Biopsy Devices: Advancing Diagnostic Precision in Modern Healthcare

Nov 12, 2025

Table of Contents

The field of oncology and pathology hinges on one definitive step: the biopsy. Serving as the gold standard for diagnosing a vast majority of cancers and other diseases, the process of obtaining tissue samples has driven continuous technological innovation. The biopsy device market represents a vital sector within the medical device industry, characterized by a relentless pursuit of greater accuracy, minimal invasiveness, and enhanced patient safety. This market is shaped by the rising global incidence of cancer, advancements in imaging technology, and the integration of smart diagnostics.

Understanding Biopsy Devices and Their Clinical Significance

A biopsy is a medical procedure involving the extraction of cell or tissue samples for examination under a microscope or for molecular and genomic analysis. Biopsy devices are the specialized instruments used to facilitate this critical task. Their clinical significance is foundational to modern medicine, as they provide the definitive diagnosis that distinguishes between benign and malignant conditions, enabling clinicians to stage the disease, determine prognosis, and select the most appropriate therapeutic regimen (surgical, chemotherapeutic, or targeted therapy). The transition from incisional (surgical) biopsies to percutaneous (needle-based) techniques has dramatically improved patient care by reducing recovery time, scarring, and procedure-related morbidity.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Alcon’s Dry Eye Treatment Device; I-VASC Secures Series A Funding; Paige’s AI Medical Device Soft...

- Mindray Collaborated with Edwards Lifesciences; DuPont’s Low-Cyclics Silicone Soft Skin Adhesive;...

- FDA Approval to DePuy TELIGEN System; FDA Breakthrough Device Designation for the EndoStim System...

- Top Five Liquid Biopsy Companies Impacting Cancer Diagnostics Market from 2020 to 2028

- MIMEDX Launches HELIOGENTM Fibrillar Collagen Matrix; DocGo Launches Mobile X-ray Program; Labcro...

Core Biopsy Device Technologies

The spectrum of biopsy devices is broad, ranging from simple aspiration needles to complex, vacuum-assisted systems. The evolution of the technology has been centered on achieving a high diagnostic yield with minimal tissue damage.

Needle-Based Biopsy Instruments

Needle-based instruments form the backbone of the market, primarily categorized into two main types:

Fine-Needle Aspiration (FNA) Systems: These use small-gauge needles (typically 21–25G) to draw out a sample of cells (cytology). While minimally invasive and rapid, the diagnostic yield can sometimes be low, as it provides cellular material rather than intact tissue architecture.

Core Needle Biopsy (CNB) Devices: These utilize larger-gauge needles (typically 12–20G) to extract a core of intact tissue (histology). CNB provides superior diagnostic accuracy due to the preservation of the tissue structure, which is vital for grading and detailed pathological analysis.

The most advanced instruments within the needle-based segment are the Vacuum-Assisted Biopsy (VAB) Devices. These systems, often considered the technological peak, use a vacuum to draw and hold tissue into the needle’s sampling chamber before excision. VAB devices allow for the collection of multiple, high-quality core samples through a single skin incision, significantly enhancing efficiency and completeness, particularly in breast biopsies.

Image-Guided Biopsy Technologies

The accuracy of a biopsy procedure is inextricably linked to the ability to precisely target the lesion, especially for small or non-palpable abnormalities. Image-guided technologies provide real-time visualization, transforming the procedure from a blind stab to a highly targeted intervention. Key guidance modalities include:

- Ultrasound (US) Guidance: The most common and cost-effective method, used frequently for breast, liver, kidney, and thyroid biopsies. It offers real-time visualization of the needle path.

- Stereotactic Guidance (X-ray/Mammography): Essential for non-palpable breast lesions only visible on mammography. It uses two angled mammography views to pinpoint the exact three-dimensional coordinates of the target.

- Computed Tomography (CT) Guidance: Used primarily for biopsies of internal organs, such as the lung, abdomen, and retroperitoneum, where precise depth control is necessary.

- Magnetic Resonance Imaging (MRI) Guidance: Utilized for lesions that are only visible on MRI, most notably in specific breast and prostate cases.

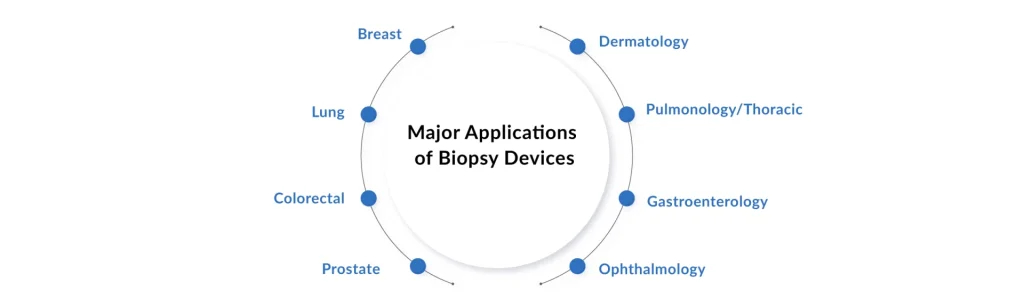

Clinical Applications of Biopsy Devices Across Specialties

The utility of biopsy devices is pervasive, but specific technologies have proven revolutionary in key oncological domains. Some of the key applications of biopsy devices include

Breast Cancer Diagnosis

The breast biopsy segment is a major driver of the market. The adoption of Vacuum-Assisted Biopsy (VAB) devices, particularly under stereotactic and ultrasound guidance, has standardized the diagnosis of breast abnormalities. VAB is highly effective not only for diagnosis but also for excising entire benign lesions (percutaneous removal), often replacing the need for open surgical procedures. This shift has led to improved cosmetic outcomes and reduced healthcare costs.

Lung Biopsy Procedures

Diagnosing indeterminate pulmonary nodules and lung masses requires highly sophisticated devices and guidance. CT-guided percutaneous transthoracic needle biopsy (TTNB) is the standard approach for peripheral lesions. For central lesions and those accessible via the airway, specialized bronchoscopic biopsy devices, including those used with electromagnetic navigation and robotic assistance, are employed. The growing prevalence of lung cancer screening programs worldwide ensures a continued demand for highly reliable lung biopsy solutions.

Prostate Cancer Detection

Historically, prostate biopsies were performed randomly using transrectal ultrasound (TRUS) guidance, leading to potential under-sampling. The market is now rapidly transitioning toward MRI/Ultrasound Fusion Biopsy. This advanced technique involves fusing pre-operative MRI scans, which highlight suspicious areas, with real-time ultrasound images to guide the needle directly to the target (known as targeted biopsy). This significantly increases the detection rate of clinically significant cancers while reducing the sampling of insignificant ones, demanding specialized fusion biopsy systems and instruments.

Safety Profile and Complication Management

While minimally invasive, biopsy procedures are not without risks. The safety profile of modern biopsy devices focuses on reducing common complications:

- Hemorrhage (Bleeding): A primary concern, particularly in highly vascular organs. Modern devices, especially VAB systems, are designed for rapid, clean cuts that minimize tissue trauma. Smaller needle gauges and meticulous post-procedure compression are standard protocols.

- Pain and Discomfort: The use of smaller, sharper needles and local anesthesia has significantly improved patient comfort.

- Infection: Risk is low but ever-present. Strict adherence to sterile techniques and the growing adoption of single-use, disposable instruments minimize this risk.

- Pneumothorax: A key complication in lung biopsies. Improved imaging guidance and specialized coaxial techniques (where a guiding cannula is placed first) help to minimize this serious complication.

The market trend is toward less invasive procedures with faster recovery, which inherently improves the safety profile and patient acceptance.

Emerging Technologies in Biopsy Devices

The future of the biopsy device market is defined by convergence with cutting-edge fields, including molecular biology, artificial intelligence, and robotics.

Liquid Biopsy Technology

Liquid biopsy is one of the most disruptive emerging technologies. It involves analyzing biological fluids, such as blood, to detect circulating tumor cells (CTCs) or cell-free circulating tumor DNA (ctDNA). While not a traditional device, its impact on the tissue biopsy device market is profound. Liquid biopsy offers a non-invasive method for:

Treatment Monitoring: Tracking therapeutic efficacy and detecting early relapse.

Genomic Profiling: Identifying actionable gene mutations for targeted therapy.

However, tissue biopsy remains essential for primary diagnosis and obtaining the vast quantity of material needed for complex, comprehensive analysis, suggesting that liquid biopsy will act as a complementary tool rather than a full replacement in the immediate future.

According to DelveInsight, the global liquid biopsy in cancer diagnostics market was valued at USD 7.64 billion in 2024, growing at a CAGR of 16.64% during the forecast period from 2025 to 2032, to reach USD 19.24 billion by 2034. Factors such as the rising incidence of various cancers, growing demand for minimally invasive procedures, increasing demand for precision medicine, and technological innovation in product development, among other factors, are expected to drive the liquid biopsy market in cancer diagnostics.

Artificial Intelligence and Robotics Integration

The integration of Artificial Intelligence (AI) and Robotics is enhancing the precision and efficiency of the biopsy procedure:

- AI for Targeting: AI algorithms can analyze imaging data (MRI, CT) to automatically delineate and highlight suspicious lesions, leading to more accurate targeting and reduced time under image guidance.

- Robotics: Robotic systems provide unparalleled stability and precision for needle placement, particularly in challenging-to-reach locations such as the lungs or spine. They enable physicians to perform procedures remotely or with enhanced dexterity, improving the consistency and safety of complex biopsies.

Point-of-Care Biopsy Devices

The trend toward decentralization and rapid diagnostics is driving the development of Point-of-Care (POC) Biopsy Devices. These are envisioned as integrated systems that cannot only collect a tissue sample but also perform immediate, fundamental molecular or immunochemical analysis right at the site of collection. Such devices would shorten the diagnostic cycle, reducing patient anxiety and expediting treatment initiation, particularly in resource-limited settings.

Biopsy Devices: Promising Companies, Market Dynamics, and Future Outlook

The biopsy devices market features several prominent players driving innovation and market growth through continuous technological advancement and strategic expansion. Major companies include Boston Scientific Corporation, Cardinal Health, Medtronic, BD, Cook, Devicor Medical Products Inc., B. Braun Melsungen AG, ARGON MEDICAL, OLYMPUS CORPORATION, FUJIFILM, INRAD Inc., Hologic Inc., C. R. Bard, Dr. Japan Co Ltd., Limaca-medical, Owlstone Medical Ltd., Zamar Care, KOELIS, ST. STONE MEDICAL DEVICES PVT LTD, Iscon Surgicals Ltd., and others.

These industry leaders are advancing biopsy technology by developing sophisticated systems that integrate imaging capabilities with biopsy functionality. Hologic’s Brevera Breast Biopsy System, for example, combines imaging and biopsy capabilities into a single platform, enabling physicians to perform real-time, image-based biopsies that reduce operation time and enhance diagnostic accuracy.

The biopsy devices market is poised for continued expansion and technological innovation. The global biopsy devices market size is expected to increase from USD 5.8 billion in 2024 to USD 10.8 billion by 2032, reflecting strong and sustained growth at a CAGR of 8.09%.

The market of biopsy devices is being primarily driven by the rising incidence of cancer, such as breast, lung, prostate, and colorectal cancer, among others, increasing demand for minimally invasive procedures, growing technological advancements in devices, and an increase in product development activities among the key market players.

The trajectory toward precision oncology is accelerating, with liquid biopsies playing an increasingly central role in treatment selection, the detection of minimal residual disease, and early cancer screening. As sequencing techniques and data analysis methods continue to advance, expanded applications across the cancer care continuum will further validate and refine these diagnostic approaches.

In summary, biopsy devices are a cornerstone of modern diagnostic medicine, enabling accurate and minimally invasive tissue sampling that informs critical treatment decisions across oncology and beyond. The convergence of advanced imaging technologies, robotics, artificial intelligence, and novel biomarker detection methods is transforming how clinicians obtain and analyze diagnostic specimens. As technological innovation continues and global access expands, biopsy devices will play an increasingly vital role in early cancer detection, personalized treatment selection, and improved patient outcomes worldwide. The ongoing evolution from traditional tissue biopsy toward liquid biopsy platforms, point-of-care diagnostics, and AI-assisted procedures signals a promising future where diagnostic precision and patient comfort are optimized simultaneously, ultimately advancing the global fight against cancer and other serious diseases.

Downloads

Article in PDF

Recent Articles

- Liquid Biopsy: Revolutionary Technique for Cancer Diagnosis

- MIMEDX Launches HELIOGENTM Fibrillar Collagen Matrix; DocGo Launches Mobile X-ray Program; Labcro...

- Mindray Collaborated with Edwards Lifesciences; DuPont’s Low-Cyclics Silicone Soft Skin Adhesive;...

- Seno Medical Secures EU MDR CE Mark for Next-Generation Imagio® Imaging System; Spine Innovation ...

- Medtronic’s Hugo Robotic-Assisted Surgery System Trial; Insightec’s Pivotal LIBERATE Clinical Tri...