Achondroplasia Treatment Space: Hunt for Potential Curative Therapies

Jan 22, 2024

Table of Contents

Achondroplasia is a rare genetic disorder affecting bone growth, causing significant short stature, known as dwarfism. This condition is attributed to a fibroblast growth factor receptor 3 (FGFR3) gene mutation. The mutation results in an overactive FGFR3 gene, leading to a slowdown in bone formation within the cartilage of the growth plate and hindering the growth of nearly all bones throughout the body.

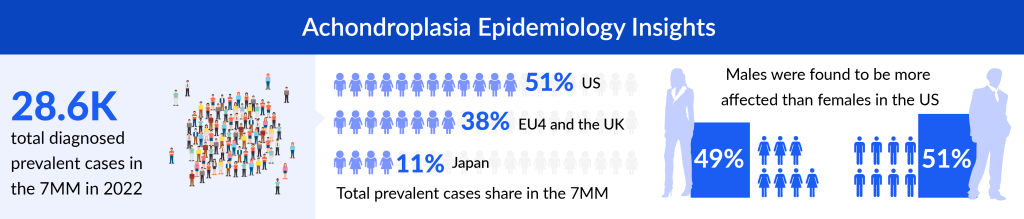

According to DelveInsight’s estimates, in 2022, there were nearly 29K diagnosed prevalent cases of achondroplasia in the 7MM. These cases will change during the study period (2019–2032). The US accounted for approximately 14K diagnosed prevalent cases of achondroplasia in 2022; these cases are projected to rise by 2032. According to DelveInsight analysis, achondroplasia occurs slightly more in males than females in the US. The gender-specific cases are expected to rise by 2032 in the US.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Novo Nordisk Seeks FDA Approval for Higher-Dose 7.2 mg WEGOVY Injection; Ascendis Pharma Granted ...

- Achondroplasia Treatment: Emerging Therapies, Pathway Strategies, and Market Outlook

- Beam’s BEAM-302 Earns FDA Orphan Drug Tag for AATD; Incannex’s IHL-42X Moves to Phase III After F...

- FDA Approves PENBRAYA for Most Common Serogroups Causing Meningococcal Disease; BIMZELX Approved ...

The effective management of achondroplasia necessitates a collaborative approach with a diverse team of healthcare professionals. While there are no definitive cures for achondroplasia, treatment focuses on alleviating complications and offering relief from symptoms.

VOXZOGO: The Only Approved Drug for Achondroplasia Treatment

The present scenario for treating achondroplasia does not offer any definitive cures and encompasses a range of both pharmaceutical and non-pharmaceutical approaches. Various achondroplasia treatments target the specific challenges associated with achondroplasia. Pharmacological measures involve the use of CNP analogs and other medications to address symptomatic complications. Additionally, the potential use of growth hormone therapy as a treatment for achondroplasia is a topic of debate, with its long-term advantages being a matter of controversy, and its authorization limited to Japan.

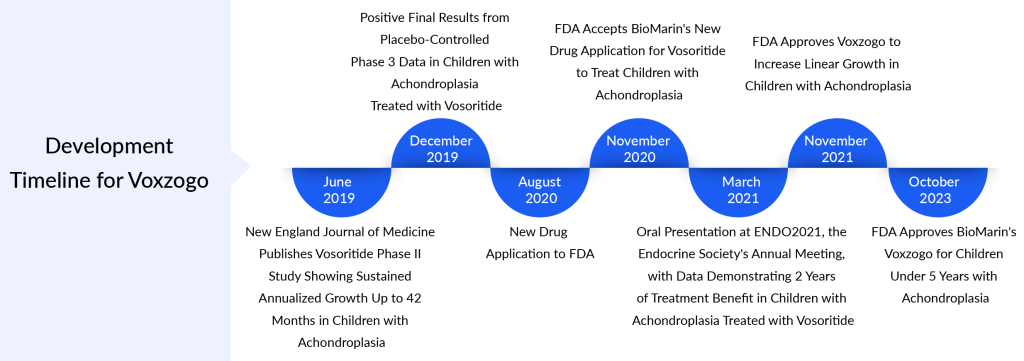

Until 2021, the United States primarily employed symptomatic approaches for managing achondroplasia. The achondroplasia treatment landscape changed with the approval of the first treatment, VOXZOGO (vosoritide), by the US FDA. This approval specifically targeted children aged 5 and above with achondroplasia, aiming to unlock their growth potential. Subsequently, in 2023, the FDA broadened the drug’s application to include pediatric patients with achondroplasia possessing open epiphyses (growth plates). VOXZOGO operates as a C-type natriuretic peptide (CNP) analog, functioning as a positive regulator in the signaling pathway downstream of FGFR3 to facilitate endochondral bone growth.

Despite its efficacy, VOXZOGO comes with certain drawbacks. It induces temporary changes in blood pressure and necessitates daily subcutaneous injections, leading to reactions at the injection site. Alongside VOXZOGO, various other achondroplasia medications are employed to address the complications of achondroplasia and alleviate symptoms. This repertoire includes statins, antihistamines, and growth hormones. Statins, known for inhibiting cholesterol synthesis, exert an anabolic effect on chondrocytes and counteract FGFR3 signaling. However, further research is imperative to ascertain whether statins indeed confer positive effects on chondrocytes in the context of achondroplasia.

The approach to treating achondroplasia in Europe and Japan closely mirrors that of the United States. Europe, like the US, has a single approved drug called VOXZOGO, which gained authorization before receiving approval in the US. In August 2021, the European Medicines Agency (EMA) approved for the treatment of achondroplasia in children from the age of 2 until the closure of growth plates, typically occurring post-puberty. In contrast, Japan approved the drug in 2022 for treating achondroplasia in children of all ages whose growth plates have not yet closed.

Search for Effective Drugs for Achondroplasia Treatment

The achondroplasia treatment market offers substantial opportunities for these participants to capitalize on an expansive and largely untapped market, addressing the unmet needs of individuals with achondroplasia. Ongoing research is exploring newer molecules such as monoclonal antibodies, peptide aptamers, and induced pluripotent stem cells, with several assets in the early and mid-phases. The emerging achondroplasia pipeline is limited with products like Ascendis Pharma’s TransCon CNP (navepegritide), QED Therapeutics (BridgeBio)/Novartis’s Infigratinib (BBP-831/BGJ398), Sanofi’s SAR442501, RIBOMIC’s RBM-007, among others. Anticipated advancements, such as the introduction of novel therapies like TransCon CNP (navepegritide) and infigratinib (BBP-831/BGJ398), are expected to contribute to a positive achondroplasia treatment market shift during the forecast period from 2023 to 2032.

TransCon CNP: Ascendis Pharma

TransCon CNP represents an innovative long-acting prodrug of CNP designed for a convenient once-weekly subcutaneous administration, aiming to provide sustained therapeutic levels of CNP exposure. This development is specifically targeted for treating achondroplasia in children. TransCon CNP is engineered to protect CNP from degradation by neutral endopeptidase in both the bloodstream and subcutaneous tissue. Additionally, it diminishes CNP’s interaction with the natriuretic peptide receptor (NPR-B) in the cardiovascular system, preventing hypotension, and limits CNP binding to the NPR-C receptor, thereby reducing clearance. Lastly, it releases unaltered CNP, which possesses the ideal size for effective penetration of growth plates.

The drug is currently in a crucial Phase II/III Approach study, and the anticipated findings are projected to emerge in the second half of 2024. Additionally, the drug is undergoing exploration in two other trials, namely ACcomplisH and AttaCH.

Infigratinib: QED Therapeutics (BridgeBio)/Novartis

Infigratinib (BBP-831/BGJ398) is an orally delivered, ATP-competitive, and specifically targeted FGFR1-3 tyrosine kinase inhibitor (TKI) designed for the treatment of FGFR-driven conditions, particularly achondroplasia in children. It functions by hindering the aberrant signaling pathway linked to FGFR3 mutations, specifically the MAPK and STAT-1 pathways.

The medication is currently in the process of undergoing two Phase II trials known as PROPEL-2 and PROPEL OLE. Furthermore, there is an ongoing Phase III trial for achondroplasia treatment, with enrollment ongoing as per the company’s press release. The outcomes of this Phase III trial are expected to be available by 2025.

Furthermore, the US has granted approval for TRUSELTIQ (infigratinib) in the treatment of previously treated, unresectable locally advanced, or metastatic cholangiocarcinoma with an FGFR2 fusion or other rearrangement, as identified by a US FDA-approved test. Additionally, there are ongoing development efforts for the use of infigratinib in the treatment of urothelial carcinoma.

SAR442501: Sanofi

SAR442501, a monoclonal antibody (mAb) designed to counteract the overactivity of FGFR3 in individuals with achondroplasia and osteochondrodysplasia, is delivered subcutaneously. Currently, SAR442501 is undergoing evaluation in a Phase II clinical trial involving pediatric patients with achondroplasia.

RBM-007: RIBOMIC

RBM-007, a newly developed nucleic acid medicine, is an oligonucleotide-based aptamer created at RIBOMIC’s research facilities in Tokyo, Japan. Comprising 36 nucleotides, this aptamer forms a stable and specific bond with FGF2, distinguishing it from other FGFs. Serving as an anti-FGF2 aptamer, RBM-007 has demonstrated significant efficacy in curbing excessive interactions between FGF2 and FGF receptor 3 activating variants, which are known contributors to achondroplasia. Through subcutaneous injection, RBM-007 effectively restored impaired skeletal growth in a mouse model of achondroplasia. Currently, RIBOMIC is progressing with a Phase IIa clinical trial for achondroplasia treatment and a Phase IIb trial for wet age-related macular degeneration treatment.

Expected Roadblocks to Achondroplasia Treatment

Due to insufficient awareness, diagnostic shortcomings, and a shortage of epidemiological information, individuals with achondroplasia face significant unmet needs. This condition affects various bodily systems throughout life, adversely influencing the well-being of both patients and their caregivers. Those with achondroplasia may encounter a spectrum of medical challenges, psychosocial hurdles, and functional constraints within a societal framework that fails to acknowledge or address their requirements.

Moreover, approved achondroplasia therapies, including limb lengthening and GH treatments, pose potential problems, whereas VOXZOGO, primarily focused on symptom relief, comes with unwanted side effects. Additionally, achondroplasia, being hereditary and lacking curative therapies, may present challenges for affected individuals when starting their own families. The current published literature and studies probably underestimate the true burden of achondroplasia in terms of HRQoL and treatment costs, thereby limiting its application in diagnosis.

The Future Achondroplasia Treatment Market Looks Promising

The dynamics of achondroplasia treatment market are likely to change in the coming years. Firstly, advancements in genetic research and diagnostics have allowed for earlier and more accurate identification of individuals with achondroplasia, enabling timely interventions and personalized treatment approaches. Additionally, the growing awareness and understanding of rare genetic disorders among healthcare professionals and the general public have spurred increased demand for therapeutic solutions. The development of targeted therapies and gene-editing technologies holds significant promise for addressing the root causes of achondroplasia, driving research and investment in novel treatment modalities. Furthermore, collaborative efforts between pharmaceutical companies, research institutions, and patient advocacy groups are fostering a supportive ecosystem for the development of innovative therapies.

According to DelveInsight’s analysis, the market size for achondroplasia reached USD 198 million in 2022 across the 7MM and is expected to grow with a significant CAGR by 2032. As per the analysis, in the US, BioMarin Pharmaceutical and Chugai Pharmaceutical’s VOXZOGO (vosoritide) had the highest market share among all the therapies in 2022, with a revenue of approximately USD 87.3 million, followed by other therapies that include statins, antihistamines, growth hormone, etc.

With the anticipated launch of emerging therapies for achondroplasia treatment, the market is going to propel forward. Additionally, as the landscape of precision medicine evolves, these achondroplasia treatment market drivers are poised to shape the future of achondroplasia treatment, offering hope for improved outcomes and quality of life for individuals affected by this condition.

Downloads

Article in PDF

Recent Articles

- Beam’s BEAM-302 Earns FDA Orphan Drug Tag for AATD; Incannex’s IHL-42X Moves to Phase III After F...

- FDA Approves PENBRAYA for Most Common Serogroups Causing Meningococcal Disease; BIMZELX Approved ...

- Novo Nordisk Seeks FDA Approval for Higher-Dose 7.2 mg WEGOVY Injection; Ascendis Pharma Granted ...

- Achondroplasia Treatment: Emerging Therapies, Pathway Strategies, and Market Outlook