J&J Enters gMG Arena with IMAAVY Approval, Challenging AstraZeneca, Argenx, and UCB

May 16, 2025

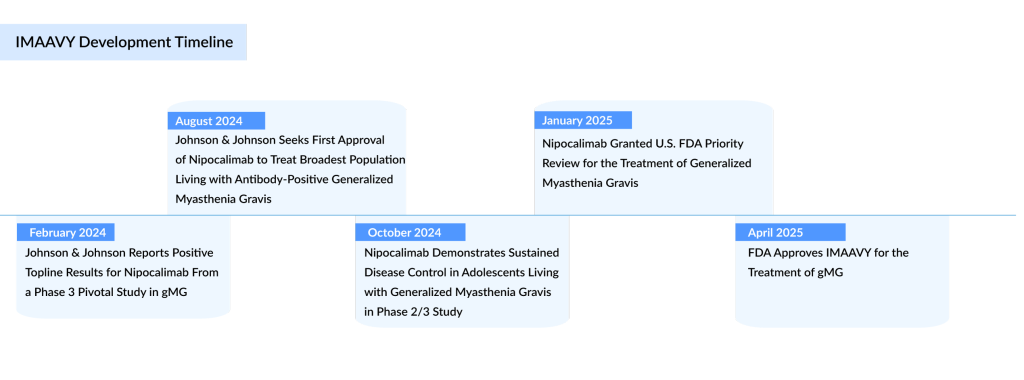

The FDA has approved Johnson & Johnson’s anti-FcRn antibody, nipocalimab, for the treatment of generalized myasthenia gravis (gMG). This myasthenia gravis drug will be marketed under the name IMAAVY. Although J&J isn’t the first to receive FDA approval for an FcRn-blocking antibody in this indication, the company is optimistic that IMAAVY’s broad label will help secure a strong foothold in the FcRN inhibitors market over time.

With this approval, J&J enters a generalized myasthenia gravis competitive landscape alongside established players such as AstraZeneca, which markets SOLIRIS and ULTOMIRIS, as well as Argenx’s VYVGART and UCB’s RYSTIGGO and ZILBRYSQ. Like IMAAVY, both VYVGART and RYSTIGGO target the FcRn pathway, but have been on the market longer—VYVGART since December 2021 and RYSTIGGO since June 2023.

IMAAVY is approved for use in adults and adolescents aged 12 and older who test positive for anti-acetylcholine receptor (AChR) or anti-muscle-specific kinase (MuSK) antibodies. These patients represent over 90% of the antibody-positive gMG population.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Agios’ PYRUKYND SNDA Accepted by FDA for Thalassemia; BridgeBio’s BBO-8520 Gets FDA Fast Track fo...

- Cellectis successfully bags USD 164 million for Gene-editing and CAR-T programs

- Will Roche’s Crovalimab An Answer to AstraZeneca PNH Treatment Drugs?

- VBL Therapeutics’ VB-111 (ofranergene obadenovec); BMS’s mavacamten (Camzyos); Merck’s KEYTRUDA; ...

- Assessment of Key Products that Got FDA Approval in Second Half (H2) of 2021

This myasthenia gravis drug functions by inhibiting FcRn, a protein that recycles IgG antibodies, including the pathogenic ones involved in autoimmune diseases. By blocking FcRn, IMAAVY significantly lowers levels of IgG autoantibodies while preserving other components of the immune system, according to clinical data.

J&J, like others exploring the FcRn pathway, sees potential beyond gMG. Given IgG’s involvement in a wide range of autoimmune disorders, the company envisions expanding IMAAVY’s use across multiple future indications. J&J acquired IMAAVY as part of its $6.5 billion acquisition of Momenta Pharmaceuticals in 2020, with the FcRn blocker serving as the central focus of the deal.

The approval is based on data from the pivotal and ongoing Vivacity-MG3 trial, which features the longest primary endpoint among registrational studies for FcRn blockers in adults with generalized myasthenia gravis. Key findings from the study include:

- IMAAVY, when combined with standard of care (SOC), significantly improved disease control over 24 weeks compared to placebo plus SOC, as measured by improvements in the MG-ADL score. These improvements reflect patients regaining critical functions such as chewing, swallowing, speaking, and breathing.

- Patients receiving IMAAVY with SOC continued to show sustained benefits for up to 20 months in the ongoing open-label extension (OLE) study.

- IMAAVY led to a rapid and lasting decrease in autoantibody levels up to 75% from the initial dose maintained across the 24-week observation period.

In the Vibrance Phase II/III study involving adolescents (ages 12–17) with anti-AChR or anti-MuSK antibody-positive gMG, IMAAVY plus SOC achieved the primary endpoint, showing a 69% reduction in total serum IgG over 24 weeks. Secondary endpoints, including improvements on the MG-ADL and QMG scales, were also met.

IMAAVY has shown a consistent safety and tolerability profile in both adult and pediatric populations across the Vivacity-MG3 and Vibrance-MG studies. Johnson & Johnson emphasizes its commitment to accessible treatment by offering the IMAAVY withMe support program in the U.S. Through this program, eligible commercially insured patients may begin treatment within a week and may pay as little as $0 per infusion.

“Today’s FDA approval of IMAAVY represents a landmark moment for the over 240 million individuals affected by autoantibody diseases, many of whom have limited or no targeted treatment options,” said David Lee, M.D., Ph.D., Global Head of Immunology Therapeutics at Johnson & Johnson Innovative Medicine. “This milestone reflects years of dedicated scientific research, collaboration, and perseverance behind our nipocalimab program, and we’re proud to offer a new treatment option for patients with anti-AChR or anti-MuSK antibody-positive generalized myasthenia gravis.”

Johnson & Johnson faces a significant challenge in establishing a foothold in the FcRn inhibitor treatment market, which is currently led by Argenx and UCB. Argenx pioneered the FcRn blockade approach with the FDA approval of its generalized myasthenia gravis treatment, VYVGART, in late 2021. This was followed by the launch of VYVGART HYTRULO, a subcutaneous formulation, which later received an additional approval for treating chronic inflammatory demyelinating polyneuropathy.

In April, Argenx announced that the FDA had approved a prefilled syringe version of VYVGART HYTRULO, enabling patients to self-administer the drug at home. On the other hand, UCB entered the FcRn space with the approval of its gMG therapy Rystiggo in June 2023. This marked the first treatment for gMG approved for both AChR and MuSK antibody-positive patients.

UCB has also secured approval for another gMG drug, ZILBRYSQ, which targets the C5 complement protein instead of FcRn. However, unlike RYSTIGGO, ZILBRYSQ is only indicated for patients who are AChR antibody positive.

Apart from these approved myasthenia gravis drugs, J&J’s IMAAVY will get fierce competition from Immunovant’s IMVT-1402. IMVT-1402 is a promising anti-FcRn therapy that could offer stronger and longer-lasting clinical benefits for patients with myasthenia gravis, CIDP, and other difficult-to-treat autoimmune diseases. In March 2025, Immunovant shared topline results from its Phase III clinical trial of batoclimab in MG. The study met its primary endpoint, showing a significant improvement from baseline in MG-ADL scores among AChR+ participants.

Patients receiving 680 mg of batoclimab via weekly subcutaneous injection showed a 5.6-point improvement at Week 12, while those on 340 mg weekly improved by 4.7 points. The placebo group improved by 3.6 points. Greater differences were seen between treatment groups at higher response thresholds. During the second phase of the study (Weeks 12–24), results aligned with expectations, with patients re-randomized to 340 mg weekly outperforming those who had a dose reduction.

Immunovant intends to launch potentially registrational trials in myasthenia gravis and CIDP using IMVT-1402 and has already received IND clearance for both indications. While current anti-FcRn therapies have provided important clinical benefits for myasthenia gravis and CIDP, there remains considerable unmet need.

At this time, Immunovant does not plan to pursue regulatory approval for batoclimab in myasthenia gravis or CIDP. Instead, it aims to use insights from the batoclimab studies to guide and accelerate the development of IMVT-1402. A final decision regarding regulatory filings for batoclimab will be made after results from its ongoing Phase III trials in thyroid eye disease are available.

At the end, it will be interesting to see how Johnson and Johnson will cope with the rising competition in the competitive landscape of the generalized myasthenia gravis market.

Downloads

Article in PDF

Recent Articles

- FDA Expands SOLIRIS for Pediatric Myasthenia Gravis; vTv’s Cadisegliatin Program Resumes as FDA L...

- Incyte’s Clinical Trial for Myelofibrosis; Eisai and Bioge’s Leqembi; FDA Approves Reata Pharmace...

- Top 12 Most Expensive Drugs in the US Healthcare Market

- Agios’ PYRUKYND SNDA Accepted by FDA for Thalassemia; BridgeBio’s BBO-8520 Gets FDA Fast Track fo...

- FcRn Inhibitors Being The Fastest Growing Class, Plans To Get Explored In 20+ Indications