CXCR Inhibitors Market Summary

- The CXCR Inhibitors Market is gaining significant traction as pharmaceutical and biotechnology companies increasingly explore chemokine receptor pathways for targeted therapeutic interventions.

- The leading CXCR Inhibitors Companies such as Dompe Farmaceutici, BioLineRx, X4 Pharmaceuticals, Novartis, and others.

CXCR Inhibitors Market Trends & Insights

- The CXCR chemokine receptor family, consisting of seven primary members (CXCR1–CXCR7), is crucial in regulating immune cell recruitment, angiogenesis, cellular proliferation, and maintaining skin homeostasis and immune functions.

- The CXCR4 has emerged as a key molecular biomarker for cancer therapies due to its critical role in tumor progression and metastases by displaying a stem cell phenotype. Its overexpression has been observed in tumors and more than 20 types of cancers, including solid hematological malignancies, and it is often associated with tumor aggressiveness and poor prognosis.

- Currently, few CXCR4-targeted therapies have received regulatory approval. MOZOBIL (plerixafor) is approved with filgrastim to mobilize hematopoietic stem cells into the peripheral blood for collection and subsequent autologous transplantation in patients with Non-Hodgkin’s Lymphoma or Multiple Myeloma. More recently, XOLREMDI (mavorixafor) was approved in April 2024 for patients aged 12 and older with WHIM Syndrome.

- Additionally, in January 2025, the EMA validated X4 Pharmaceuticals’ a marketing authorization application (MAA) for mavorixafor, now under CHMP review, with a decision expected in 1H 2026.

- Additionally, APHEXDA is being evaluated in a Phase II study for Metastatic Pancreatic Cancer, sponsored by Columbia University, which commenced in July 2023.

- Emerging players like Syntrix Pharmaceuticals are advancing SX-682 across multiple indications, including metastatic melanoma, Myelodysplastic Syndrome (MDS), metastatic Castration-resistant Prostate Cancer (mCRPC), metastatic colorectal cancer, metastatic Pancreatic Ductal Adenocarcinoma, metastatic or recurrent stage IIIC or IV Non-small Cell Lung Cancer (NSCLC), and relapsed or refractory multiple myeloma.

- Other companies—such as Dompe (Reparixin for Acute Respiratory Distress Syndrome), AdAlta (AD-214 for Idiopathic Pulmonary Fibrosis (IPF) and wet age-related macular degeneration), Pfizer (PF-06835375 for seropositive Systemic Lupus Erythematosus, Rheumatoid Arthritis, and primary Immune Thrombocytopenia [ITP]), and Idorsia Pharmaceuticals (ACT-777991 and ACT-1004-1239 preparing for proof-of-concept studies in vitiligo and Progressive Multiple Sclerosis are also developing novel immunotherapies at various stages.

Request for Unlocking the Sample Page of the "CXCR Market Size"

Factors contributing to the Growth of the CXCR Inhibitors Market

-

Rising Oncology and Hematologic Disease Burden

The growing incidence of cancers and hematologic malignancies increases demand for targeted therapies that address metastasis, chemo-resistance, and stem-cell niches, all areas where CXCR4 plays a validated role.

-

Clinical Validation Through Approved Therapy

Regulatory approval and clinical adoption of plerixafor (MOZOBIL) for hematopoietic stem-cell mobilization demonstrate clinical utility for CXCR4 modulation and de-risk the target for investors and developers.

-

Growing CXCR Inhibitors Clinical Trial Pipeline

Syntrix Pharmaceuticals’ SX-682, Pfizer’s PF-06835375, Dompe’s Reparixin, Idorsia Pharmaceuticals’ ACT-777991 and ACT-1004-1239, AdAlta’s AD-214, and others are currently in different phases of development. The anticipated launch of these therapies will change the CXCR inhibitors market dynamics.

DelveInsight’s “C-X-C Chemokine Receptor Inhibitor Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the CXCR inhibitor, eligible patient population as well as the DPP1 inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The CXCR Inhibitor Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM CXCR inhibitor market size from 2020 to 2034. The report also covers current CXCR inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Scope of the CXCR Inhibitor Market | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

CXCR Inhibitor Epidemiology |

Segmented by:

|

|

CXCR Inhibitor Companies |

|

|

CXCR Inhibitor Therapies |

|

|

CXCR Inhibitor Market |

Segmented By

|

|

Analysis |

|

CXCR Inhibitor Disease Understanding

CXCR Inhibitor Overview

The CXCR chemokine receptor family, consisting of seven primary members (CXCR1–CXCR7), represents a critical subset of chemokine receptors, essential for immune cell recruitment, angiogenesis, and cellular proliferation. As part of the G protein-coupled receptor superfamily (GPCR), these receptors are characterized by seven transmembrane domains, an extracellular N-terminal, and an intracellular C-terminal, facilitating diverse intracellular signaling cascades. Predominantly expressed on various immune cells, CXCR receptors engage with CXC chemokines to regulate inflammatory responses and immune cell function.

These receptors play critical roles in immune cell signaling, chemotaxis (cell movement in response to chemical stimuli), and various physiological and pathological processes—including inflammation, angiogenesis (formation of new blood vessels), and cancer progression. CXCR1 and CXCR2 are located on chromosome 2q35, while CXCR3 is positioned on chromosome Xq13.1. CXCR4, a member of the G protein-coupled receptor (GPCR) family, is found on chromosome 2q21. CXCR5, another GPCR expressed on B cells, follicular helper T cells (Tfh), and antigen-presenting dendritic cells, is located on chromosome 11q23.3. CXCR6, also known as CD186, Bonzo, STRL, and TYMSTR, resides on chromosome 3p21.31 and interacts with CXCL16 to activate the PI3K-Akt/PKB pathway, NF-κB, and Tumor Necrosis Factor (TNF)-α, thereby modulating cell activation, proliferation, homing, and migration. CXCR7, also referred to as ACKR3 (atypical chemokine receptor 3), is involved in the regulation of cell migration and angiogenesis and is located on chromosome 2q37.3.

CXCR Inhibitor Epidemiology

The CXCR inhibitor epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total incident cases in selected indications for CXCR inhibitor, total eligible patient pool in selected indications for CXCR inhibitor, and total treated cases in selected indications for CXCR inhibitor in the 7MM covering the US, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan from 2020 to 2034.

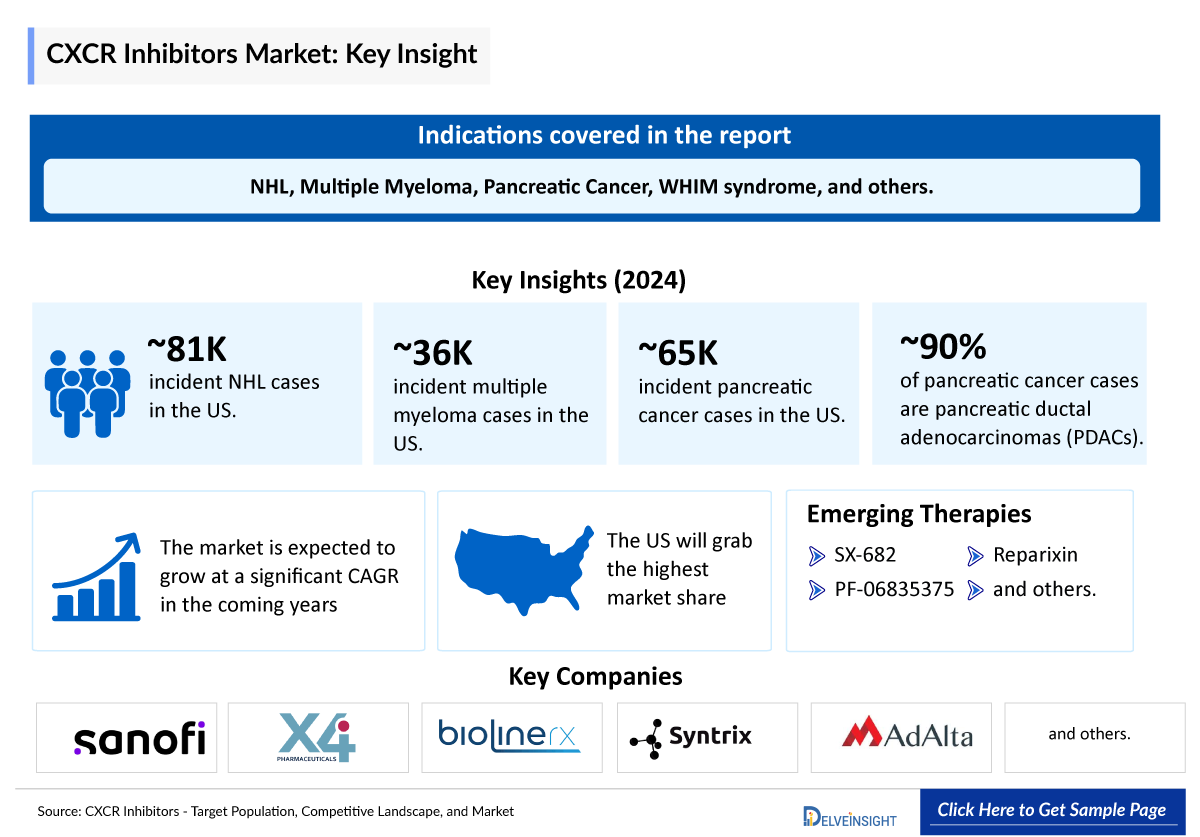

Key Findings from the CXCR Inhibitors Epidemiological Forecast

- According to secondary research, pancreatic cancer is currently the third leading cause of cancer-related deaths in the United States. In 2025, the American Cancer Society projects approximately 67,440 new cases, including 34,950 men and 32,490 women.

- Approximately 90% of pancreatic cancers are Pancreatic Ductal Adenocarcinomas (PDACs).

- According to secondary research, Non-Hodgkin’s Lymphoma (NHL) accounts for 3.9% of all new cancer cases in the US, with an annual incidence rate of 18.7 per 100,000 men and women.

- According to secondary research, NHL is common in ages 65 to 74, with the median age being 67 years. In children, peak incidence occurs between ages 4 and 7, with a male-to-female ratio of approximately 2:1.

- According to DelveInsight’s analysis, among EU4 and the UK, the incident cases of multiple myeloma were the maximum in Germany and France, with approximately 24% of the total cases in 2024. While the lowest number of cases was in Spain.

- Among the age distribution of multiple myeloma in Japan, the majority, approximately 70% occurred in the age group of 65 years and above, compared to lower proportions in the 0–54 and 55–64 year age groups.

CXCR Inhibitors Epidemiology Segmentation

- Incident cases in selected indications for CXCR inhibitor

- Total eligible patient pool in selected indications for CXCR inhibitor

- Total treated cases in selected indications for CXCR inhibitor

|

Epidemiology of Top Indications | |

|

Indication |

Estimated Incident Cases in 2024 in the US |

|

NHL |

~81,000 |

|

Multiple Myeloma |

~36,000 |

|

Pancreatic Cancer |

~65,000 |

NOTE: The list of indications is not exhaustive and will be provided in the final report. In addition, numbers are indicative and are subject to change as per report updation.

CXCR Inhibitor Drug Analysis

The drug chapter segment of the CXCR inhibitor Therapeutics Market Report encloses a detailed analysis of approved as well as emerging drugs in late and early-stage (Phase III, Phase II, and Phase I) CXCR Pipeline Drugs. It also helps understand the CXCR inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

CXCR Inhibitors Marketed Drugs

-

MOZOBIL (plerixafor): Sanofi

MOZOBIL is a CXCR4 antagonist used in conjunction with granulocyte-colony stimulating factor to mobilize hematopoietic stem cells into the peripheral blood for collection and autologous transplantation in Patients with NHL and multiple myeloma.

In December 2008, the US Food and Drug Administration (FDA) granted marketing approval for MOZOBIL to mobilize hematopoietic stem cells to the bloodstream for collection and subsequent autologous transplantation in patients with NHL and multiple myeloma.

MOZOBIL received a marketing authorisation valid throughout the EU in July 2009.

-

XOLREMDI (mavorixafor): X4 Pharmaceuticals

XOLREMDI is a selective CXCR4 receptor antagonist approved in the US for use in patients 12 years of age and older with WHIM syndrome to increase the number of circulating mature neutrophils and lymphocytes.

In April 2024, the US FDA approved XOLREMDI capsules for use in patients 12 years of age and older with WHIM syndrome.

In January 2025, X4 Pharmaceuticals announced that its MAA for XOLREMDI for the treatment of WHIM syndrome has been validated for review and is now under evaluation with the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP). The EMA previously granted orphan designation to XOLREMDI in WHIM syndrome. Decision on MAA expected in 1H 2026.

|

Comparison of Key Emerging CXCR Inhibitors | |||||

|

Product |

Company |

Mechanism of Action |

RoA |

Approval year |

Indication |

|

MOZOBIL (plerixafor) |

Sanofi |

CXCR4 inhibitor |

SC |

US: 2008 EU: 2009 |

Autologous transplantation in patients with NHL or multiple myeloma |

|

XOLREMDI (mavorixafor) |

X4 Pharmaceuticals |

CXCR4 inhibitor |

Oral |

US: 2024 |

WHIM syndrome |

|

APHEXDA (motixafortide) + Filgrastim |

BioLineRx |

CXCR4 inhibitor |

SC |

US: 2023 |

Hematopoietic stem cells to the peripheral blood for collection and subsequent autologous transplantation in patients with multiple myeloma |

CXCR Inhibitors Emerging Drugs

-

SX-682: Syntrix Pharmaceuticals

SX-682 is an oral allosteric small-molecule inhibitor of CXCR1 and CXCR2 (CXCR1/2) being investigated in several Phase I/II clinical trials. It is involved in the recruitment of immunosuppressive MDSCs and the autocrine growth of disease-initiating leukemic stem cells in AML and MDS.

In May 2024, at ASCO 2024, SX-682 combined with pembrolizumab showed a tolerable safety profile and encouraging activity in metastatic melanoma patients who had progressed on anti–PD-1 and anti–CTLA-4 therapies, demonstrating objective responses and meaningful disease control.

-

PF-06835375: Pfizer

PF-06835375 is a selective antibody currently under investigation as a new molecular entity in a Phase II clinical trial for ITP, and as a product enhancement in a Phase I trial for lupus.

|

Comparison of Key Emerging CXCR Inhibitors | |||||

|

Product |

Company |

Mechanism of Action |

RoA |

Phase |

Indication |

|

SX-682 |

Syntrix Pharmaceuticals |

CXCR1 and CXCR2 inhibitor |

Oral |

II |

Metastatic or recurrent Stage IIIC or IV NSCLC (SX-682 and pembrolizumab) |

|

Ib/II |

Unresectable or metastatic colorectal cancer (SX-682 and Nivolumab) | ||||

|

I/II |

mCRPC (in Combination With apalutamide) | ||||

|

I |

Metastatic melanoma (SX-682 and pembrolizumab) | ||||

|

I |

MDS (alone and in combination with oral or intravenous decitabine) | ||||

|

I |

Relapsed or Refractory multiple myeloma (sx-682 in combination with carfilzomib, daratumumab-hyaluronidase, and dexamethasone) | ||||

|

PF-06835375 |

Pfizer |

CXCR5 inhibitor |

Intravenous/ Subcutaneous injection |

II |

Primary ITP |

|

I |

Seropositive SLE | ||||

|

Reparixin |

Dompe |

CXCR1 and CXCR2 inhibitor |

Oral |

II |

ARDS |

CXCR Inhibitor Market Outlook

CXCR4 has emerged as a remarkable molecular target in cancer therapy, due to its overexpression in many types of tumors and its strong association with poor prognosis and cancer stem cell phenotype. Numerous tools have been developed to block and target this receptor for therapeutic use, most of them initially identified for their role in HIV infection. Over the last decade, many of these targeting strategies have been repurposed for cancer therapy, unlocking new possibilities for clinical interventions.

Given that CXCR4 is overexpressed in more than 20 different types of tumors, many of the molecules previously identified have now been applied to both cancer diagnosis and treatment through CXCR4 inhibition. These therapies have shown highly promising results, leading to numerous clinical trials, particularly in combination with standard chemotherapies. Emerging players such as Syntrix Pharmaceuticals are actively evaluating its investigational therapy, SX-682, across multiple indications, including metastatic melanoma, MDS, mCRPC, metastatic colorectal cancer, metastatic pancreatic ductal adenocarcinoma, metastatic or recurrent stage IIIC or IV NSCLC, and relapsed or refractory multiple myeloma.

Additionally, other companies, including Dompe developing Reparixin for ARDS, AdAlta developing AD-214 for IPF and wet-AMD, and Pfizer developing PF-06835375 for seropositive SLE or Rheumatoid Arthritis and Primary ITP. While Idorsia Pharmaceuticals’ ACT-777991 and ACT-1004-1239 are in preparation for a proof-of-concept study for Vitiligo and PMS.

CXCR Inhibitor Drugs Uptake

This section focuses on the uptake rate of the emerging CXCR inhibitor expected to be launched in the market during 2025–2034 with its inclusion across multiple indications—such as SX-682 for NSCLC, metastatic colorectal cancer, and metastatic melanoma, and PF-06835375 for SLE and ITP—anticipated to significantly enhance adoption by broadening clinical applicability and expanding the target patient population.

CXCR Inhibitor Pipeline Development Activities

The CXCR Inhibitors Therapeutics Market Report provides insights into different therapeutic candidates in Phase II, Phase I/II, and Phase I. It also analyzes key CXCR Inhibitors Companies involved in developing targeted therapeutics. The presence of numerous drugs at different stages is expected to generate immense opportunities for the CXCR inhibitor market growth over the forecasted period. The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for CXCR inhibitor emerging therapies.

Latest KOL Views on CXCR Inhibitors

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on CXCR inhibitors’ evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 15+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Centers such as Institut de Recerca Sant Pau Barcelona, Josep Carreras Leukaemia Research Institute, University of Torino, University of Texas, Dana-Farber Cancer Institute, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or CXCR inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“The overexpression of CXCR4 in multiple cancer types and its pivotal role in tumour progression via the CXCR4/CXC12 axis makes this chemokine receptor an attractive target for cancer diagnosis, response assessment, and patient profiling. Molecular radioimaging offers a non-invasive approach where a targeted radiolabelled tracer is tracked by Positron Emission Tomography (PET) or Single-proton Emission Computed Tomography (SPECT).” -Researcher, Institut de Recerca Sant Pau Barcelona, Spain |

CXCR Inhibitors Qualitative Analysis Report

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated, wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

CXCR Inhibitors Market Access and Reimbursement

|

Region/Country |

Key 2025 Developments |

|

United States |

· Ongoing tariff threats and delays · Most-Favored-Nation drug pricing policy seen as a major concern · Proposal: Nations to spend a set GDP % on innovative medicines (NATO-style commitment) |

|

Europe (EU-wide) |

· Joint Clinical Assessment launched (6 drugs under review) · EU pharma law revision in trilogue; hard to reach consensus · EU Life Sciences Strategy supports innovation but faces uncertain implementation |

|

Germany |

· AMNOG reform: focus on rebates & personalized medicine · Ongoing disputes between parliament and insurers over HTA/pricing |

|

France |

· Expanding use of health economic evaluations and value metrics · Aligning drug pricing with geopolitical factors |

|

Italy |

· AIFA revised innovation criteria · Innovative Medicines Fund updated |

|

Spain |

· Ongoing gradual reform of the HTA and pricing system · More legislative updates expected |

|

United Kingdom |

· VPAG renegotiation delayed; sector plan postponed · NHS 10-Year Plan: major changes for the pharma sector |

|

China |

· Lower market access barriers, fair competition promoted · The hybrid reimbursement model supports high-priced drugs · Promotes global pharma growth |

|

Japan |

· Structural pharmaceutical reform and focus on drug discovery · An HTA review may broaden economic evaluation |

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates CXCR Inhibitor

- As per X4 Pharmaceuticals’ Q1 2025 financial results (May 2025), the 4WARD Phase III trial of XOLREMDI in chronic neutropenia is ongoing, with full enrollment expected by 3Q or 4Q 2025 and top-line data anticipated in 2H 2026.

- In January 2025, X4 Pharmaceuticals announced that the EMA validated its MAA for XOLREMDI for WHIM syndrome, with CHMP review underway and a decision expected in the first half of 2026.

CXCR Inhibitor Market Report Insights

- CXCR Inhibitor Targeted Patient Pool

- CXCR Inhibitor Competitive Landscape

- CXCR Inhibitor Pipeline Analysis

- CXCR Inhibitor Market Size and Trends

- Reimbursement Scenario

- Existing and Future Market Opportunity

CXCR Inhibitor Market Report Key Strengths

- 10-Year CXCR Inhibitors Market Forecast

- The 7MM Coverage

- Key Cross Competition

- CXCR Inhibitors Drugs Uptake

- Key CXCR Inhibitors Market Forecast Assumptions

- Physicians' Perspective on Drug Performance and Prescribing Feasibility

CXCR Inhibitor Market Report Assessment

- Current CXCR Inhibitors Treatment Practices

- CXCR Inhibitors Unmet Needs

- Safety and Efficacy Head-to-Head Comparison

- CXCR Inhibitors Pipeline Product Profiles

- CXCR Inhibitors Drugs Market Attractiveness

- Cost Analogues and Pricing Trends

- Anticipated Launch Years

- CXCR Inhibitors Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the CXCR Inhibitors Market Report

- What was the CXCR inhibitor Market Size, the market size by therapies, CXCR Inhibitors Drugs Market Share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- What is the most lucrative CXCR inhibitor Market?

- Which drug type segment accounts for the maximum CXCR inhibitor’s sales?

- What are the pricing variations among different geographies?

- What are the risks, burdens, and unmet needs of treatment with a CXCR inhibitor? What will be the growth opportunities across the 7MM for the patient population of the CXCR inhibitor?

- What are the key factors hampering the growth of the CXCR inhibitor market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for the CXCR inhibitor?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to Buy the CXCR Inhibitors Market Report

- The CXCR Inhibitors Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing dynamics driving the CXCR inhibitor Drugs Market.

- Understand the existing CXCR Inhibitors Market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the CXCR Inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing CXCR Inhibitors Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles

-inhibitors-pipeline.png&w=256&q=75)