TSLP Inhibitors: The New Frontier in Treating Type 2 Inflammatory Diseases

Nov 17, 2025

Table of Contents

Thymic stromal lymphopoietin (TSLP) has emerged as a key target in the treatment of severe inflammatory diseases. These TSLP therapies offer a novel approach by targeting a key initiator of the inflammatory cascade. Following AstraZeneca and Amgen’s TEZSPIRE’s breakthrough approvals and a robust pipeline of emerging therapies, TSLP inhibitors are poised to revolutionize treatment for severe asthma, chronic rhinosinusitis, COPD, and beyond.

Understanding TSLP: The Master Controller of Type 2 Inflammation

Thymic stromal lymphopoietin represents a critical epithelial cytokine that sits at the top of multiple inflammatory cascades. Released from airway epithelial cells, the first point of contact for viruses, allergens, and pollutants, TSLP initiates and perpetuates type 2-mediated immune responses that characterize severe asthma, atopic dermatitis, eosinophilic esophagitis, and chronic rhinosinusitis.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Biogen’s SPINRAZA Phase II/III Trial Results; Travere’s FILSPARI FDA Approval; GSK’s ...

- Neurotech’s ENCELTO Becomes First FDA-Approved Treatment for MacTel Type 2; Plus Therapeutics’ Rh...

- Aktis’s Novel Targeted Alpha Radiopharmaceuticals; Koye Partners with Sonde Health; Novartis to S...

- Alarming Growth of Chronic Respiratory Diseases (CRDs) and Their Prolonged Impact on the Quality ...

- AstraZeneca’s new Asthma Drug Aces Phase III trial

Unlike downstream inflammatory mediators, TSLP functions as an upstream orchestrator of the immune response. When released in response to environmental triggers, it activates dendritic cells and type 2 innate lymphoid cells (ILC2s), driving Th2 differentiation and perpetuating allergic inflammation. Expression of TSLP becomes substantially elevated in the airways of asthma patients, correlating directly with disease severity, making it an attractive therapeutic target.

The scientific foundation for TSLP targeting emerged gradually. Early studies have demonstrated that TSLP expression increases in acute and chronic atopic dermatitis lesions, in asthmatic airways, and in the nasal mucosa of patients with chronic rhinosinusitis. Genetic association studies have linked single-nucleotide polymorphisms at the TSLP and TSLP receptor loci with an increased risk for asthma, atopic dermatitis, and eosinophilic esophagitis. This convergence of evidence positioned TSLP blockade as a potentially transformative therapeutic strategy.

TEZSPIRE: The First-in-Class TSLP Inhibitor

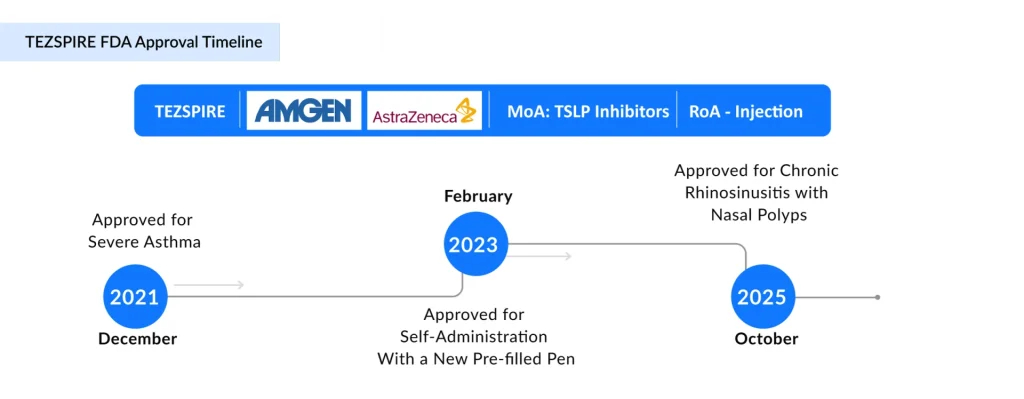

TEZSPIRE (tezepelumab-ekko), developed through a partnership between AstraZeneca and Amgen, represents the first-in-class human monoclonal antibody that directly targets and blocks TSLP. The drug received FDA approval in December 2021 for the treatment of severe asthma and has since become the only approved TSLP inhibitor on the market.

Mechanism and Clinical Validation in Severe Asthma

TEZSPIRE operates through a highly specific mechanism: it binds to circulating TSLP, preventing the cytokine from interacting with its receptor complex (TSLPR and IL-7Rα) on immune cells. This blockade interrupts downstream signaling cascades that would otherwise drive eosinophilic and allergic inflammation.

The clinical efficacy of TEZSPIRE in severe asthma proved remarkable precisely because it worked independently of phenotype or biomarker status. In pivotal Phase III trials (NAVIGATOR and PATHWAY), the drug demonstrated a 71% reduction in annualized asthma exacerbation rates in patients with blood eosinophil counts of≥300 cells/µL, as well as similarly impressive 48% reductions in those with lower eosinophil counts (<300 or <150 cells/µL). This biomarker-independent efficacy distinguishes TEZSPIRE from IL-5 or IL-4Rα-targeted biologics, which primarily benefit eosinophilic asthma phenotypes.

Recent data from the WAYFINDER trial underscore the transformative potential of TEZSPIRE in steroid-dependent asthma. Among patients receiving maintenance oral corticosteroids at a baseline average dose of 10.8 mg daily, 89.9% reduced their dose to 5 mg or less by week 52, while maintaining asthma control. The proportion of individuals achieving well-controlled asthma increased ninefold from 3% at baseline to 26.9% at study end. These outcomes offer genuine relief to patients with severe, steroid-refractory disease who face significant toxicity risks from long-term systemic corticosteroids.

Expansion into Chronic Rhinosinusitis with Nasal Polyps

In October 2025, the FDA approved TEZSPIRE for a second indication: chronic rhinosinusitis with nasal polyps (CRSwNP). This approval, based on the Phase III WAYPOINT trial, demonstrated that TEZSPIRE reduced nasal polyp severity, with near-elimination of the need for surgery and significant reductions in systemic corticosteroid use compared with the placebo. Specifically, treated patients achieved a mean reduction in total nasal polyp score of 2.08 points compared with the placebo, accompanied by an 88% reduction in systemic corticosteroid requirements and a remarkable 98% reduction in the need for future sinus surgery.

The CRSwNP TEZSPIRE approval validates TSLP’s role in epithelial-driven Type 2 inflammation beyond the respiratory tract and establishes TEZSPIRE as uniquely positioned to address underlying disease drivers in multiple indications simultaneously.

Ongoing Development and Market Performance

TEZSPIRE continues advancing through clinical development for additional indications, including chronic obstructive pulmonary disease (COPD), chronic spontaneous urticaria (CSU), and eosinophilic esophagitis (EoE). The COURSE trial in COPD demonstrated a 17% numerical reduction in moderate-to-severe exacerbations, though this did not achieve statistical significance. Subgroup analyses suggested potential benefit in COPD patients with baseline eosinophil counts ≥150 or ≥300 cells/µL, indicating that refined patient selection may enhance outcomes in this indication.

From a commercial perspective, TEZSPIRE generated combined sales of $1.2 billion in 2024 (across all indications) and $1.6 billion in 2024 from severe asthma alone, establishing it as a significant commercial success and validating TSLP as a viable drug target.

The Emerging TSLP Inhibitor Pipeline

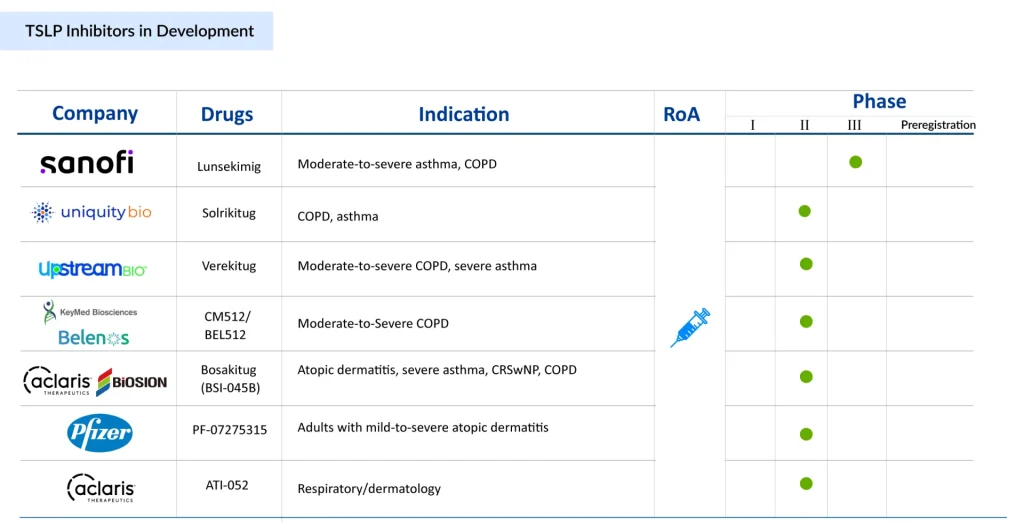

The approval of TEZSPIRE catalyzed intense pharmaceutical interest in TSLP targeting. At least 20 distinct TSLP-targeting molecules currently exist in clinical development, representing diverse therapeutic approaches and indicating robust competition ahead.

Next-Generation Approaches

Verekitug (Upstream Bio): A key emerging competitor, verekitug represents a novel approach by targeting the TSLP receptor rather than the ligand itself. This distinction carries important mechanistic implications. Preclinical data revealed that verekitug binds with extremely high affinity (KD < 1 pM) and occupies most of the TSLP binding sites on the TSLP receptor. Structurally, this allows verekitug to outcompete TSLP binding even in the presence of preformed heterodimeric receptor complexes—a potential advantage when TSLP levels are very high.

Functionally, in vitro comparisons showed that verekitug demonstrated 15-fold greater potency than tezepelumab in inhibiting receptor dimerization, 6-fold greater potency in reducing STAT5 phosphorylation, and 10-fold greater effectiveness in suppressing TARC (CCL17) production. These differences reflect distinct epitope engagement and the mechanism of action. Clinical data from Phase Ib trials demonstrated that verekitug achieved sustained biomarker reductions and strong target engagement in asthma patients, maintaining TSLP receptor inhibition for up to 24 weeks after the last dose—potentially enabling less frequent dosing than TEZSPIRE.

Solrikitug (Uniquity Bio): Another emerging candidate showing promise is solrikitug, which similarly demonstrated superior in vitro potency to tezepelumab across multiple assays while binding distinct epitopes on TSLP. In May 2024, Blackstone announced funding of up to USD 300 million for Uniquity Bio, which is set to initiate Phase II clinical trials in COPD and Asthma with a novel Anti-TSLP mAb.

Lunsekimig (Sanofi): Representing an innovative bispecific approach, lunsekimig combines TSLP inhibition with IL-13 blockade in a single molecule. This bispecific NANOBODY compound (approximately 10-fold smaller than conventional monoclonal antibodies) demonstrated favorable safety and tolerability in first-in-human studies and showed linear pharmacokinetics across doses. Sanofi initiated a Phase IIb asthma trial with results anticipated in 2026, and plans to launch Phase II/III COPD trials the same year.

The bispecific strategy reflects growing recognition that dual targeting of upstream epithelial cytokines might enhance therapeutic benefit. Research has demonstrated that combined blockade of TSLP, alongside IL-25 and IL-33, produces more profound reductions in Type 2 inflammation and fibrosis than single-pathway antagonism in preclinical models.

Bispecific and Combination Strategies

ATI-052 (Aclaris Therapeutics): Advancing the frontier further, ATI-052 represents a bispecific monoclonal antibody targeting both TSLP and interleukin-4 receptor (IL-4R). This approach blocks TSLP-driven initial activation while simultaneously preventing IL-4 and IL-13 signaling through their shared receptor. The FDA approved Aclaris’ IND application in April 2025 to initiate Phase Ia/Ib clinical trials.

The rationale for combining TSLP and IL-4R blockade reflects the architecture of Type 2 inflammation: TSLP activates dendritic cells to promote Th2 differentiation, while IL-4 and IL-13 drive terminal effector functions, including IgE production and eosinophil recruitment. Dual blockade addresses both initiation and perpetuation phases of disease.

Additional Pipeline Candidates

The TSLP inhibitors pipeline includes numerous other candidates at various stages: Bosakitug (BSI-045B) from Aclaris Therapeutics/Biosion, CM512/BEL512 (from Keymed Biosciences/Belenos Bioscience), PF-07275315 (from Pfizer), and compounds from other companies. Collectively, these candidates employ diverse modalities, traditional monoclonal antibodies, receptor antagonists, bispecific antibodies, and novel formats, indicating pharmaceutical confidence in sustained TSLP targeting across multiple indications.

TSLP Inhibitors Market Landscape and Future Outlook

The TSLP inhibitor market is expected to exhibit early commercial maturity following the approval of TEZSPIRE, with significant expansion anticipated in the years to come. TSLP inhibitors specifically are predicted to experience substantial expansion through 2034, driven by broadening indications, increasing diagnosis rates, and growing adoption of targeted biologics. The asthma treatment market more broadly is valued at $27 billion in 2024 and expected to grow at a 1.95% CAGR, reflecting TSLP inhibitors as one component of the expanding biologic landscape.

The competitive environment is intensifying with over 10 TSLP-targeting candidates in clinical development across major pharmaceutical companies. AstraZeneca and Amgen’s TEZSPIRE currently dominate, but competitors including Upstream Bio (verekitug), Sanofi (lunsekimig), Uniquity Bio (solrikitug), Aclaris Therapeutics/Biosion (bosakitug), Keymed Biosciences/Belenos Bioscience (CM512/BEL512), Pfizer (PF-07275315), Aclaris Therapeutics (ATI-052), and others are advancing promising alternatives. Chinese pharmaceutical companies, including Hengrui Medicine, are making significant inroads, particularly in emerging markets, further intensifying competition.

In summary, as the market evolves through the next decade, TSLP inhibitors are poised to capture substantial market share, growing from niche therapies into foundational components of management algorithms for severe asthma, CRSwNP, and potentially atopic dermatitis and other Type 2-driven diseases. Success will hinge on demonstrating sustained real-world efficacy, establishing favorable economic profiles, and identifying patient populations most likely to benefit from specific TSLP-targeting approaches.

Downloads

Article in PDF

Recent Articles

- How Emerging Pipeline Therapies Will Unfold the Severe Asthma Treatment Market Dynamics?

- Understanding the Chronic Obstructive Pulmonary Disease Increasing Prevalence and Trends

- Airway Management Devices: Charting the Evolving Market Trends and Key Innovations

- AstraZeneca’s new Asthma Drug Aces Phase III trial

- Mapping the Top Asthma Therapies: Inhaled Blockbusters and Injectable Powerhouses