Interpreting the Growth and Major Developments in the Medical Device Contract Manufacturing Market

May 20, 2022

Table of Contents

Contract manufacturing is a type of outsourcing in which a company manufactures entire products or parts of larger products. Such services are employed in the medical device sector as well. Medical device OEMs (original equipment manufacturers) are companies that own the product outsource manufacturing to another medical device contract manufacturing companies that specialize in a specific area, such as molding, assembly, or R&D design. Medical device contract manufacturing refers to the process by which a manufacturer creates medical devices or components for medical devices in accordance with the international standards and FDA criteria, and according to the OEM’s specifications that are then sold by another company.

Medical device contract manufacturers specialize in a specific process or activity and can provide expertise based on their manufacturing experience. Product concept and development, process validation, production, manufacturing, and packaging of devices are some of the services that medical device contract manufacturing companies offer their clients and medical device innovators. Some medical device contract manufacturing companies also provide end-to-end solutions to OEMs.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Antibody-Drug Conjugate and Big Pharmaceutical Companies

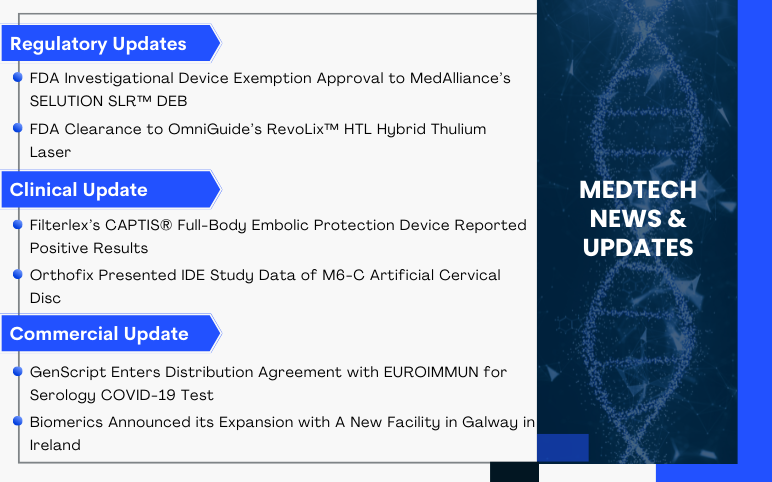

- GenScript Enters Distribution Agreement with EUROIMMUN; Biomerics’s New Facility in Galway (Irela...

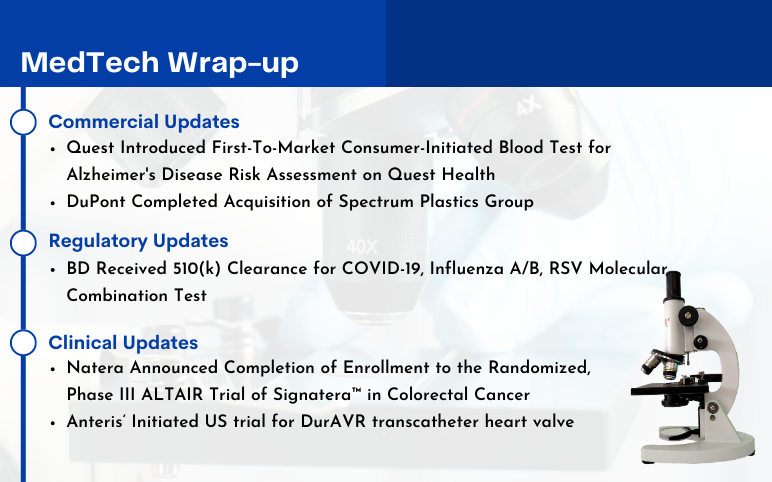

- Quest Introduced Consumer-Initiated Blood Test for Alzheimer’s Disease Risk Assessment; DuP...

- Cambrex acquires Avista; Sobi pays $50M; LEO Pharma signs deal; Boston Scientific remunerates

Types of Services offered by Medical Device Contract Manufacturers

- Design & Development

- Components & Devices Manufacturing

- Process Validation & Verification

- Packaging

- Regulatory Consultation

- Full Services

Factors Driving the Medical Device Contract Manufacturing Market

Increase in Life Expectancy

One of the prominent factors driving the demand for medical devices is the considerable increase in the life expectancy of humans across the globe. According to the World Health Organization (2022), life expectancy increased by more than 6 years between 2000 and 2019 – from 66.8 years in 2000 to 73.4 years in 2019. This can be credited to the significant improvement in the healthcare infrastructure globally. This, in turn, has resulted in a significant decrease in mortality rates specifically in the elderly age group. This has led to a surge in the geriatric population who form a formidable share of the most high-risk demographic who are susceptible to many age-related degenerative indications as well as infections and other diseases due to weakened immunity. All the factors mentioned above, collectively indicate the growing need for medical devices across medical specialties and modalities such as devices for hospital use as well as homecare-use, ultimately boosting the demand for contract manufacturer medical devices.

Growing Prevalence of Various Diseases Such as Lifestyle Disorders

The drastic change in lifestyle and the subsequent increase in the prevalence of various diseases such as cardiovascular diseases have also been instrumental in stimulating the demand for contract manufacturer medical devices in recent years. For instance, as per WHO (2021), an estimated 1.28 billion adults aged 30-79 years worldwide had hypertension, with the majority of the population residing in low- and middle-income countries. Lifestyle disorders such as diabetes, hypertension, and obesity can be extremely debilitating to patients and also act as a key risk factor that may lead to the development of other diseases such as peripheral neuropathy, and cancers among others. Medical devices such as glucose monitoring systems, and blood pressure monitoring systems are in high demand due to the growing popularity of at-home monitoring systems which can further be correlated to the growing awareness among people regarding lifestyle disorders.

Increased focus on research and innovation

There has been a significant increase in the use of implantable medical devices (IMDs) to improve medical outcomes for patients. These devices are comparatively more complex in terms of design and require strenuous planning on part of designers of implantable medical devices who have to balance complexity, reliability, power consumption, and costs incurred in device development and maintaining the final price of the device in an affordable range. Consequently, companies are shifting their focus to innovation rather than non-core activities and are therefore choosing to outsource these services in order to launch efficient devices. Moreover, amendments in the ISO standards may drive the demand for regulatory affairs and quality assurance service providers in Europe, as well as the US as small- and medium-sized enterprises (SMEs), would require third-party assistance in order to comply with new ISO guidelines.

Rising popularity of in vitro diagnostic devices

The sudden onset of the COVID-19 pandemic along with the growing focus on point-of-care (POC) diagnostics, blood-based tests, and the growing popularity of at-home testing is another factor contributing to the demand for in vitro diagnostic devices. The growing requirement for IVDs is another aspect leading to the growth of the medical device contract manufacturing market. The exigency created by the COVID-19 pandemic resulted in the development of rapid antigen kits, polymerase chain reaction (PCR) kits, and reagents which witnessed an extremely high demand during the pandemic phase. This posed a major demand and supply issue for the original equipment/medical device contract manufacturers. Therefore, handing over the manufacturing operations to the medical device contract manufacturing companies to meet the high demand for these devices also positively stimulated the medical contract manufacturing services market.

Rising number of MedTech Startups

Technological advancements and the propagation of the idea to include these new-age technologies into already existing medical devices or strategizing the development of devices with novel design has provided a conducive environment for more MedTech startups arriving on the scene. Even though these startups have the edge in terms of revolutionary ideas, they fall short of the monetary strength in terms of scaling up manufacturing facilities wherein outsourcing the device manufacturing process becomes extremely helpful for such small companies.

Benefits of Medical Device Contract Manufacturing

Outsourcing the manufacturing of medical devices to contract manufacturing organizations have numerous benefits associated with it.

Cost Optimization

One of the most important benefits of outsourcing the medical device manufacturing for the original equipment manufacturers (OEMs) is the cost savings the contract manufacturing services offer. Many of these medical device contract manufacturing services have expertise in the specific areas of device manufacturing such as devices specific to cardiology, prefilled syringes, and blood glucose monitoring systems among others. Outsourcing of the manufacturing of the device helps the OEMs in significant cost savings as they do not have to establish an exclusive product assembly line or invest in a skilled labor force, both the aspects which can be taken care of by the medical device contract manufacturing companies.

Support with the regulatory process

Since contract manufacturing companies may be locally located and are certified by national regulatory agencies such as the US Food and Drug Administration, they are well verse with the regulatory process of medical devices. Medical device contract manufacturing companies are capable of offering assistance in gaining regulatory approval for the device by providing necessary documents and guidance for filing regulatory documents.

Ample Focus on Product Branding

Outsourcing the product development/manufacturing activities to a contract manufacturer also helps the original equipment manufacturer (OEM) to save up on time and effort involved in producing or manufacturing a device. This allows the OEM to invest time in appropriate product branding and marketing thereby creating awareness about the device that may translate into better prospects of generating revenue for the OEMs.

A big room for innovation/improvement

Contract manufacturing companies offers massive scope for improvement in product design/technology which may vary based on different projects. The work involved in medical device contract manufacturing is done by experienced people who handle many similar projects. This may further benefit the development of the new device as the expertise of these people may prove to be helpful in bringing about design innovation in the product in development if required.

Key Players in the Medical Device Contract Manufacturing Market

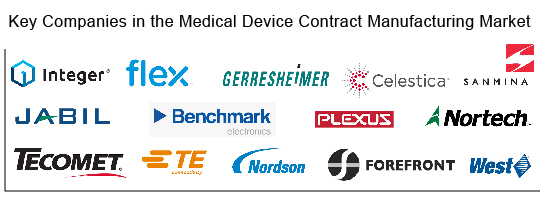

Some of the key medical device contract manufacturing companies such as Integer Holdings Corporation, Flex, Ltd., Gerresheimer AG, Celestica International Lp., Sanmina Corporation, Plexus Corp., West Pharmaceutical Services, Inc., Benchmark Electronics Inc., Jabil Inc., Nortech Systems Inc., Tecomet Inc., TE Connectivity, Nordson Corporation, Forefront Medical Technologies, among others are currently operating in the medical device contract manufacturing market arena. The top medical device contract manufacturing companies are:

Integer Holdings Corporation

Integer® Holdings Corporation is one of the most prominent companies operating in medical device outsourcing (MDO). It is a public company and listed on New York Stock Exchange (NYSE: ITGR). The company has a global presence and is a market leader involved in the development of neuromodulation, cardiac, vascular, and portable medical devices. The company offers high-quality, innovative technologies and manufacturing to medical device OEMs. The company has been operational for over 80 years and it also develops products such as batteries for high-end niche applications in energy, military, and environmental markets. Greatbatch Medical®, Lake Region Medical®, and Electrochem® are the brands of Integer Holdings Corporation.

The company offers manufacturing services for medical devices such as catheters, class III medical devices systems, combined devices, guidewires, introducers, and stents among others. Integer Holdings Corporation is headquartered in the United States.

Jabil Inc.

Jabil is a global manufacturing company with a presence in 30 countries. The company operates in numerous segments namely packaging, healthcare, smartphones, cloud equipment, home appliances, and automotive. Jabil Healthcare’s Medical Devices segment offers services such as manufacturing and supply chain solutions, combined with exceptional engineering and design capabilities in the development of product solutions across a broad range of medical devices.

Jabil Healthcare includes various segments that specifically focus on manufacturing medical devices such as medical devices, diagnostics, pharmaceutical delivery systems, orthopedics, and consumer health. Jabil is a public company and it is listed on New York Stock Exchange (NYSE: JBL). Jabil Inc. is headquartered in the United States.

Gerresheimer AG

Gerresheimer is the global partner for biotech, pharma, healthcare, and cosmetics companies and offers an extensive product range for pharmaceutical, cosmetic packaging, and drug delivery devices. The company is focuses on providing innovative solutions from concept to delivery of the end product. The company has a comprehensive global network with numerous innovation and production centers in Europe, America, and Asia.

Besides offering extensive pharmaceutical solutions, the company also offers customized medical device solutions from conceptualization of the idea to series production-readiness that combines innovative strength and industrialization competence. Gerreheimer produces medical products and medical devices such as infusion sets, lancing devices, disposable systems for a hemostatic scalp clip system, and for artificial respiration. The company is listed on XETRA Stock Exchange (German stock exchange operated by Frankfurt Stock Exchange) (GXI: Xetra) and it is headquartered in Germany.

Conclusion

According to DelveInsight analysis, the medical device contract manufacturing market would grow at a significant CAGR of 10.82%. Moreover, among all the regions, North America is expected to capture the maximum medical device contract manufacturing market size. This can be attributed to various factors such as the increasing product demand owing to the rising prevalence of various diseases, improvement in life expectancy, along with the recent outbreak of the COVID-19 pandemic resulting in the surge in demand for in vitro diagnostic products and other devices. Furthermore, the Industry 4.0 technologies such as including cloud computing, machine-to-machine communication, and cyber-physical systems are being promoted among medical device manufacturers as they enable advanced automation that helps overcome challenges associated with the production of medical devices. The inclusion of these technologies is being thought to streamline connectivity and data-gathering capabilities of these technologies thereby helping in building high-volume, regulation-compliant manufacturing processes with efficient inventory and production management.

Additionally, the establishment of numerous small and medium-sized MedTech startups has also helped in driving the medical device contract manufacturing industry to grow. For instance, as per the Irish MedTech Association (2022), the number of MedTech companies operating in the country has risen to 450. Ireland is home to the top 9 of the top 10 global MedTech companies. The increase in the number of MedTech companies across the globe is further thought to have a synergistic effect on the growth of the global medical device contract manufacturing market. Moreover, efforts taken by governments to establish local manufacturing hubs in their own countries are further expected to drive the demand for the medical device contract manufacturing market. For instance, the Indian Government has undertaken deep structural and sustained reforms to strengthen the healthcare sector in the country by announcing policies encouraging foreign direct investment. The Aatmanirbhar Bharat Abhiyaan packages include several short-term and longer-term measures for the health system, including Production-Linked Incentive (PLI) schemes for boosting domestic manufacturing of pharmaceuticals and medical devices.

Furthermore, the impact of the COVID-19 pandemic remained neutral on the medical device contract manufacturing market due to the COVID-19 infection being infectious in nature and affecting the respiratory system, directly driving the demand for medical equipment such as ventilators, pulse oximeters, face masks, personal protective equipment among others. However, the manufacturing of medical devices belonging to other medical specialties such as pacemakers, medical robots, and orthopedic products was affected due to a reduction in demand. As the impact of COVID-19 pandemic started to subside, the medical device contract manufacturing market is on the path to recovery as product demand starts returning to pre-COVID-levels due to resumption of activities across virtually all domains including healthcare, thereby presenting a conducive growth environment for medical device contract manufacturing market in the coming years.

Downloads

Article in PDF

Recent Articles

- Cambrex acquires Avista; Sobi pays $50M; LEO Pharma signs deal; Boston Scientific remunerates

- Antibody-Drug Conjugate and Big Pharmaceutical Companies

- GenScript Enters Distribution Agreement with EUROIMMUN; Biomerics’s New Facility in Galway (Irela...

- Quest Introduced Consumer-Initiated Blood Test for Alzheimer’s Disease Risk Assessment; DuP...