Botanical Bounty: Cracking the Herbal Medicine Market Enigma and Growth Potential

Oct 03, 2025

Table of Contents

Herbal medicine, once rooted in folk traditions, has evolved into a structured and evidence-based segment of modern healthcare. The global herbal medicine market and herbal medicinal products market are witnessing strong growth, with the US herbal medicine market gaining momentum alongside Asia and Europe’s longstanding traditions. Product diversification, such as the herbal tincture market, reflects adaptability to modern lifestyles, while the broader natural medicine market integrates herbal remedies with nutraceuticals and dietary supplements.

Each pharmaceutical company specializing in herbal products is increasingly emphasizing preventive herbal remedies, aligning with consumer demand for long-term wellness. Simultaneously, the botanical plant-derived drugs market highlights advanced extraction and standardization methods that are reshaping raw botanicals into reliable therapeutics. With the herbal medicinal product market undergoing stricter quality and regulatory oversight, the herbal medicine industry now represents a convergence of tradition, science, and global trade.

Downloads

Click Here To Get the Article in PDF

Collectively, the expanding herbalism market underscores the sector’s shift from cultural heritage to innovative, evidence-backed healthcare solutions.

Historical Context and Evolution of Herbal Medicine

The history of herbal medicine is as old as civilization itself. From the earliest records in Mesopotamia, Egypt, India, and China, plants were used not only as food but also as essential therapeutic resources. These early practices formed the foundation of the traditional medicine market, where local knowledge and cultural heritage guided healing traditions for centuries. Even today, many modern formulations can trace their roots back to the same herbs that ancient healers relied on, highlighting the enduring importance of this knowledge system in shaping the global traditional medicine market.

Ancient Civilizations and Indigenous Knowledge

In India, Ayurveda classified hundreds of herbs into precise categories for preventive and curative care. In China, Traditional Chinese Medicine (TCM) emphasizes balance and harmony, using plant-based remedies to restore health. Indigenous peoples in Africa and the Americas developed equally rich systems of healing, where herbs were central to both medicine and ritual. Together, these diverse traditions laid the groundwork for what we now call the medicinal herbs market, a sector that continues to thrive as consumers rediscover the value of natural remedies.

Commerce, Globalization, and Standardization

The colonial spice trade and global exploration played a pivotal role in spreading herbal knowledge and products across continents. Cinnamon, ginger, clove, and nutmeg became global commodities, shaping not only diets but also healthcare practices. As the scope of trade expanded, herbal remedies transformed from community-based treatments into commercial products, stimulating the earliest forms of herbal product development. This evolution marked the transition of herbal medicine from local tradition to global commerce, where it continues to play an essential role.

From Heritage to Trend

What was once preserved primarily through tradition has now become a dynamic part of global consumer culture. The growth of herbal teas, supplements, and capsules reflects a powerful herbal trend that merges cultural authenticity with modern lifestyle choices. Today’s herbal trends not only emphasize the healing power of plants but also align with sustainability, eco-consciousness, and preventive healthcare. In this way, the historical journey of herbal medicine demonstrates both continuity and transformation, evolving from localized traditions into a thriving component of the global healthcare system.

The Modern Resurgence of Herbal Medicine

In recent decades, herbal medicine has experienced a remarkable revival, evolving from a traditional practice into a fast-growing global wellness movement. Rising health consciousness, concerns over synthetic drug side effects, and a desire for natural approaches have fueled renewed interest in plant-based therapies. This momentum is reflected in the rapid expansion of the organic herbal medicine market, where consumers increasingly favor clean-label, chemical-free, and sustainably sourced remedies that align with eco-conscious values.

Changing Consumer Preferences

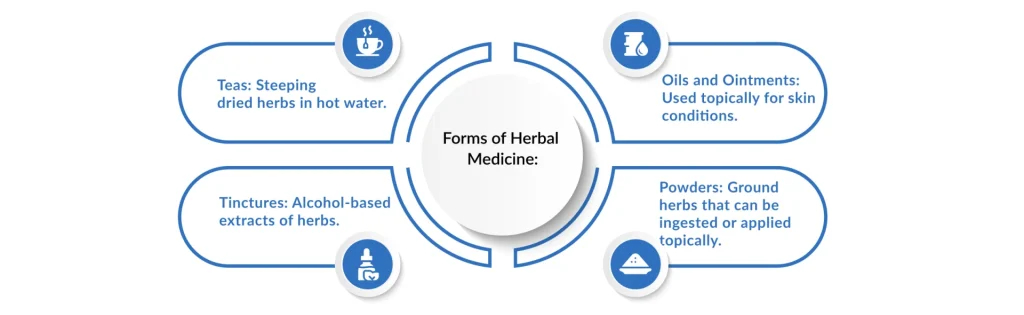

The modern herbal product market is no longer confined to tinctures and teas; it now spans capsules, powders, oils, functional beverages, and fortified foods. These innovations make herbal remedies more accessible and adaptable to diverse lifestyles. Importantly, the appeal of herbal solutions extends beyond treating illness; many are embraced for preventive care and overall wellness. As a result, demand for holistic options has surged, particularly in the form of herbal health solutions that emphasize balance, immunity, and long-term well-being.

Industry Response and Innovation

To meet this growing demand, herbal pharmaceutical companies are investing in advanced extraction techniques, rigorous testing, and standardized formulations. These companies are playing a pivotal role in elevating herbal medicine from folk remedies to regulated healthcare products, blending tradition with science. Their efforts have enabled broader medical acceptance and created new commercial opportunities within the pharmaceutical, nutraceutical, and functional food industries.

Expanding Applications in Wellness

The herbal supplements remedies market has grown significantly, driven by interest in immune support, detoxification, digestive health, and energy management. Consumers are increasingly incorporating herbal remedies into daily routines as part of a broader wellness strategy. Parallelly, the herbal supplements for mental health market is expanding rapidly, with adaptogens such as ashwagandha, rhodiola, and valerian gaining popularity for stress management, sleep support, and mood regulation. This shift underscores how herbal medicine is no longer seen as an alternative therapy but as an essential component of modern mental and physical wellness.

A Mainstream Movement

The modern resurgence of herbal medicine demonstrates a powerful convergence of cultural heritage, scientific validation, and consumer demand. With sustainability and natural living at the forefront of global health priorities, the organic herbal medicine market and broader herbal product market are positioned for sustained growth. By delivering both traditional wisdom and evidence-based credibility, the sector continues to redefine the role of plant-based therapies in contemporary healthcare.

The Science behind the Leaves

The credibility and growth of modern herbal medicine lie in its scientific underpinnings. While tradition forms the foundation, contemporary research and pharmacological validation are propelling herbal therapies into regulated healthcare systems worldwide. The rise of the pharmaceutical and medicinal herbal extracts market demonstrates how bioactive compounds derived from plants are increasingly recognized for their therapeutic potential. These extracts are not only used in dietary supplements but are also gaining traction in the pharmaceutical industry, bridging the gap between natural remedies and evidence-based medicine.

Pharmacological Basis of Herbal Medicine

Herbal medicines work through a variety of pharmacological pathways, including anti-inflammatory, immunomodulatory, and antioxidant effects. Research has identified active compounds such as curcuminoids in turmeric, ginsenosides in ginseng, alkamides in echinacea, and withanolides in ashwagandha, which provide measurable therapeutic outcomes. This pharmacological grounding has helped the pharmaceutical medicinal herbal extracts market expand rapidly, with growing integration into both conventional therapeutics and nutraceutical formulations.

Accepted and Well-Researched Herbs

| Herb | Key Bioactive Compound(s) | Therapeutic Applications | Market Impact |

| Turmeric (Curcuma longa) | Curcumin | Anti-inflammatory, antioxidant, anticancer, arthritis, metabolic syndrome | Major driver in the botanical and herbal drug market, highly used in supplements & pharma |

| Ginseng (Panax ginseng) | Ginsenosides | Cognitive enhancement, stress & fatigue reduction, immune modulation | Strong growth in the pharmaceutical, medicinal herbal extracts market, and the herbal botanical extracts health products market |

| Echinacea (Echinacea purpurea) | Alkylamides, caffeic acid derivatives, polysaccharides | Immune-boosting, reduces cold/flu severity, and increases infection resistance | Among the top sellers in the herbal botanical extracts health products market |

| Ashwagandha (Withania somnifera) | Withanolides | Stress relief, improved sleep, fertility enhancement, and adaptogenic effects | Fast-growing herb in the pharmaceutical and medicinal herbal extracts market, aligned with herbal trends |

| Ginkgo biloba | Flavonoids, terpenoids (ginkgolides, bilobalide) | Memory enhancement, improved circulation, neuroprotection | Popular in the botanical and plant-derived drugs market, widely studied for cognitive health |

| Elderberry (Sambucus nigra) | Anthocyanins, flavonoids | Antiviral, immune support, flu, and cold symptom reduction | High demand in the herbal supplements remedies market, especially post-pandemic |

| Milk Thistle (Silybum marianum) | Silymarin complex | Liver protection, detoxification, antioxidant activity | Growing traction in the herbal medicinal products market for liver health supplements |

| Garlic (Allium sativum) | Allicin, sulfur compounds | Cardiovascular health, cholesterol regulation, and antimicrobial | Strong adoption in the herbal health solutions and nutraceutical sectors |

| Green Tea (Camellia sinensis) | Catechins (EGCG) | Antioxidant, metabolic booster, cardiovascular support, cancer prevention | Strong footprint in the herbal capsule market and global nutraceutical formulations |

These widely researched herbs form the backbone of the botanical and plant-derived drugs market, reflecting how traditional remedies are being translated into modern pharmacopoeias.

Scientific and Clinical Validation

The scientific credibility of herbal medicine depends on rigorous validation through clinical research. While historical usage offers valuable insight, modern healthcare systems require standardized data on efficacy, safety, and mechanisms of action. This demand has accelerated growth in the pharmaceutical and medicinal herbal extracts market, where bioactive compounds are tested and validated with the same rigor as conventional drugs. Such scientific frameworks are redefining the botanical and plant-derived drugs market, moving herbal remedies beyond tradition into evidence-based practice.

Standardized Extracts vs. Whole-Plant Formulations

One of the central debates in herbal medicine research concerns the use of standardized extracts versus whole-plant formulations. Standardized extracts ensure consistent concentrations of key active compounds, which support reproducibility in clinical outcomes and have become the cornerstone of the pharmaceutical medicinal herbal extracts market. In contrast, whole-plant formulations may leverage the synergistic interactions of multiple phytochemicals, offering broader therapeutic potential. Both approaches are vital, but striking a balance between standardization and holistic efficacy remains a challenge in the botanical and herbal drug market.

Biomarker-Driven Research and Clinical Trial Design

Modern herbal clinical trials increasingly rely on biomarkers to assess physiological responses and therapeutic outcomes. For instance, reductions in inflammatory markers (CRP, TNF-α, IL-6) are commonly used in trials studying turmeric and curcumin, while cortisol levels and heart rate variability are tracked in ashwagandha studies targeting stress reduction. Such biomarker-driven designs help ensure scientific rigor and make results translatable to medical practice. These advances are strengthening the herbal botanical extracts health products market, where standardized testing protocols are essential for credibility.

Real-World Evidence and Digital Health Integration

Beyond clinical trials, real-world evidence is becoming increasingly important in validating herbal interventions. Wearables, mobile health apps, and electronic patient-reported outcomes (ePROs) now allow researchers to capture continuous, real-life data on herbal use and outcomes. For example, sleep trackers help assess ashwagandha’s effects on insomnia, while heart rate variability monitors validate adaptogen use for stress resilience. Integrating digital health into herbal research not only expands evidence generation but also enhances consumer trust, supporting innovation within the botanical and plant-derived drugs market.

Consumer Psychology and the Herbal Medicine Appeal

The success of the herbal medicine sector is not driven by clinical science alone, but it also rests heavily on consumer psychology. The way individuals perceive and relate to plant-based remedies shapes demand and influences the trajectory of the herbal capsule market, the herbal supplements for mental health market, and broader wellness industries. Understanding these underlying motivations reveals why herbal medicine continues to thrive as both a cultural practice and a commercial phenomenon.

Perceptions of Safety and the “Natural = Healthy” Belief

One of the most powerful psychological drivers of herbal medicine adoption is the belief that “natural” equates to safer and healthier. Unlike synthetic pharmaceuticals, which are often associated with side effects and chemical interventions, herbal remedies are perceived as gentler, preventative, and more compatible with the human body. This perception fuels consistent growth in the herbal capsule market, where convenient, pill-based formulations provide consumers with the familiarity of conventional medicine while maintaining a natural, plant-derived appeal.

Millennials, Gen Z, and Eco-Conscious Consumption

Younger generations, particularly Millennials and Gen Z, are shaping modern herbal trends. These consumers prioritize sustainability, ethical sourcing, and eco-friendly packaging when making purchasing decisions. For them, herbal medicine is not just about personal wellness but also about environmental responsibility. Brands that emphasize organic cultivation, carbon-neutral production, and transparent supply chains are better positioned to capture loyalty in this demographic, making eco-consciousness a defining factor in the long-term success of the herbal market.

Psychological Dimensions: Tradition, Spirituality, and Cultural Identity

Herbal medicine also carries deep symbolic meaning tied to tradition, spirituality, and cultural heritage. For many consumers, using herbal remedies represents more than a health choice; it is a reaffirmation of cultural identity and a connection to ancestral wisdom. Practices like Ayurveda, Traditional Chinese Medicine, and Indigenous herbalism resonate because they embody holistic worldviews. Increasingly, consumers seek a holistic herbal assessment, where physical, emotional, and spiritual dimensions of health are integrated. This deeper resonance differentiates herbal medicine from conventional treatments, giving it a unique psychological advantage.

Social Media, Influencers, and Herbal Trends

The digital era has amplified the popularity of herbal medicine. Social media platforms, health bloggers, and influencers play a major role in shaping herbal trends, from adaptogenic blends like ashwagandha lattes to detox teas promoted as lifestyle enhancers. Viral wellness movements often spark demand spikes in specific categories, such as the booming herbal supplements for mental health market, where remedies for anxiety, sleep, and mood balance are promoted widely online. This dynamic illustrates how consumer psychology is increasingly intertwined with digital visibility and peer influence, driving both awareness and sales.

Technology Transforming Herbal Medicine

The herbal medicine industry is undergoing a technological renaissance, where advanced tools and scientific innovation are reshaping how botanical products are discovered, validated, cultivated, and delivered. Once rooted solely in tradition, the field is now integrating biotechnology, artificial intelligence, and nanotechnology to enhance product quality, safety, and efficacy. These innovations are not only redefining the pharmaceutical and medicinal herbal extracts market but are also expanding new applications in areas such as botanical extracts for medical devices and health-oriented nutraceuticals.

Biotechnology and Plant-Based Drug Discovery

Biotechnology is unlocking new frontiers in herbal medicine by isolating active compounds, replicating them at scale, and optimizing therapeutic properties. Plant cell cultures, metabolic engineering, and molecular farming are being used to produce bioactive compounds without depleting natural resources. This approach is accelerating drug discovery pipelines, contributing significantly to the pharmaceutical and medicinal herbal extracts market, where standardized, lab-optimized extracts are becoming the backbone of next-generation botanical therapeutics.

AI and Data Analytics in Ethnobotany Research

Artificial intelligence (AI) and machine learning (ML) are reshaping the herbal medicine market and the wider herbal medicinal products market by modernizing ethnobotany and traditional plant-based practices. By analyzing historical records, clinical data, and chemical profiles, AI identifies promising compounds for the botanical plant-derived drugs market and accelerates innovation in the natural medicine market. This evidence-based approach strengthens herbal product development and supports the growth of the herbal medicine industry, where herbal pharmaceutical companies and herbal medicine companies are introducing advanced formulations such as herbal tinctures, herbal capsules, and preventative herbal remedies.

Regionally, the US herbal medicine market, the Germany herbal medicine market, and the India herbal medicine market are leading in product adoption, while the South America herbal medicinal products market is emerging as a strong growth hub. These regions also reflect rising demand in the herbal supplements for mental health market, driven by consumer interest in holistic herbal assessment and wellness-focused solutions.

Beyond therapies, AI is influencing the botanicals and acupuncture market, quality validation in the botanical and herbal drug market, and the use of botanical extracts for medical devices, fueling the herbal botanical extracts health products market and the pharmaceutical and medicinal herbal extracts market.

As herbal trends continue globally, the herbalism market, botanical medicine market, and traditional medicine market are transitioning toward science-backed, technology-driven models. This synergy between AI and traditional knowledge is ensuring that the herbal product pharma company landscape and the organic herbal medicine market evolve into central pillars of modern healthcare, delivering comprehensive herbal health solutions worldwide.

Cultivation Innovations: Vertical Farming, Organic Agriculture, and Sustainable Harvesting

To meet surging demand while preserving biodiversity, cultivation methods for medicinal plants are evolving. Vertical farming systems and hydroponics allow for controlled environments that yield consistent, high-quality herbs regardless of climate conditions. Coupled with organic agricultural practices and sustainable wild-harvesting protocols, these methods ensure the long-term stability of the herbal botanical extracts health products market. In parallel, innovations in precision agriculture are reducing resource consumption, aligning herbal production with global sustainability goals.

DNA Barcoding to Ensure Authenticity and Avoid Adulteration

One of the biggest challenges in the herbal industry is product adulteration and mislabeling. DNA barcoding has emerged as a powerful solution to verify plant species at the genetic level, ensuring authenticity in raw materials and finished goods. This technique helps safeguard consumers and strengthens the credibility of the herbal botanical extracts health products market by promoting transparency and quality assurance. For regulators and herbal pharmaceutical companies, DNA barcoding is becoming indispensable for building trust and protecting consumer safety.

Nanotechnology in Herbal Formulations for Better Bioavailability

Traditional herbal remedies often face limitations due to poor solubility or low absorption of active compounds. Nanotechnology is transforming this challenge by enhancing the delivery of bioactive molecules at the cellular level. Nano-encapsulation and nano-emulsions improve bioavailability, stability, and targeted delivery of herbal compounds, making treatments more effective. These innovations are creating high-value opportunities in the herbal botanical extracts health products market, where nanotechnology-enabled formulations bridge the gap between tradition and precision medicine.

Regulatory Framework and Compliance

The regulatory environment surrounding herbal medicine is complex, diverse, and often fragmented across regions. Unlike conventional pharmaceuticals, herbal medicinal products sit at the intersection of tradition, wellness, and healthcare, creating unique challenges in establishing uniform global standards. Regulatory frameworks aim to ensure safety, efficacy, and quality while balancing the cultural heritage and accessibility of these therapies. As the herbal medicine market continues to expand, compliance with evolving standards is becoming critical for both established herbal pharmaceutical companies and emerging players in the herbal product market.

Global Diversity in Regulatory Approaches

United States: In the US herbal medicine market, most herbal products are regulated as dietary supplements under the Dietary Supplement Health and Education Act (DSHEA). This means manufacturers are responsible for safety and labeling, but pre-market approval by the FDA is not required unless safety concerns arise.

Europe: The EU applies stricter frameworks through directives like the Traditional Herbal Medicinal Products Directive (THMPD), mandating quality standards, safety testing, and proof of traditional use for market authorization.

Asia-Pacific: Countries like China and India, with rich traditions in herbal medicine, integrate herbal remedies more deeply into national healthcare systems. The traditional medicine market here benefits from state-backed regulations and codified pharmacopeias such as Ayurveda, Unani, and Traditional Chinese Medicine (TCM).

These varying approaches illustrate the difficulty of creating a harmonized global traditional medicine market, but also highlight opportunities for cross-regional collaboration.

Quality Standards and Product Safety

Ensuring the safety of herbal products requires stringent quality control. Regulatory authorities emphasize:

- Good Manufacturing Practices (GMP): Applied globally to ensure consistent production quality and prevent contamination.

- Standardization of Extracts: Essential for maintaining consistent concentrations of bioactive compounds, which supports both consumer trust and clinical reliability.

- Pharmacovigilance: Monitoring adverse events and long-term safety outcomes, especially for widely used herbal supplements in the herbal capsule market and the herbal tincture market.

Compliance with these measures safeguards consumer health while strengthening the credibility of the herbal medicine industry.

Intellectual Property and Traditional Knowledge

An important aspect of regulation involves protecting traditional knowledge from exploitation. International agreements, such as the Nagoya Protocol, seek to ensure equitable sharing of benefits derived from genetic resources and indigenous wisdom. For herbal medicine companies, respecting these frameworks not only prevents legal disputes but also fosters sustainable herbal product development rooted in ethical sourcing.

Challenges in Standardization and Compliance

- Variability in raw material quality due to differences in soil, climate, and cultivation.

- Inconsistent labeling practices across markets can mislead consumers.

- The difficulty of applying pharmaceutical-style clinical validation to complex multi-compound herbal products.

Addressing these challenges is crucial for strengthening the herbal medicinal products market and ensuring long-term growth built on consumer trust.

Herbal Medicines Market Overview and Dynamics

The global herbal medicine market was valued at USD 71,445.63 million in 2024, growing at a CAGR of 10.18% during the forecast period from 2025 to 2032 to reach USD 154,072.10 million by 2032. Key drivers include increasing preference for natural and preventive healthcare, growing instances of various chronic disorders, and expanding retail and e-commerce channels.

In 2024, Europe accounts for 39% of the global herbal medicine market, supported by a well-structured regulatory framework, high consumer acceptance, and the presence of established industry players. The introduction of the Traditional Herbal Medicinal Products Directive (THMPD) by the European Union provided standardized guidelines on safety, quality, and efficacy, making Europe one of the first regions to formalize the use of herbal medicines within mainstream healthcare.

Countries such as Germany, France, and Italy have strong traditions of phytotherapy, where herbal medicines are not only widely used but also recommended by physicians and, in some cases, reimbursed by healthcare systems. Demographic trends further support market expansion, with Europe’s aging population increasingly seeking natural and preventive alternatives to synthetic drugs.

Leading companies, including Schwabe, Bionorica, and Weleda, continue to drive growth through clinical validation, product innovation, and strong export capabilities, positioning the region as both a key consumer base and a global supplier. This combination of regulatory clarity, cultural integration, and industry leadership has ensured Europe’s sustained dominance in the herbal medicine market, although Asia-Pacific is emerging as the fastest-growing competitor due to traditional medicine adoption and expanding healthcare markets.

North America is a mature, retail-led herbal medicine/herbal supplements market driven by high consumer health spend, retail distribution, and fast e-commerce adoption. Annual retail sales of herbal dietary supplements in the U.S. were estimated at ~USD 13 billion in 2024, confirming steady consumer demand for botanicals and single-herb products.

Key demand drivers

- Wellness & preventive health: consumers favor botanicals for immunity, stress, sleep, and joint support.

- Retail & e-commerce penetration: large national chains, health-food retailers, and online marketplaces drive distribution and impulse purchases.

- Product innovation & clean-label positioning: clinically-backed extracts, standardized dosages, and organic / sustainably sourced claims command premium price points.

Regulatory & reimbursement landscape

- The U.S. primarily treats most herbal products as dietary supplements under DSHEA; the FDA does not pre-approve supplements for efficacy (manufacturers are responsible for safety & labeling), which enables faster market entry but attracts greater post-market regulatory scrutiny and voluntary quality certification demand (USP, NSF).

- Health Canada regulates natural health products under its own framework with pre-market requirements. These regulatory regimes shape product claims, R&D needs, and supply-chain traceability investments.

Competitive landscape & channels

- Established supplement brands (Nature’s Bounty, NOW Foods, Gaia Herbs, Nature’s Way, Jarrow/Solgar) and specialty players dominate retail and e-commerce. Clinical positioning and supply-chain transparency separate leading brands from commodity players.

Risks & near-term opportunities

- Risks: adulteration/quality incidents, tightening claims enforcement, and ingredient supply volatility.

- Opportunities: clinically validated botanicals, direct-to-consumer clinical storytelling, subscription/retail bundles, and fortification with probiotics/active extracts.

While Asia-Pacific is the fastest-growing regional market for herbal medicines, anchored by centuries-old systems (TCM, Ayurveda, Kampo), it has large domestic demand in China/India/Japan, and growing export/manufacturing capacity.

Key demand drivers

- Cultural acceptance & clinical integration: TCM and Ayurveda are widely used and, in many countries, partially integrated into formal healthcare pathways. This delivers a large, culturally embedded demand base.

- Government support & industrial policy: China and India support traditional medicine industries through policy, R&D funding, and export promotion (e.g., Chinese TCM industrial policy; India’s AYUSH-related programs), lowering barriers for local manufacturers.

- Rising middle class & e-commerce: higher disposable incomes, urbanization, and rapid e-commerce growth accelerate retail penetration for modern packaged herbals and nutraceuticals.

Regulatory & quality environment

- Fragmented regulation across APAC: China (NMPA & TCM-specific rules), India (AYUSH + FSSAI overlaps), Japan (Kampo regulation integrated with pharmaceuticals/OTC), Australia (therapeutic goods framework). This heterogeneity affects export standards, clinical evidence requirements, and cross-border label harmonization. Ongoing regulatory modernization in several countries is improving GMP, standardization, and traceability, but also raising compliance costs for smaller suppliers.

Competitive landscape & channels

- Local incumbents such as Tongrentang, Yunnan Baiyao, Himalaya, Dabur/Patnajali, and many regional herb houses dominate domestic markets; meanwhile, contract manufacturing and ingredient exports to Europe and North America are significant. Digital-first native brands targeting younger consumers are also emerging.

Risks & near-term opportunities

- Risks: inconsistent quality standards, supply chain traceability for wild-harvested botanicals, and international market access barriers (phytosanitary and claims enforcement).

- Opportunities: scaling standardized extracts for global markets, clinical validation of traditional formulations, sustainable & certified sourcing programs, and cross-border partnerships (APAC manufacturer + Western clinical/marketing partner).

Herbal Medicine Market Dynamics:

Market Drivers

- Rising consumer preference for natural and preventive healthcare: Increasing distrust of synthetic drugs due to side effects, growing adoption of preventative herbal remedies and holistic wellness approaches, and expanding interest in herbal supplements for the mental health market (stress, anxiety, sleep).

- Rising instances of chronic diseases and lifestyle disorders: Herbal remedies are increasingly being used to support the management of conditions such as diabetes, cardiovascular issues, obesity, and weakened immunity. Preventive use of herbs like turmeric, ginseng, and ashwagandha is gaining wider clinical acceptance, while patients are progressively embracing integrative medicine by combining herbal solutions with conventional therapies.

- Cultural heritage and globalization of traditional medicine: The Asia-Pacific region continues to show strong reliance on Ayurveda, Traditional Chinese Medicine (TCM), Kampo, and Unani systems. Meanwhile, growing acceptance in Western countries is reshaping the global traditional medicine market. Supporting this shift, the WHO is actively promoting the integration of herbal practices into national healthcare strategies worldwide.

- Expansion of retail and e-commerce reach: E-commerce platforms have significantly enhanced global access to herbal supplements, making products more convenient and widely available. Direct-to-consumer models, along with subscription-based wellness boxes, are fostering steady usage patterns. Meanwhile, herbal teas, oils, and nutraceuticals are increasingly becoming integral lifestyle choices within the herbal product market.

Market Restraint

- Limited scientific and clinical validation: While studies on herbs such as turmeric, ginseng, and ashwagandha are progressing, many herbal treatments still lack robust, large-scale, randomized clinical trials. Ongoing debates around their efficacy continue to hinder broader acceptance in conventional medicine, with skepticism among healthcare professionals often limiting their prescription or recommendation.

- Lack of Standardization and Quality Control: Differences in bioactive compound concentrations from batch to batch often result in inconsistent therapeutic outcomes. Issues such as adulteration and contamination with pesticides, heavy metals, or synthetic substances further undermine consumer confidence. Moreover, the absence of unified global standards for herbal medicinal products adds complexity to regulatory approvals and market entry.

- Competition from conventional pharmaceuticals: The dominance of synthetic drugs, backed by strong clinical evidence, insurance reimbursements, and physician endorsements, often limits the visibility of herbal alternatives. As a result, herbal medicine manufacturers face the ongoing challenge of demonstrating comparable or superior efficacy to well-established pharmaceutical counterparts.

Future Outlooks/Opportunity

The future of the herbal medicine market is highly promising, fueled by a global shift toward natural, safe, and preventative healthcare solutions. Growing consumer awareness of the benefits of medicinal herbs and the expanding role of herbal medicinal products in immunity enhancement, stress relief, and mental health management are reshaping the industry. In particular, the herbal supplements for mental health market is witnessing significant growth as consumers seek natural remedies for anxiety, depression, and cognitive health. The increasing adoption of preventative herbal remedies reflects the broader expansion of the global traditional medicine market and the rising prominence of the herbalism market.

Technological advancements are accelerating the evolution of this sector. Innovations in biotechnology, nanotechnology, and DNA barcoding are enhancing the safety, efficacy, and standardization of botanical and herbal products in the market. Similarly, AI-driven digital health platforms are driving holistic herbal assessment and personalized recommendations, while botanical extracts for medical devices are expanding the applications of the botanical plant-derived drugs market beyond traditional pharmaceuticals. Such progress supports the integration of herbal medicine industry solutions into mainstream, science-backed healthcare practices.

The herbal tincture market, herbal capsule market, and herbal botanical extracts health products market are witnessing rapid adoption due to consumer preference for convenient and organic options, especially within the organic herbal medicine market. Regional dynamics are also shaping the sector: the US herbal medicine market and US herbal medicinal products market are growing steadily due to rising wellness trends, while the German herbal medicine market and Germany herbal medicinal products market remain global leaders in clinical validation and research-driven formulations. Meanwhile, the India herbal medicine market and the Indian herbal medicinal products market are expanding rapidly, driven by Ayurveda-based formulations and government support. Similarly, the South American herbal medicinal products market is gaining traction due to the region’s rich biodiversity and heritage in traditional medicine.

On the industry side, the role of herbal pharmaceutical companies and herbal medicine companies is becoming increasingly critical as they invest in herbal product development, advanced extraction techniques, and partnerships with global pharma leaders. The herbal product pharma company landscape is now focusing not only on traditional remedies but also on the commercialization of pharmaceutical and medicinal herbal extracts market and pharmaceutical medicinal herbal extracts market applications. The rise of herbal trends and the expansion of the herbal product market highlight how the herbal medicine industry is aligning with sustainability, innovation, and consumer-driven wellness.

Additionally, new opportunities are emerging in complementary segments such as the botanicals and acupuncture market (or botanicals acupuncture market) and the botanical herbal drug market, reflecting the convergence of herbal solutions with integrative health practices. The global herbal market is no longer confined to traditional remedies; it is evolving into a diverse ecosystem that incorporates the natural medicine market, the herbal product market, and advanced applications in healthcare and wellness.

Investment and Business Dynamics in the Herbal Medicines:

- In January 2025, Botanic Healthcare raised USD 29 million in Series B Funding to Accelerate Global Expansion.

- In November 2024, the Government of China pledged USD 5 million over the period from 2024 to 2028 to support the World Health Organization’s (WHO) Traditional, Complementary, and Integrative Medicine (TCIM) programme.

- In July 2024, India pledged USD 85 million in support of the WHO Global Centre for Traditional Medicine.

- In March 2022, the World Health Organization (WHO) and the Government of India agreed to establish the WHO Global Centre for Traditional Medicine. Backed by an investment of USD 250 million from the Indian government, this global hub is designed to leverage the wealth of traditional medicine worldwide by integrating it with modern science and technology. The initiative aims to advance human health while also promoting the well-being of the planet.

Market key players in Herbal Medicines:

Leading Players

- Bio-Botanica, Inc. – A US-based pioneer in botanical extracts with over 45 years of experience, known for supplying high-quality herbal ingredients to pharma, nutraceutical, and cosmetic industries.

- Kalsec Inc. – A global leader in natural flavor and herbal extracts, specializing in antioxidants and colorants derived from herbs and spices.

- Glanbia plc – A multinational nutrition company with a strong presence in herbal supplements, functional foods, and plant-based wellness solutions.

- MartinBauer – A well-established German herbal company, recognized worldwide for its large portfolio of botanical products catering to pharmaceuticals, teas, and health supplements.

- Sabinsa – A leading global player focused on standardized herbal extracts and nutraceutical ingredients, well-known for research-driven innovations.

- Naturex – Now part of Givaudan, it is a global leader in plant-based natural ingredients serving herbal medicine, functional food, and dietary supplement markets.

Emerging Players

- Ambe Phytoextracts Pvt. Ltd. – An Indian company specializing in herbal extracts and nutraceutical ingredients, steadily expanding its global footprint.

- Layn Natural Ingredients – A fast-growing supplier of botanical extracts and plant-based sweeteners, gaining recognition in the herbal medicine sector.

- Falcon Trading International – An emerging herbal supplier focusing on natural and sustainable sourcing, particularly in niche global markets.

- All-Biz Ltd. – A smaller-scale but expanding herbal product company, emphasizing natural formulations for wellness.

- E.g., Organic Herbs – Focused on organic herbal farming and supply, catering to the growing demand for clean-label herbal solutions.

- Hishimo Pharmaceuticals Pvt. Ltd. – An Indian-based emerging player manufacturing Ayurvedic and herbal medicines with an expanding domestic and regional presence.

Conclusion

The herbal medicine market stands at the crossroads of tradition and modern science, blending centuries-old practices with cutting-edge innovation to meet the evolving demands of global healthcare. Once rooted primarily in cultural and folk remedies, herbal medicine has now transformed into a structured and rapidly expanding industry, supported by clinical validation, technological integration, and shifting consumer preferences toward natural, sustainable, and holistic wellness.

While challenges such as regulatory complexities, standardization, and efficacy debates remain, the growth opportunities are vast, ranging from personalized herbal therapies and advanced formulations to global digital accessibility and strategic partnerships with mainstream pharmaceutical companies. As the industry continues to gain credibility and acceptance, herbal medicine is poised not only to complement conventional treatment but also to emerge as a mainstream, science-driven, and patient-centric pillar of modern healthcare.

FAQs

Yes, herbal medicine can be effective for many conditions, especially when herbs are used in standardized, clinically tested forms. Well-studied herbs such as turmeric, ginseng, and ashwagandha have shown proven benefits. However, the effectiveness varies by herb, dosage, preparation, and individual response, and scientific validation is still ongoing for many traditional remedies.

Garlic is widely regarded as one of the strongest natural antibiotics due to its compound allicin, which shows antibacterial, antiviral, and antifungal properties. Other potent natural antibiotics include oregano oil, honey (especially Manuka honey), and turmeric.

Although natural, herbal drugs can still cause side effects such as allergic reactions, digestive issues (nausea, diarrhea), headaches, or skin irritation. Some herbs may interact with prescription medications (e.g., St. John’s Wort, reducing the effectiveness of antidepressants or birth control pills). Overuse or poor-quality products can increase risks.

Yes, herbal medicine is widely used today across the globe. It is integrated into modern healthcare systems in countries like China and India and is increasingly popular in the West for wellness, preventive care, and as complementary therapy alongside conventional medicine. The global herbal medicine market is growing rapidly due to consumer demand for natural and sustainable health solutions.

The oldest recorded medicinal herb is likely garlic, used for over 5,000 years in ancient civilizations such as Egypt, India, and China. Other ancient herbs include turmeric (used in Ayurveda for more than 4,000 years) and willow bark (the natural origin of aspirin).

Downloads

Article in PDF