Lupus Nephritis: A SILENT but SEVERE Systemic Lupus Erythematosus Manifestation

Jan 27, 2023

Table of Contents

Lupus Nephritis (LN) is the most feared and common complication of systemic lupus erythematosus (SLE) and is responsible for the major share of morbidity and mortality of this disease. It affects around half of the systemic lupus erythematosus patients, and in ~35% of patients, lupus nephritis is the presenting feature at the time of systemic lupus erythematosus diagnosis. The disease is characterized by accumulating immune complexes in glomeruli and often an inflammatory response in all kidney compartments. Over time inflammation leads to chronic damage of the renal parenchyma and loss of kidney function.

Signs and lupus nephritis symptoms vary highly and may differ for everyone. The most frequent lupus nephritis symptoms include joint pain or swelling, muscle pain, or fever with no known cause. Clinical signs such as hematuria and proteinuria suggest lupus nephritis in patients with systemic lupus erythematosus. Kidney biopsy remains the only confirmatory test for establishing the lupus nephritis diagnosis. Active surveillance is recommended in systemic lupus erythematosus patients at high risk of kidney involvement (males, juvenile lupus onset, and serologically active disease).

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Aelis Farma pockets $30M; Alcyone unveils $23M for AAV gene therapies; Progentec and GSK collabor...

- New Lupus Nephritis Drugs on the Horizon: 6 Promising Therapies Eyeing Newly Approved GAZYVA’s Ma...

- Business Cocktail

- Systemic Lupus Erythematosus Treatment Market: How the Leading Companies are Countering the Risin...

- CAR-T Beyond Cancer: Resetting Immunity in Autoimmune Diseases

Among the adults, systemic lupus erythematosus patients ~40–50% develop lupus nephritis. However, it has been widely known that juvenile onset of lupus results in a more aggressive disease, and ~60–80% of juvenile systemic lupus erythematosus patients develop lupus nephritis.

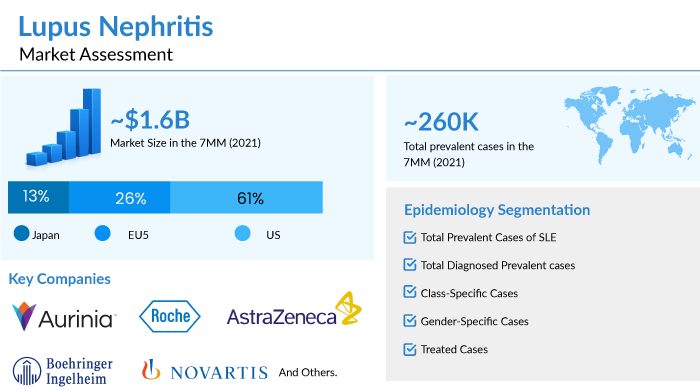

As per a recent analysis by DelveInsight, in the 7MM, the total prevalent cases of lupus nephritis in 2021 were approximately 260K cases. The growth in the lupus nephritis treatment market can be attributed to the aging population and increased exposure to pollutants, industrial agents, UV light, etc. The increasing use of hormonal drugs has also been identified as a risk factor among females.

What are the currently available lupus nephritis treatment options for patients?

Lupus nephritis treatment recommendations are dependent on the degree of histological kidney involvement. Currently, patients with Class I/II (ISN/RPS 2003 criteria) are mostly monitored and do not need immunosuppressants. Patients with Class VI LN have ≥90% glomerular sclerosis and are unlikely to respond to medical therapy. For such patients, dialysis or complete renal replacement are the only available options. Patients with Class III/IV ± V LN (also known as proliferative LN ± membranous nephropathy), which account for ~80% of all lupus nephritis patients, are recommended pharmacological therapy

For decades, rheumatologists and nephrologists have had to manage lupus nephritis patients solely through immunosuppressants and corticosteroids. The lupus nephritis treatment armamentarium was finally expanded by GSK’s Benlysta (belimumab) approval in 2020. Benlysta became the first drug approved for managing adult patients with active lupus nephritis who receive standard therapy.

In 2021, Aurinia Pharmaceutical gained US FDA approval for Lupkynis (voclosporin), a calcineurin inhibitor, in combination with a background immunosuppressive therapy regimen to treat adult patients with lupus nephritis for Class III, IV-S, IV-G (±V) (ISN/RPS 2003 criteria).

What is the unmet need for the current lupus nephritis treatment market?

Lupus nephritis remains a kidney disease with significant unmet medical needs despite extensive clinical and translational research. These include

- Novel diagnostic biomarkers for early diagnosis

- Therapeutic options for patients who do not respond to or are unfit for immunosuppressive therapies

- Steroid/immunosuppressant-sparing drugs can provide sustained remission

- Improve the design of randomized clinical trials so that effective drugs demonstrate efficacy

Scope of upcoming lupus nephritis therapies

Although there has been a history of high trial failure rates in lupus nephritis, the approval of Benlyta and Lupkynis has given hope of light and significant lupus nephritis pipeline activity. Here is a list of major key players and competitors in the lupus nephritis treatment market:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other notable players like Kezar Life Sciences (KZR-616 in PI/II), Johnson & Johnson (Nipocalimab and Guselkumab in PII), Novartis (CFZ533 [iscalimab] in PII), Boehringer Ingelheim (BI 655064 in PII), AstraZeneca (Ravulizumab and ALXN2050 [Vemircopan] in PII), Biocon/Equillium (Itolizumab in PI), and Omeros Corporation (OMS721 [narsoplimab] in PII) are enriching the robust lupus nephritis pipeline.

The lupus nephritis treatment market is expected to grow at a CAGR of 8.4% from 2021 and generate approx. USD 3 billion in revenue in the seven major markets (the United States, Germany, France, Italy, Spain, UK, and Japan) by 2032 owing to the uptake of Lupkynis (voclosporin) and Benlysta (belimumab), expected approvals of the emerging lupus nephritis therapies.

Less competitive scenarios, increasing government initiatives to create public awareness, and increasing systemic lupus erythematosus patients will also positively impact the growth of the lupus nephritis treatment market.

FAQs

Lupus Nephritis (LN) is the most feared and common complication of systemic lupus erythematosus (SLE) and is responsible for the major share of morbidity and mortality of this disease.

Signs and lupus nephritis symptoms vary highly and may differ for everyone. The most frequent lupus nephritis symptoms include joint pain or swelling, muscle pain, or fever with no known cause.

Kidney biopsy remains the only confirmatory test for establishing the lupus nephritis diagnosis. Active surveillance is recommended in systemic lupus erythematosus patients at high risk of kidney involvement (males, juvenile lupus onset, and serologically active disease).

Lupus nephritis treatment recommendations are dependent on the degree of histological kidney involvement. Currently, patients with Class I/II (ISN/RPS 2003 criteria) are mostly monitored and do not need immunosuppressants. Patients with Class VI LN have ≥90% glomerular sclerosis and are unlikely to respond to medical therapy.

Leading companies such as Aurinia Pharmaceuticals, Roche, AstraZeneca, Boehringer Ingelheim, Novartis, and others are developing therapies for lupus nephritis treatment.

Downloads

Article in PDF

Recent Articles

- Is Hydroxychloroquine the answer to all the COVID-19 questions?

- New Lupus Nephritis Drugs on the Horizon: 6 Promising Therapies Eyeing Newly Approved GAZYVA’s Ma...

- 7 Late-Stage SLE Drugs Expected to Enter Therapeutic Domain

- Pfizer & Lilly’s JAK Inhibitors Drug; FDA Approves Lilly’s Bebtelovimab; GSKR...

- Bayer’s New Cardiology Drug Acoramidis; Two Datopotamab Deruxtecan Applications Validated in the ...