New Lupus Nephritis Drugs on the Horizon: 6 Promising Therapies Eyeing Newly Approved GAZYVA’s Market Space

Nov 03, 2025

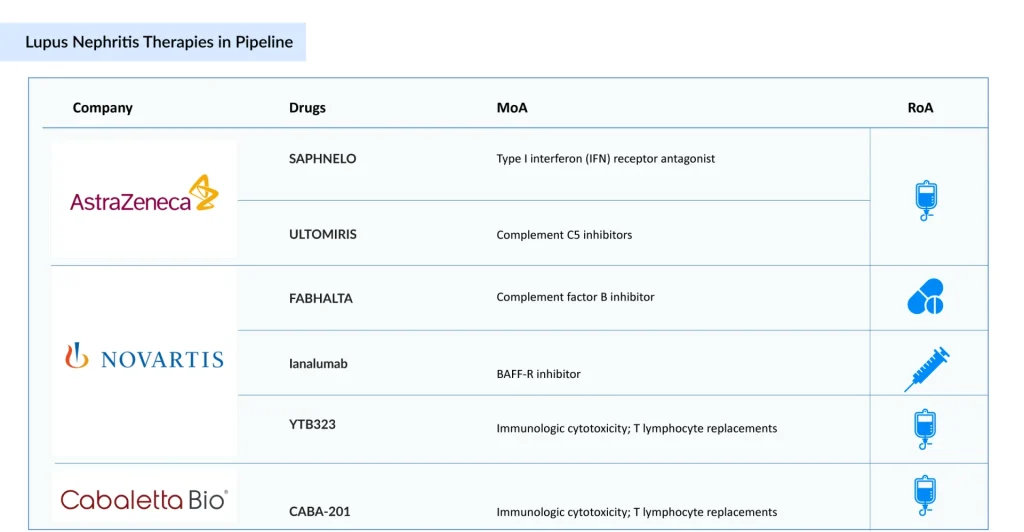

Roche’s GAZYVA FDA approval has already rewritten the lupus nephritis playbook — it turned a long-standing oncology B-cell drug into a validated, kidney-saving option. It proved that aggressive B-cell targeting can materially boost complete renal responses when added to standard therapy. The GAZYVA approval (driven by the phase II NOBILITY and phase III REGENCY data) gives clinicians a new, evidence-backed tool to chase remission, pressures payers and guideline panels to rework algorithms, and forces rivals to prove either better efficacy, safer long-term profiles, or meaningful convenience advantages. Can Roche keep the lead? Short answer: Maybe — but the field is noisy and fast. Several promising lupus nephritis drug rivals are charging up the pipeline and could nibble at GAZYVA’s advantage if they show complementary wins. Currently, Novartis is leading with three lupus nephritis drugs in its pipeline. AstraZeneca and Cabaletta Bio are not far behind, with two and one candidates, respectively, in their pipelines. Let’s take an in-depth review of these six upcoming lupus nephritis drugs.

Novartis’ Ianalumab, FABHALTA, and YTB323

Novartis is currently developing its three lead candidates, Ianalumab, FABHALTA, and YTB323, for the treatment of lupus nephritis. Ianalumab is a fully human, HuCAL-derived monoclonal antibody targeting the BAFF receptor (BAFF-R) and is administered subcutaneously. It is designed to induce direct ADCC-mediated B-cell depletion and is being evaluated for autoimmune hepatitis, idiopathic pulmonary fibrosis, systemic lupus erythematosus (SLE), and lupus nephritis. The lupus nephritis drug is currently in Phase III clinical development, with Novartis aiming to submit for regulatory approval around 2028.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Roche’s GAZYVA Extends Indications Into Lupus, Strengthening Immunology Pipeline

- Lupus Nephritis: A SILENT but SEVERE Systemic Lupus Erythematosus Manifestation

- FDA Approves Genentech’s GAZYVA for Lupus Nephritis; Glaukos’ EPIOXA Wins FDA Approval for Kerato...

- Emerging Lupus Nephritis Therapies: Addressing Unmet Needs through Innovation and Mechanistic Tar...

- Survodutide Phase II trial Shows Groundbreaking Results in Liver Disease; GSK Announces Positive ...

FABHALTA (iptacopan), an oral Factor B inhibitor, is being explored as a potential treatment for lupus nephritis, building on its proven efficacy in other complement-mediated kidney disorders, such as IgAN, PNH, and C3G. While lupus nephritis-specific results are still awaited, its robust mechanistic rationale and growing commercial momentum, reflected in USD 129 million in 2024 sales, highlight its promise in addressing proliferative lupus nephritis.

YTB323 is a CD19-targeted CAR-T cell therapy designed to restore immune tolerance by eliminating autoreactive B cells. Developed using Novartis’ T-Charge platform, the treatment is currently in Phase II trials, with a regulatory submission focused on lupus nephritis anticipated after 2027.

AstraZeneca’s SAPHNELO and ULTOMIRIS

AstraZeneca’s SAPHNELO (anifrolumab), a type I interferon receptor blocker, is advancing through Phase III trials for lupus nephritis. Already approved for SLE in more than 65 countries, the drug has demonstrated promising steroid-sparing benefits and durable remission. Nonetheless, its once-every-four-week IV administration and lack of a subcutaneous formulation limit its convenience compared to BENLYSTA. At the same time, obinutuzumab’s stronger CRR outcomes in Phase II trials pose a notable competitive challenge.

Meanwhile, ULTOMIRIS (ravulizumab), a long-acting inhibitor of complement C5, is currently in Phase II trials for the treatment of Class III/IV lupus nephritis. Although specific efficacy data in lupus nephritis are not yet available, the drug’s proven success in other complement-driven conditions, such as aHUS, PNH, and NMOSD, yielding global sales of USD 3.9 billion in 2024, underscores its potential in lupus nephritis based on mechanistic rationale.

Cabaletta Bio’s CABA-201

CABA-201 is a fully human CD19-directed chimeric antigen receptor (CAR) T-cell therapy that incorporates a 4-1BB co-stimulatory domain. Cabaletta is conducting RESET (REstoring SElf-Tolerance) Phase I/II trials across multiple autoimmune indications, including lupus nephritis, systemic lupus erythematosus, myositis, systemic sclerosis, and generalized myasthenia gravis, with the potential to extend to a broad spectrum of other autoimmune disorders.

Roche’s GAZYVA approval represents more than just a clinical milestone — it’s a commercial and strategic inflection point. By successfully repositioning an oncology drug for an autoimmune indication, Roche has opened a lucrative new therapeutic frontier while validating the broader B-cell depletion class. However, the approval also shifts the benchmark for future entrants: efficacy alone may no longer suffice. Upcoming competitors will need to show faster onset, sustained remission with reduced steroid dependency, or a more favorable safety profile to justify share capture and payer adoption.

The competitive lupus nephritis pipeline paints a dynamic picture. Novartis’ diversified strategy, spanning antibody, complement, and CAR-T modalities, signals a long-term bet on precision immune modulation in renal autoimmunity. AstraZeneca, meanwhile, is banking on its expertise in the interferon pathway to defend and expand its lupus franchise. At the same time, Cabaletta Bio’s autologous CAR-T approach introduces a bold, potentially one-time curative paradigm. If these candidates deliver, Roche may find itself defending its first-mover advantage not just in nephrology clinics, but also across policy, pricing, and patient access fronts.

In the near term, GAZYVA’s success is expected to drive broader acceptance of combination regimens targeting B cells and complement cascades, while accelerating investment in cell-based and gene-modified immunotherapies. Yet the long-term winner in lupus nephritis may not be the drug with the deepest depletion, but the one that most effectively restores immune balance with minimal toxicity. Roche has set the pace — but the race to redefine lupus nephritis treatment has only just begun.

Downloads

Article in PDF

Recent Articles

- CAR-T Beyond Cancer: Resetting Immunity in Autoimmune Diseases

- FDA Fast Track Status to Kyverna’s KYV-101; Annovis’s Phase III Study for Buntanetap; Gilteritini...

- FDA Approves Genentech’s GAZYVA for Lupus Nephritis; Glaukos’ EPIOXA Wins FDA Approval for Kerato...

- Promising Nephrotic Syndrome Treatments: A Look into the Future

- Roche’s GAZYVA Extends Indications Into Lupus, Strengthening Immunology Pipeline