Roche’s CD79b ADC POLIVY: Attempt to Change DLBCL Treatment Space

Apr 28, 2023

Table of Contents

In recent years, the field of oncology has witnessed a remarkable transformation thanks to the groundbreaking innovation of antibody-drug conjugates (ADCs). These game-changing molecules have three key components: an antibody drug, a potent cytotoxic payload, and a specialized linker protein that binds them together. The result is a powerful therapeutic agent that can precisely target cancer cells, delivering its potent payload with surgical precision.

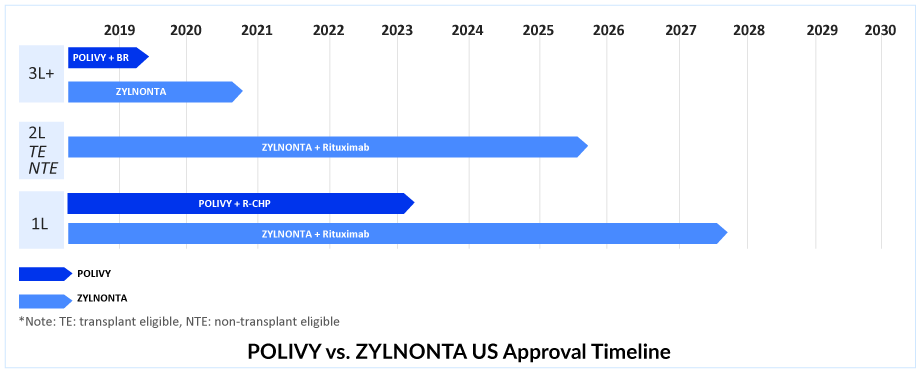

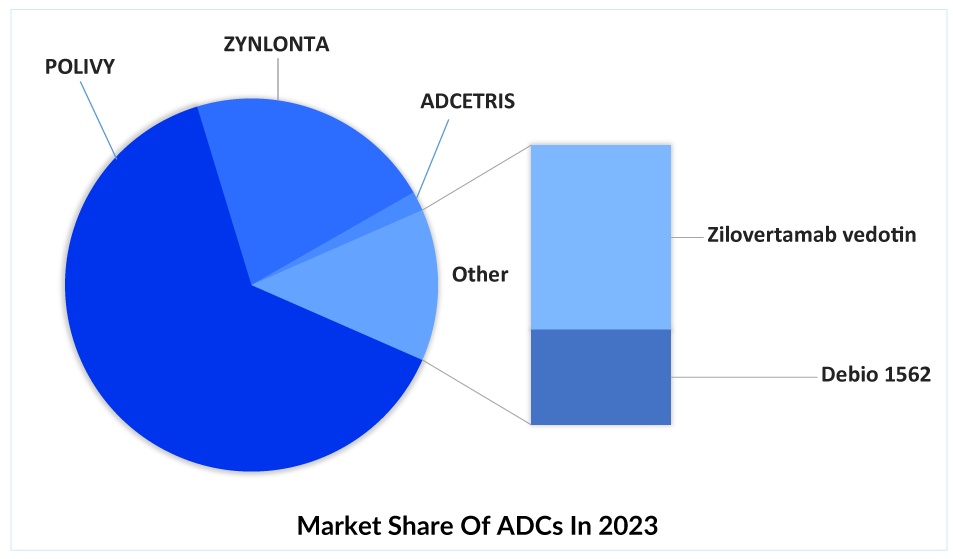

Currently, two ADCs have received approval for the treatment of DLBCL, namely Roche’s POLIVY and ADC Therapeutics’ ZYLNONTA. ZYLNONTA and POLIVY + bendamustine and rituximab (BR) are likely preferable DLBCL treatments for people with primary resistance.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Angelman Syndrome Market: Insights Into The Recent Late-Stage Drug Failures And Novel Approaches ...

- Top 5 Cancers Creating Major Challenge To The Global Healthcare System

- Roche’s Tecentriq combo proves effective in Bladder cancer

- Roche’s HEMLIBRA: A Game Changer in Hemophilia A Treatment Landscape

- Daiichi Sankyo’s Trastuzumab Deruxtecan; ODD to Bexmarilimab for AML; Roche’ Alecensa; Ergomed Ai...

POLIVY in R/R DLBCL setting

POLIVY is the only ADC in DLBCL targeting CD79b and delivers monomethyl auristatin E, a microtubule inhibitor (MMAE). POLIVY is presently authorized as a widely accessible, fixed-duration therapy option for R/R DLBCL in combination with BR, following at least two prior therapies in more than 80 nations and regions around the world, including the US and Europe. As monotherapy or in combination with a regimen containing an anti-CD20 monoclonal antibody, POLIVY has demonstrated encouraging efficacy for R/R DLBCL.

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

POLIVY takes the lead in 1L DLBCL treatment. Substitute for the Oncovin (O) component of the R-CHOP regimen?

In March 2023, FDA’s Oncologic Drugs Advisory Committee voted 11 to 2 in favor of the clinical benefit of the Phase III POLARIX study of POLIVY + R-CHP for 1L DLBCL treatment. After the Phase III POLARIX study provided crucial data, Roche successfully obtained approval for the use of POLIVY + R-CHP in DLBCL treatment in the United States on April 19, 2023. This marks the end of a nearly two-decade-long period of clinical practice, which is expected to undergo a significant shift due to this development. Despite previous regulatory concerns, Roche’s efforts have paid off, and combination therapy is anticipated to be widely adopted.

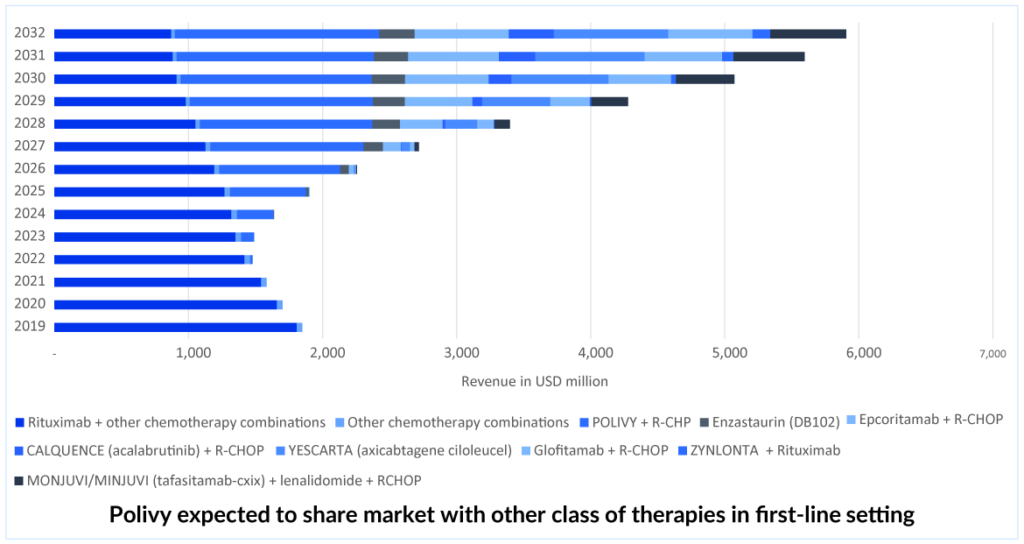

The combination of POLIVY + R-CHP has been approved for 1L DLBCL treatment in over 60 countries, including the EU, UK, Japan, Canada, and China. This DLBCL treatment option has also been added to the National Comprehensive Cancer Network Clinical Practice Guidelines in Oncology as a preferred category 1 regimen for DLBCL in the first-line setting.Therefore, out of all the emerging therapies in 1L DLBCL, DelveInsight expects the POLIVY + R-CHP combination to lead with a peak revenue of approximately USD 950 million in the United States by 2032. POLIVY + R-CHP shows a statistically significant reduction in the risk of disease worsening or death compared to R-CHOP after a median follow-up of 3 years. According to the POLARIX trial data, POLIVY + R-CHP is showing better PFS than R-CHOP alone. POLIVY plus R-CHP response rates are significant.

Scrutiny by the FDA

The FDA scrutinized the data of POLARIX, examining the results in various patient subgroups. Upon analysis, the FDA discovered that high-grade B-cell lymphoma patients mostly drove the enhancement in progression-free survival, while patients with DLBCL, which was the most extensive subgroup, experienced minimal benefit. In the future, the willingness of physicians to prescribe POLIVY + R-CHP as first-line therapy will also be a key factor in winning over patients in the 1L setting. However, POLIVY + R-CHP’s acceptance may be affected in first-line DLBCL treatment due to the lack of an OS benefit.

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

POLIVY’s share expected to decline in later lines. Competition arises.

After its approval in the first-line setting, POLIVY is expected to gain a significant portion of the DLBCL treatment market share. Nevertheless, it is anticipated that in the second and third-line settings, POLIVY’s market share will decrease. As a result, ZYNLONTA is expected to maintain a stable share of patients for a few years while competition in the third-line and beyond settings grows. ZYNLONTA may be more tolerable than POLIVY-BR, but both would be effective. ZYNLONTA is approved in the US and currently has a favorable CHMP (Committee for Medicinal Products for Human Use) opinion adopted in Europe. The third line is getting quite crowded, and the only hope in this situation is outstanding efficacy and safety data; thus, ZYNLONTA needs to expand into markets other than the United States and earlier lines. ZYNLONTA is likely to face competition from other ADCs, as well as from upcoming bi-specific antibodies and monoclonal antibodies such as MONJUVI.

ADC Therapeutics is developing a comprehensive program for DLBCL, which includes the Phase III LOTIS-5 study of ZYNLONTA combined with rituximab in 2L non-transplant eligible patients and is expected to read out data in mid-2025 and could potentially provide an advantage to ZYNLONTA over MONJUVI. Additionally, ADC Therapeutics is conducting a Phase II LOTIS-3 trial of ZYNLONTA in combination with ibrutinib, which has demonstrated encouraging results in non-GCB DLBCL. The data from this trial is anticipated in mid-2025 and could further solidify ZYLONTA’s position.

After the approval of POLIVY and ZYNLONTA in 3L+, several companies have shifted their focus on developing ADCs for R/R DLBCL treatment, such as Debiopharm (Debio 1562 + Rituximab), Seagen/Takeda (ADCETRIS + lenalidomide + rituximab), Merck (Zilovertamab vedotin + BR) and others.

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In conclusion, antibody-drug conjugates (ADCs) have revolutionized the field of oncology by providing a targeted and effective approach to treating cancer. The recent approvals of ADCs such as Roche’s POLIVY and ADC Therapeutics’ ZYNLONTA for DLBCL treatment have brought new hope to patients and physicians. POLIVY has shown promising results in the first-line setting and is expected to lead the DLBCL treatment market in terms of revenue. However, competition in the second and third-line settings is expected to increase, with ZYNLONTA likely to maintain a consistent patient share for at least a few years. ADC Therapeutics’ comprehensive program for DLBCL, including the ongoing Phase III LOTIS-5 study of ZYNLONTA, is expected to provide an advantage over upcoming therapies such as MONJUVI. As the fight against cancer continues, ADCs are a shining beacon of progress and possibility. The release of several new ADCs in R/R DLBCL treatment is likely to affect the market share of other unique emerging classes, such as bispecific antibodies, cancer vaccines, and BTK inhibitors.

FAQs

Diffuse Large B-cell Lymphoma (DLBCL) is the most prevalent type of non-Hodgkin’s lymphoma that can develop in lymph nodes or outside the lymphatic system (for example, in the gastrointestinal tract, testes, thyroid, skin, breast, bone, or brain).

DLBCL symptoms include painless, fast swelling in the neck, underarms, or groin produced by swollen lymph nodes. The swelling may be uncomfortable for some people. Night sweats, fever, and unexpected weight loss are some other DLBCL symptoms. Patients may experience weariness, appetite loss, shortness of breath, or discomfort.

A tissue sample is required for a definite DLBCL diagnosis. Because DLBCL is a blood cancer, it is critical to seek any symptoms of lymphoma throughout the body. This is commonly accomplished with a positron emission tomography (PET) scan. A morphological DLBCL diagnosis should be validated in all patients by immunophenotypic investigations, either immunohistochemistry (IHC) or flow cytometry, or a combination of both techniques.

DLBCL treatment is often initiated quickly after diagnosis with the goal of achieving a long-term remission or cure. Most treatments still rely on a combination of chemotherapy and a monoclonal antibody targeting CD20. R-CHOP (rituximab, cyclophosphamide, doxorubicin, vincristine, and prednisone) is the most often used combination chemotherapy regimen for DLBCL. It is normally administered in 21-day cycles. Etoposide (VePesid, Toposar, Etopophos) is sometimes combined with the R-CHOP regimen, resulting in the R-EPOCH medication combination. Radiation therapy is sometimes used in DLBCL treatment.

Downloads

Article in PDF

Recent Articles

- Inozyme Raises $67M; Shanghai Miracogen partners with Synaffix; EdiGENE raises $15M; Antengene an...

- Gilead’s remdesivir trials; F2G raises $60.8M; Cancer immunotherapy research updates; Celle...

- Antibody-Drug Conjugate: The Smart Biological Bomb

- Assessing the Major Growth and Ongoing Developments in the Clinical Diagnostics Market

- FDA Approves RINVOQ for Crohn’s Disease; FDA Approves Krystal Biotech’s Gene Therapy Vyjuve...