga]FAPI-46 |

SOFIE |

IV |

Small molecule |

II |

|

BXCL701 |

BioXcel/OnkosXcel |

Oral |

Small molecule |

II |

|

AZD 2389 |

AstraZeneca |

Oral |

Small molecule |

II |

|

AVA6000 |

Avacta |

IV |

Small molecule |

I |

Note: Detailed emerging therapies assessment will be provided in the final report.

FAP Inhibitor Market Outlook

FAPI represents a new class of tracers that have applications in the assessment and treatment of various cancers. Ongoing clinical trials are exploring the safety and effectiveness of FAP inhibitors in both cancer and fibrotic diseases, with several compounds progressing to mid-phase clinical trials. Currently, there are no approved therapies for FAP inhibitors in the market, and despite challenges such as optimizing drug delivery and minimizing toxicity, the FAP inhibitors drug development marks a significant advancement in targeted cancer and fibrosis therapy. With further research and clinical validation, FAP inhibitors show promise as a novel therapeutic approach to improve outcomes for patients facing these complex diseases. FAP has garnered attention as a specific marker of carcinoma-associated fibroblasts (CAFs) and activated fibroblasts in tissues undergoing extracellular matrix (ECM) remodeling due to chronic inflammation, fibrosis, or wound healing. Numerous studies have evaluated FAPI across various tumor types, both in diagnostic and therapeutic contexts. The tumor microenvironment (TME) is crucial in understanding cancer biology, primarily located in the ECM, comprising blood vessels, growth factors, cytokines, and fibroblasts. Fibroblasts play a key role in collagen production and regulating the homeostasis and inflammation of surrounding cells. A distinct subset, myofibroblasts, possesses contractile properties akin to smooth muscle cells. Overexpression of FAP in colorectal cancer fibroblasts is linked to adverse clinical outcomes such as increased lymph node metastasis, tumor recurrence, angiogenesis, and reduced overall survival.

Key FAP inhibitor companies, including AstraZeneca, SOFIE/GE Healthcare, BioXcel/OnkosXcel, Boehringer Ingelheim, Avacta, Lantheus, and Others, are involved in developing FAP inhibitor drugs for various indications such as prostate cancer, NSCLC, pancreatic cancer, and other malignancies.

FAP Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential emerging FAP expected to be launched in the market during 2025–2040.

FAP Inhibitor Clinical Trials Analysis

The report provides insights into different FAP inhibitor therapeutic candidates in Phase II and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for FAP market growth over the forecasted period.

FAP Inhibitor Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for FAP Inhibitor targeted therapies.

Latest KOL views on FAP Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on the FAP inhibitor drugs evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs across the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center, UCSF Health, Memorial Sloan Kettering Cancer Center, Department of Biomedical Science in Penn’s School of Veterinary Medicine, Division of Hematology & Oncology, University of Illinois Health, Oncology Department at San Luigi Hospital Center for Thoracic Cancers at the Massachusetts General Hospital, Dana-Farber Brigham Cancer Center, and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or FAP market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying FAP Inhibitor Patient Trends? |

|

“This is the first time we’ve shown that FAP is important for promoting metastasis. By targeting FAP with a drug, we may be able to slow down the spread of cancer by treating distal tissues that you don’t even realize are getting ready to accept tumor cells, a phenomenon referred to as treating pre-metastatic niches.” -MD, Oncology Department at San Luigi Hospital Center in Massachusetts |

FAP Inhibitor Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

FAP Inhibitor Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs) and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the FAP Inhibitor Market Report

- The report covers a segment of key events, an executive summary, and a FAP descriptive overview, explaining its mechanism and emerging therapies.

- Comprehensive insight into the FAP inhibitor competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborative profiles of mid-stage and prominent therapies will impact the current landscape.

- A detailed review of the FAP inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM FAP market.

FAP Inhibitor Market Report Insights

- FAP Inhibitor Targeted Patient Pool

- Therapeutic Approaches

- FAP Inhibitor Pipeline Analysis

- FAP Inhibitor Market Size and Trends

- Existing and Future Market Opportunity

FAP Inhibitor Market Report Key Strengths

- 16 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

FAP Inhibitor Market Report Assessment

- Current Treatment Practices

- FAP Inhibitor Market Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the FAP Inhibitor Market Report

- What was the FAP Inhibitor total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2040? What are the contributing factors for this growth?

- Which FAP Inhibitor drug is going to be the largest contributor in 2040?

- Which is the most lucrative FAP Inhibitor market for FAP?

- What are the risks, burdens, and unmet needs of treatment with FAP based therapies? What will be the growth opportunities across the 7MM for the patient population of FAP based therapies?

- What are the key factors hampering the growth of the FAP Inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing FAP inhibitor treatments?

- What key designations have been granted to the FAP Inhibitor therapies?

- What is the cost burden of approved FAP Inhibitor therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy the FAP Inhibitor Market Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the FAP inhibitor Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the FAP inhibitor market unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.