How Will the Emerging Therapies for Cutaneous T-cell Lymphoma Reshuffle its Treatment Landscape

Nov 11, 2022

Table of Contents

Cutaneous T-cell lymphoma (CTCLs) characterized by cutaneous infiltration of malignant monoclonal T-lymphocytes is a rare lymphoma affecting around 6.4 cases per million individuals every year. The total incident population of Cutaneous T-cell lymphoma in the 7MM was around 7.5K in 2021, with the US accounting for the highest patient share/incidence. CTCL is further characterized by mycosis fungoides (MF), Sézary syndrome, and primary cutaneous peripheral T cell lymphoma, while the most common CTCL type is mycosis fungoides.

Various treatment options available for CTCL treatment depend upon the severity of the disease or the stage of cancer. It also depends upon whether the disease involves the lymph nodes, the blood or other organs in the body, type, extent of skin lesions present (patches, plaques, or tumors), number of Sézary cells in the blood, and transformation to large cell type or folliculotropic mycosis fungoides.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Amgen to Acquire Horizon Therapeutics; Sanofi and Teva Announce Collaboration; Boehringer Obesity...

- Cutaneous T-cell lymphoma Market Outlook

- Insights Into The Cutaneous T-cell Lymphoma Treatment Market

- FDA Approves Ojjaara for Myelofibrosis; EMA Grants PRIME Designation to Iopofosine I-131; EBGLYSS...

- Novome raises USD 33M, Buyout of Bioniz, Adagene raises USD 69M

Currently, the FDA-approved drugs available in the CTCL market for the treatment of mycosis fungoides or Sézary syndrome include Istodax (romidepsin), Valchlor (mechlorethamine), Uvadex (methoxsalen), Targretin (bexarotene), Adcetris (brentuximab vedotin) and Zolinza (vorinostat).

Moreover, several pharma giants are working on CTCL treatment therapies, including, Soligenix, Merck Sharp & Dohme Corp, Elorac, Innate Pharma, Viridian Therapeutics, Sorrento Therapeutics, Bio-Path Holdings, Legend Biotech, Genzada Pharmaceuticals, VidacPharma, Bioniz Therapeutics, Otsuka Pharmaceutical, Hoffmann-La Roche, BioInvent International AB, Scopus BioPharma, Codiak BioSciences, and are working on developing effective cures for CTCL to cater to the needs of the patients.

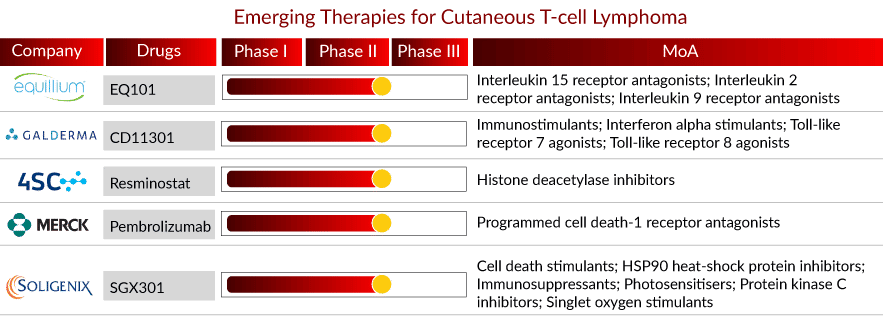

Emerging Therapies in the Cutaneous T-cell Lymphoma Market

The CTCL pipeline is robust, with several therapies in the mid-stage of clinical development. The anticipated launch of emerging therapies such as SGX301, Pembrolizumab, Resminostat, CD11301, and EQ101 will boost the CTCL market growth in the coming years. A detailed assessment of some of these therapies is given below::

Drug: SGX301

Company: Soligenix

Phase: Phase III

MoA: Cell death stimulants; HSP90 heat-shock protein inhibitors; Immunosuppressants; Photosensitisers; Protein kinase C inhibitors; Singlet oxygen stimulants

SGX301 by Soligenix is a first-in-class photodynamic therapy that majorly overcomes the risks of already preferred PDT-UVA therapies and has received Fast-track and Orphan Drug designation from the USFDA.

Recently, Soligenix announced positive topline results for its Phase III (NCT02448381) FLASH Trial. Follow-up visits were completed in Q4 2020, and data lock and the final analysis remain ongoing.

Soligenix is preparing to commercialize SGX301 in the US and entered into a strategic partnership with Daavlin for the supply and distribution of SGX301 companion light devices to treat cutaneous T-cell lymphoma. In 2021, the drug received conditional FDA acceptance of the proposed brand name HyBryte for SGX301 in the CTCL treatment market.

Drug: Pembrolizumab

Company: Merck & Co.

Phase: Phase II

MoA: Programmed cell death-1 receptor antagonists

Pembrolizumab developed by Merck & Co. is an anti-programmed death receptor-1 (PD-1) therapy that works by increasing the ability of the body’s immune system to help detect and fight tumor cells. It is a humanized monoclonal antibody that blocks the interaction between PD-1 and its ligands, PD-L1, and PD-L2, thereby activating T lymphocytes which may affect both tumor cells and healthy cells.

Currently, this drug is in Phase II (NCT03385226) to assess the effect of pembrolizumab combined with radiotherapy in patients with relapsed, refractory, specified stages of Cutaneous T-cell Lymphoma (CTCL) Mycosis Fungoides (MF)/Sezary Syndrome (SS).

Drug: Resminostat

Company: 4SC AG

Phase: Phase II

MoA: Histone deacetylase inhibitors

Resminostat developed by 4SC AG, is an orally administered histone deacetylase (HDAC) inhibitor that potentially represents a novel therapy for a broad spectrum of oncology indications, both in monotherapy and particularly in combination with other anti-cancer drugs.

The clinical development of resminostat is currently focused on cutaneous T-cell lymphoma (CTCL).

Currently, this drug is in Phase II (RESMAIN) (NCT02953301) to trial evaluate it for maintenance treatment of patients with advanced stage (Stage IIb-IVb) mycosis fungoides (MF) or sézary syndrome (SS) that have achieved disease control with systemic therapy.

Drug: CD11301

Company: Galderma

Phase: Phase II

MoA: Immunostimulants; Interferon alpha stimulants; Toll-like receptor 7 agonists; Toll-like receptor 8 agonists

Galderma’s CD11301 has completed the Phase II (NCT03292406) study for CTCL treatment. It is a topical gel containing the Toll-like receptor (TLR) agonist resiquimod, imidazoquinolinamines, with potential immunomodulating activity. Upon topical application, the resiquimod gel CD11301 binds to TLR7 and 8, which are found mainly on dendritic cells (DCs), macrophages, and B lymphocytes. It activates the TLR signaling pathway, which results in the induction of the nuclear translocation of transcription activator nuclear factor kappa-B (NF-kB) and the activation of other transcription factors. Subsequently, NF-kB-dependent gene expression is induced, and cytokine production increases, especially interferon-alpha (INF-a), which enhances T-helper 1 (Th1) immune responses. In addition, topical application of resiquimod appears to activate epidermal Langerhans cells, leading to enhanced activation of T lymphocytes.

Drug: EQ101

Company: Equillium Bio.

Phase: Phase I/II

MoA: Interleukin 15 receptor antagonists; Interleukin 2 receptor antagonists; Interleukin 9 receptor antagonists

Equillium Bio.’s EQ101, formerly known as BNZ-1, is a first-in-class, tri-specific inhibitor of IL-2, IL-9, and IL-15, three inflammatory cytokines implicated in multiple diseases. It has demonstrated clinical proof-of-concept as a novel cytokine inhibitor through a completed Phase I/II (NCT03239392) study in the CTCL treatment market.

BNZ-1 is currently formulated for intravenous administration, with subcutaneous formulation development underway. It has received orphan drug designation from EC and FDA.

What Lies ahead?

The current CTCL treatment options in the market have been a constant challenge for the past 20 years. Apart from that, the newer therapies are constantly changing, adding to the challenges. The hunt to look for improved and better CTCL treatment options has constantly been emerging to land upto treatment entities that possess better efficacy and have a safer therapeutic window to fulfill unmet medical needs.

The most common CTCL treatment drug options that are currently being examined include fusion molecules like denileukin diftitox, topical retinoids, interleukin-2, interleukin-12, and pegylated interferon. A few more therapies that show clinical potential include gemcitabine, Pegylated liposomal doxorubicin, and chlorodeoxyadenosine. The remaining therapies that can be used for cutaneous T-cell lymphoma treatment include vaccines and monoclonal antibodies. The newer emerging therapies have the potential to overcome the downsides of the currently existing therapies and can possibly improve the health quality and decrease the cutaneous T cell lymphoma fatality rate.

Furthermore, the CTCL treatment market is posing newer opportunities for several new market players as there is no existing curative treatment and the disease has a high tendency to resist newer developed therapies.

FAQs

Cutaneous T-cell lymphoma (CTCL) is a rare type of blood cancer. It begins in a type of white blood cell called the T-lymphocyte (T-cell). T-cells help prevent infections and other diseases.

CTCL treatment options include topical chemotherapy, radiation therapy, photo-chemotherapy, vitamin A derivatives (retinoids), and chemotherapy. These treatments may be used alone or in varied combinations.

In the seven major geographies, the cutaneous T-cell lymphoma market size is estimated to be approximately USD 399 million in 2021.

Currently, the FDA-approved drugs available in the cutaneous T-cell lymphoma market include SGX301 (Soligenix), WP1220 (Moleculin Biotech), and Lacutamab (Innate Pharma).

Downloads

Article in PDF

Recent Articles

- Novome raises USD 33M, Buyout of Bioniz, Adagene raises USD 69M

- Insights Into The Cutaneous T-cell Lymphoma Treatment Market

- Cutaneous T-cell lymphoma Market Outlook

- Amgen to Acquire Horizon Therapeutics; Sanofi and Teva Announce Collaboration; Boehringer Obesity...

- FDA Approves Ojjaara for Myelofibrosis; EMA Grants PRIME Designation to Iopofosine I-131; EBGLYSS...