Multiple Myeloma: An Incurable B-cell Malignancy and A Vicious Cycle of Relapse

Jul 19, 2024

A cancer of plasma cells, a malignant plasma cell dyscrasia, Multiple Myeloma is a cancer that accumulates in the bone marrow leading to the number of healthy blood cells to plunge. The condition results in osteolysis due to an increase in osteoclastic and decreased osteoblastic activity.

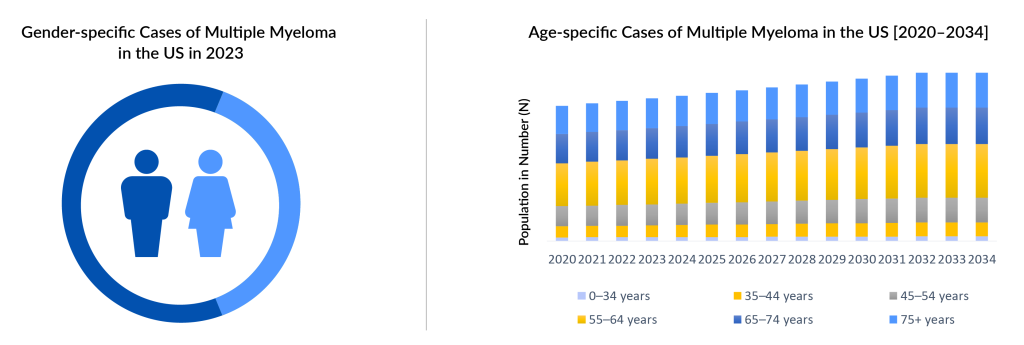

Multiple myeloma predominantly affects individuals aged 65 and older, although some patients can be diagnosed as early as 40. In 2023, DelveInsight estimated a total of approximately 75,000 multiple myeloma incidence cases in the 7MM, with the highest incidence observed in individuals aged 65 years and above and the lowest incidence in the 0–54 years age group. This number is projected to rise during the forecast period from 2024 to 2034. It has also been reported that multiple myeloma is more commonly diagnosed in men than in women, with over 50% of cases occurring among males in the US. However, the pathogenic events giving rise to gender disparity to date remain unclear.

The intricate pathogenesis of multiple myeloma often leaves researchers and scientists grappling, as there is currently no universally accepted standard of care for this cancer. The primary hallmark of the disease is encapsulated in the acronym CRAB: C (elevated calcium levels), R (renal failure), A (anemia), and B (bone lesions), alongside the presence of various chromosomal abnormalities affecting several genes. The diverse and complex nature of these pathologies makes therapeutic intervention a formidable challenge.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- AbbVie Presents Phase III CANOVA Study Results; Novartis’ Iptacopan Shows Promise in Phase III St...

- AstraZeneca’s Imfinzi Shows Positive Results; Novartis Announces Results of Tislelizumab; FDA Gra...

- Sandoz’s Generic Revlimid; Agios’ Pyrukynd; Organon Announces 4Q & Full-year Earnings ...

- J&J’s 2-in-1 Tablet for Prostate Cancer; FDA Approves TALVEY for Heavily Pretreated Multiple ...

- Novartis’ Canakinumab for NSCLC; Novartis’s Zolgensma Updates; Trodelvy Prospects in New Breast C...

Nevertheless, recent technological advances have dramatically changed the treatment patterns for treating Multiple myeloma. The entry of novel pharmaceutical entities has substantially progressed, and a lot more are in the pipeline. Looking at the current scenario, the multiple myeloma treatment majorly revolves around chemotherapies in conjunction with proteasome inhibitors, monoclonal antibodies, anti-resorptive agents such as bisphosphonates along with NSAIDs or narcotics, corticosteroids, and bone marrow transplantation.

Classic conventional chemotherapy has always held its position as indispensable in the Multiple myeloma market. Chemotherapy drugs primarily comprise Melphalan, Vincristine (Oncovin), Cyclophosphamide (Cytoxan), among others, and can be given alone or in combination with other drugs. Corticosteroids, such as dexamethasone and prednisone, are an important part of the treatment of multiple myeloma as they are administered to address the side effects due to chemotherapy, such as nausea and vomiting.

Classic conventional chemotherapy has always held its position as indispensable in the Multiple myeloma treatment. Among the stalwarts are Melphalan, Vincristine (Oncovin), and Cyclophosphamide (Cytoxan), wielded either alone or in strategic combinations. Supporting this arsenal are corticosteroids like dexamethasone and prednisone, pivotal not only for their direct therapeutic impact but also for mitigating the taxing side effects of chemotherapy, such as nausea and vomiting.

Recent research and trials have underscored the positive impact of immunomodulatory drugs (IMiDs), including thalidomide, lenalidomide, and pomalidomide, in enhancing Multiple Myeloma therapy. However, understanding the precise mechanisms by which IMiDs operate remains a focal point, crucial for optimizing their potential in the Multiple Myeloma treatment landscape. Another promising therapeutic avenue involves targeting myeloma cells through the inhibition of Proteasome Inhibitors (PIs), which effectively manage the excess M protein characteristic of the disease.

Currently, the Multiple Myeloma treatment is anchored by essential classes like Proteasome Inhibitors, Immunomodulating Agents, Monoclonal Antibodies (mAbs), Nuclear export inhibitors, CAR-T cell therapy, and Bi-specific antibodies. Notably, Histone Deacetylase (HDAC) inhibitors were formerly part of treatment protocols but have been withdrawn from the US market.

IMiDs, stemming from the resurgence of thalidomide under the brand THALOMID by Celgene Corporation, have revolutionized Multiple Myeloma treatment. Subsequent innovations such as REVLIMID (lenalidomide) have further expanded treatment options, with FDA approvals encompassing IMiDs such as thalidomide (THALOMID), lenalidomide (REVLIMID), and pomalidomide (POMALYST).

Proteasome Inhibitors (PIs) like VELCADE (bortezomib), KYPROLIS (carfilzomib), and NINLARO (ixazomib) constitute another cornerstone of Multiple Myeloma therapy, providing effective options for patients facing relapsed or refractory disease.

Monoclonal antibodies targeting CD38, including DARZALEX (daratumumab) and SARCLISA (isatuximab), have significantly advanced Multiple Myeloma treatment strategies. DARZALEX, particularly in combination with KYPROLIS, has been pivotal in improving outcomes for patients with relapsed or refractory disease. The evolving landscape continues to explore novel therapies such as cellMoDs, BCL-2 inhibitors, ADCs, and CAR-T therapies, promising continued advancements in personalized approaches to Multiple Myeloma treatment and enhancing the Multiple Myeloma drugs market.

The landscape of Multiple Myeloma treatment has evolved significantly with a diverse range of therapeutic options available today, including Proteasome Inhibitors, Immunomodulating Agents, Histone Deacetylase (HDAC) inhibitors, Monoclonal Antibodies, Chemotherapy, Corticosteroids, Nuclear export inhibitors, CAR-T cell therapy, and Bispecific antibodies across various treatment lines. Historically, alkylating agents like melphalan and cyclophosphamide, along with corticosteroids such as dexamethasone and prednisone, formed the backbone of treatment, later enhanced by autologous stem cell transplantation in the mid-1980s.

As of 2023, the Multiple Myeloma market in the 7MM was valued at approximately USD 21,300 million, with the US accounting for the largest share of around USD 14,300 million, followed by the EU4 and the UK. Key players driving innovation in this space include GlaxoSmithKline, Bristol-Myers Squibb, AbbVie, Roche, Janssen Research & Development, Merck Sharp & Dohme Corp., Pfizer, Takeda, Amgen, AstraZeneca, Celgene, Arcellx, Novartis, Regeneron Pharmaceuticals, Cartesian Therapeutics, Heidelberg Pharma, BeiGene, CARsgen Therapeutics, C4 Therapeutics, AbbVie (TeneoOne), and Roche (Genentech). Recent advancements include the approval of XPOVIO (selinexor) in the US for refractory multiple myeloma cases in 2019 and regulatory developments such as the EMA’s decision regarding BLENREP in December 2023. These developments underscore ongoing efforts to optimize treatment outcomes while navigating regulatory dynamics in the global Multiple Myeloma Treatment.

In January 2024, Bristol Myers Squibb received a positive CHMP opinion for CAR T cell therapy ABECMA for use in earlier lines of therapy for triple-class exposed relapsed and refractory multiple myeloma patients. This was followed by ABECMA’s approval in Japan in December 2023 for earlier lines of therapy in patients with relapsed or refractory multiple myeloma. Concurrently, in December 2023, the European Commission approved Pfizer’s ELREXFIO (elranatamab) specifically for relapsed and refractory multiple myeloma. In August 2023, the FDA granted approval for TALVEY (talquetamab), expanding treatment options for heavily pretreated multiple myeloma patients.

Johnson & Johnson’s CAR T cell therapy, CARVYKTI (ciltacabtagene autoleucel), received FDA approval in April 2024 for relapsed or refractory multiple myeloma patients who have received at least one prior therapy line, including a proteasome inhibitor and an immunomodulatory agent. This approval builds on its initial clearance in February 2022 for patients with more extensive treatment histories, including proteasome inhibitors, immunomodulatory agents, and anti-CD38 monoclonal antibodies.

Janssen’s investigational BCMA-directed CAR-T therapy, JNJ-4528, continues to demonstrate efficacy in clinical trials, including the ongoing CARTITUDE-1 Phase Ib/II trial across the US and Japan. Additionally, Janssen expanded the use of DARZALEX (daratumumab) in the multiple myeloma market by gaining FDA approval for its combination with KYPROLIS (carfilzomib) and dexamethasone (DKd) in 2020, enhancing treatment options for relapsed or refractory multiple myeloma patients who have received up to three prior lines of therapy.

Looking ahead, Bristol Myers Squibb is advancing mezigdomide (CC-92480) in Phase III trials, with anticipated new drug approvals by 2026–2027. Regeneron’s linvoseltamab (REGN5458), a BCMAxCD3 bispecific antibody, is progressing through clinical trials, including a Phase III confirmatory trial (LINKER-MM3) enrolling patients with relapsed or refractory multiple myeloma, and undergoing FDA priority review for its Biologics License Application (BLA), expected by August 2024.

The multiple myeloma pipeline is rich and comprises several novel therapies. These include PHE885 (Novartis), Iberdomide (Bristol-Myers Squibb/Celgene), and CART-ddBCMA, among others.

Despite the presence of a plethora of treatment approaches, however highly treatable, Multiple Myeloma, to date, remains incurable. The issue of relapsing of Multiple myeloma remains inevitable and unpredictable. Thus, the future goal of the Multiple myeloma treatment remains to overcome the resistance of the available options and address the issue of relapse of cancer. Nearly all Multiple myeloma patients continue to relapse. Ultimately, they become multi-drug resistant. The remission periods go on to reduce, with an average life expectancy of approximately five to six years after diagnosis. The increasing incidence due to an increase in the geriatric population is further adding to the healthcare burden Multiple myeloma poses.

Nevertheless, a lot is going on in the Multiple myeloma market, and pharmaceutical companies are exploring the possibility of novel entities in combination or alone to tackle Multiple myeloma. The hope is still there for a standard treatment in the Multiple myeloma pipeline that enables relief of the disease, prevention of progression/ organ damage, retrieval from resistant drugs, and achieving long-term remission.

Downloads

Article in PDF

Recent Articles

- Antibody–Drug Conjugates: An Emerging Concept in Cancer Therapy

- A New Era for Multiple Myeloma Treatment: Bispecific Antibodies Enter the Fray

- Kiadis inks license deal with Sanofi; Gilead Ends Hep B Collaboration; Merck & Foghorn inks ...

- 7 Companies at the Forefront of Trispecific Antibody Development

- Cilta-cel Demonstrates Prolonged and Deep Responses across Advanced Treatment Lines, Signifying P...