DUPIXENT’s Launch Brings Next Chapter of Biologics in COPD

Sep 12, 2025

Table of Contents

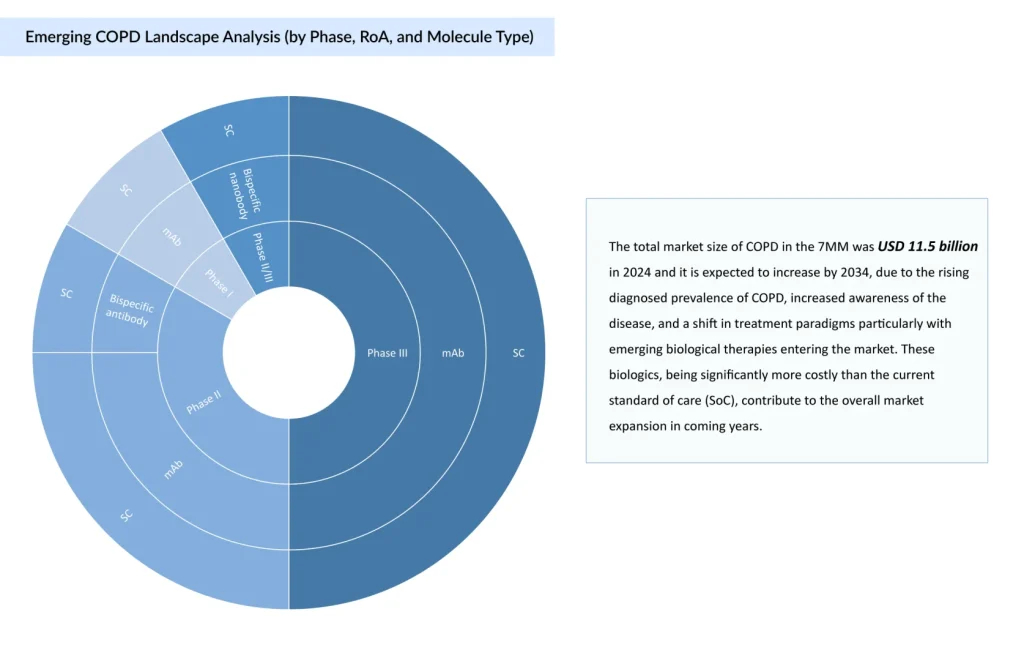

COPD management has progressively centered on bronchodilator-based regimens, with Long-acting Muscarinic Antagonists (LAMAs) and Long-acting Beta-agonists (LABAs) forming the therapeutic core. Dual LAMA/LABA therapy is standard for moderate disease, while triple therapy with Inhaled Corticosteroids (ICS) is reserved for severe cases or frequent exacerbators. The current development COPD clinical trials landscape reflects an inflection point in treatment strategy, with a shift from conventional bronchodilators toward targeted therapies and biologics.

What is the Market Outlook of DUPIXENT With its “First-ever Biologic” Advantage in COPD?

Even though good therapies are available, the primary need is for better therapies, because patients suffering from frequent exacerbations and significant morbidity and disability, despite the currently available therapies, still exist. Biologics were utilized in COPD to fill a treatment gap.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- PTC Therapeutics’ Gene Therapy Upstaza; Sanofi and Regeneron’s Dupixent; Bayer CAR-T Collaboratio...

- Biogen’s SPINRAZA Phase II/III Trial Results; Travere’s FILSPARI FDA Approval; GSK’s ...

- World COPD Day

- How Emerging Pipeline Therapies Will Unfold the Severe Asthma Treatment Market Dynamics?

- Aerin Medical’s RhinAer Stylus; CE Mark for Haemonetics’s VASCADE Vascular Closure Device; J&...

The US market for eosinophilic COPD is substantial, with “over 1.2 million” patients potentially eligible for biologic therapy.

DUPIXENT (dupilumab), followed by NUCALA (mepolizumab), marked the beginning of the biologic era in COPD, signaling a shift from bronchodilator-based management to targeted, biomarker-driven care. The European Medicines Agency (EMA) was the first regulatory authority to approve a biologic therapy for COPD, followed shortly thereafter by the US FDA.

The EMA’s approval of DUPIXENT in July 2024, followed by FDA approval in September 2024, introduced the first biologic for COPD and underscored the rising importance of inflammatory biomarkers, particularly blood eosinophil counts, in guiding treatment decisions. With dual inhibition of IL-4 and IL-13, DUPIXENT offers broad suppression of Type 2 inflammation, strong efficacy in reducing exacerbations, and a favorable safety profile supported by its use in other inflammatory conditions. The subsequent approval of NUCALA in May 2025 expanded the biologics landscape as the “first IL-5 inhibitor” for COPD and the only agent validated in a broad eosinophilic population (≥150 cells/μL), enhancing its utility in patients with chronic bronchitis and persistent eosinophilia. However, despite its broader inclusion criteria, NUCALA enters a market already shaped by DUPIXENT’s first-mover advantage, better efficacy, and established prescriber confidence. Positioned as high-value alternatives to standard inhalers, DUPIXENT and NUCALA are expected to drive major market growth and widen the gap between conventional care and precision biologics, with DUPIXENT projected to reach nearly USD 2.8 billion by 2034.

“Verona received FDA Approval in 2024, OHTUVAYRE, a dual PDE3/4 inhibitor, introducing a novel, non-immunologic COPD therapy, combining bronchodilation and anti-inflammatory action. While it does not compete directly with biologics like DUPIXENT or NUCALA, it fills a critical gap for noneosinophilic patients, reinforcing the growing divergence between biomarker-driven and bronchodilator-centric treatment strategies.”

The strategic use of biologics during COPD exacerbations offers a compelling therapeutic opportunity to intervene at the height of inflammatory activity, where clinical risk is greatest. Targeting this critical window could enhance treatment precision, improve outcomes, and redefine current paradigms of exacerbation management.

GSK’s regulatory win positions NUCALA as a frontrunner in the IL-5 space, intensifying the “battle for IL-5 supremacy”

A major clinical development in the competitive landscape of IL-5-targeted therapies is seen in COPD, spotlighting GSK’s NUCALA and its recent successful regulatory approval.

GSK and AstraZeneca are positioning themselves strategically within the emerging IL-5–targeted COPD market, each leveraging distinct clinical and operational advantages. GSK, having already secured first-mover advantage with NUCALA, is advancing a dual-asset strategy by introducing depemokimab, a long-acting IL-5 agent with twice-yearly dosing. While depemokimab is initially expected to gain approval in asthma (early market entry could help build prescriber familiarity and payer alignment) ahead of its COPD indication, potentially reducing treatment burden and reinforcing GSK’s leadership in eosinophilic COPD.

In parallel, AstraZeneca’s FASENRA (benralizumab), targeting IL-5Rα, offers a mechanistically distinct approach with rapid eosinophil depletion. Pending positive Phase III results, a 2026 COPD launch is anticipated. FASENRA benefits from prior asthma approval and growing acceptance of biologics post-DUPIXENT, placing it in a strong position to gain market share, provided it demonstrates clear efficacy in COPD. Additionally, recent data suggest benralizumab may outperform standard-of-care therapies like prednisolone in managing acute eosinophilic exacerbations, offering further clinical differentiation. However, AstraZeneca must navigate a competitive market increasingly shaped by established agents like NUCALA and innovation-focused candidates such as depemokimab.

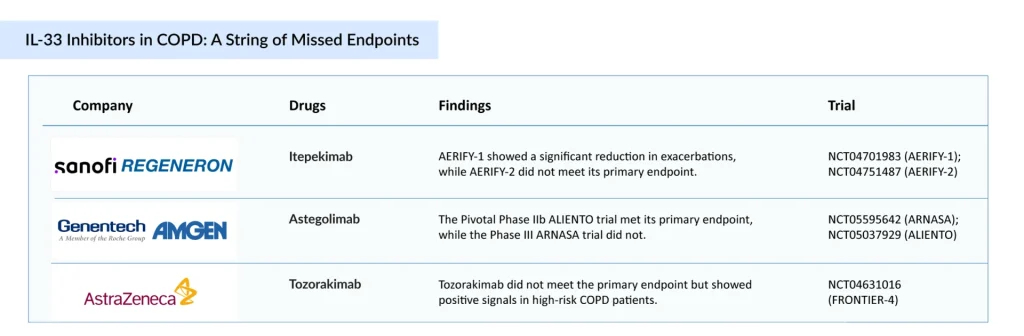

IL-33 Inhibitors Face Reality Check in COPD: Mixed Results Suggest a Shaky Road to Regulatory Nod

The IL-33 pathway, once positioned as a breakthrough target for noneosinophilic and mixed-inflammatory COPD phenotypes, is now facing a critical inflection point due to a series of underwhelming clinical outcomes. Itepekimab (Sanofi/Regeneron) remains the most promising candidate in this class, showing consistent reductions in moderate to severe exacerbations, particularly in former smokers, a traditionally underserved subgroup. However, its progress is overshadowed by broader class-wide setbacks.

Astegolimab (Roche/Genentech/Amgen), a selective ST2 antagonist, failed to meet primary endpoints across trials and showed only modest efficacy, diminishing its clinical appeal despite a favorable safety profile. Similarly, Tozorakimab (AstraZeneca), which targets both ST2 and RAGE/EGFR signaling, missed its primary endpoint in Phase II COPD clinical trials, showing limited benefit except in a small, high-risk subgroup with frequent exacerbations. These results collectively cast doubt on the IL-33 pathway’s viability as a broadly effective strategy for COPD.

Despite ongoing investment, this class is losing momentum, and the likelihood of near-term regulatory approvals appears low unless future studies can identify responsive subpopulations or demonstrate added value through combination strategies, IL-33 inhibition risks being deprioritized in favor of more consistent biologic targets, such as TSLP and IL-5 pathways, that have shown clearer clinical differentiation and regulatory traction.

The evolving COPD biologics landscape is increasingly favoring mechanism-driven precision therapies with proven impact across defined patient segments. While IL-33 inhibitors showed promise in theory and early trials, real-world clinical impact has been modest. Future research may focus on identifying responsive subgroups (former smokers with COPD) or combination therapies to unlock their full potential.

“Apart from Interleukins, anti-TSLP therapies are also expected to enter the market. The Thymic Stromal Lymphopoietin (TSLP) pathway is validated with one FDA-approved therapy in asthma (TEZSPIRE [tezepelumab]).”

Anti-TSLP Therapies Beyond Asthma: Will TSLP Inhibitors Lead the COPD Space?

TEZSPIRE, the first TSLP inhibitor approved for asthma, is now being evaluated for its potential in COPD. Leveraging its proven efficacy in a biomarker-defined asthma population, the company aims to expand into the COPD segment.

TSLP may be a shared target, but TEZSPIRE and solrikitug are charting distinctly different paths. TEZSPIRE has shown modest efficacy in biomarker-selected COPD patients, those with eosinophilic inflammation, chronic bronchitis, or elevated FeNO, but its clinical utility remains limited outside these subgroups. Solrikitug, while still in early development, demonstrates roughly 15-fold greater potency in inhibiting TSLP-driven cell proliferation and TARC expression. This enhanced pharmacologic profile suggests broader, more durable anti-inflammatory potential, positioning solrikitug as a next-generation contender with the capacity to move TSLP inhibition beyond the narrow boundaries defined by TEZSPIRE.

Further shaping the evolving COPD biologics treatment landscape, CM512 and Lunsekimig have advanced into mid- and late-stage development, respectively. Both candidates employ a dual-inhibition strategy targeting TSLP and IL-13, two key upstream mediators of Type 2 inflammation. This approach positions them to directly challenge established agents: DUPIXENT in the IL-13 pathway, and TEZSPIRE and Solkitrug within the TSLP class. By aiming to broaden inflammatory control through multi-pathway modulation, these next-generation biologics may usher in a new era of precision therapy and intra-class competition. Meanwhile, other promising assets are progressing through the pipeline. Rademikibart in Phase II trials for acute exacerbations of COPD, with topline data expected in H1 2026. A Phase II trial of ensifentrine combined with a LAMA was initiated in July 2025. Verekitug, Dexpramipexole, and additional candidates also remain noteworthy for their potential to impact future treatment paradigms.

Summary

COPD treatment adherence remains a persistent challenge, primarily driven by the complexity of inhaler devices, particularly among elderly patients and those with cognitive or physical limitations. Misuse is common and directly undermines therapeutic outcomes. While dual and triple inhaled therapies continue to dominate the COPD treatment landscape, owing to their early approvals and broad use, these agents face increasing pressure from patent expirations and expected price erosion, which will reshape their market presence over the forecast period. In contrast, biologics are emerging as high-value add-on maintenance therapies targeting a narrower, biomarker-defined population, particularly those with Type 2 inflammation. Despite significantly higher costs, often 10 times that of standard inhaled therapies, biologics offer clinical precision, reduced dosing frequency, and the potential for improved outcomes in select patients. DUPIXENT and NUCALA have established early leadership, but upcoming entrants such as FASENRA, solrikitug, tozorakimab, and others are expected to intensify competition. As the market shifts, sustained competitiveness will depend on simplifying delivery, demonstrating clear clinical differentiation, and aligning value with payer expectations in an increasingly cost-sensitive environment.

Downloads

Article in PDF

Recent Articles

- Eisai Announces Solo Development of Farletuzumab Ecteribulin (FZEC); Johnson & Johnson’s Nipo...

- Ipsen’s Cabometyx Rejected by NICE; Vertex and CRISPR Therapeutics’s Submit BLA to the FDA for ex...

- What are the Top Five Leading Causes of Deaths in the World?

- Survodutide Phase II trial Shows Groundbreaking Results in Liver Disease; GSK Announces Positive ...

- Airway Management Devices: Charting the Evolving Market Trends and Key Innovations