EGFR Market Forecast

- The EGFR inhibitors market is expected to grow significantly due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of EGFR inhibitors, and the increasing number of EGFR inhibitors that are being approved by the FDA.

- The use of EGFR-TK inhibitory action revolutionizes cancer treatment in Epidermal Growth Factor Receptor Inhibitor Market. Some of these include targeted therapies called EGFR tyrosine kinase inhibitors (TKIs), including TARCEVA (erlotinib), IRESSA (gefitinib), GILOTRIF (afatinib), TAGRISSO (osimertinib), and RYBREVANT (amivantamab).

- Two classes of anti-EGFR drugs are currently on the market. One of these is small-molecule tyrosine kinase inhibitors (TKIs) and another is monoclonal antibodies against the extracellular domain that can block the dimerization of the receptor.

- Despite its aggressive nature, EGFR-mutated lung cancer is generally treatable, especially with the emergence of new treatment options over recent years.

- The mechanism of resistance to third-generation EGFR-TKIs is very complex, is impacted by EGFR mutations, and differs among patients and tumor sites.

- The only approved EGFR inhibitors drugs for EGFR exon 20 insertion NSCLC are RYBREVANT and EXKIVITY. However, EXKIVITY was voluntarily withdrawn by Takeda in October 2023 after it failed to meet the primary endpoint.

- RYBREVANT, the first bispecific antibody approved for NSCLC, generated USD 40 million in the US in 2023.

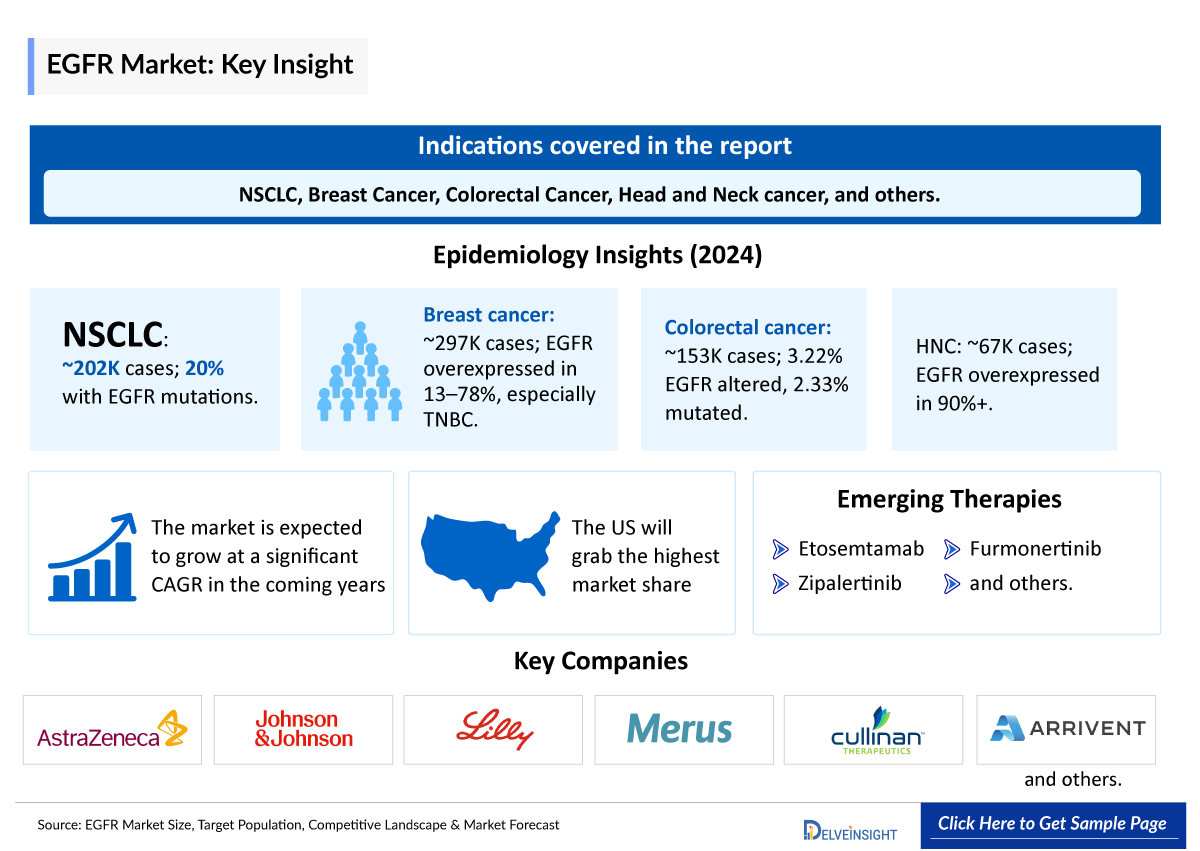

- In May 2024, Merus announced that the US FDA granted Breakthrough Therapy Designation (BTD) for petosemtamab for the treatment of patients with recurrent or metastatic HNSCC whose disease has progressed following treatment with platinum-based chemotherapy and an anti-programmed cell death receptor-1 (PD-1) or anti-programmed death ligand 1 (PD-L1) antibody.

- In February 2024, the US FDA approved the combination of TAGRISSO plus chemotherapy for the treatment of EGFR-mutated non-small cell lung cancer.

- The pipeline for EGFR-targeting inhibitors is strong, with Merus (Petosemtamab), Cullinan Oncology/Taiho Pharma (Zipalertinib), Arrivent Biopharma (Furmonertinib), Blueprint Medicines (BLU-945), and others developing selective EGFR inhibitors that could greatly enhance the EGFRi market.

Uncover the opportunities and challenges in your industry with a free sample page from our detailed report @ EGFR inhibitor market

DelveInsight’s “Epidermal Growth Factor Receptor Inhibitor Market, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the EGFR inhibitor, historical and Competitive Landscape as well as the EGFR inhibitor market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The EGFR inhibitor market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM EGFR inhibitor market size from 2020 to 2034. The EGFR inhibitors market report also covers current EGFR inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the EGFR inhibitors market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

EGFR inhibitors Epidemiology |

Segmented by:

|

|

EGFR inhibitors Companies |

|

|

EGFR inhibitors Therapies |

|

|

EGFR inhibitors Market |

Segmented by:

|

|

Analysis |

|

EGFR Inhibitors Market: Understanding

EGFR Inhibitors Overview

EGFR inhibitors are a class of targeted drugs used to treat various common malignancies, including breast cancer, colon cancer, lung cancer, and pancreatic cancer, non-small cell lung cancer (NSCLC), and head and neck cancer. These inhibitors target four related receptors: EGFR (HER1/ErbB1), ErbB2 (HER2/neu), ErbB3 (HER3), and ErbB4 (HER4), which share similar structural features. EGFR plays a pivotal role in cell signaling pathways that regulate cell proliferation, apoptosis, angiogenesis, and metastasis. When mutations cause EGFR to become overactive, it leads to uncontrolled cell growth, a characteristic of cancer. By blocking this receptor, EGFR inhibitors disrupt these signaling pathways, thereby inhibiting cancer progression. This precise approach, a hallmark of precision medicine, often results in fewer side effects than traditional chemotherapy, as it specifically targets cancer cells while sparing healthy ones. Through personalized medicine, EGFR inhibitors are leading to more effective and tailored cancer treatments.

EGFR-targeted cancer treatments include TKIs like erlotinib and osimertinib, which block intracellular kinase activity, and monoclonal antibodies like cetuximab, which inhibit extracellular ligand binding. These therapies improve patient outcomes but can cause side effects and resistance. Ongoing research focuses on developing next-generation inhibitors and combination therapies. FDA-approved EGFR inhibitors for NSCLC include afatinib, dacomitinib, erlotinib, gefitinib, and osimertinib, while lapatinib and neratinib target HER2-positive breast cancer.

Further details related to country-based variations are provided in the report...

EGFR Inhibitors Epidemiology

The EGFR inhibitor epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Target pool (Incident Cases by Indication, Eligible and Treatable Cases by Indication) in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

|

S.No. |

Indications |

Estimated Incident Cases in 2023 in the US |

Expression |

| 1 |

~202,000 |

20% of patients are affected with EGFR mutation in NSCLC | |

| 2 |

~297,000 |

EGFR overexpressed in breast cancer, especially in TNBC, with a frequency ranging from 13% to 78%, depending on the primary antibodies used | |

| 3 |

~153,000 |

EGFR is altered in 3.22% of colorectal carcinoma patients with EGFR Mutation present in 2.33% of all colorectal carcinoma patients | |

| 4 |

~66,920 |

EGFR is overexpressed in over 90% of head and neck tumors. |

Recent Developments in EGFR inhibitor Clinical Trials

- On September 18, 2024, Glycomine, Inc. announced that the FDA granted Fast Track designation for GLM101, a mannose-1-phosphate replacement therapy for treating patients with phosphomannomutase 2-congenital disorder of glycosylation (PMM2-CDG).

EGFR Inhibitors Drug Chapters

The drug chapter segment of the EGFR inhibitor market reports encloses a detailed analysis of EGFR inhibitor marketed drugs and late-stage (Phase III and Phase I/II) pipeline drugs. It also helps understand the EGFR inhibitor's clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

EGFR inhibitor Marketed Drugs

ERBITUX (cetuximab): Eli Lilly

ERBITUX (cetuximab), is a recombinant chimeric monoclonal antibody that binds and inhibits human epidermal growth factor receptor (EGFR, HER1, c-ErbB-1) on normal and tumor cells. ERBITUX is an approved treatment for people with certain advanced colorectal and head and neck cancers.

TAGRISSO (osimertinib): AstraZeneca

TAGRISSO (osimertinib) is a prescription medicine used to treat adults with NSCLC that has certain abnormal EGFR genes to help prevent the lung cancer from coming back after the tumor has been removed by surgery, or as a first treatment when the lung cancer has spread to other parts of the body (metastatic), or when the lung cancer has spread to other parts of the body and the patient have had previous treatment with an EGFR tyrosine kinase inhibitor (TKI) medicine that did not work or is no longer working. In June 2024, TAGRISSO granted priority review in the US for patients with unrespectable, Stage III EGFR-mutated lung cancer.

|

Product |

Company |

Initial approval |

|

ERBITUX |

Eli Lilly |

In February 2004, approved in colorectal cancer as a single agent for the treatment of EGFR-expressing metastatic CRC after failure of both irinotecan- and oxaliplatin-based regimens. |

|

GILOTRIF |

Boehringer Ingelheim |

In July 2013, the FDA approved GILOTRIF for Late Stage Non-Small Cell Lung Cancer |

|

TAGRISSO |

AstraZeneca |

In February 2016, the EC granted conditional marketing authorization for TAGRISSO for the treatment of adult patients with locally advanced or metastatic EGFR T790M mutation-positive NSCLC |

|

NERLYNX |

Puma Biotechnology |

In July 2017, NERLYNX was approved for the extended adjuvant treatment of adult patients with early-stage HER2- overexpressed/amplified breast cancer to follow adjuvant trastuzumab-based therapy |

Note: Detailed current therapies assessment will be provided in the full report of EGFR inhibitor..

Transform your strategy with insights from our latest research. Access a free sample page to get started @ EGFR Market Size

Emerging EGFR inhibitor Drugs

Petosemtamab (MCLA-158): Merus

Petosemtamab is a bispecific biclonics low-fucose human full-length IgG1 antibody targeting the EGFR and the leucine-rich repeat-containing G-protein-coupled receptor 5 (LGR5). Petosemtamab is being developed for the potential treatment of HNSCC. The Phase I/II clinical trial of petosemtamab is ongoing in the dose expansion phase of the open-label, multicenter trial. Enrollment of patients with HNSCC continues, evaluating petosemtamab monotherapy in previously treated HNSCC, as well as petosemtamab in combination with KEYTRUDA (pembrolizumab) in untreated HNSCC.

According to the company presentation, a clinical update on HNSCC for 2L+ is planned for the second half of 2024, with a Phase III 1L combination trial starting by year-end, and a 2L CRC trial also planned to begin in 2024.

Zipalertinib: Cullinan Oncology/Taiho Pharma

Zipalertinib (CLN-081/TAS6417) is a novel, orally bioavailable, irreversible EGFR inhibitor that, based on preclinical models, selectively and potently targets cells expressing EGFRex20ins mutations while relatively sparing cells expressing wild-type EGFR in order to avoid the toxicities associated with inhibition of wild-type EGFR. The pivotal Phase IIb study for second-line and beyond treatment of NSCLC with exon 20 insertion mutations was fully enrolled by 2024. Simultaneously, enrollment is actively underway for the Phase III study targeting frontline treatment for NSCLC with exon 20 insertion mutations.

Note: Detailed emerging therapies assessment will be provided in the final report...

|

List of Emerging Drugs | ||||

|

Drug Name |

Company |

Condition |

Phase |

NCT Number |

|

Furmonertinib |

Arrivent Biopharma |

Patients With Locally Advanced or Metastatic Non-Small Cell Lung Cancer (NSCLC) With Epidermal Growth Factor Receptor (EGFR) Exon 20 Insertion Mutations |

III |

NCT05607550 (FURVENT) |

|

Zipalertinib |

Cullinan Oncology/Taiho Pharma |

Advanced or Metastatic NSCLS With Exon 20 Insertion Mutation |

III |

NCT05973773 (REZILIENT3) |

|

Petosemtamab |

Merus |

Patients With Advanced Solid Tumors including metastatic CRC and Head and neck squamous cell carcinoma |

I/II |

NCT03526835 |

|

BLU-945 |

Blueprint Medicines |

EGFR Mutant Non-Small Cell Lung Cancer |

I/II |

NCT04862780 |

Note: The emerging drug list is indicative, the full list will be given in the final report...

EGFR Inhibitors Market Outlook

The EGFR inhibitors market is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cancer, the growing awareness of EGFR inhibitors, and the increasing number of EGFR inhibitors that are being approved by the FDA.

There are multiple approved approaches in the frontline, as well as in previously treated patients, and some new emerging therapies. In the frontline setting, FDA-approved regimens include first-generation EGFR inhibitors, which are really TARCEVA (erlotinib) and IRESSA (gefitinib) and are effective. Also, second-generation agents, GILOTRIF (afatinib) and VIZIMPRO (dacomitinib), are approved. The most commonly used agent is single-agent TAGRISSO (osimertinib).

- First-Generation EGFR-TKIs: In 2003 and 2004, the US FDA approved quinazoline-based derivatives such as IRESSA and TARCEVA from the first-generation EGFR-TKIs for the treatment of NSCLC patients. IRESSA is a TKI that is used to treat individuals with metastatic NSCLC and was authorized on 13 July 2015, for metastatic EGFR mutation-positive NSCLC.

- Second-Generation EGFR-TKIs: EGFR TKIs of the second generation, including GILOTRIF, VIZIMPRO, NERLYNX, and XALKORI were developed to treat T790M mutations. NERLYNX is an irreversible EGFR, HER2/4 receptor tyrosine kinase inhibitor that was approved for use in the treatment of HER2-positive breast cancer on 17 July 2017.

- Third-Generation EGFR-TKIs: The T790M mutation-mediated resistance to first- and second-generation EGFR-TKIs in NSCLC has been overcome by third-generation EGFR-TKIs, which have been developed and produced. TAGRISSO is a third-generation EGFR inhibitor.

- Fourth-Generation EGFR-TKIs: Recently, several fourth-generation allosteric EGFR inhibitors that bind to a site in the EGFR other than the PTK (protein tyrosine kinase) domain were reported. These inhibitors are ineffective against NSCLC with a mutant EGFR; when paired with an EGFR inhibitor such as TAGRISSO or the monoclonal antibody ERBITUX, they have synergistic anticancer benefits.

- Some of the drugs in the pipeline include Petosemtamab, Zipalertinib, Furmonertinib, and others.

- In March 2024, RYBREVANT was approved as 1L in combination with carboplatin and pemetrexed for exon 20 insertion mutations.

- As far as EGFR-positive NSCLC market size is concerned, third-generation EGFRs such as AstraZeneca’s TAGRISSO are expected to dominate.TAGRISSO secured the EGFR NSCLC market with USD 1,900 million in 2023.

- Among the 7MM, the US accounted for the highest colorectal cancer market size in 2023.

|

Classification Based on the Target Kinases | ||

|

Drug Name |

Targets |

Indications |

|

GILOTRIF (afatinib) |

ErbB1/2/4 |

NSCLC |

|

TAGRISSO (osimertinib) |

EGFR |

NSCLC |

|

NERLYNX (neratinib) |

ErbB2/HER2 |

Breast cancer |

|

TYKERB (lapatinib) |

EGFR/ErbB2 |

Advanced or metastatic breast cancer |

EGFR inhibitors Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging EGFR inhibitors expected to be launched in the EGFR inhibitors market during 2024–2034.

EGFR Inhibitors Pipeline Development Activities

The EGFR inhibitors market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics. The presence of numerous drugs under different stages is expected to generate immense opportunity for EGFR inhibitors market growth over the forecasted period.

EGFR inhibitors Clinical Trial activities

The EGFR inhibitors drugs market report covers information on designation, collaborations, acquisitions and mergers, licensing, and patent details for EGFR inhibitor emerging therapies. The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example, in May 2024, Petosemtamab granted BTD for the treatment of previously treated HNSCC.

KOL Views on EGFR inhibitors

To keep up with current and future EGFR inhibitors market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on the EGFR inhibitor evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as MD Anderson Cancer Center, Texas from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or EGFR inhibitor market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the EGFR inhibitors market and the unmet needs.

|

KOL Views |

|

“The development of clinically deployable allosteric EGFR inhibitors is still needed. Allosteric EGFR inhibitors may also be therapeutically valuable in EGFR TKI naïve EGFR L858R mutant cancers, given their inferior PFS and OS outcomes following osimertinib treatment relative to EGFR exon 19 deletion cancers." |

|

“STX-241 is designed to be a highly selective, CNS-penetrant, fourth-generation EGFR inhibitor with a potential best-in-class profile that addresses resistance to third-generation EGFR inhibitors.” |

EGFR Market Size Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis, and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Experience the unique insights and analysis that distinguish our report. Request a free sample page today @ EGFR Market Size

EGFR Inhibitor Market Access and Reimbursement

- TAGRISSO Patient Savings Program – for Eligible, Commercially Insured Patients

- The TAGRISSO Patient Savings Program aims to assist eligible, commercially insured patients with their out-of-pocket costs for TAGRISSO

- Most eligible patients will pay USD 0 per month and may have access to up to USD 26,000 per year to assist with TAGRISSO out-of-pocket costs. There are no income requirements to participate in the program.

The EGFR Inhibitor Market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

2024 ASCO Updates on EGFR Inhibitors

|

List of Abstracts | ||||

|

Drug Name |

Company |

Abstract No. |

Phase/ NCT Number |

Result |

|

Petosemtamab + pembrolizumab |

Merus |

6014 |

I/II NCT03526835 |

· 67% response rate overall (13/24 confirmed and 3/24 unconfirmed responses) · Responses observed across HPV-related and -unrelated cancer; and across PD-L1 CPS subgroups · Favorable safety profile including manageable IRRS (38% all Grades, 7% Grade 3; no Grade 4 or 5) |

|

Osimertinib |

AstraZeneca |

LBA4 |

III NCT03521154 |

· Median PFS was 39.1 months · Interim OS data showed a positive trend in favor of osimertinib, despite a high proportion of patient’s crossing over to osimertinib in the placebo arm (81%) · Safety profile of osimertinib post-chemoradiotherapy was as expected and manageable |

|

Panitumumab |

AMGEN |

3535 |

ACTRN 12618000233224 |

· 6-month PFS was 63% in arm A and 82% in arm B. · Median OS was 21 months in arm A and 28 months in arm B. · ORR was 47% and 65% in arms A and B respectively. |

Abstract list is not exhaustive, will be provided in the final report...

Scope of the EGFR inhibitor Market Report

- The EGFR inhibitors market report covers a segment of key events, an executive summary, and a descriptive overview of EGFR inhibitors, explaining their causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the EGFR inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The EGFR inhibitors market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM EGFR inhibitor market.

EGFR inhibitors Market report insights

- EGFR Targeted Patient Pool

- EGFR Inhibitors EGFR inhibitors Pipeline Analysis

- EGFR Inhibitor EGFR inhibitors Market Size

- EGFR inhibitors Market Trends

- Existing and future EGFR inhibitors Market Opportunity

EGFR inhibitors Market report key strengths

- Eleven years Forecast

- The 7MM Coverage

- Key Cross Competition

- EGFR inhibitors Drugs Uptake

- Key EGFR inhibitors Market Forecast Assumptions

EGFR inhibitors Market Report Assessment

- Current EGFR inhibitors Treatment Practices

- EGFR inhibitors Unmet Needs

- EGFR inhibitors Pipeline Product Profiles

- EGFR inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

- EGFR inhibitors Market Drivers

- EGFR inhibitors Market Barriers

Key Questions EGFR inhibitors Market Report

- What was the EGFR inhibitors market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- Which EGFR inhibitors is going to be the largest contributor in 2034?

- Which is the most lucrative market for EGFR inhibitors?

- Which indication accounts for maximum EGFR inhibitor sales?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for EGFR inhibitor evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to EGFR inhibitor?

- What are the key factors hampering the growth of the EGFR inhibitor market?

- What are the recent novel therapies, targets, and technologies developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for EGFR inhibitor?

- What is the cost burden of approved EGFR inhibitors therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved EGFR inhibitors therapies?

Reasons to buy EGFR inhibitors Market Report

- The EGFR inhibitors market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the EGFR inhibitor market.

- Understand the existing EGFR inhibitors market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming EGFR inhibitors companies in the EGFR inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise potential current and emerging EGFR inhibitors therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet need of the existing EGFR inhibitors market so that the upcoming EGFR inhibitors companies can strengthen their development and launch strategy.

Click here to view the latest blogs:

- Potential of EGFR Inhibitors: A Promising Avenue in Cancer Treatment

- FDA Approves RINVOQ for Crohn's Disease; FDA Approves Krystal Biotech’s Gene Therapy Vyjuvek; FDA Approves EPKINLY to Treat R/R DLBCL; FDA Orphan Drug Designation to Mitazalimab; Phase 3 Trial Result of OCS-01 Eye Drops; TAGRISSO® + Chemotherapy for the EGFR-mutated Advanced Lung Cancer

- Nkarta’s Anti-CD19 Allogeneic CAR-NK Cell Therapy, NKX019; Eisai Presents Results of lecanemab for Alzheimer’s Disease; EQRx’s Aumolertinib for EGFR-Mutated NSCLC; FDA Approves Olutasidenib for IDH1-Mutated R/R AML; FDA Orphan Drug Designation to AUM302 for Neuroblastoma; X4 Pharma Announces Results for WHIM Syndrome Drug

- Evaluating Key Advancements and Emerging Therapies in EGFR-Non Small Cell Lung Cancer Treatment Market

- ESMO Asia 2022: Role of EGFR and ALK mutations in the East Asian Lung Cancer Market

Visit out latest infographs:

Visit delveinsight latest blogs @ Latest Delveinsight Blogs