Boehringer Ingelheim’s JASCAYD Brings Hope Back to IPF Patients After a Decade of Waiting

Oct 10, 2025

Over a decade after launching one of the first treatments for idiopathic pulmonary fibrosis, Boehringer Ingelheim is rejuvenating its presence in the rare lung disease arena with a newly approved therapy. On October 7, the FDA approved JASCAYD, marking the first new IPF treatment in over ten years. The approval follows that of Boehringer’s OFEV and Roche’s ESBRIET, both of which were cleared in 2014 and currently dominate the US IPF market.

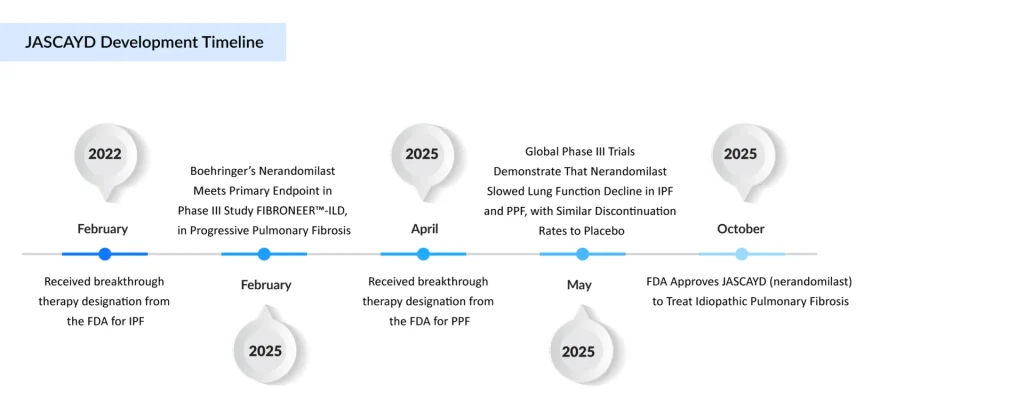

The new drug, nerandomilast, is a first-in-class, oral PDE4B inhibitor taken twice daily. Boehringer Ingelheim’s IPF treatment, JASCAYD, acts by inhibiting phosphodiesterase 4B, an enzyme abundantly present in the lungs that plays a key role in inflammation and scar tissue development. Its active ingredient, nerandomilast, received FDA breakthrough therapy designation in 2022. Boehringer Ingelheim has not yet disclosed its launch timeline or pricing details.

IPF is deadlier than several common cancers and may affect as many as 3.6 million people worldwide. IPF affects approximately 100,000 people in the US, with 30,000–40,000 new cases diagnosed annually. According to DelveInsight’s 2024 analysis, there were ~200,000 diagnosed prevalent cases of IPF across the leading markets, with the US alone contributing ~97,000 cases. This number is expected to change by 2034.

Downloads

Click Here To Get the Article in PDF

Recent Articles

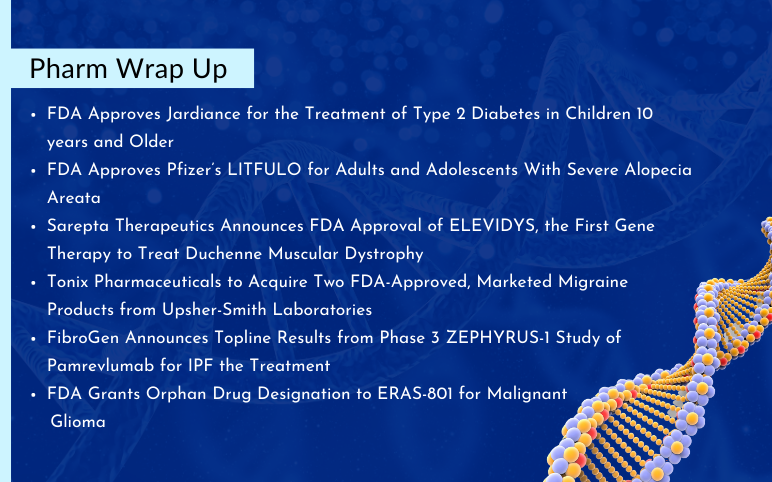

- FDA Approves Boehringer’s JASCAYD as First New IPF Therapy in Over a Decade; Denali Therapeutics&...

- Coherus Biosciences’ Toripalimab; Keymed’s CMG901; Biogen Alzheimer’s Drug Aduhelm; Vicore’s Digi...

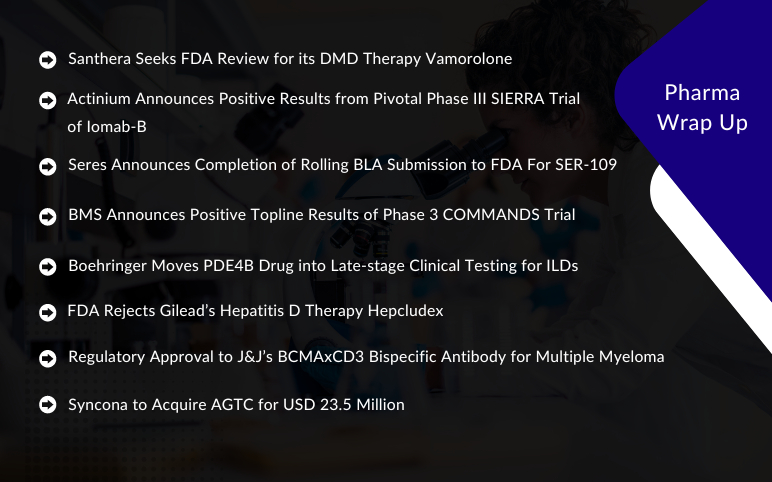

- Actinium Announces SIERRA Trial Results; Santhera Seeks FDA Review for Vamorolone; Seres Announce...

- BMS Sells NY Biologics Plant; FDA Approves Mitsubishi Tanabe’s Radicava, Love Pharma Acquires Mic...

- Idiopathic Pulmonary Fibrosis (IPF) – When to start and what is coming in the race to treat the d...

The FDA’s approval was based on results from the Phase III FIBRONEER-IPF trial. In September last year, Boehringer Ingelheim announced that JASCAYD had successfully met its primary endpoints in the late-stage study. Although the company did not disclose specific figures at the time, it reported that JASCAYD produced significant improvements in lung function, measured by forced vital capacity (FVC), after 52 weeks compared to the placebo.

More detailed data, published in May in the New England Journal of Medicine, showed that patients receiving 18 mg of JASCAYD achieved a 68.8-mL gain in FVC over placebo, a result deemed highly statistically significant. The lower 9-mg dose also demonstrated a statistically significant 44.9 mL improvement compared to the placebo.

Regarding safety, the FIBRONEER-IPF trial reported that serious adverse events were comparable across all treatment groups. The most frequent side effect linked to JASCAYD was diarrhea, which occurred in 41.3% of participants on the 18-mg dose and 31.1% on the 9-mg dose, compared with 16% in the placebo group.

Describing the condition as a “rare, serious, and progressive disease with no cure and limited treatment options,” the FDA stated in its announcement that IPF occurs when the tissue around the small air sacs in the lungs becomes thickened. This results in permanent scarring, which causes symptoms such as difficulty breathing and persistent coughing. The disease primarily impacts individuals between 60 and 70 years of age.

Although the drug did not achieve a statistically significant improvement in survival, it did indicate a ‘nominally significant reduction in the risk of death’ for patients with IPF and the related condition progressive pulmonary fibrosis. Nevertheless, JASCAYD’s profile marks a meaningful advancement in the IPF field, which has been described as a ‘graveyard of clinical development’ with over 36 unsuccessful trials in the past ten years.

Boehringer’s more than a decade of experience in the IPF market with OFEV provides a strong foundation for JASCAYD’s market debut. That said, OFEV is far from outdated, still ranking as a top-performing product for Boehringer with $4 billion in sales last year. The question now is whether JASCAYD can match the success of its blockbuster predecessor. Its approval marks a “turning point” in IPF drug development and suggests that the standard of care is likely to change “significantly” in the coming years.

IPF has become a highly appealing focus for the biopharma sector, with several companies pursuing the development of innovative treatments for the disease. For example, in January, Eli Lilly invested $99 million and committed up to $687 million in milestone payments to collaborate with Mediar Therapeutics on a first-in-class IPF therapy. However, the development pathway has faced challenges; in February, Pliant Therapeutics was compelled to halt dosing in a Phase IIb/III trial following recommendations from a data safety monitoring board, although the company did not disclose the specific reasons for the interruption.

Numerous other companies are also entering the IPF market, posing significant competition for Boehringer in the near future. For example, United Therapeutics’ nebulized inhalation therapy, TYVASO, achieved a phase III victory last month, with company executives describing the results as ‘overwhelmingly positive.’ Both United and Boehringer are also investigating their drugs in PPF, an additional indication that Boehringer is pursuing with the FDA.

Bristol-Myers Squibb is working on Admilparant, a potential first-in-class, oral, small molecule lysophosphatidic acid receptor 1 (LPA1) antagonist currently being evaluated as a novel antifibrotic treatment for patients with IPF and PPF. BMS-986278 has received both Fast Track designation (FTD) and ODD from the US FDA for the treatment of IPF. Admilparant is currently in a Phase III clinical trial, with data expected in 2026.

Incyte, in collaboration with Syndax, is working on Axatilimab, a first-in-class antibody targeting the colony-stimulating factor-1 receptor (CSF-1R), which is being evaluated in collaboration with Syndax for the treatment of IPF. Currently, axatilimab is being evaluated in a Phase II trial in patients with IPF.

The approval of JASCAYD could stimulate additional research and innovation in IPF, as patients and physicians gain access to a new therapeutic option. Its emergence also highlights the importance of continued investment in rare lung disease research, particularly for conditions where unmet medical needs remain high. The expanding pipeline and competitive landscape could accelerate the development of IPF treatment options, ultimately improving long-term outcomes for patients suffering from progressive pulmonary fibrosis.

Boehringer Ingelheim is also expected to leverage its extensive patient and physician networks to ensure the rapid uptake of JASCAYD, while monitoring real-world data to optimize dosing and safety strategies further. With multiple competitors advancing novel therapies, the next few years could redefine the IPF treatment paradigm, offering renewed hope to patients and caregivers who have waited over a decade for meaningful progress.

Downloads

Article in PDF

Recent Articles

- Roche, Boehringer tout; Pfizer, Bristol-Myers got sued; FDA commissioner unveils; EpicGenetics ex...

- Algernon’s NP-120 (ifenprodil); Pieris’s cinrebafusp alfa (PRS-343) clinical trial; Gaumard...

- Idiopathic Pulmonary Fibrosis Market Landscape and Forecast

- Idiopathic Pulmonary Fibrosis –Scarring For A Lifetime

- Idiopathic Pulmonary Fibrosis: Recent Scenario