Navigating the Loss of Exclusivity: Big Pharma’s New Playbook

Jun 13, 2025

Table of Contents

The Patent Cliff Returns: Can Big Pharma Innovate Fast Enough to Stay on Top?

For decades, blockbuster drugs have fueled the pharmaceutical industry’s golden age. But as the 2020s unfold, a familiar threat is resurfacing with unprecedented intensity: the Loss of Exclusivity (LOE). With patents on multibillion-dollar therapies nearing expiry, pharma giants are once again bracing for revenue shocks. Yet this time, the stakes are higher—and the playbooks are different. From bold R and D bets to surgical cost-cutting and smarter lifecycle management, the next 5 years will separate the truly future-ready players from the rest. Here is how three of the biggest names, Merck, AstraZeneca, and BMS, are rewriting their post-LOE strategies.

Merck: A Case Study in Pipeline-driven Resilience

As Merck nears the Loss of Exclusivity for its flagship immunotherapy, KEYTRUDA, the company is entering a pivotal phase where strategic foresight is critical. With KEYTRUDA’s patent protection set to expire in 2028, Merck faces substantial revenue pressure, given the drug’s dominant position in its oncology portfolio. In response to this impending challenge, Merck is taking proactive steps to reshape its pipeline and diversify its revenue streams through internal R&D investment, business development efforts, and strategic partnerships, all designed to sustain long-term growth beyond the patent cliff.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- Novel and Emerging Metastatic Colorectal Cancer Treatment Drugs Anticipated to Change Market Dyna...

- Lilly moves ahead; Authorities raid; Bristol-Myers, AZ in legal; PhRMA expected to weed out

- EC grants; Pfizer cuts; 27 medicines sold; Keytruda nabs

- Merck’s Keytruda Wins Another FDA Approval; Sanofi Pauses Trial of Myasthenia Gravis Drug, tolebr...

- AstraZeneca-Daiichi’s results; Novartis remunerates; Pfizer to acquire Therachon; Gilead & G...

In anticipation of the loss of exclusivity, Merck is accelerating its pipeline development, focusing on 20 promising growth drivers across key therapeutic areas such as cardiometabolic diseases, infectious diseases, ophthalmology, and immunology. This diversified approach reflects Merck’s commitment to mitigating the financial impact of patent expirations and ensuring sustained revenue generation.

Among its new assets, Merck is particularly optimistic about WINREVAIR, a promising therapy for pulmonary arterial hypertension (PAH). WINREVAIR is eligible for 12 years of data exclusivity in the US and 10 years in the EU, with exclusivity potentially extending until 2037 through granted patents covering its treatment of PAH. This positions WINREVAIR as a key pillar in Merck’s growth strategy, reinforcing the company’s outlook for long-term success despite the looming loss of KEYTRUDA’s exclusivity.

“We are positioned for long-term leadership in oncology as we continue to diversify and deepen our pipeline. We are excited about cardiometabolic as a future area of growth, including with our oral PCSK9 inhibitor program, where we have important Phase III readouts this year. In immunology, HIV, and ophthalmology, we have opportunities to bring forward first-in-class and/or best-in-class blockbuster medicines,” said Robert Davis, Chairman of the Board, President, and Chief Executive Officer of Merck, during the company’s earnings call in February 2025.

Beyond KEYTRUDA, several other critical assets in Merck’s portfolio are poised to lose exclusivity by 2030, heightening the urgency of its diversification strategy. This wave of impending expirations further emphasizes the need for Merck to rapidly accelerate its pipeline development and strategically expand into high-potential therapeutic areas. By doing so, the company aims to safeguard its long-term growth and mitigate the revenue impact of these upcoming losses, positioning itself for continued success in an increasingly competitive pharmaceutical landscape.

| Key Merck Assets Facing Loss of Exclusivity by 2030 and Their 2024 Performance | ||||

| Drug Name | US | EU | JP | 2024 Revenue(in USD millions) |

| JANUVI | 2026a | Expired | 2025–2026 | 1,334 |

| JANUMET/JANUMET XR | 2026a | Expired | N/A | 935 |

| LENVIMAb | 2026 | 2026c | 2026 | 1,010 |

| BRIDION | 2026 | Expired | Expired | 1,764 |

| GARDASIL | 2028 | Expired | Expired | 8,583 |

| GARDASIL 9 | 2028 | 2030c | 2030 | |

| KEYTRUDA | 2028d | 2031 | 2032–2033 | 29,482 |

| LYNPARZAe | 2027c (with pending PTE) | 2029c | 2028–2029 | 1,311 |

| a. As a result of settlement agreements related to a patent directed to the specific sitagliptin salt form of the products, exclusivity will extend through May 2026 for Januvia and JANUMET and through July 2026 for JANUMET XR. b. Part of a global strategic oncology collaboration with Eisai. c. Eligible for six months of pediatric market exclusivity. d. The compound patent family contains two additional patents that expire in 2029 due to patent term adjustment resulting from patent office delay. These patents are based on the initial discovery of the active ingredient in KEYTRUDA. While these patents may provide additional protection, the Company expects that they will be the subject of litigation in the future. e. Part of a global strategic oncology collaboration with AstraZeneca. | ||||

With the expiration of several major assets, Merck is set to lose nearly USD 45 billion in revenue-generating products by 2030. KEYTRUDA, the company’s highest-earning therapy, contributed approximately USD 29 billion to Merck’s revenue in 2024.

To extend KEYTRUDA’s patent life, Merck is leveraging additional compound patents that expire in 2029 due to patent term adjustments related to regulatory delays. Although these patents, stemming from the original discovery of KEYTRUDA’s active ingredient, may provide some protection, they are expected to face significant litigation.

In parallel, Merck is expanding KEYTRUDA’s clinical applications, exploring its potential in hepatocellular, ovarian, and small-cell lung cancers, as well as evaluating a subcutaneous formulation combined with berahyaluronidase alfa for the first-line treatment of metastatic non-small cell lung cancer.

As Merck prepares for the post-KEYTRUDA era, the company is shifting focus to WINREVAIR, which generated USD 419 million in sales in 2024. WINREVAIR is poised to play a pivotal role in Merck’s post-KEYTRUDA growth strategy, providing a promising avenue for future revenue.

“I would just say, overall, our confidence in WINREVAIR and the potential benefit for patients with PAH and, in turn, its importance for growth are unchanged,” said Robert Davis, Chairman of the Board, President, and Chief Executive Officer of Merck, during the company’s earnings call in February 2025.

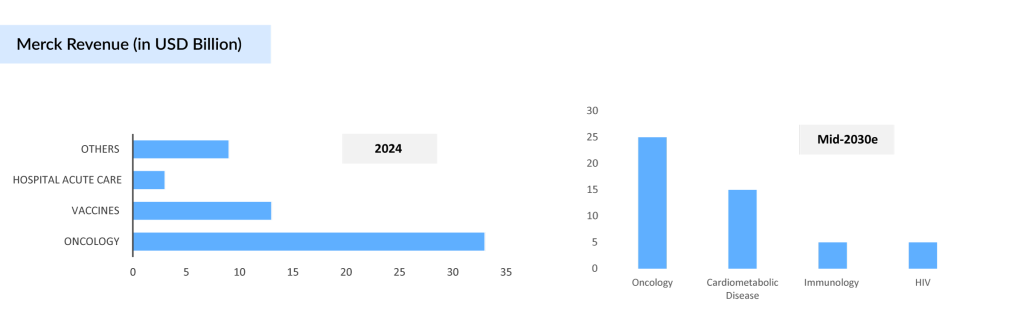

According to Merck’s Q4 2024 earnings presentation, the company generated approximately USD 57 billion in 2024, but this figure is expected to undergo a significant shift in the coming years. Merck aims to generate USD 50 billion in revenue by the mid-2030s through a diversified portfolio across various therapeutic areas.

While oncology will continue to be the leading therapy area, the company is currently over-dependent on this segment, a reliance that is poised to change. By the mid-2030s, revenue from other therapy areas, including cardiometabolic, immunology, ophthalmology, and infectious diseases, is expected to contribute approximately 50% of Merck’s total revenue, reflecting the company’s strategic pivot toward a more balanced and diversified growth model.

Merck’s strategic shift toward innovation and portfolio diversification highlights its proactive approach to navigating upcoming patent expirations. As the company moves into the post-KEYTRUDA landscape, the performance of its new and advancing assets, including WINREVAIR, will be central to driving sustained long-term growth.

AstraZeneca: Diversifying With Science-Backed Expansion

AstraZeneca is entering a pivotal phase marked by the approaching loss of exclusivity for several key therapies. With a strong emphasis on scientific innovation, the company is strategically positioning itself to mitigate the impact of upcoming patent expirations through a combination of internal pipeline advancement, targeted acquisitions, and global expansion efforts.

Several high-value assets from AstraZeneca are approaching the end of their patent protection by 2030, signaling potential revenue challenges ahead. Among them, FARXIGA stands out as the company’s top-performing cardiovascular drug, having generated approximately USD 7.7 billion in revenue in 2024. With its patent set to expire in 2026, AstraZeneca faces mounting pressure to offset the anticipated loss through pipeline innovation or strategic lifecycle management.

In addition to FARXIGA, several other AstraZeneca assets across key therapeutic areas, including oncology, rare diseases, respiratory, and immunology, are poised to lose market exclusivity by 2030. This upcoming wave of expirations underscores the need for AstraZeneca to bolster its late-stage pipeline and explore new growth drivers to sustain momentum in the face of looming patent cliffs.

| Key AstraZeneca Assets Facing Loss of Exclusivity by 2030 and Their 2024 Performance | ||||

| Drug Name | US | EU | JP | 2024 Revenue(in USD millions) |

| LYNPARZA (olaparib) | 2024, 2027(2024–2041) | 2029(2024–2029) | 2029(2024–2034) | 3,072 |

| FARXIGA/FORXIGA (dapagliflozin) | 2026 (2025–2040) | 2028 (2027, 20282) | 2024–2025(2028–2040) | 7,656 |

| FASENRA (benralizumab) | 2024 (2028–2034) | 2025(2028–2034) | 2025(2034) | 1,689 |

| SYMBICORT(budesonide/formoterol) | 2025–2029 | Expired | Expired | 2,879 |

| SOLIRIS(eculizumab) | 2027a (2025–2032) | 2027 (2029) | 2027 (2029) | 2,588 |

| BRILINTA/BRILIQUE (ticagrelor) | 2025(2030–2036) | 2025 (2037) | 2024 (2025–2030) | 1,333 |

| a. Settled with Amgen and Samsung Bioepis for a licensed biosimilar entry date of March 2025. | ||||

AstraZeneca is strategically positioned to manage the upcoming patent cliff, supported by a robust pipeline of over 90 late-stage trials with an average non-risk-adjusted peak-year revenue potential of USD 1 billion per asset. With a revenue target of USD 80 billion by 2030, the company remains focused on core therapeutic areas, oncology, respiratory, and cardiovascular diseases, while expanding into immunology and rare diseases. Its growing interest in cell therapy reflects a forward-looking strategy to address complex immune disorders through innovation and advanced technologies.

“We are making a very important step toward the achievement of our strategic ambitions, in particular, the USD 80 billion sales in 2030. And we are progressing high-value readouts that will unlock further growth,” said Pascal Soriot, Executive Director and Chief Executive Officer of AstraZeneca, during the company’s earnings call in February 2025.

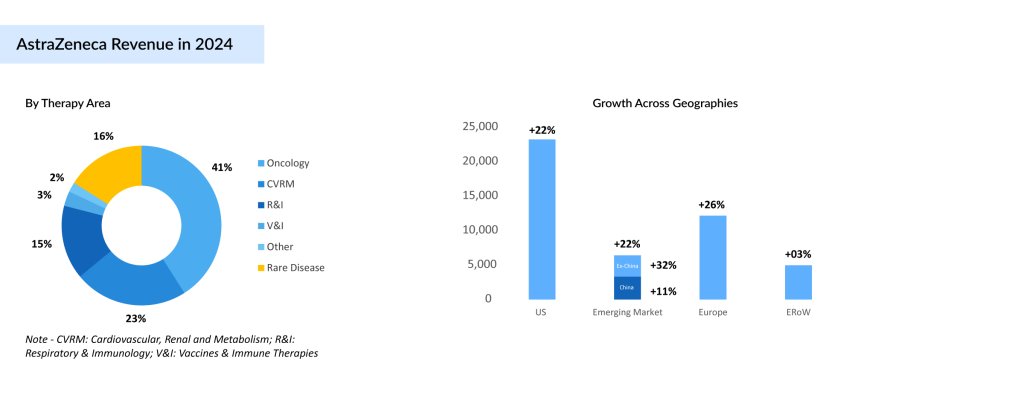

Oncology continues to be the company’s primary growth engine, generating USD 22.4 billion in 2024—up 24% year-over-year. TAGRISSO led with over USD 6.5 billion in sales and remains the market leader in frontline EGFR-mutated NSCLC. LYNPARZA exceeded USD 3 billion, while IMFINZI and IMJUDO together approached USD 5 billion in revenues. CALQUENCE and ENHERTU each delivered over USD 2 billion, with CALQUENCE sustaining its lead in frontline chronic lymphocytic leukemia (CLL), supported by anticipated volume growth and the potential approval of AMPLIFY targeting the finite therapy segment.

Recent regulatory momentum, such as the EU recommendation for IMFINZI in resectable muscle-invasive bladder cancer (MIBC), and the uptake of TRUQAP in second-line biomarker-altered breast cancer further highlight AstraZeneca’s ability to drive growth through indication expansion.

Although AstraZeneca’s rare disease segment is under pressure, mainly from declining SOLIRIS sales due to patient shifts to ULTOMIRIS and biosimilar competition such as the April 2024 launch of EPYSQLI, the company is entering a critical juncture with a significant patent cliff ahead. As high-revenue assets like FARXIGA and LYNPARZA approach loss of exclusivity, AstraZeneca’s robust oncology portfolio, deep late-stage pipeline, and strategic investments in innovation and cell therapy position it well to navigate these challenges and sustain long-term growth beyond 2030.

Patent Expirations Force a Reset: Can BMS Sustain Growth Through Cost Discipline?

Bristol Myers Squibb is at a critical juncture as it confronts the financial impact of an upcoming loss of exclusivity for key assets. In response, the company has initiated sweeping cost-cutting measures aimed at preserving margins and reallocating resources toward pipeline innovation and strategic growth areas. This shift marks a recalibration of Bristol Myers Squibb’s operating model, offering a glimpse into how the company is rewriting its playbook to remain competitive in a post-patent world.

Several high-revenue assets at Bristol Myers Squibb are nearing loss of exclusivity, placing substantial pressure on the company’s future earnings. In 2024, the company reported revenue of approximately USD 48.3 billion, with ELIQUIS (apixaban) alone contributing USD 13.3 billion. Set to expire in 2026, ELIQUIS represents a major revenue pillar, and its upcoming loss underscores the scale of exposure Bristol Myers Squibb faces as it braces for a wave of patent expirations that could reshape its earnings trajectory. Beyond ELIQUIS, several high-performing therapies are approaching the end of their market exclusivity, intensifying the pressure on Bristol Myers Squibb’s revenue sustainability.

| Key BMS Assets Facing Loss of Exclusivity by 2030 and Their 2024 Performance | ||||

| Drug Name | US | EU | JP | 2024 Revenue(in USD millions) |

| YERVOY (ipilimumab) | 2025 | 2026 | 2025 | 2,530 |

| ORENCIA (abatacept) | 2026 | 2026 | 2026 | 3,682 |

| POMALYST/IMNOVID (pomalidomide) | 2026 | Generics available | 2026 | 3,545 |

| REVLIMID (lenalidomide) | 2026 | Generics available | Generics available | 5,773 |

| OPDIVO (nivolumab) | 2028 | 2030 | 2031 | 9,304 |

To navigate the wave of upcoming patent expirations, Bristol Myers Squibb is relying on both operational restructuring and lifecycle management strategies. The recent launch of a subcutaneous formulation of OPDIVO (nivolumab) reflects an effort to sustain its immuno-oncology franchise beyond the drug’s expected loss of exclusivity in 2028. While early physician outreach is underway, the projected 30–40% conversion from IV to subcutaneous remains an internal estimate, and actual uptake will depend on market dynamics and clinical adoption.

In a bold move to strengthen its oncology pipeline, Bristol Myers Squibb has teamed up with BioNTech in a high-stakes, ~USD 11 billion partnership to co-develop and co-commercialize the investigational bispecific antibody BNT327 for solid tumors. The deal includes a USD 1.5 billion upfront payment and USD 2 billion in guaranteed milestone payments through 2028, all recorded as acquired in-process research and development (IPR&D) expenses. BioNTech stands to gain an additional USD 7.6 billion in potential development, regulatory, and commercial milestones. With a 50:50 split on development costs, manufacturing responsibilities, and global profits and losses, this collaboration signals Bristol Myers Squibb’s aggressive push to fuel future growth through innovation and strategic alliances.

“With respect to the cost programs, just a bit of context. As we were executing on last year’s program, we cataloged a number of opportunities for us to become a more agile company, to become more nimble and speedy in terms of how we operate,” said Christopher S. Boerner, Chairman and Chief Executive Officer of Bristol Myers Squibb during the Q4 2024 Earnings Call.

On the cost front, Bristol Myers Squibb has expanded its cost-saving program by an additional USD 2 billion, aiming to reduce operating expenses from USD 16 billion to USD 15 billion by 2027. Of this, USD 1 billion is expected to be realized in 2025, with the remaining USD 1 billion by the end of 2027. Unlike the initial USD 1.5 billion initiative, where most savings were reinvested, this expanded effort is intended to drop entirely to the bottom line. The savings are split evenly between organizational redesign and enhancements in operational efficiency. While this aggressive approach may support short-term financial stability, it also raises concerns about overdependence on internal restructuring at a time when sustained investment in innovation remains critical.

The approval of COBENFY in September 2024 highlights continued investment in select pipeline assets, but the company’s decision not to issue long-term guidance may reflect caution amid a shifting revenue base. While Bristol Myers Squibb aims to exit the decade with top-tier growth, execution risks remain as it balances cost containment with the need to replenish its portfolio.

“We’re not going to be giving long-term guidance as a standard course. This reflects the philosophy that we have that we’re going to guide to what we and you can hold us accountable for. But what we’ve also been very clear on is that our focus continues to be on driving top-tier growth exiting this decade,” said Christopher S. Boerner, Chairman and Chief Executive Officer of Bristol Myers Squibb during the Q4 2024 Earnings Call.

As Bristol Myers Squibb navigates a pivotal period marked by major loss of exclusivity events, its strategy reflects both urgency and uncertainty. While expanded cost-cutting measures and lifecycle extensions, such as the subcutaneous OPDIVO, may provide temporary relief, they also underscore a heavier reliance on defensive tactics rather than bold innovation. However, recent moves like the high-stakes alliance with BioNTech signal a growing emphasis on external innovation to strengthen its oncology pipeline and offset future revenue gaps. The absence of long-term financial guidance raises questions about visibility into future growth, especially as pressure mounts to replace high-revenue assets with new launches. Ultimately, the success of BMS’s post-patent playbook will depend not just on operational discipline but on its ability to deliver meaningful pipeline-driven value in an increasingly competitive environment.

Outlook: Reinvention, Not Just Defense

As Merck, AstraZeneca, and Bristol Myers Squibb approach the patent cliff, each company is taking a distinct strategic path to sustain growth. Merck is proactively diversifying beyond oncology, with a focus on cardiometabolic and immunology assets like WINREVAIR, aiming for an equal split between oncology and other therapy areas by the mid-2030s. AstraZeneca, while facing the LOE of FARXIGA and other assets, is better insulated by a deep pipeline and a strong innovation engine spanning oncology, CVRM, and rare diseases. In contrast, Bristol Myers Squibb is leaning heavily into operational streamlining to preserve margins amid LOE for ELIQUIS and others, while also advancing external innovation through high-value partnerships such as its recent alliance with BioNTech. Collectively, these strategies underscore the evolving playbooks big pharma is adopting to navigate the loss of exclusivity and reposition for sustainable growth.

Frequently Asked Questions

Loss of exclusivity refers to the expiration of patent protection or market exclusivity for a drug, which allows generic or biosimilar competitors to enter. This often leads to significant revenue erosion for the innovator company.

Companies are responding by diversifying their pipelines, accelerating R&D, forging partnerships, cutting costs, and pursuing life-cycle management strategies (e.g., new formulations or indications).

Merck is preparing for the impending LOE of its blockbuster Keytruda (expected around 2028) by investing in new assets across immunology, cardiometabolic diseases, and ophthalmology, and by expanding indications of existing drugs.

Lifecycle management helps extend market value by reformulating drugs (e.g. subcutaneous vs intravenous), expanding indications, or combining drugs, thereby delaying revenue decline after exclusivity ends.

Pharma firms should shift from defensive tactics to reinvention—building resilient, diversified pipelines, strengthening innovation, and ensuring they are less reliant on single blockbuster drugs.

Downloads

Article in PDF

Recent Articles

- Symdeko’s approval; Erytech target solid tumors; Oncologie snapped bavituximab; Merck delivers

- FDA Grants Priority Review to Merck’s Application for KEYTRUDA Plus Padcev; Roche and Carmot Ther...

- AstraZeneca announces; Trivitron launches; BrainStorm Cell Therapeutics validates

- Remdesivir accelerates for COVID-19 recovery; Merck pact with Almac; Pfizer, BioNTech finish dosi...

- Bayer’s AskBio Initiates Phase II GenePHIT Trial; FDA Approves Merck’s KEYTRUDA Plus Chemoradioth...