Pharma Industry

Jan 06, 2025

Parkinson’s and Tuberculosis Share a Common Protein That Could Provide Better Drugs for Both

Parkinson's disease and tuberculosis are two significant health challenges that affect millions worldwide. Recent research has unveiled a fascinating connection between these two diseases through a common protein known as Parkin. Understanding this link not only sheds light on the mechanisms of both diseases but al...

Read More...

Sep 04, 2024

Nonalcoholic Steatohepatitis (NASH): A Growing Epidemic

Obesity and diabetes are a global epidemic contributing to an increasing prevalence of related systemic disorders, including non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH). Nonalcoholic Steatohepatitis is a subtype of NAFLD (Nonalcoholic Fatty Liver disease) that is characterized...

Read More...

Aug 25, 2021

Top 7 Pharma Industry Leaders in 2020 By the Numbers

Pharmaceutical companies play a vital part in our lives and in helping us to live healthier lives. The pharmaceutical industry finds, develops, manufactures, and promotes medicines or pharmaceutical drugs for usage as medications that are administered (or self-administered) to patients in order to cure, vaccinate, ...

Read More...

Sep 22, 2020

Samsung/AZ Deal; Gyroscope’s Dry AMD Gene Therapy; Inflazome’s Buyout; Abbott’s MitraClip4 EU Approval; Grail Buybacks

Samsung Biologics strikes a USD 330.8 Mn supply deal with AstraZeneca Samsung Biologics announced the conclusion of a long-term supply deal with AstraZeneca worth USD 330.8 Million. AZ has made several headlines the past few months, forming a slew of deals to manufacture and supply its products. H...

Read More...

Jul 14, 2020

Merck, Dewpoint’s HIV Pipeline; Pfizer, BioNTech ‘s COVID-19 Vaccines; Roche’s Tecentriq- Avastin Duo Failure in Ovarian Cancer

Merck Collaborates with Dewpoint Therapeutics to Cure HIV with Condensates Merck has forged a collaboration with Boston-based Dewpoint Therapeutics to treat HIV using Dewpoint’s proprietary platform for condensate-based drug discovery.Under the terms of the agreement, Dewpoint is eligible for receiving ...

Read More...

Dec 12, 2019

Omega’s sixth funding round; Correvio’s drug failure; and BIMA acquisition

A leading global international investment firm, Omega Funds has announced the closure of its sixth fundraising USD 438 Million. More than decade old Life Sciences-based investment firm specialized in direct secondary transactions, Omega funds focuses in investing in Life Sciences vertical, aiming to fulfil the ...

Read More...

Dec 10, 2019

Acquisition of ArQule; Synthorx; and Zentalis nabs a raise

Merck is set to complete the already planned purchase of the ArQule for USD 2.7 Billion. Under the terms of the agreement, Merck will pay USD 20 for each share in cash for a total amount of USD 2.7 Billion. ArQule is a biopharmaceutical, which is focused on kinase inhibitor discovery, finding cures for cancer p...

Read More...

Nov 19, 2019

Nordisk ties up with Dicerna; Pfizer’s drug gets FDA nod

Novo Nordisk has announced to enter into a collaboration with Dicerna’s RNAi platform to focus on metabolic and liver-related diseases. The companies will be focusing to advance the treatment landscape of the diseases such as non-alcoholic steatohepatitis (NASH), Type 2 diabetes and obesity. Nordisk will be inv...

Read More...

Sep 11, 2019

Japan is transforming its Healthcare sector through Regenerative Medicine

Regenerative medicine is an innovative approach to regrow and repair the damaged cells, tissues or organs. The process involves the regeneration of the lost body cells by stimulating the body’s own immune system. Regenerative medicine includes a group of biomedically engineered approaches that uses therapeutic stem...

Read More...

May 16, 2018

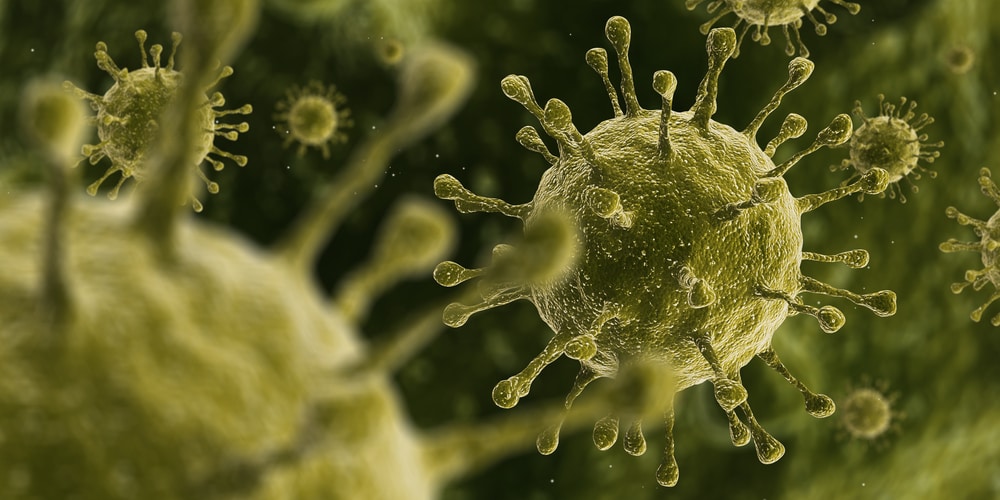

Potential cure for Common cold

A group of Researchers at Imperial College London created a molecule that can successfully block multiple strains of the common cold by targeting a protein required for the survival of the virus. The newly created molecule (IMP-1088) resides inside a protein in cells called N-myristoyltransferase (NMT). After invadi...

Read More...

-Agonist.png)