ASH 2022: Yescarta emerging as the CAR-T leader in DLBCL; Failure of Kymriah in early lines of DLBCL

Dec 16, 2022

CAR T-cell therapy is a type of immunotherapy that uses your body’s white blood cells to fight your lymphoma. It uses a particular kind of white blood cell known as T lymphocytes or T cells. An essential part of CART therapies is lymphodepleting conditioning, which is administered to the patient before infusion of the CART product. Currently, there are only three FDA-approved CAR T-cell therapies for the treatment of patients in DLBCL. YESCARTA (Axicabtagene ciloleucel), KYMRIAH (tisagenlecleucel), and BREYANZI (lisocabtagene maraleucel) are autologous CAR T-cell products targeting CD19, which have been approved by the US FDA for the treatment of patients with DLBCL.

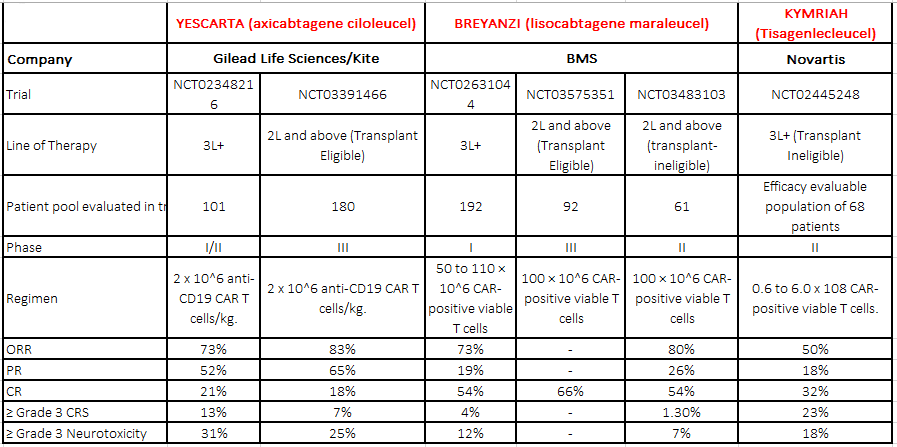

The promising treatment of CAR T-cell therapies after their launch in the Relapsed/Refractory (R/R) DLBCL patients has experienced an exciting impact in the DLBCL market. Moreover, CAR T-cell therapy has also changed the therapeutic landscape for several hematological malignancies with promising efficacy measures. Clinical trials with CART19 therapy have shown great efficacy in heavily pretreated patients with DLBCL, high-grade B lymphoma, and primary mediastinal B-cell lymphoma (PMBCL). Outstanding results in studies led to the clinical development and subsequent approval by regulatory agencies of three different CAR19 T-cell products. Below is a summary table:

*CRS- Cytokine Release Syndrome

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Startup focuses tumors with CAR-T; AbCellera grabs USD 105M; Gilead inks USD 2B deal; GSK’s anti-...

- ASH 2022- Emergence of Bispecific antibodies in DLBCL: Prospects, Opportunities, and Challenges

- Roche’s CD79b ADC POLIVY: Attempt to Change DLBCL Treatment Space

- Bristol-Myers Squibb’s Opdivo Approval; Mirati’s KRAS-inhibitor Adagrasib; J&J and Legend Bi...

- AbbVie Receives Approval; Kymriah Approved; Shire Gets USFDA Approval; NICE Rejects; Bristol-Myer...

ORR- Overall Response Rate

PR- Partial Response Rate

CR- Complete Remission Rate

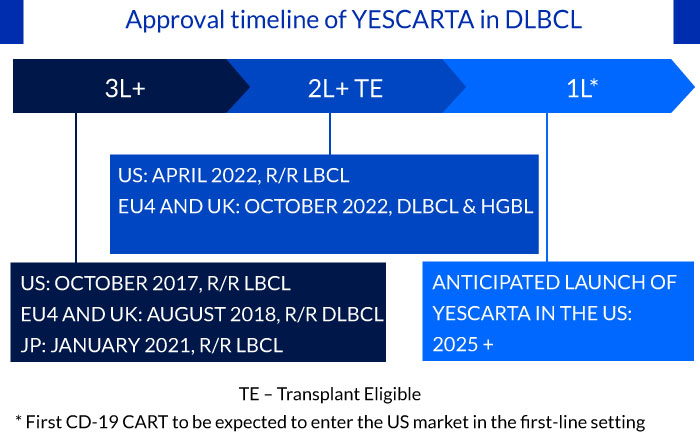

Approval timeline of YESCARTA in DLBCL

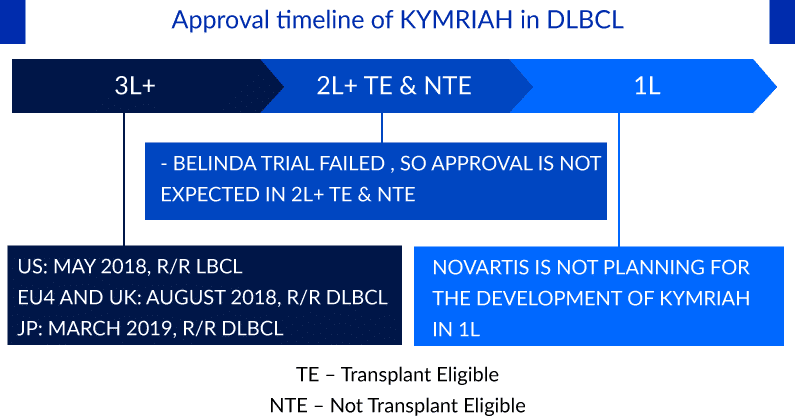

Approval timeline of KYMRIAH in DLBCL

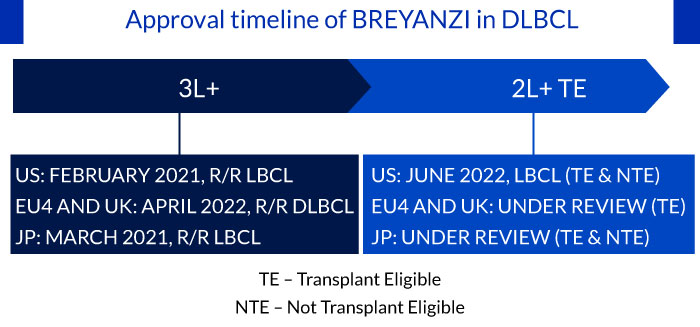

Approval timeline of BREYANZI in DLBCL

The approval of CARTs including YESCARTA (transplant eligible) and BREYANZI (transplant ineligible) is expected to transform the treatment paradigm in the early relapse setting

CARTs were earlier approved for use in later lines of therapy in DLBCL, and recently YESCARTA and BREYANZI have received approval in the early relapse setting. Despite, the high incidence of treatment-induced CRS events and time-consuming manufacturing process, the two CARTs will likely experience a higher patient adoption rate in early relapse patients, as they are fit to tolerate the serious adverse events associated with CART compared to heavily pretreated patients. Hence, underlining the potential of CARTs in bringing transformative change in the early relapse setting.

Additionally, the results from the ZUMA-12 clinical trial has given hope that patients with DLBCL may receive access to the YESCARTA CAR T-cell treatment as soon as possible in the first-line setting. The study enrolled 42 patients with LBCL. The 1-year survival rate for YESCARTA as first-line therapy was 91%, comparable to chemotherapy; the ORR was 89%, and the CRR was 78%. Coming to the safety profile of YESCARTA, Grade ≥3 CRS and neurologic events occurred in three patients (8%) and nine patients (23%), respectively. Earlier this year, YESCARTA became the first CAR T-cell therapy approved by the US FDA for treating DLBCL after first line treatment has failed. The next step is approving the cancer cell and gene therapy for use right after a patient is diagnosed. In November 2022, Gilead added a ZUMA-23 trial for testing YESCARTA in high-risk 1L DLBCL patients vs. R-CHOP; based on data from the ZUMA-23 trial, the company could potentially move forward into the 1L setting

With CART-like clinical benefits and off-the-shelf availability, bi-specific antibodies are set to enhance the treatment options in R/R DLBCL

CAR T-cell therapy had earlier revolutionized the treatment of DLBCL. However, bi-specific antibodies such as Epcoritamab and Glofitamab are now set to have a significant impact on the treatment of R/R DLBCL, since these agents are available off the shelf and do not require specialty centers for administration like CART cell therapy. In addition to that, it provides outpatient administration with a better safety profile. Therefore, off-the-shelf availability and a better safety profile make these bi-specific antibodies an attractive option that is likely to find a high level of adoption post-approval.

POLIVY + R-CHP is expected to compete with CARTs in the frontline setting

In the current scenario, YESCARTA is the only CART being evaluated as a first-line therapy in subjects with High-Risk Large B-Cell Lymphoma, and on the other end, POLIVY + R-CHP is being evaluated in previously untreated patients with DLBCL. Roche recently demonstrated a 27% PFS benefit over R-CHOP using POLIVY + R-CHP in the POLARIX trial, with the benefit driven by older, higher risk, and ABC sub-type patients. In the Phase III POLARIX study, OS at 2 years was 88.7% in the POLIVY + R-CHP group and 88.6% in the R-CHOP group. POLIVY combined with R-CHP did not significantly improve 2-year OS compared to R-CHOP. The patient pool was the largest compared to other therapies in this line. Moreover, the POLARIX study results suggested that POLIVY + R-CHP could transform the treatment of this aggressive malignancy. This combination could be key to driving significant uptake as physicians were focused on the cost/benefit of adding an expensive ADC to an otherwise generic regimen. Nearly 68% of physicians are willing to offer POLIVY + R-CHP to older or higher-risk patients. With a target action date of April 2, 2023, the FDA has accepted the POLARIX data for evaluation, bringing POLIVY + R-CHP one-step closer to clearance. We anticipate a change in market dynamics following the approval of the POLARIX regimen, especially in higher-risk patients.

Safety concerns in the CAR T-cell therapies

CAR T-cell therapies are also extremely expensive and can only be carried out at facilities that can handle adverse events, such as CRS & neurotoxicities. Hence, the use of CAR-T therapy is limited to specialty healthcare facilities. However, in terms of efficacy, the CARTs are promising, but there is a safety concern among all the current CAR-T products, such as CRS and neurotoxicity, that may disrupt the clinical uptake of CARTs in earlier lines.

Failure of KYMRIAH’s Belinda Trial in the 2nd-line setting

The BELINDA study, in which patients were randomly assigned 1:1 to receive KYMRIAH or standard-of-care treatment with platinum-containing bridging therapy followed by autologous stem cell transplant, failed to meet its primary endpoint, with equivalent EFS of 3 months in both groups. In contrast, the similarly designed ZUMA-7 study, which evaluated YESCARTA, and the TRANSFORM study of BREYANZI both met their primary endpoints and demonstrated superior EFS compared with standard of care and complete response rates of approximately 65%. Importantly, differences in trial design and patient population may also play a role. The ZUMA-7 and TRANSFORM studies had higher rates of primary refractory disease (about 74%) compared with the BELINDA study (about 66%), which represented a more chemo-insensitive population among whom CAR-T is expected to perform better. Owing to the failure of BELINDA trial, Novartis has now shifted its focus on it another CART, YTB323, targeting a similar patient population who have failed first-line chemo immunotherapy. As per the recent investor presentation of Novartis, the pivotal study of YTB323 for 2L DLBCL is expected to begin in the second half of 2022, and the company expects submissions for the same by 2025.

CAR T-cell therapies in earlier lines

As CAR T-cell, therapies are moving to earlier lines, the patient’s share in the 3L+ setting is likely to slow down. The emergence of many CAR-Ts has increased competition, but BREYANZI has set itself apart from the other two CAR-Ts and has gained a competitive edge in increased safety. CAR-Ts are now performing well and in line with expectations, but due to current cost, manufacturing, and competitive uncertainties, peak sales may yet fall short of projections. Furthermore, the market for CAR T-cell therapies is going to be crowded in the R/R setting owing to the entry of next-generation CARTs and other novel classes, and sales may face further competition in 4–7 years when newly approved products enter the market.

What next for CAR T-cell therapies?

CAR T-cell therapies have provided a good treatment option in the R/R setting but treatment options for patients who relapse or progress on CART are not yet established. Moreover, evaluation of treatment options for the CART refractory will become essential as the adoption of CARTs increases and they move up the treatment ladder to treat early relapse patients.

Downloads

Article in PDF

Recent Articles

- Snippet

- Gilead Sciences Introduces Sovaldi: A Potent Hepatitis C Treatment

- AbbVie Receives Approval; Kymriah Approved; Shire Gets USFDA Approval; NICE Rejects; Bristol-Myer...

- Abbvie-Genmab’s EPKINLY/TEPKINLY Performance in DLBCL Treatment: The First CD20XCD3 Bispecific An...

- Future Perspectives Of CAR-T Cell Therapy Market In Acute Lymphoblastic Leukemia (ALL)