Interleukin Inhibitors Market Summary

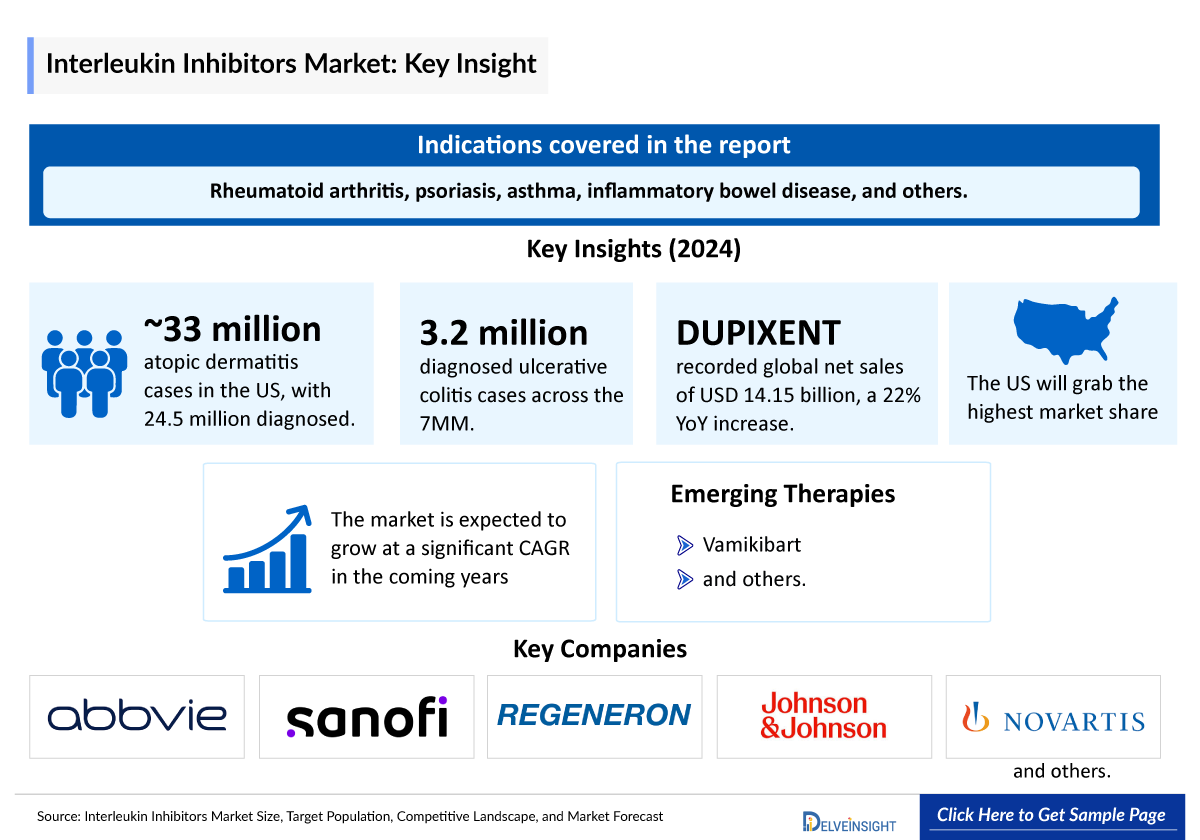

- The Interleukin Inhibitor market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

Interleukin Inhibitor Market and Epidemiology Analysis

- Interleukins (ILs) are a major class of cytokines— signaling proteins—first identified as leukocyte-derived but now known to be secreted by many cell types. They modulate immune responses, including activation, proliferation, differentiation, migration, adhesion, and both pro-/anti-inflammatory actions, via autocrine, paracrine, and endocrine receptor pathways, thus orchestrating immunity and inflammation

- Interleukin inhibitors are targeted therapies that block specific interleukins involved in immune and inflammatory responses. They play a crucial role in managing conditions like rheumatoid arthritis, psoriasis, asthma, inflammatory bowel disease, and others. With expanding indications and strong clinical outcomes, these biologics show significant potential in transforming chronic disease treatment.

- DUPIXENT (dupilumab) is a leading interleukin inhibitor developed by Regeneron, targeting the IL-4 receptor alpha to modulate type 2 inflammation across a range of chronic allergic and inflammatory diseases, including asthma, atopic dermatitis, and eosinophilic disorders.

- In 2024, DUPIXENT achieved global net sales of USD 14.15 billion, marking a 22% year-over-year increase, reflecting strong demand across multiple indications. The US accounted for USD 10.4 billion of total revenue, representing approximately 73.5% of global sales, underscoring its dominant presence in the domestic market.

- Recently, in June 2025, DUPIXENT got US FDA approval as the only targeted medicine to treat bullous pemphigoid patients. Further, in April 2025, it also got approval as the first new targeted therapy in over a decade for Chronic Spontaneous Urticaria (CSU).

- SKYRIZI (risankizumab-rzaa), AbbVie's IL-23 inhibitor for chronic inflammatory diseases, achieved USD 11.7 billion in global net revenues, with the US contributing USD 10.1 billion, about 86% of total sales. As a key product in AbbVie's immunology portfolio, SKYRIZI continues to see strong market uptake across multiple approved indications.

- In June 2024, the US FDA approved SKYRIZI for the treatment of ulcerative colitis, expanding its label and strengthening its position in the market.

- Several therapies are currently being evaluated in Interleukin inhibitors clinical trials. One of these assets in the late stage is Roche’s Vamikibart, which is in Phase III trials for Uveitic Macular Edema (UME) and in Phase II trials for Diabetic Macular Edema (DME) and is anticipated to receive approval during the forecast period.

- In May 2025, Regeneron and Sanofi announced that the Phase III AERIFY-1 trial evaluating itepekimab in adults with inadequately controlled COPD met its primary endpoint, showing a 27% reduction in moderate or severe exacerbations at week 52 in former smokers. However, the AERIFY-2 trial did not meet the same endpoint, despite early signs of benefit.

- Novo Nordisk, Affibody Medical, Regeneron Pharmaceuticals, and several other companies are currently engaged in the development and production of Interleukin inhibitor, which has the potential to significantly impact and enhance the Interleukin Inhibitors market.

- In June 2024, the US FDA approved SKYRIZI (risankizumab-rzaa) for the treatment of ulcerative colitis, expanding its label and strengthening its position in the market.

- In May 2025, Ascletis Pharma announced that the US FDA cleared its IND application for ASC50, enabling a Phase I trial in mild-to-moderate plaque psoriasis. ASC50 is an in-house developed oral small-molecule inhibitor targeting interleukin-17 (IL-17), a well-validated target in autoimmune and inflammatory diseases such as psoriasis.

- In April 2025, it was designated as an orphan drug by the EMA for the treatment of non-infectious uveitis, highlighting its potential in addressing a significant unmet medical need.

- In March 2025, Johnson & Johnson announced that the US FDA approved TREMFYA (guselkumab) for the treatment of adults with moderately to severely active Crohn’s disease. TREMFYA is now the first and only IL-23 inhibitor to offer both subcutaneous (SC) and intravenous (IV) induction options for this chronic gastrointestinal condition.

- In September 2024, Eli Lilly and Company's US FDA approved EBGLYSS (lebrikizumab-lbkz), a targeted IL-13 inhibitor, for the treatment of moderate-to-severe atopic dermatitis in adults and adolescents aged 12 and older weighing at least 88 pounds (40 kg), whose condition remains inadequately controlled with topical prescription therapies.

DelveInsight’s “ Interleukin Inhibitors Market Size Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the Interleukin Inhibitors, historical and Competitive Landscape as well as the Interleukin Inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Interleukin Inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted Interleukin Inhibitors market size from 2020 to 2034 across 7MM. The report also covers current Interleukin inhibitors treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Interleukin Inhibitors Patient Pool |

Segmented by:

|

|

Key Interleukin Inhibitors Companies |

|

|

Interleukin Inhibitors Key Therapies |

|

|

Interleukin Inhibitors Market |

Segmented by:

|

|

Interleukin Inhibitors Market Analysis |

|

Interleukin Inhibitors Understanding and Treatment Algorithm

Interleukin Inhibitors Overview

Interleukin inhibitors are targeted therapies designed to block specific interleukins—cytokines that play crucial roles in immune signaling and inflammation. Different inhibitors focus on various interleukins such as IL-1, IL-6, IL-12/23, IL-17, and IL-23, each implicated in distinct immune-mediated diseases. For instance, IL-6 inhibitors are used in rheumatoid arthritis, while IL-17 and IL-23 inhibitors are effective in treating psoriasis and psoriatic arthritis. These therapies, often monoclonal antibodies or receptor antagonists, offer precise modulation of immune responses, improving disease control with fewer side effects compared to broad immunosuppressants.

Widely adopted across multiple indications, including psoriasis, inflammatory bowel disease, asthma, and autoimmune disorders, interleukin inhibitors have become key tools in modern immunotherapy. Their use as first- or second-line treatments has expanded with growing clinical evidence and regulatory approvals. However, availability and access still vary based on region, healthcare systems, and insurance. Ongoing research continues to develop novel inhibitors targeting additional interleukins, further broadening therapeutic options and advancing personalized treatment strategies.

Further details related to country-based variations are provided in the report

Interleukin inhibitor Treatment

The treatment landscape for interleukin inhibitors has evolved rapidly, revolutionizing care for many chronic inflammatory and autoimmune diseases. Leading brands like SKYRIZI have achieved blockbuster status, generating global revenues exceeding USD 11.7 billion, with the majority coming from the US market. This strong commercial performance highlights the high demand for targeted therapies in conditions such as psoriasis, psoriatic arthritis, and inflammatory bowel diseases, where traditional treatments often fall short.

Several interleukin inhibitors are widely prescribed across different indications. COSENTYX and TALTZ, both IL-17 inhibitors, are key therapies for psoriasis and psoriatic arthritis, while ACTEMRA and SYLVANT serve as important IL-6 blockers for rheumatoid arthritis and related diseases. Additionally, anakinra and ILARIS (canakinumab), targeting IL-1 pathways, are utilized in various autoinflammatory conditions. The availability of these diverse brands enables clinicians to tailor treatments based on disease characteristics and patient needs, improving outcomes and quality of life.

The interleukin inhibitors pipeline continues to expand with promising candidates progressing through clinical trials. New agents like Itepekimab (targeting IL-33) are being evaluated for diseases beyond autoimmune disorders, such as COPD. This broadening of indications demonstrates the evolving role of interleukin inhibitors in personalized medicine, where treatments are increasingly designed to target specific immune pathways.

Despite the growing portfolio of interleukin inhibitors, access remains uneven globally due to differences in healthcare infrastructure and reimbursement. However, ongoing approvals and increasing awareness of these therapies’ benefits are improving availability worldwide. The interleukin inhibitor market is set for continued growth, driven by expanding indications, innovation, and strong clinical demand.

Further details related to country-based variations are provided in the report

Interleukin Inhibitors Patient Pool

The Interleukin Inhibitors epidemiology chapter in the report provides historical as well as forecasted patient pool segmented as total cases in selected indications for Interleukin Inhibitors, total eligible patient pool in selected indications for Interleukin Inhibitors, and total treated cases in selected indications for Interleukin Inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight, in 2024, the total number of Atopic dermatitis prevalent cases in the United States was approximately 33 million. Among this, the total number of diagnosed prevalent cases of atopic dermatitis in the US was approximately 24.5 million.

- As per our analysis, in 2024, there were approximately 3.2 million diagnosed ulcerative colitis prevalent cases across the 7MM, driven by improved disease recognition, enhanced diagnostic capabilities, and a growing patient population in key regions.

Further details related to country-based variations are provided in the report

Interleukin Inhibitors Drug Chapters

The drug chapter segment of the Interleukin Inhibitors reports encloses a detailed analysis of Interleukin Inhibitor marketed drugs and late-stage (Phase III and Phase II) Interleukin Inhibitor pipeline drugs. It also helps understand the Interleukin Inhibitors' clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, the latest news and press releases.

Interleukin Inhibitors Marketed Drugs

DUPIXENT (dupilumab): Regeneron

DUPIXENT (dupilumab), developed by Regeneron and Sanofi, is a monoclonal antibody that targets the IL-4 and IL-13 signaling pathways, key drivers of type 2 inflammation. It is approved for multiple chronic inflammatory conditions, including atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), and eosinophilic esophagitis. DUPIXENT offers a targeted, steroid-sparing treatment option for patients with moderate to severe disease and has helped redefine the standard of care across several immune-mediated indications.

It first got the US FDA approval in March 2017 for the treatment of Eczema while it got approval for several other indications. Its latest approvals were related to the Chronic Spontaneous Urticaria (CSU), and Bullous Pemphigoid (BP).

SKYRIZI (risankizumab-rzaa): AbbVie

SKYRIZI (risankizumab‑rzaa), developed by AbbVie, is a humanized monoclonal antibody that selectively targets the p19 subunit of interleukin‑23, a key driver of inflammation. SKYRIZI provides patients with a targeted, biologic option that reduces disease activity and promotes remission. Delivered via infrequent subcutaneous injections after initial dosing, it offers a convenient and effective immunomodulatory therapy.

It first received US FDA approval in April 2019, for the management of moderate to severe plaque psoriasis. After that, it received approval for the management of active psoriatic arthritis and moderately to severely active Crohn's disease in Adults in 2022. In June 2024, it also got approval for the ulcerative colitis management.

|

Product |

Company |

Indication |

|

DUPIXENT (dupilumab) |

Regeneron |

|

|

SKYRIZI (risankizumab-rzaa) |

AbbVie |

Indicated for the treatment of:

|

Note: Detailed current therapies assessment will be provided in the full report of Interleukin Inhibitors

Interleukin Inhibitors Emerging Drugs

Vamikibart: Roche

Vamikibart (RG6179) is an investigational monoclonal antibody developed by Roche that targets interleukin-6 (IL-6), a key cytokine involved in inflammatory pathways. By potently binding to IL-6, vamikibart aims to reduce inflammation and vascular permeability, offering potential therapeutic benefit in retinal diseases. It is currently in uveitic macular edema Phase III trials and diabetic macular edema Phase II trials. If successful, vamikibart could provide a novel treatment option for patients with vision-threatening retinal conditions.

In April 2025, it was designated as an orphan medicine by the EMA for the non-infectious uveitis treatment, highlighting its potential in addressing a significant unmet medical need.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | ||||

|

Vamikibart |

Roche |

UME |

III |

NCT05642325 |

|

DME |

II |

NCT05151731 NCT05151744 | ||

Note: The emerging drug list is indicative; the full list will be given in the final report.

Interleukin Inhibitors Market Outlook

The Interleukin inhibitors market is experiencing substantial growth, fueled by increasing prevalence of autoimmune and inflammatory diseases, rising awareness, and the availability of multiple approved and investigational candidates. These biologics have become integral to the treatment of conditions such as psoriasis, rheumatoid arthritis, asthma, Crohn’s disease, and ulcerative colitis. The success of market leaders like SKYRIZI, DUPIXENT, COSENTYX, and TALTZ, etc. has validated interleukin inhibition as a highly effective therapeutic approach, driving both commercial interest and continued R&D investment.

Interleukin Inhibitor market expansion is supported by a growing number of indications, improved access to biologics, and favorable regulatory dynamics across major regions. Developers are actively targeting additional inflammatory pathways such as IL-6, IL-33, and IL-36, with agents advancing through late-stage trials in dermatology, gastroenterology, and respiratory medicine. Emerging markets are also showing stronger uptake, driven by expanding healthcare infrastructure and biosimilar entry, which could further boost affordability and adoption globally.

Interleukin inhibitors demand is projected to rise significantly in the coming years. With priority review designations, supportive reimbursement frameworks, and strong clinical outcomes across multiple indications, the market is well-positioned for sustained long-term growth. As novel agents enter the pipeline and existing therapies broaden their labels, interleukin inhibitors are expected to play an even larger role in the shift toward personalized, immune-targeted treatment strategies across a wide range of chronic conditions.

With a growing number of Interleukin Inhibitors clinical trials, expanding indications, and continued pharma investment, the Interleukin inhibitor landscape is positioned for accelerated expansion. As current studies mature, they will further define the scope of Interleukin inhibitors in immune-mediated diseases, solidifying their role as a transformative class of therapeutics.

Interleukin Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging Interleukin Inhibitors expected to be launched in the market during 2020–2034.

Interleukin Inhibitors Pipeline Development Activities

The report provides insights into different Interleukin Inhibitors therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Interleukin Inhibitors companies involved in developing targeted therapeutics.

The presence of numerous Interleukin Inhibitors drugs at different stages is expected to generate immense opportunities for Interleukin Inhibitors market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Interleukin Inhibitors emerging therapies.

Major Interleukin Inhibitors companies are increasingly pursuing strategic agreements to advance pipeline development and fuel market growth. In April 2021, C4X Discovery signed an exclusive global licensing deal with Sanofi for its oral pre-clinical IL-17A inhibitor program. The agreement includes a EUR 7 million upfront payment and up to EUR 407 million in potential milestones, along with single-digit royalties.

Latest KOL Views on Interleukin Inhibitor

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on Interleukin Inhibitors' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Dana-Farber Cancer Institute, M.D. Anderson Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or Interleukin inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“TREMFYA is the first and only IL-23 inhibitor that offers a fully subcutaneous treatment option for moderately to severely active Crohn’s disease. With the approval of TREMFYA, it is now possible to achieve meaningful improvements in clinical and endoscopic outcomes with the flexibility of self-administration from the start” |

|

“People living with bullous pemphigoid often suffer from persistent, severe itching and painful blisters that compromise skin integrity and quality of life. Treatment options have historically been limited, particularly for the elderly population most affected, and existing therapies frequently carry significant side effect burdens. The approval of DUPIXENT represents a much-needed advancement, offering a new, targeted approach for managing this challenging condition. This milestone marks important progress in addressing an area of high unmet clinical need.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Interleukin Inhibitors Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and a payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

In the US, the DUPIXENT MyWay program offers commercial insurance patients up to USD 13,000/year in copay support—potentially reducing out-of-pocket costs to USD 0 per fill—while also providing a Quick Start option during coverage delays. The program includes benefits investigation, prior authorization and appeals support, nursing and injection assistance, and a Patient Assistance Program for uninsured or underinsured individuals.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on Interleukin Inhibitors

- In June 2024, the US FDA approved SKYRIZI (risankizumab-rzaa) for the treatment of ulcerative colitis, expanding its label and strengthening its position in the market.

- In May 2025, Ascletis Pharma announced that the US FDA cleared its IND application for ASC50, enabling a Phase I trial in mild-to-moderate plaque psoriasis. ASC50 is an in-house developed oral small-molecule inhibitor targeting interleukin-17 (IL-17), a well-validated target in autoimmune and inflammatory diseases such as psoriasis.

- In April 2025, it was designated as an orphan drug by the EMA for the treatment of non-infectious uveitis, highlighting its potential in addressing a significant unmet medical need.

- In March 2025, Johnson & Johnson announced that the US FDA approved TREMFYA (guselkumab) for the treatment of adults with moderately to severely active Crohn’s disease. TREMFYA is now the first and only IL-23 inhibitor to offer both subcutaneous (SC) and intravenous (IV) induction options for this chronic gastrointestinal condition.

- In September 2024, Eli Lilly and Company US FDA approved EBGLYSS (lebrikizumab-lbkz), a targeted IL-13 inhibitor, for the treatment of moderate-to-severe atopic dermatitis in adults and adolescents aged 12 and older weighing at least 88 pounds (40 kg), whose condition remains inadequately controlled with topical prescription therapies.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Interleukin Inhibitors Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Interleukin Inhibitors, explaining its mechanism, and therapies (current and emerging).

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the Interleukin Inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM Interleukin Inhibitors market.

Interleukin Inhibitors Report Insights

- Interleukin Inhibitors Targeted Patient Pool

- Interleukin Inhibitors Therapeutic Approaches

- Interleukin Inhibitors Pipeline Analysis

- Interleukin Inhibitors Market Size and Trends

- Existing and Future Interleukin Inhibitors Market Opportunities

Interleukin Inhibitors Report Key Strengths

- Ten-Year Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Interleukin Inhibitors Report Assessment

- Current Interleukin Inhibitors Treatment Practices

- Interleukin Inhibitors Unmet Needs

- Interleukin Inhibitors Pipeline Product Profiles

- Interleukin Inhibitors Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions Answered in the Interleukin Inhibitor Market Report

- What was the total Interleukin Inhibitors market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which Interleukin Inhibitors drug is going to be the largest contributor in 2034?

- Which is the most lucrative Interleukin Inhibitors market?

- Which drug type segment accounts for the maximum Interleukin inhibitors sales?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape for Interleukin has Inhibitors evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with Interleukin Inhibitors? What will be the growth opportunities across the 7MM for the patient population on Interleukin Inhibitors?

- What are the key factors hampering the growth of the Interleukin Inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for Interleukin Inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy Interleukin Inhibitor Market Report

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the Interleukin Inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.