Eli’s Jaypirca: A Beacon of Success in the BTK Inhibitor Market

Dec 11, 2023

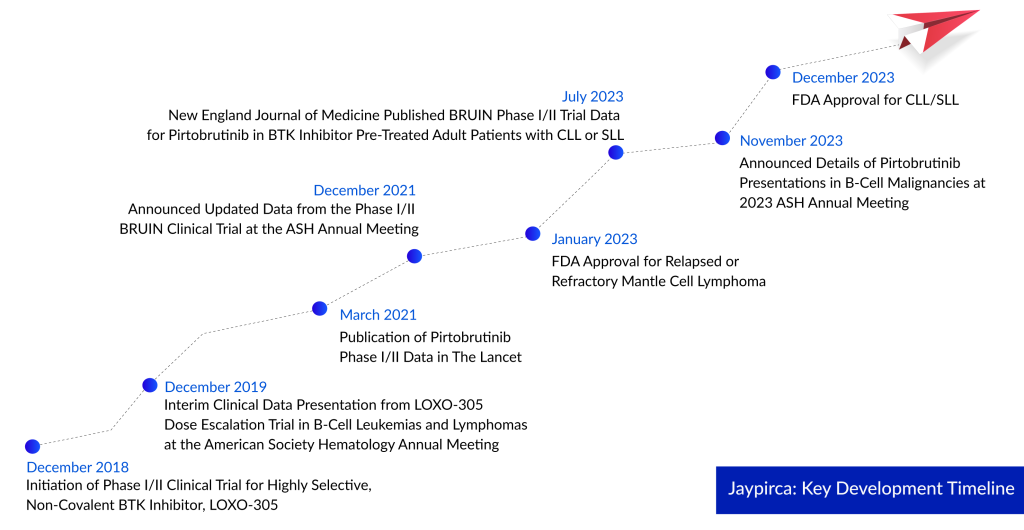

As the battle intensifies among AbbVie, Johnson & Johnson, AstraZeneca, and BeiGene in the BTK inhibitor market, Eli Lilly stands out by forging a new direction in the landscape of blood cancer drugs. Just at the beginning of this month, the FDA granted accelerated approval to Lilly’s Jaypirca. This approval is significant for patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) who have undergone at least two prior lines of therapy. What sets Jaypirca apart is that, as a BTK inhibitor, it is now authorized for use after treatment with both a BTK inhibitor and a BCL-2 inhibitor.

Nearly a year since Jaypirca secured its initial approval in January 2023 for treating adults with relapsed or refractory mantle cell lymphoma, this recent FDA approval marks another significant milestone. Jaypirca remains the sole FDA-approved reversible BTK inhibitor available in the market.

Chronic lymphocytic leukemia (CLL) is a type of blood cancer that primarily affects the lymphocytes, a type of white blood cell crucial for the immune system. CLL is the most common form of leukemia in adults, particularly in Western countries. As per DelveInsight analysis, chronic lymphocytic leukemia prevalence tends to increase with age, with the majority of cases diagnosed in individuals over 60.

Downloads

Click Here To Get the Article in PDF

Recent Articles

“Following progression on covalent BTK inhibitor and BCL-2 inhibitor therapies in patients with CLL or SLL, treatment options become limited, and the prognosis can be unfavorable. The approval of Jaypirca represents a significant advancement and a much-needed addition to the therapeutic arsenal for these patients,” commented Dr. William G. Wierda, Professor, Medical Director, and CLL Section Head for the Department of Leukemia at The University of Texas MD Anderson Cancer Center. “Jaypirca introduces a novel treatment approach, targeting BTK in a distinctive manner, and it has demonstrated clinical efficacy for a substantial number of patients with CLL or SLL in the BRUIN Phase I/II trial, particularly those whose disease progressed after undergoing covalent BTK inhibitor and BCL-2 inhibitor treatments.”

Eli Lilly’s Jaypirca acts as a small molecule inhibitor specifically designed to target the BTK enzyme. This enzyme is normally instrumental in the development, proliferation, and function of B lymphocytes, making BTK a recognized and validated target in various leukemias and lymphomas.

While drugs like Imbruvica (ibrutinib) by J&J and Calquence (acalabrutinib) from AstraZeneca rely on covalent interactions to disrupt BTK activity, Jaypirca distinguishes itself by establishing non-covalent connections. This unique mechanism not only prevents the development of resistance, often linked to covalent bonds but also enables Jaypirca to exert its effects on both wildtype and mutated BTK. Unlike traditional BTK blockers, Jaypirca’s action is not contingent on the presence of specific amino acid residues at the enzyme’s active site.

“The recent FDA clearance, marking Jaypirca’s second approval in 2023, highlights the significant clinical advantages of persistently tapping into the BTK pathway in CLL or SLL patients, as demonstrated in the BRUIN trial,” commented Jacob Van Naarden, CEO of Loxo@Lilly. “These initial two endorsements for Jaypirca mark the commencement of the potential impact we envision for patients, and we eagerly anticipate the outcomes of the comprehensive Phase III development program encompassing CLL, SLL, and MCL.”

“The advancements in treating CLL have been significant with the advent of covalent BTK inhibitors and BCL-2 inhibitors. Despite these improvements, a majority of patients may experience relapse over time,” stated Dr. Brian Koffman, Chief Medical Officer, and Executive Vice President at the CLL Society. “The approval of Pirtobrutinib offers a crucial alternative for patients, opening up new avenues in their treatment course.”

Despite the rapid FDA approval, the path taken isn’t without drawbacks. Prior disclosures reveal Lilly’s pursuit of accelerated approval in the third line, leveraging tumor shrinkage data from the single-arm BRUIN phase I/II trial. Notably, this trial encompassed patients who had previously received a BTK inhibitor but not a BCL-2 inhibitor like AbbVie and Roche’s Venclexta.

Jaypirca’s recent approval stems from data derived from a subgroup of participants in the Phase I/II BRUIN study. Among 108 CLL or SLL patients subjected to a once-daily 200-mg Jaypirca dose, a noteworthy 72% objective response rate was observed, with a median time to response standing at 3.7 months. The treatment response, evaluated by an independent review committee, exhibited a median duration of 12.2 months.

Regarding safety, 56% of Jaypirca-treated patients encountered serious side effects, with the predominant issues being pneumonia, COVID-19, sepsis, and febrile neutropenia. Adverse events prompted treatment interruptions in 42% of the treated cohort, along with dose reductions in 3.6%. Notably, 9% of patients permanently ceased Jaypirca treatment due to associated toxicities.

In adherence to the FDA’s accelerated pathway requirements and to maintain Jaypirca’s market presence, Lilly is conducting Phase III BRUIN CLL-321. This open-label, randomized study serves as Jaypirca’s confirmatory trial, comparing its efficacy against idelalisib or bendamustine combined with rituximab in CLL or SLL. Lilly has communicated topline data from BRUIN CLL-321 to the FDA and commits to sharing it with the wider medical community during an upcoming congress.

Another ongoing trial, BRUIN CLL-322, is investigating the combination of Jaypirca with Venclexta and rituximab in patients with previously treated CLL/SLL. These individuals may or may not have received prior treatment with a BTK inhibitor. In contrast to the current Jaypirca regimen, where the chronic lymphocytic leukemia drug is administered until disease progression or unacceptable toxicity, the BRUIN CLL-322 trial discontinues Jaypirca after a specified duration. Furthermore, Lilly’s BRUIN CLL-313 trial is examining Jaypirca as compared to the bendamustine-rituximab combination in CLL/SLL patients who have not received prior treatment.

The three covalent treatment options are currently competing at the forefront of the chronic lymphocytic leukemia treatment market, and Imbruvica is experiencing a decrease in market share. In the third quarter of 2023, BeiGene witnessed a remarkable 150% year-over-year increase in Brukinsa sales, reaching $270 million in the US AstraZeneca’s Calquence also saw a 2% sales growth, reaching $468 million in the U.S. during Q3. Meanwhile, AbbVie reported a 20% decline in Imbruvica’s US revenue, which amounted to $678 million.

Jaypirca received its initial FDA approval in January as a third-line treatment for mantle cell lymphoma after BTK inhibitor therapy. Despite its limited indication, Jaypirca generated $22.7 million in sales in Q3. The confirmatory trial for its accelerated approval, BRUIN MCL-321, is currently comparing Jaypirca with the investigator’s choices such as Imbruvica, Calquence, or Brukinsa in MCL patients who have undergone at least one prior line of therapy.

Downloads

Article in PDF

Recent Articles

- Lilly moves ahead; Authorities raid; Bristol-Myers, AZ in legal; PhRMA expected to weed out

- Phase III RUBY Trial of Jemperli Plus Chemotherapy Updates; FDA Approves Roche’s Vabysmo for RVO;...

- Alnylam’s lumasiran results; AZ’s oncology drug; Astellas Roxadustat; Evotec’s partnership with ABL

- Eli Lilly strengthening its Gastroenterology portfolio post Acquisition of Morphic. Tracking comp...

- Notizia