Mapping the Top Asthma Therapies: Inhaled Blockbusters and Injectable Powerhouses

Sep 01, 2025

Table of Contents

Asthma: A Global Burden Driving Therapeutic Breakthroughs

Asthma is a chronic inflammatory condition of the airways characterized by variable symptoms including wheezing, shortness of breath, chest tightness, and cough. It involves underlying airway inflammation, bronchial hyperresponsiveness, and reversible airflow obstruction. Despite being highly manageable with existing therapies, asthma remains a significant global health concern due to its persistent burden across age groups and its potential to cause severe exacerbations, particularly in uncontrolled or severe cases.

Strained Systems: The Healthcare Challenge of Mounting Asthma Burden

According to DelveInsight estimates, there were more than 56 million diagnosed prevalent cases of asthma across the major markets (the United States, Germany, France, Italy, Spain, the United Kingdom, and Japan) in 2024. This unprecedented volume highlights the pressing need for innovative therapeutic approaches and optimized healthcare delivery to mitigate the long-term clinical and economic burden of asthma across these key markets.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Annovis announces IPO results; Conatus merges with Histogen; Novartis discontinues its generic jo...

- AZ’s benralizumab; Sanofi, Regeneron set; Nordisk preps; European countries offer

- Dupixent Breaks Ground: First and Only Eosinophilic Esophagitis Treatment for Pediatric Patients

- DUPIXENT’s Launch Brings Next Chapter of Biologics in COPD

- OPDIVO Approved for Resectable NSCLC; Palvella Gets $2.6M FDA Grant; First Patient Dosed in UGN-1...

Asthma prevalence in the major markets demonstrates a steady upward trajectory, adding millions of patients and creating an ever-expanding pool of individuals requiring continuous care. This rise is fueled by worsening air quality, accelerating urbanization, and enhanced diagnostic capabilities, which together increase exposure to environmental triggers and identify previously unrecognized cases. The sheer volume of affected patients exerts sustained pressure on healthcare infrastructure, from primary care to specialized services, and drives escalating long-term costs. These dynamics highlight the urgent need for targeted prevention strategies, personalized treatment approaches, and optimized resource allocation to mitigate the growing clinical and economic burden.

Current Asthma Treatment Paradigm

Contemporary inhaled asthma therapies now extend beyond dual bronchodilator–corticosteroid combinations to include triple fixed-dose regimens that enhance both bronchodilation and anti-inflammatory control in a single device. Agents such as budesonide/formoterol with glycopyrronium and fluticasone furoate with umeclidinium/vilanterol exemplify this trend, delivering synergistic mechanisms to patients whose symptoms remain uncontrolled despite treatment with conventional inhalers. The introduction of rescue inhalers combining Short-acting β₂-agonists (SABA) with low-dose steroids further refines acute management by addressing bronchoconstriction and inflammation concurrently. Meanwhile, newer breath-activated dry-powder formulations prioritize patient adherence through simplified dosing and optimized lung deposition, sharpening the precision of maintenance and relief strategies across the severity spectrum.

On the biologics front, antibodies targeting key drivers of airway inflammation have ushered in an era driven by phenotype. Eosinophil-depleting therapies like anti-IL-5 and anti-IL-5R agents reduce exacerbation rates in high-eosinophil populations, while inhibitors of thymic stromal lymphopoietin broaden applicability to both eosinophilic and non-eosinophilic disease. Anti-IL-4/IL-13 blockade provides an additional mechanism for patients with overlapping Type-2 comorbidities, and anti-IgE therapy remains a cornerstone for allergic asthma. Despite high acquisition costs and infrastructure needs, these targeted immunomodulators demonstrate substantial reductions in oral steroid dependence and exacerbation frequency, underscoring the critical importance of matching biologic mechanism to individual patient profiles.

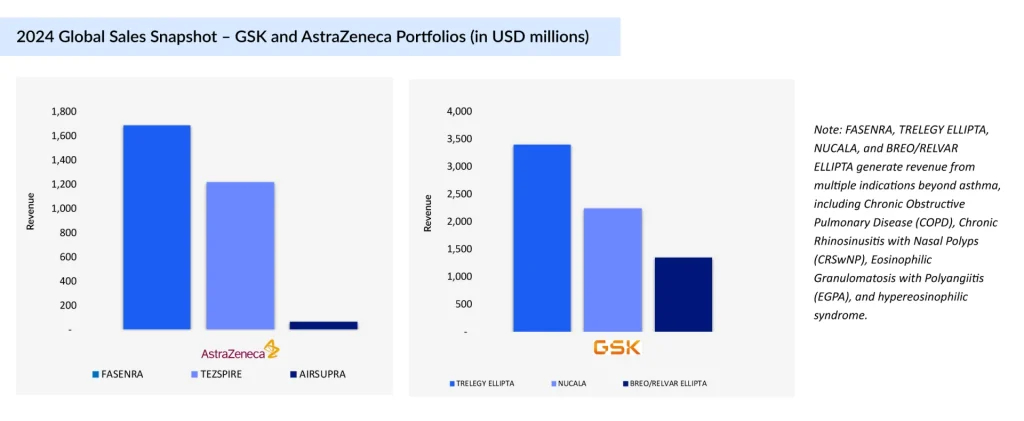

Empire Builders: GSK vs. AstraZeneca

Both GSK and AstraZeneca have meticulously built their asthma portfolios with complementary strengths. GSK has centered its strategy on once-daily inhaled maintenance therapies combined with a foundational anti-IL-5 biologic, streamlining long-term asthma control. On the other hand, AstraZeneca leans into innovative rescue and biologic approaches, offering a dual-action rescue inhaler alongside biologics that target both eosinophilic and broad asthma phenotypes. This alignment underscores each company’s differentiated path toward treatment leadership.

AIRSUPRA (albuterol and budesonide)

First and only US FDA-approved anti-inflammatory rescue inhaler for asthma, combining albuterol (SABA) and budesonide (ICS) to deliver both rapid bronchodilation and inflammation control in a single as-needed inhalation. Approved in January 2023 in the US, it strategically bridges the rescue and controller segments. Developed under the AstraZeneca–Avillion partnership, with AstraZeneca leading commercialization, it redefines the rescue inhaler category.

TEZSPIRE (tezepelumab)

A TSLP-blocking monoclonal antibody targeting upstream inflammation in severe asthma with phenotype-agnostic efficacy. Approved in the US (December 2021), EU, and Japan, it is co-developed by Amgen and AstraZeneca. Amgen holds US rights and reports US sales, while AstraZeneca manages sales elsewhere. TEZSPIRE addresses both eosinophilic and noneosinophilic asthma, expanding treatment beyond traditional biologics.

FASENRA (benralizumab)

An anti-IL-5Rα monoclonal antibody inducing eosinophil apoptosis via antibody-dependent cell-mediated cytotoxicity. Approved in the US in November 2017 and available in the EU and Japan, it differentiates through 8-week maintenance dosing and strong exacerbation reduction. Its recent pediatric label expansion broadens its eligible patient pool.

TRELEGY ELLIPTA (fluticasone furoate, umeclidinium, and vilanterol inhalation powder)

A once-daily triple-therapy inhaler (ICS/LAMA/LABA) in a single device streamlines treatment for uncontrolled asthma. Approved for asthma treatment in the US and in Japan, it is the only triple inhaler with US approval for this use, giving GSK a competitive edge despite EU label restrictions.

NUCALA (mepolizumab)

The first anti-IL-5 monoclonal antibody approved for asthma targeting eosinophils to reduce exacerbations and steroid dependence. US approval came in November 2015, with subsequent rollouts in the EU and Japan. Widely adopted for severe eosinophilic asthma, it set the biologic benchmark in this segment.

ARNUITY ELLIPTA (fluticasone furoate inhalation powder)

A once-daily Inhaled Corticosteroid (ICS) for maintenance treatment, designed for high adherence and consistent anti-inflammatory control. First approved in the US in 2014 and later in Japan, it remains positioned as a prophylactic maintenance option rather than acute therapy.

BREO/RELVAR ELLIPTA (fluticasone furoate and vilanterol inhalation powder)

A once-daily ICS/LABA inhaler for maintenance in patients inadequately controlled on ICS therapy. First approved in the US in 2015 and available in the EU and Japan, it continues to anchor GSK’s dual-therapy inhaler segment, offering strong efficacy with a convenient dosing schedule.

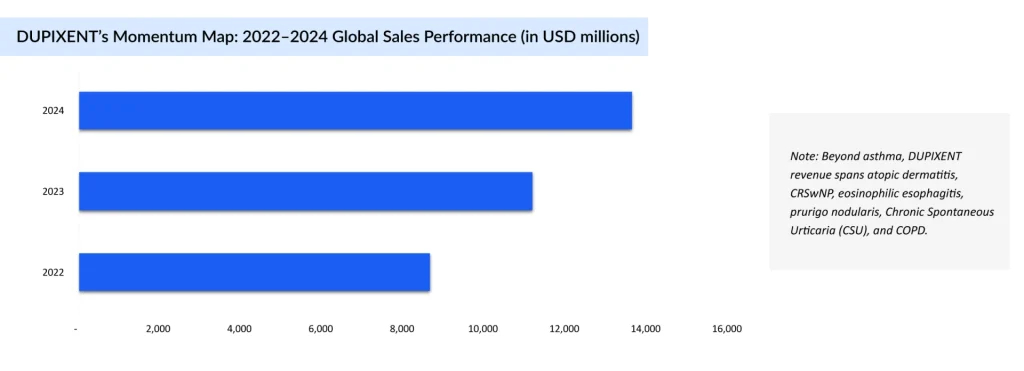

The Biologic Crown: DUPIXENT’s Edge

DUPIXENT (dupilumab) is a subcutaneous monoclonal antibody administered every 2 or 4 weeks (depending on age and weight) and functions as a potent IL-4/IL-13 signaling inhibitor, targeting key drivers of Type 2 inflammation in moderate-to-severe asthma. Approved across major regions, US (2018), EU, and Japan (2019), it serves as an add-on maintenance treatment for patients aged 6 years and older with eosinophilic asthma or those who are oral corticosteroid-dependent. DUPIXENT is also approved in several other indications, with approximately more than 30% of its total revenue derived from asthma. This broad regulatory footprint underscores its role as a cornerstone biologic for difficult-to-control asthma phenotypes.

Clinical data reinforce DUPIXENT’s durable efficacy and disease-modifying potential. In pivotal trials (e.g., QUEST and VENTURE), it significantly reduced exacerbation rates, improved lung function, and enabled substantial reductions in oral steroid use. Real-world findings disclosed at ATS 2025 reveal that up to 77% of patients sustained clinical remission by Year 3, while additional data highlight resolution of mucus plugs, enhanced airway clearance, and meaningful decreases in FeNO levels, positioning DUPIXENT as not just a symptom controller, but a pathway to sustained disease remission.

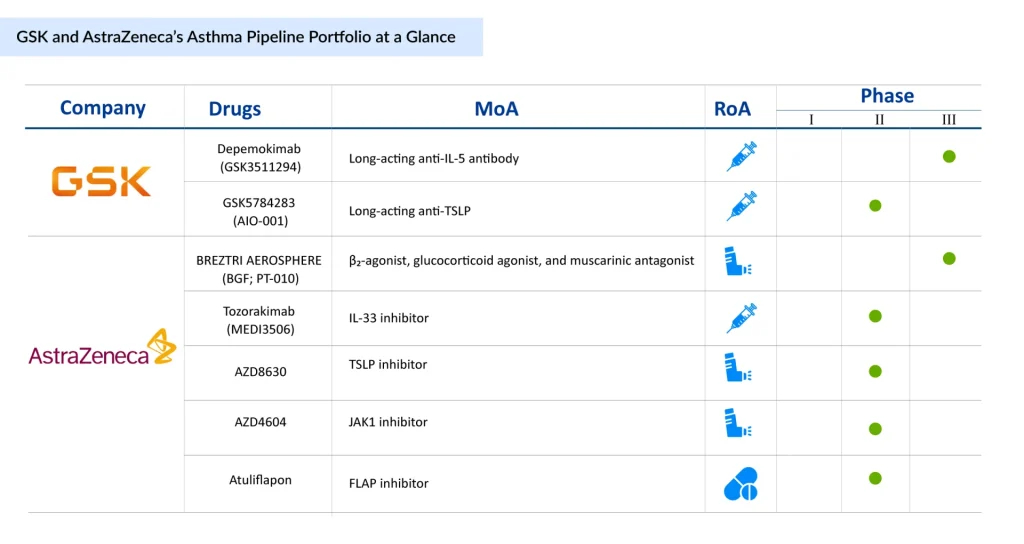

Pipeline Giants: GSK and AstraZeneca’s Next Wave of Asthma Innovation

The asthma pipeline for GSK and AstraZeneca reflects an aggressive push to expand their dominance in the respiratory therapeutics space, targeting both biologic innovation and next-generation inhaled therapies. Both companies already have a wide portfolio of marketed drugs addressing various asthma phenotypes, providing them with a strong commercial foundation to leverage new launches. GSK is advancing high-potential monoclonal antibodies such as Depemokimab and GSK5784283, aimed at addressing eosinophilic and TSLP-driven inflammation, underscoring its focus on precision medicine for severe, uncontrolled asthma.

AstraZeneca, in contrast, is building a more diversified asthma pipeline that spans biologics, small molecules, and novel inhaled formulations, with assets like BREZTRI AEROSPHERE and Tozorakimab complementing early-stage candidates targeting IL-33, TSLP, JAK1, and FLAP pathways. Collectively, these programs, alongside their extensively marketed portfolios, signal a strategic commitment to capturing unmet needs across a broad spectrum of asthma phenotypes, from severe allergic to non-eosinophilic disease, while reinforcing both companies’ positions as market leaders in the evolving asthma treatment landscape.

Conclusion: The Next Frontier in Asthma Treatment Care

The asthma market landscape is entering a decisive inflection point where inhaled blockbusters and injectable powerhouses no longer operate in silos, but converge into integrated, phenotype-driven strategies. GSK and AstraZeneca’s deep portfolios and high-velocity pipelines position them to define this new standard—one where precision, convenience, and durability are non-negotiable. Yet, the rise of oral agents like dexpramipexole and the steady advance of versatile biologics such as DUPIXENT signal that market dominance will hinge on adaptability as much as innovation. The next wave of winners will be those who can seamlessly align breakthrough science with real-world accessibility, turning therapeutic ambition into measurable, population-wide control. In the race to tame asthma’s global burden, the leaders of tomorrow will be those who can make “control” not just possible, but inevitable.

Downloads

Article in PDF

Recent Articles

- The Evolving Landscape of COPD Treatments: New Hope for Patients

- 4 Investigational Chronic Pruritus Drugs Shaping the Treatment Landscape

- Dupixent Breaks Ground: First and Only Eosinophilic Esophagitis Treatment for Pediatric Patients

- Global Allergic disease market

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021